The Daily StockTips Newsletter 10.25.2021

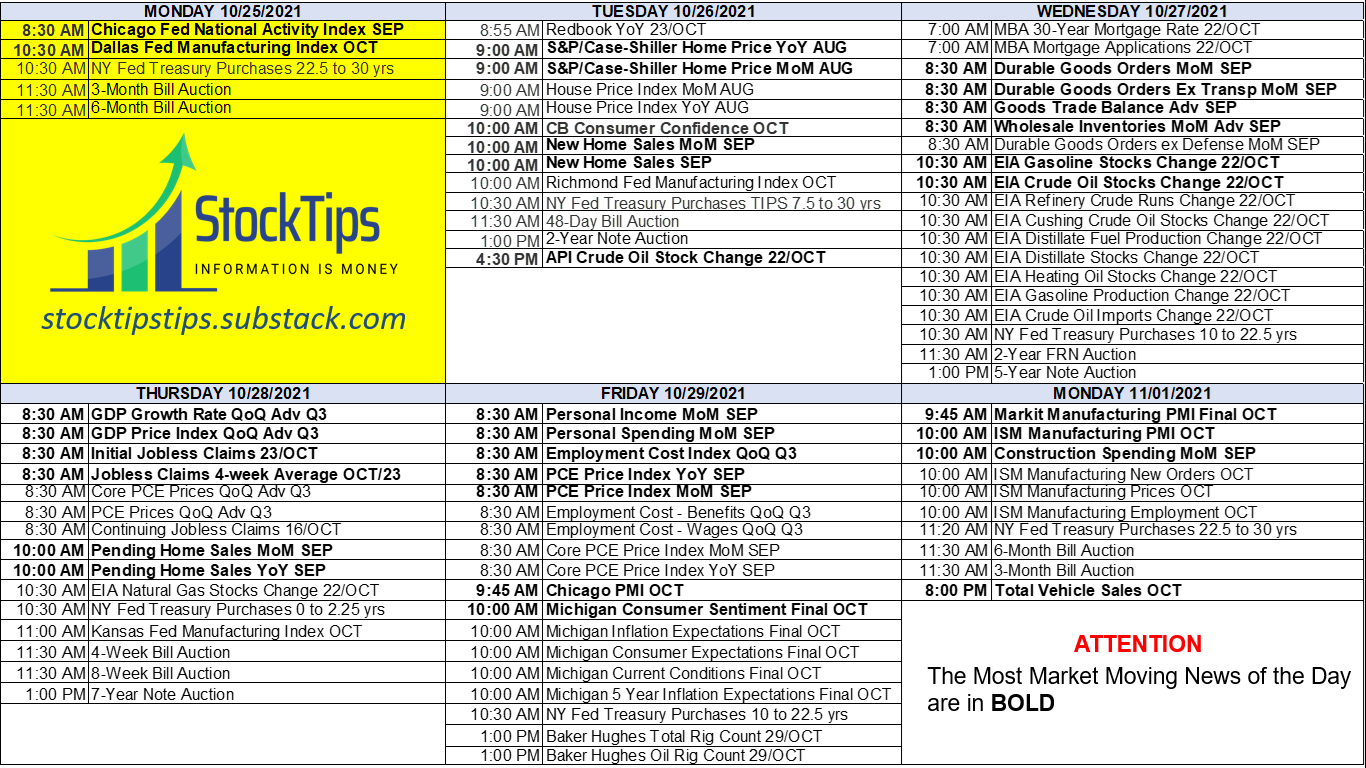

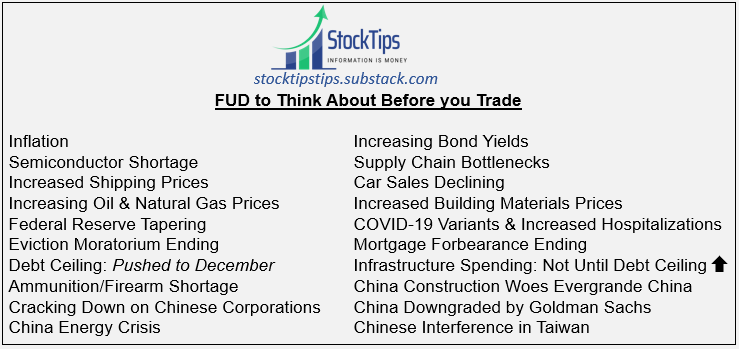

The Daily StockTips Newsletter 10.25.2021I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)Below you will find a list of stocks researched, hand picked & watched by me. I grade, organize, & rank the plays taking into account Risk (R), Value (Va), Growth Potential (G), Intuitional Ownership (I), Volatility (Vo), Earnings History (H), & Market Conditions (M). I then score them, set price targets, & provide a quick thesis about the company. I do not throw stocks up until I thoroughly research them. The way I figure it, I ought not be drawing attention to stocks I'm not confident enough to buy myself. The Stock Tip Report is NOT investment advice, it is strictly to assist you in your own idea generation, & you should always do your own DD. Please read the "Important Disclaimer" at the Bottom of this Page.IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.Before you Trade Today: Know the Economic Calendar! StockTips Market Key Takeaway’s: Big tech earnings will determine what kind of earnings season & outlook we’ll have through to next quarter. This week we will find out precisely to what extent tech is affected by inflation, supply chain issues, & the semiconductor shortage. Expect the market to be indecisive until conditions eventually provide some kind of assurance as to the direction of the economy. Remember that tech makes up a massive block of U.S. markets & tech firms are among the more seriously overvalued sectors of the economy. Bearish earnings or bearish guidance will therefore have the potential the draw down the entire market. Watch closely. Do not assume that each company is in its own vacuum. We will want to assess reoccurring trends early. Personally I welcome a possible correction. Tech has the tendency to drag down the entire market when the market turns against it. As someone who invests primarily in reliably profitable growth company’s trading at a solid value on a pullback of no true consequence, my plays thrive in such conditions. So as long as I have enough capital to average down every 5% or so, my profit is generally amplified under such circumstances. Moreover, when folks readjust their portfolio under market corrections what do they usually seek out? Value & growth! I say bring on the bears! Going into Tomorrow: On the economic calendar we have the National Activity Index & the Dallas Fed Fed Manufacturing index. The National Activity Index gauges overall economic activity & related inflationary pressure. You’ll want to pay attention to that. The Dallas Fed Manufacturing Index asks firms whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month. Its a solid indicator as to the state of manufacturing. Among the earnings coming out tomorrow are BGFV, AMKR, & FB. These earnings, for us, will be essential in assessing much of the rest of the quarter. For example, BGFV will give a great deal of insight into the sporting goods market … and more specifically, I’ll be anticipating their firearms segment (think POWW). Remember that AMKR is a semiconductor packaging & test services provider. The company should give us some solid insight as to the state of semi’s. $FB already crashed somewhat due to bearish conditions as implied from poor $SNAP guidance. That, & well, their CEO Jack Dorsey hasn’t exactly been positive lately. Twitter, like many tech companies of their stripe, make most of their revenue through advertising. Investors will be asking if $FB can prove that $SNAP is a one off event, or a continuation of poor social media guidance. Breaking Market Moving News Heading into 10/25/2021:

Todays STOCK TIPS: If its on this list (BELOW), I’m either holding a position or considering it for my own portfolio.Note: I likely have a different trading style than you. Therefore I may look at stocks & approach the market differently than you. I trust the financials. I mostly target reliably profitable growth stocks trading at a value on a dip of no consequence pending favorable economic conditions. I buy in slow, & sell the excess, if necessary, on the parodic pops above my cost basis. I love covered calls on volatile stocks. I build positions by buying in slowly in the red & I’m willing to run the clock on what I see as a promising trade. I also expect & account for uncertainty & constantly re-evaluate. FOMO to me is an F-word. I don't chase & I never buy meme stocks. I am willing to limit profit to guarantee it & there is nothing I love more than a market panic. I outperform impatient folks swinging for grand slams because I hit homeruns while swinging for base hits. Quite often plays can take as long as a quarter, or perhaps more, to pan out. Discipline goes a long way. Discipline, however, is a lot easier if you know what you’re trading.REMEMBER: My personal buy list gets updated early at a zone above my desired buy-in-price so as to react in time when stocks hit the proper price target. The profit/loss percentage as reflected on the “date added” line" therefore does not reflect profit/loss percentage from the desired buy-in price. PAID CONTENT BELOW: 7 Stocks in the Buy Zone (Waiting to Swing), 4 Stocks (Profiting) Above the Buy Zone / 35 Stocks on the Price Based Assessment Watchlist... Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

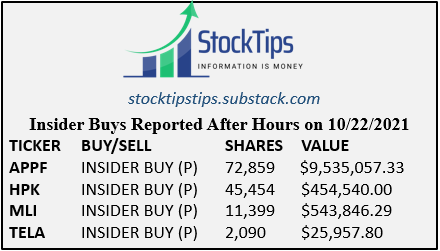

The Daily StockTips Newsletter 10.22.2021

Friday, October 22, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

The Daily StockTips Newsletter 10.21.2021

Thursday, October 21, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

The Daily StockTips Newsletter 10.20.2021

Wednesday, October 20, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

The Daily StockTips Newsletter 10.19.2021

Tuesday, October 19, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

The Daily StockTips Newsletter 10.18.2021

Monday, October 18, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

You Might Also Like

🇨🇳 The US is out, China is in

Tuesday, March 11, 2025

Citigroup's forecast for US and Chinese stocks, Lego stacked bricks, and Boeing's investigation | Finimize Hi Reader, here's what you need to know for March 12th in 3:10 minutes. Citigroup

The Under-the-Radar Threat to Your Retirement

Tuesday, March 11, 2025

Nearly half of older adults are burdened by bad debt ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

15 Years Since We Bought Our Toxic Asset

Tuesday, March 11, 2025

In a new Planet Money plus episode, former Planet Money hosts David Kestenbaum and Chana Joffe-Walt look back at a pioneering series that sought to explain a major source of the 2008 financial crisis.

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏