Why you should try Arbitrum and Optimism

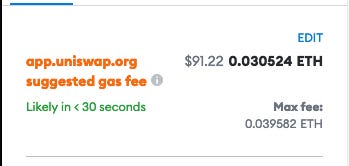

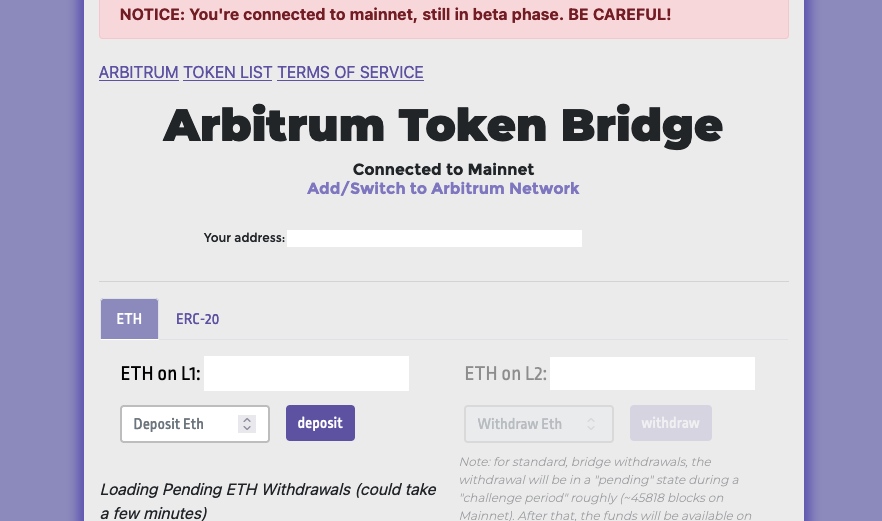

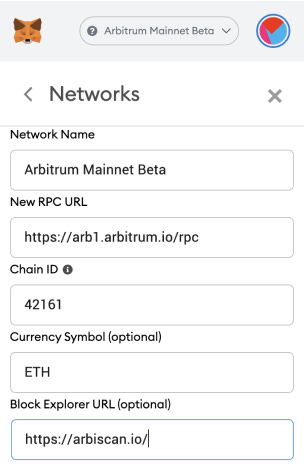

Hi friends 👋 You have probably noticed that doing stuff on Ethereum can be very expensive at the moment... And this is pricing out many people that don't understand why they should spend $$$ just to swap tokens. Honestly, Uniswap is making Western Union look cheap at the moment. Essentially this is happening because there are more and more people trying to use Ethereum, and as block space is limited transaction (gas) fees rise to balance supply and demand. Ethereum can do around 30 transactions per second, well below what a centralised service such as Visa (7000 tps) can do or even some other, arguably more centralised blockchains such as Solana (65,000 tps), so it doesn't take too much for the system to get congested. One way the Ethereum teams are tackling this problem is with Layer 2 chains, which are essentially blockchains that take some transactions away from the main chain, whilst trying to keep the security of the main chain. There are a couple of reasons why you should care about this. Firstly, these L2s should enable much lower fees, and secondly, there is a reasonable chance that they will do an airdrop at some point in the near future. Retroactive airdrops for early users are quite common in the crypto industry. DYDX recently had an airdrop worth up to $100k for example. This is one thing I love about this industry, in crypto it pays to be an adopter that it usually doesn't in web2. Think about the early users of Facebook, I am pretty sure that the Harvard students using Facebook didn't get any shares. In crypto, you get shares (governance tokens) Today, I am going to walk you through how you can get started with two of the most popular L2's, Arbitrum and Optimism. Give it a try today and you might be in luck if they decide to roll out their own governance token later. Let's get started. To begin with, you should know that the process is almost identical for each of them. We're going to look at Arbitrum. Step 1 - Head to the bridge: This is where you will 'bridge' your assets from the main Ethereum blockchain to the Arbitrum side chain. You might worry that you have stepped back into the web circa 1999 with this design, but fear not, you are in the right place. For some reason a lot of crypto looks like it was designed in the 90's....but I digress. Step 2 - Connect your Metamask wallet Now you are going to have to add the Arbitrum chain to your Metamask. Go to Settings → Networks → Add Network, and add the following info:

You can then switch back and forth between Arbitrum and mainnet by clicking on the network name at the top of your wallet. Step 3 - Transfer ETH to Arbitrum You are now ready to send some ETH to Arbitrum. Add the amount you want to bridge over and click "deposit". You will need to approve the transaction in Metamask (which will cost tx fees as usual). In about 10 minutes you will see your ETH on Arbitrum. Remember you will need to switch the network to see it. Congratulations, you now have ETH on Arbitrum! There's not that much you can do at the moment on Arbitrum, as it is still very early, but both Balancer and Uniswap are available and you will get to enjoy significantly cheaper transactions if you make use of either of them. If you want to head straight back, you just need to go to the bridge again and click 'withdraw' (note there is a 7 day withdrawal period!). But why not stick around and explore with those sweet low fees. Whatever you do, hopefully this will help you qualify you for any future Arbitrum/Optimism airdrops. If you do receive an airdrop after reading this article, let us know! Thanks for reading Jamie ⚠️ Health warnings Both these projects are at an early stage. Things can still break. Please also note that when bridging back to the main ETH ecosystem you will have to wait 7 days for your funds to be released. You will also have to pay fees both ways, so you will get back slightly less ETH than you bridged. Although Arbitrum is planning to become decentralized, at the moment the team has most of the control over the network. Arbitrum is well respected, so it is unlikely they will abuse that control, but it is still worth being aware that the risk exists. Get involved with Arbitrum and Optimism: If you enjoy Block Breakdown, access subscriber only benefits for $5 per month, or $50 per year. This is the introductory price, and it will increase in future, but if you subscribe now you will always stay at this lower price. 🚨 Disclaimer: This is not investment advice. Everything in this newsletter is for entertainment and education purposes only. Do your own research. Think for yourself. Any financial interest the Block Breakdown team has in any project mentioned will be clearly highlighted. If you enjoy Block Breakdown, consider becoming a full subscriber for $5 per month, or $50 per year. This is the introductory price, and it will increase in future, but if you subscribe now you will always stay at this lower price. |

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏