Accelerated - 🚀 Tesla joins the trillion-dollar club

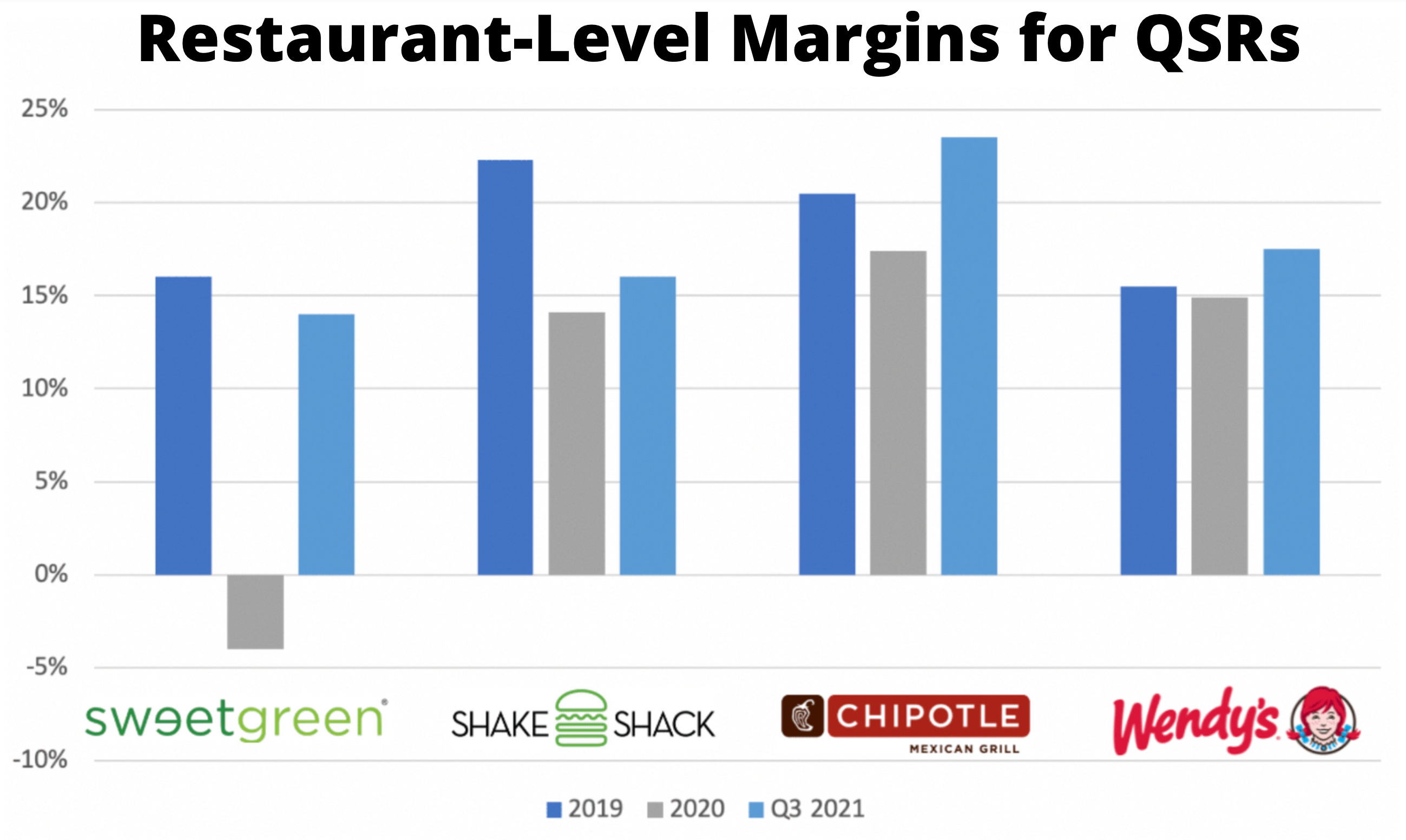

Cult-favorite salad company Sweetgreen publicly filed to IPO this week. Sweetgreen was founded in 2007, and raised $670M from VC and growth firms. There’s been a lot of talk about how the company is not yet profitable - Sweetgreen lost $141M last year on only $221M in revenue. Public investors typically expect these types of brick-and-mortar businesses to be making a profit! However, it’s worth noting that Sweetgreen’s margins on a store level are comparable to other quick service restaurants (QSRs). With the exception of 2020, when Sweetgreen was hit hard by COVID (maybe because so many regular customers bought their salads as an office lunch?), the company’s restaurant-level margin tends to be ~15% - similar to that of Shake Shack and Wendy’s. And according to the S-1, Sweetgreen is aiming for an 18-20% margin moving forward. What does this mean? We need to look at the other costs that aren’t incorporated in this margin, like HQ expenses, pre-opening costs, and depreciation & amortization. Without getting too deep into the accounting, the largest driver of expense for Sweetgreen is general & administrative. This bucket includes the costs of things like HQ-level employees, running the company’s support center, brand marketing, and acquisitions (Sweetgreen purchased robotics startup Spyce). This analysis suggests that Sweetgreen’s model may not be inherently unprofitable - assuming the company can achieve greater efficiency on G&A spend at scale. Today, Sweetgreen has 140 locations, which is relatively small. As a point of comparison, Chipotle has ~2,800 locations and Shake Shack (another “upstart”) has nearly 350 locations. I’m interested to see how this progresses over time! As a sidenote, I am somewhat of a biased observer here - I’m such a big Sweetgreen fan that I was once mistaken as a secret shopper from corporate by employees at Sweetgreen’s “test kitchen” in Culver City. 🚨 Attention crypto / web3 enthusiasts: Accelerated community member Sarah Du is collecting data on how people get into this space! She’d love your thoughts in this quick survey. news 📣🚘 Tesla crosses $1T. Tesla stock surged on Monday after Hertz announced that it will order 100K+ cars to build out an electric fleet (half of which will be available to Uber drivers!). This drove the company’s market cap over $1 trillion for the first time, making it more valuable than Facebook. Most car companies trade at 1-2x LTM revenue - Tesla is at 24x. It’s also a favorite of retail investors, consistently ranking in top 5 most-held stocks on Robinhood. Coincidence? 🤔 🌲 Sequoia shakes it up. VC firm Sequoia Capital is abandoning the traditional fund structure in favor of a new model - a single fund that will both own public stocks and allocate capital to closed-end funds investing in startups. This will allow Sequoia to maintain ownership in companies post-IPO - Axios has an overview on what this means + why the firm is doing it. 💰 Earnings updates. It was a big week for tech earnings! A recap:

what i’m following 👀Insights on early stage marketplaces from Annelies Gamble at Scribble. Instagram is now allowing all users to put links in Stories. Learnings from BVP on how enterprise software companies can unlock their “second act.” An update on VC funding to Florida-based startups. The biggest news of the week was undoubtedly Facebook’s rebrand to Meta, reflecting (1) a focus on building the metaverse, and (2) a de-emphasis on the namesake app. Mark Zuckerberg is putting his money where his mouth is - he told analysts that Meta will spend $10B this year on AR/VR hardware and software. We rarely see established companies recognize potential forces of disruption and realign priorities accordingly - remember when Blockbuster refused to pay $50M for Netflix? But Zuckerberg has often been ahead of the curve, as evidenced by his prescient acquisitions of Instagram ($1B seemed crazy for 13 employees!) and WhatsApp (which gave FB a critical foothold internationally). Facebook’s investment in the metaverse may take a while to pay off, but there was a near-term winner from this announcement…Twitter. The platform thrives when the “chronically online” are consuming the same content and want to share hot takes. Think about the flurry of tweets and memes during events like the presidential inauguration, a surprise Taylor Swift album drop, or Tiger King. Facebook’s Connect event (where Zuckerberg announced the rebrand) was a perfect opportunity for Twitter to shine. A few of my favorite storylines: the BBQ sauce bookend, other brands proposing new names, and the BJ Novak logo (context here). jobs 🎓Carrot - Global Strategy & Ops Associate, Product Manager (Remote) Launch House - Community Launcher*, Community Manager (Remote) N26 - Strategy & Ops Data Associate (Remote) AngelList - Founder Ops Associate, Product Data Analyst (Remote) Evernow - Biz Ops Analyst (Remote) Method Financial - Developer Evangelist (Austin, Remote) B Capital Group - Senior Associate / Principal (SF) Notarize - Associate Product Manager (Boston) BBG Ventures - Analyst (NYC) Redesign Health - Ops Associate (NYC) QED Investors - Principal (TBD) *Requires 3+ years of experience. internships 📝Ribbon - Data Analyst Intern (Remote) Coinbase - PM Intern (SF) Uber - Winter Product Designer Intern (SF) Snap - MBA Strategy Intern (LA) Duffl - Campus Growth Lead Intern (LA, Berkeley, Santa Barbara) LTK - Creator Success Intern (Dallas) Techstars - Accelerator Intern (Knoxville, TN) Elektra Health - MBA Intern (NYC) Galaxy Digital - Ventures Intern (NYC) ZX Ventures - MBA Summer Investment Intern (NYC) Lovepop - Product Research Intern (Boston) puppy of the week 🐶Meet Lu, a one-year-old English Cocker Spaniel who lives in Macedonia. Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Walmart welcomes Bitcoin

Sunday, October 24, 2021

Plus, a starter guide for building online communities!

Which tech giant is leaving China?

Sunday, October 17, 2021

Plus, a new way to meet other Accelerated readers!

🚀 That time when FB broke the Internet...

Sunday, October 10, 2021

Plus, a big week for consumer startup S-1s 👀

🚀 A new age of water-cooler content

Sunday, October 3, 2021

Why is "Couch Guy" the future of entertainment?

🚀 How to get a startup internship

Sunday, September 26, 2021

A cold email template + tips!

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏