Recap of Professor's Office Hour (Week 8)

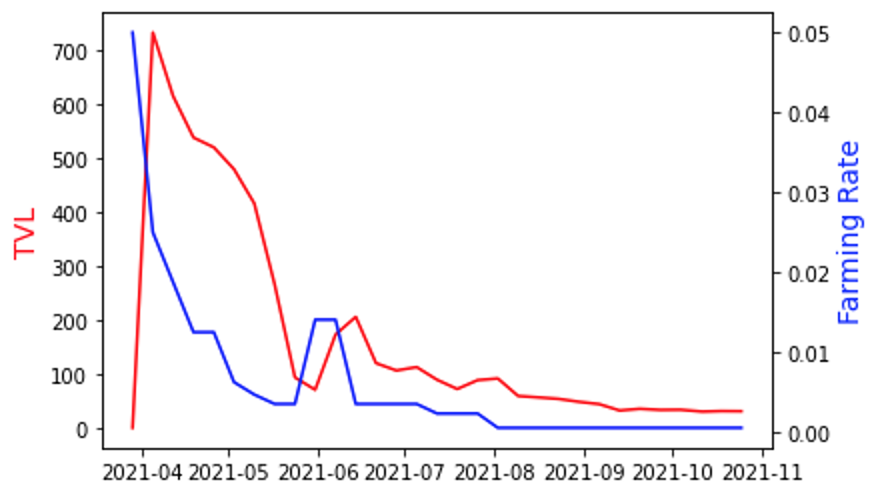

Weekly RecapMarketing/Business developmentWe are still accumulating enough sales leads for the upcoming OTC launch. And to help with these sales and further build the Integral name we sponsored an exclusive, invite-only NFT Halloween party in Las Vegas on Oct 28th. Messari, one of the leading research firms in crypto, just dropped a report on Integral! The report analyses our technology, product and roadmap. Also, we have released our premium membership program - DeFi Trader Club. The DeFi Trader Club (DTC) will be an exclusive group connecting our team with our high-volume traders along with other VIP benefits such as early access to our products, features and updates, a unique DeFi Superhero NFT (designed by BAYC artist) and plenty more. Read up on all the benefits here. Additionally, there are a few more marketing events happening in November, including Integral's 1st NFT Collection - DeFi Superheroes. We will be running a series of community based events to gift these. So, if you missed the first announcement, come join our discord and stay tuned for the next community event. And lastly, our sponsorship of The Defiant Podcast is still ongoing and will be for the next couple of months so make sure you head over and listen to Camila Russo’s weekly podcast on everything DeFi. Product DevelopmentWe have finished building the Integral OTC. The Kovan test-net, should be available by the end of the week, and we'll use the first two weeks in November to finish auditing it. We are also upgrading our ui and landing page. Below is one of the design sketches. Operational updateWe've finished reimbursing the first batch of 27 wallets who have migrated their staking position to the new contract. The reimbursement includes gas costs incurred from their first stake, interest claims, and principal withdrawal. The team suggests you move your funds ASAP, as the old staking contract has stopped distributing interest. If you haven’t done so, please follow this guide. Spread the wordThe next few months we will be generating enough leads for our OTC product. The next few months we will be generating enough leads for our OTC product. Q&AMarketing & CommunityThe DeFi Trader Club (DTC) is an exclusive club for elite traders with an order size of $500k+. As much as I can understand why this proposal is being put forward as it fits with Integral’s strategies and aims, I can't help but feel that, despite being an early investor at launch, I am being left out because I'm not one of those elite traders who does that type of volume. I think there should also be a way to reward/acknowledge early investors especially as they invested quite early knowing that their investment will be vested over 3 years…. Thanks for the comment. I would like to use this opportunity to make some clarifications. First of all, Integral OTC is not a retail-level product, which means that its user base will be extremely small. According to our analysis, there are only 4-5k wallets who have done a trade >500k on-chain. This means, we cannot rely on old marketing tactics to reach such people (like putting up ads or airdrops). We have to implement something new to connect with these users and build the product for them. That's why we we have launched the DeFi Traders Club. It's not replacing the current community by any means, it's more of a new channel which helps us connect. We will definitely keep sharing our insights/knowledge/updates to our community and we humbly ask for your understanding. Everything we do always has the communities greater good at heart. Can I ask how are the Heroes role is awarded here in Discord? On what basis? And whether the role comes with any privileges? We designed the hero system when we first launched our protocol. It is a community based rewards structure that is currently being redesigned. We are always on the lookout for those of you that go that extra mile in helping build and inspire our community. This could be in many forms such as reviews, articles or even memes. @Skipper in our discord is currently leading this - if you are interested in what's going on and want to become a Integral Hero yourself, you can always reach out to him! ProductCan you tell me the difference between Integral and a company like Galaxy why should institutional organizations use the service of Integral and not Galaxy's service to buy crypto in a safe and trusted way against good prices? That's actually quite easy to answer. Unlike Galaxy, Integral is DeFi. It can allow whales/institutions to trade large orders while preserving the beauty of DeFi: you have 100% control of your assets. Which groups are you targeting that you hope will use our product? Elite DEX Traders (aka Whales), standalone OTC Desks (sometimes their clients specifically ask them to execute the orders through DeFi) or crypto native funds that need to hoard eth/stable for farming etc. TVL & L2Are you planning to focus on the OTC, or are you going to boost marketing for both your products when OTC is live? Right now there are not enough liquidity in most/all the pools for whale trades. So the below graph illustrates the relationship between the $ITGR farming rate and TVL. The reason that there's not enough liquidity in the pool, is because currently the farming reward is very low (only emitting 0.053% of the token cap every week). After the OTC product launches and we will witness a sustainable flow as we will increase the rate to make sure there's enough liquidity in the pool for all trades. It would be great if this system, which uses the protocol to feed its liquidity, could be implemented in the largest number of blockchains and L2 of course. In addition implementing to the backend of other protocols, fintechs and tradfi. Yes, we are looking at L2 at the moment. Before we choose and implement an L2 on the trading function we'll use it to first solve the high-gas problem for claiming ITGR tokens. Follow us and keep up-to-date To join in on The Professors Office Hour next week please join our Discord server: Discord: https://discord.gg/hJdG95ykHD Website: https://integral.link/ Twitter: https://twitter.com/integralhq Substack: https://blog.integral.link/ Telegram: https://t.me/integralresistance Github: https://github.com/ProfessorJEY/Integral-Smart-Contracts/ If you liked this post from Integral Resistance, why not share it? |

Older messages

Introducing The DeFi Trader Club by Integral!

Tuesday, October 26, 2021

The DeFi Trader Club (DTC) will be an exclusive chat group connecting our core team with our high-volume traders and liquidity providers. Membership to this club is free, but invite-only and limited to

Recap of Professor's Office Hour

Tuesday, October 19, 2021

We are very pleased to have concluded our 7th weekly office hour. Please find below our recap, survey question results and the live community Q&A session that followed.

Changes to Staking

Thursday, October 14, 2021

One month after we roll out the staking, the contracts now have locked nearly 1000000 $ITGR for 3-year stakes, accounting for almost 20% of the circulating supply.

The Declaration of Resistance

Saturday, October 2, 2021

Thank you for signing up for Integral Resistance

Recap of Professor's Office Hour (Week 5)

Saturday, October 2, 2021

We are very pleased to have concluded our 5th weekly office hour. Please find below our weekly recap, survey question results and the live community Q&A session that followed.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏