Popular Information - The billionaires are angry

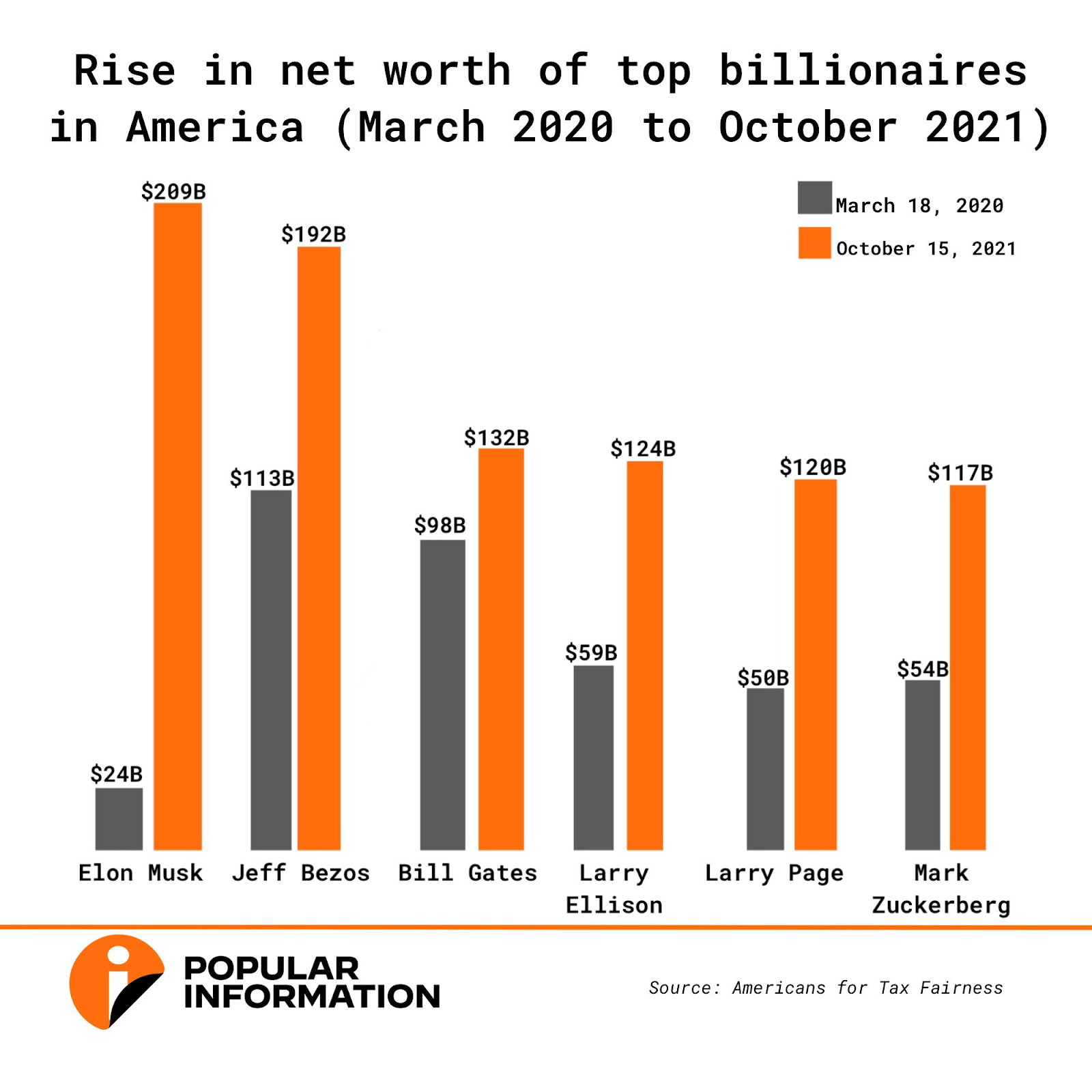

Popular Information is not backed by billionaires. And we don't accept advertising from anyone. That allows us to remain completely independent from the powerful people and corporations we cover. But it also means this newsletter only exists because of support from readers like you. A paid subscription is $6 per month or $50 per year. If paying for a subscription isn't affordable for you today, just stay on the free list. That's why we've taken down our paywall. But, if you can swing it, please consider becoming a paid subscriber now. Since the start of the pandemic, the nation's billionaires have done well. Very well. Between March 18, 2020, and October 15, 2021, the total wealth of American billionaires increased more than 70% — from $2.9 trillion to $5 trillion. Over the same time period, the six wealthiest Americans saw their income increase even more sharply. This group, which includes Bezos, Zuckerberg, and Gates, has increased its wealth by more than 125% — from $400 billion to $896 billion. The current wealthiest American, Elon Musk, was worth $209 billion on October 15. But, according to the Bloomberg Billionaire Index, Musk is now worth $289 billion. Musk's net worth increased $36 billion on Monday. But Musk and his fellow billionaires pay an extremely small percentage of these gains in taxes. Leaked tax records obtained by ProPublica revealed that in 2018, when Musk was the second-wealthiest person in the world, he paid no federal income taxes. Between 2014 and 2018, Musk's wealth increased by $13.9 billion and he paid $455 million in taxes — a true tax rate of just 3.2%. Over the same time period, the 25 wealthiest Americans paid an average true tax rate of 3.4%. How do the billionaires do it? Yes, there are complex tax avoidance strategies. But the core reason is simple. Most billionaires increase their wealth almost entirely from the appreciation of assets, mostly large quantities of stock. (Musk, Zuckerberg, and other billionaire CEOs pay themselves a salary of $1 per year.) Under the current tax system, stocks and other assets are only taxed at the capital gains rate (about 23.8%) when they are sold. Billionaires can get as much cash as they need by borrowing money against the value of their assets. Financial institutions provide them with loans with interest rates under 1%. (In 2020, Musk had "pledged more than 92 million of his 227 million Tesla shares to secure personal debts.") While average Americans get their taxes deducted automatically from every paycheck, billionaires can avoid paying most taxes indefinitely. And many of them do. This gravy train, however, may be ending soon. Democrats were initially planning to pay for the Biden administration's Build Back Better plan by raising the corporate tax rate from 21% to 26.5% and restoring the top income tax rate from 37% to 39.6%. This would partially roll back Trump's 2017 tax cuts. The money would pay for a genuine effort to combat climate change, universal Pre-K, expanded Medicare benefits, the nation's first paid family leave plan, and other investments. But recently, Senator Krysten Sinema (D-AZ), who voted against Trump's tax bill, abruptly said she opposed any increase to the corporate or individual tax rate. This sent Democrats scurrying for alternative sources of revenue. Soon, that attention focused on a proposal being developed by Senator Ron Wyden (D-OR) to increase taxes on billionaires. The Wyden proposal would tax the unrealized capital gains of people whose wealth exceeds $1 billion. Currently, that threshold applies to 745 people, or .0005% of the population. But since these people have such an immense amount of wealth, Wyden's proposal could raise an impressive amount of money. Musk is not happy. As Robert Reich noted, it would take a typical worker 800,000 years to earn as much as Musk made on Monday. Leon Cooperman, a hedge fund manager worth about $2.5 billion, was more outspoken. "We should not be attacking wealthy people," Cooperman said. He called the proposal "stupid." Bezos, Zuckerberg, Ballmer, and other billionaires did not respond to a request for comment by the Washington Post. How the billionaire tax would workThe details of the plan are still being hashed out but the basic structure is clear. The tax would apply to "those with assets of more than $1 billion, or three-years consecutive income of $100 million." Each year, people who meet that threshold would be required "to pay taxes on the gains of stocks and other tradeable assets, rather than waiting until holdings are sold." The rate is expected to be similar to the current capital gains tax, which is around 23.8%. For assets that are not tradeable, like real estate or privately held companies, "taxes will be deferred until the asset is sold." Billionaires, however, would be charged interest for "years that taxes were avoided and the asset increased in value." How much money the billionaire tax could raiseOn Sunday, Nancy Pelosi estimated that the billionaire tax could raise $200 to $250 million over 10 years. And that might significantly underestimate the revenue potential. In the first year, the tax would apply to all the unrealized capital gains held by the nation's billionaires. According to the latest figures, billionaires currently hold about $5 trillion in wealth. Of that total, $3.5 trillion is in stocks. Gabriel Zucman, an economist that teaches at the University of California, conservatively estimates that 60% of billionaire stock holdings represent unrealized capital gains. That's a tax base of $2.1 trillion. If you tax that at 23.8% it would generate $500 billion in revenue. $275 billion would come from the top 10 billionaires alone. That excludes revenue from any non-tradable assets that are sold during the 10-year budget window and any additional unrealized capital gains over that period of time. So a tax that impacts fewer than 1,000 people could pay for a major portion of the entire reconciliation package. How difficult would the billionaire tax be to enforceCritics like Senator Mitt Romney (R-UT) say that billionaires will simply shift their holdings into non-tradable assets to avoid paying the tax. "These multi-billionaires are gonna look and say, ‘I don’t want to invest in the stock market, because as that goes up, I gotta get taxed. So maybe I will instead invest in a ranch or in paintings," Romney said. Romney, who is worth just a few hundred million dollars and would not be impacted by the tax, underestimates the vast wealth of those involved. There are only a handful of paintings that have sold for over $100 million — and most are rarely available. The most expensive home on Zillow is $169 million. It's simply not practical for Musk and Bezos to shift billions into art and real estate. And, to the extent that does happen, the billionaire tax would still apply and the unrealized gains would accrue interest until the assets are sold. In an interview with Anand Giridharadas, Wyden said that the final legislative text will have "a number of anti-abuse provisions" and close "a lot of loopholes." Robert Willens, the tax guru for the ultra-wealthy, is not projecting confidence. "This is going to be perhaps the most difficult tax we have ever seen in terms of trying to plan to minimize it," Willens told Politico. For many top billionaires, selling their stock is not an attractive option. Zuckerberg, whose wealth is composed almost entirely of unrealized capital gains, can't sell his stock without losing control of Facebook. Musk also "doesn’t like selling stock" and "told The Wall Street Journal in 2016 that he planned to never sell his Tesla shares." It would be very difficult for billionaires that hold their wealth in publicly traded companies to avoid enforcement. Their total ownership — including stock owned indirectly through trusts, shell companies, and other vehicles — is reported to the SEC and disclosed publicly. "For these guys, the truth is it’s so easy to enforce the tax because it’s so obvious what they own," Zucman said. |

Older messages

5 things you should know about Facebook

Tuesday, October 26, 2021

Whistleblower Frances Haugen, a former Facebook product manager, has released a trove of internal Facebook documents to a variety of media outlets, including the Wall Street Journal, the Associated

The new bugaboo

Monday, October 25, 2021

Across the country, conservatives are mobilizing against the inclusion of Critical Race Theory (CRT) in K-12 education. There is just one problem: CRT is a complex theory developed by law professors

Banks engaged in multi-million dollar lobbying effort to protect wealthy tax cheats

Thursday, October 21, 2021

Most working Americans cannot underreport their income to the IRS to avoid paying the taxes they owe. Why? Their precise income is reported to the IRS by their employers. You don't hear many people

A small step for political transparency

Wednesday, October 20, 2021

This newsletter spends a lot of time reporting on corporate political spending. Corporations are extremely powerful entities and how they spend their political dollars matters. But the reality is that,

How Joe Manchin's policy positions impact West Virginians

Tuesday, October 19, 2021

The reconciliation bill, the centerpiece of Biden's Build Back Better agenda, remains in limbo. The primary hurdle is the opposition to the bill, as originally conceived, by two Democratic Senators

You Might Also Like

☕ Fine by media

Thursday, January 9, 2025

The year ahead in retail media. January 09, 2025 View Online | Sign Up Retail Brew Presented By Bloomreach Hello, it's Thursday. We'd like to express our deepest sympathies to all those

Jimmy Carter's life and legacy.

Thursday, January 9, 2025

Plus, a reader question about why we didn't cover the January 6 anniversary. Jimmy Carter's life and legacy. Plus, a reader question about why we didn't cover the January 6 anniversary. By

PC Herod

Thursday, January 9, 2025

The Life Of Herod The Great // The Dictionary Of PC PC Herod By Caroline Crampton • 9 Jan 2025 View in browser View in browser The Life Of Herod The Great Zora Neale Hurston | LitHub | 7th January 2025

🍿 Netflix’s Brutal New Western

Thursday, January 9, 2025

Plus: 'The Batman II' may not be about the Joker after all. Inverse Daily The Wild West gets even more wild in Netflix's epic drama 'American Primeval,' which gives the genre a

🫧 It all comes out in the wash

Thursday, January 9, 2025

Fun stuff for you to click on curated with joy by CreativeMornings HQ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Facebook Fact Checks Were Never Going to Save Us. They Just Made Liberals Feel Better.

Thursday, January 9, 2025

Billionaires gonna billionaire — and lick the boots of whoever will bring them more riches and impunity. Most Read Facebook Fact Checks Were Never Going to Save Us. They Just Made Liberals Feel Better.

Bureaucracy Isn't Measured In Bureaucrats

Thursday, January 9, 2025

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Big Oil Hindered The Fight Against L.A.’s Wildfires

Thursday, January 9, 2025

California's oil and gas companies avoided paying billions of dollars in taxes that could have been used to fight the inferno. As deadly blazes engulf much of Los Angeles, a new report reveals that

Southern California’s extraordinary fires, explained

Thursday, January 9, 2025

Plus: a new experiment in affordable housing, a meltdown in the New York mayor's circle, and more. January 9, 2025 View in browser Lavanya Ramanathan is a senior editor at Vox and editor of the

UPDATE: Republicans on North Carolina Supreme Court block certification of Democratic justice's election victory

Thursday, January 9, 2025

On Monday, Congress certified the results of the 2024 presidential election in routine fashion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏