Economic Powerhouse - The Daily Gwei #358

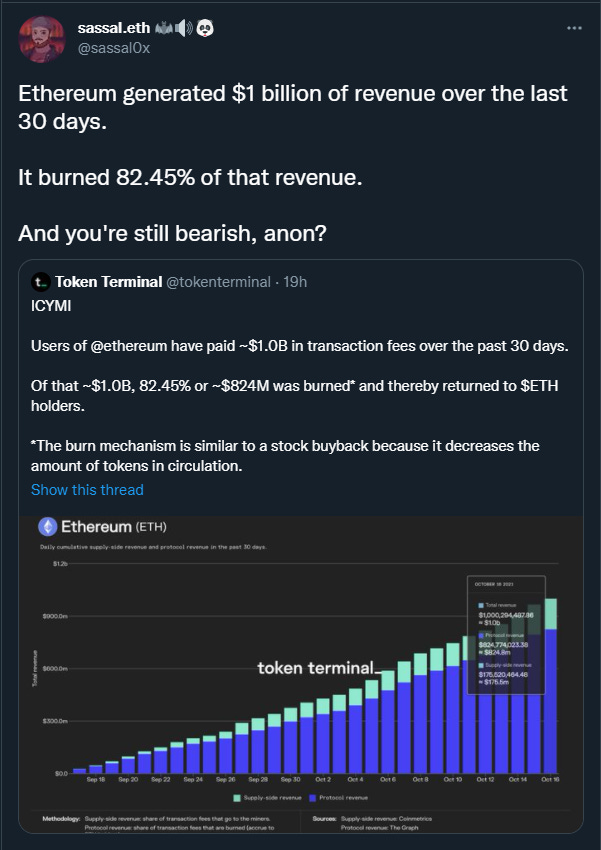

There’s no denying that demand to use the Ethereum network is at absolutely insane levels. If we take the metrics from Token Terminal below and annualize it, we can see that Ethereum is currently generating $12 billion worth of revenue per year. On top of that, over 80% of that revenue is being burned which drives value back to ETH holders everywhere. I realise that some people view high fees as a “bearish” thing for Ethereum but I’ve never really understood the logic behind this. Ethereum is a network that sells one product - decentralized blockspace - and that product is in very short supply while the demand to use it is through the roof. Ethereum deals with this dynamic by auctioning off blockspace to the highest bidder which means that inevitably people will end up getting priced out. Of course, Ethereum is dealing with its scaling woes by utilizing layer 2’s where instead of the individuals paying Ethereum for its blockspace, the layer 2 network pays for it while also making much more efficient use of it (via transaction compression and other techniques). What I personally find most bullish about Ethereum’s fee revenue is that most of it is being burned which effectively produces a “dividend” of sorts for all ETH holders. Logically, as fee revenue is continuously burned in perpetuity, it should drive value directly to ETH leading to an increased price over time. Then throw in all of ETH’s other demand drivers - DeFi, NFTs, staking etc - and you have a recipe for one of the most bullish assets on the planet. Some people will push back on me when I bring up these points by saying that while this is all bullish for ETH as an asset, it is bearish for actual Ethereum network adoption. Obviously I believe this view is totally misguided and comes from people who are generally just misinformed about Ethereum’s roadmap. So ultimately I ask the bears - how is a network that generates $12 billion+ worth of revenue a year (and burns most of it) while also driving value to its native asset via numerous other means considered bearish? If the answer is that it’s because it prices people out of the network then I feel that the bears are misunderstanding Ethereum’s design which actually works to create a symbiotic relationship between the network and its users without sacrificing core properties such as decentralization and security. I really think that this is the crux of it - many people just assume that Ethereum’s layer 1 is the best Ethereum can offer them. I expect that as we progress through the layer 2 rollout and adoption phase, the narrative around Ethereum scaling will very quickly shift to a positive one. The last thing to touch on here is that Ethereum is still a very young network with plenty of growth potential left. I’m betting that eventually Ethereum’s layer 1 (with sharding) will be generating $100’s of millions (if not billions) of dollars per day in fee revenue while users are enjoying a seamless and cheap experience at layer 2. For context, during the more active times, Ethereum already generates anywhere from $30 million to $70 million a day in fee revenue - so I don’t believe it’s farfetched to speculate that it may generate billions in daily fee revenue one day soon. And, as a reminder, 70-80% of that fee revenue will be burned forever - I really don’t understand how anyone could possibly be bearish on ETH. Have a great day everyone, Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox! Join the Daily Gwei EcosystemAll information presented above is for educational purposes only and should not be taken as investment advice. If you liked this post from The Daily Gwei, why not share it? |

Older messages

Paradigm Shifts - The Daily Gwei #357

Friday, October 15, 2021

Paradigm shifts don't happen very often but when they do you better be paying attention.

Scarce Resources - The Daily Gwei #356

Thursday, October 14, 2021

Optimizing resources for long-term health and sustainability.

Innovate or Die - The Daily Gwei #355

Thursday, October 14, 2021

Every company will be a crypto company.

Respecting the Builders - The Daily Gwei #353

Monday, October 11, 2021

Fostering an inclusive Ethereum community for everyone.

Early Adopters - The Daily Gwei #352

Friday, October 8, 2021

Enjoy being early even if there are some growing pains.

You Might Also Like

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏