Scouting Matt Redler, Cofounder/CEO of Panther

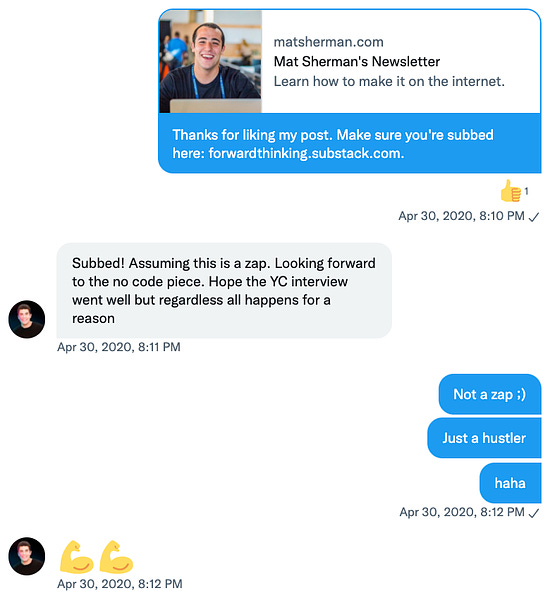

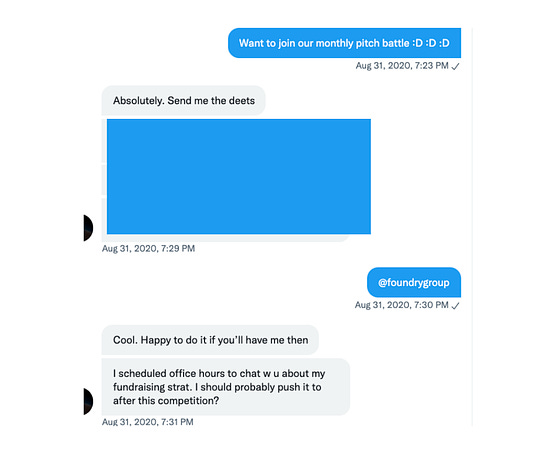

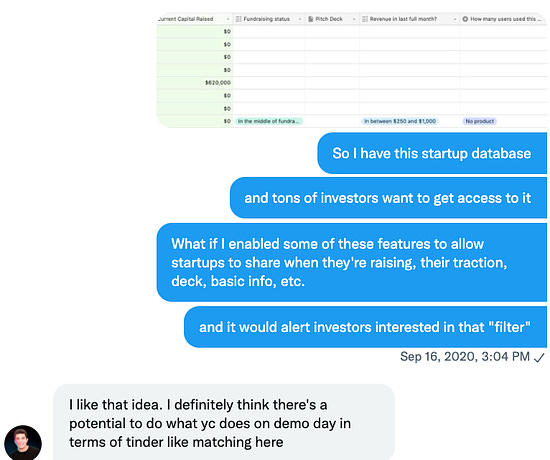

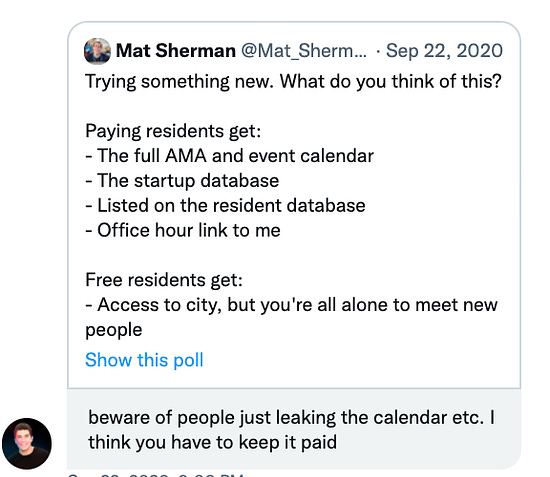

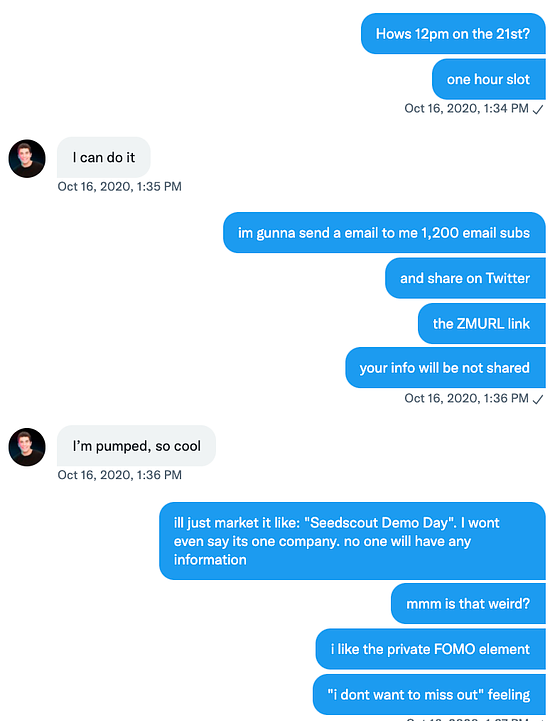

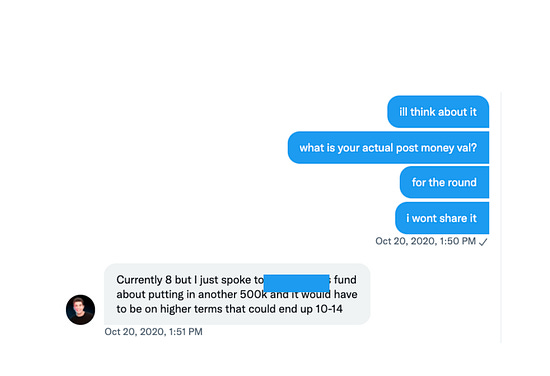

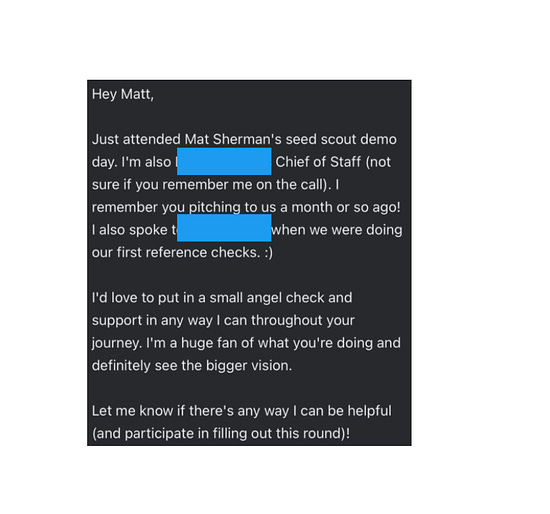

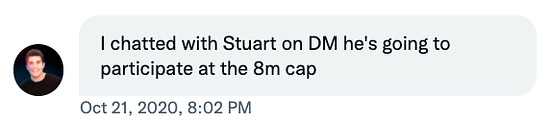

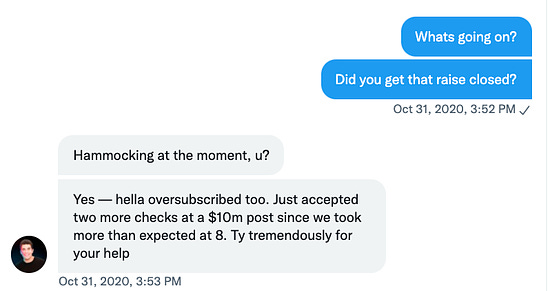

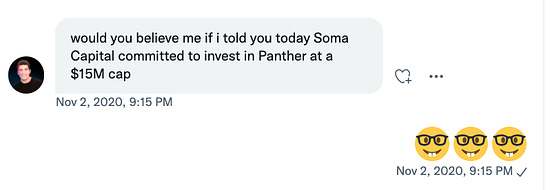

Panther is on fire in all of the best ways. If you do a quick Google search on global hiring options, you’ll find that it sits among the leaders gunning for the giant market opportunity. You’d see Matt Redler (CEO) on Forbes, see that every other post from him on social media is a hiring post, and you’d see a company that comes up in casual conversation on Twitter daily. Clearly, Panther is a company in growth mode that has a fairly decent shot at becoming a billion dollar company and even much bigger than that. It’s an exciting time. Yet, like all startups, Panther has its origin story. Just a year and a half ago, Matt was working on a different startup that COVID left for dead almost immediately. Most of the startup world had not heard of him at this point, he was based 3,000 miles from the Bay Area, and he appeared just like any average techie who had dreams to build a startup from the ground up and solve growing problems in an industry. So much has changed in these 1.5 years. Panther’s rise over is fairly well documented by its fans, investors, and employees online, yet this post is aimed to outline and document the rise before the rise. What was Panther like before everyone knew about them? What about Matt Redler? this story starts 8 months before Panther announced their pre-seed round of financing. And of course, it started on Twitter. Scouting MattOur relationship got kicked off by a Twitter DM, naturally. He liked a post, so i reached out to make sure he got more of my content. For some reason, I was DMing people who liked my tweets that day. Matt was one of the people I DMd and it all started there. Over the coming weeks/months, we chatted a bit and we got to know eachother. Matt was clearly a motivated founder. Different from many. Personally, I was in the process of leaving my job and starting Forward Thinking City, (the precursor to Seedscout). As the supportive friend he is, he joined that and played a core early “resident”. Weeks after he joined, I asked him if he wanted to partake in a city pitch battle format. At the time, Seth Levine (Foundry Group) was joining us which is a huge name in venture. I was hoping to get Matt in front of Seth. This is where I started to connect him to my network. He was onto something with Panther. That didn’t materialize but the ball was rolling. I wanted to help Matt raise capital. In fact, I just wanted to help all founders raise capital. Over time, our DMs just turned into jams on this topic. This is my foreshadowing Seedscout without realizing it at the time. Matt was really core for me in helping hash out the earliest versions of Seedscout. He was a great thought partner. Here are some examples of him truly just helping me out, founder to founder. I share all of this because I want the record to show that Matt was and still is more than giving with his time. Sometimes even I forget that before all the venture capital and huge teams, there was just founders helping founders. This is what’s so key about Seedscout. We aren’t VCs. We aren’t LPs. We are all just founders figuring it out, and if we’re lucky, we find people like Matt to help us on the journey to find product market fit. It was around October when things started lightly lining up for me, which enabled me to truly help Matt in a material way, and repay him for all the time and help he’s given me. Seedscout’s Value AddPodcastWe recorded the Panther podcast with Matt on October 18th, 2021. At this point, his story was clear. He was persuasive. But most importantly, he was right. His thesis for remote work had stayed strong through the year and the prospects for Panther were looking up. Once the podcast ended, I thought Matt had a good shot at raising some real capital. And I wanted to help even more than a podcast. Seedscout Demo Day 1I was building conviction in Matt as we gotten to know eachother over that 6 months, and I was ready to go to bat for him. He crushed the podcast (although I knew he would) and all the signals are care about were screaming that this was about to take off. And I wanted to do my part. So I asked Matt to participate in the first Seedscout Demo Day. I thought it could help him get some more investment. He was in and the first demo days from Seedscout was on for October 21st, 2020. As we were prepping for the demo day, I asked him what his current post money valuation was. At this point, just about a year ago, the post money was $8M. In a moment, you’ll realize how bonkers that is. So the day before the demo day, Panther’s valuation was $8M. And I was hosting a demo day for 72 investors who RSVPed, all of whom had the opportunity to invest at the end of demo day. The attendee range was vast. Dozens of angels came, as well as about a dozen VC firm partners. The stage was set to get Matt funded! Once the demo day ended, the only thing I could feel was bliss. Matt completely crushed it. I was expecting a few investors from the demo day to put money in at least. And they did. Immediately after the event ended, Matt sent me this screenshot. He also sent me this message about another attendee (and friend). He was getting in on the $8M post money cap. Wow! A few other investors invested but it wasn’t the majority. Maybe 90% of the attendees probably had no intention of investing, but to snoop. This would go on to bite them, unfortunately. I don’t know how much of a role we played in them increasing their momentum, but I know we at least played a small one :) It seemed like right after the demo day, things started to take off for Panther on the Fundraising side. Two weeks after the demo day. I get this message from Matt. Just a month ago, I was helping get my investor base into Panther at $8M, and just two weeks later, that valuation had almost doubled. From this point on, Panther really just took off and hasn’t stopped since. Shortly after Soma invested, Panther put out a press release for it. Panther Was Inevitable.Not long after that in May of 2021, they announced another funding round including Tribe Capital, Adapt Ventures and Eric Ries (who I pulled into the round). Today, Panther is scaling like no other and is starting to take a dominate position in their market. Their team has taken over LinkedIn with humorous hiring posts, the team seems to be in scale mode, and Matt is building his influence as the de facto guy to go to for remote/global hiring. These days, I am sure the top series A funds are tracking Panther as a potential investment. What is the valuation at today? $40M? $65M? $80M? Higher? I don’t have this information but i’m sure it’s growing rapidly as the business scales. What I do know is that some how, some way, Matt and I were pulled into eachothers orbit nearly 8 months before any of this started taking off I remember him talking about his former company and needing to bounce back. Him supporting me and my ventures early on. Letting me jam with him on all things Forward Thinking City and trying to help him with his fundraise before I even know how to help. All of this culminated into a demo day where 50+ had the opportunity to invest in Panther at a $8M post money valuation. 3 or 4 did. And not even a year later, Panther is on the path to 10x and 10x after that. The Best Founders Are InevitableThis is what Seedscout does. We connect with great founders early. We get to know them. They get to know us. And at the right time, we get our network involved with the founders as we get to know them over months, sometimes years. But we’ve seen greatness enough times to recognize it in founders sometimes before they even recognize it for themsleves. Not Matt though. He always knew he was great. You could tell by his self confidence and in his communication style. Some could call a founder like Matt Redler inevitable. I personally cherish the 8 months before things started popping off for him. Yet I am even more excited to see where he’ll be in 8 years. Thanks for letting Seedscout play a small part in your journey, Matt 🙏 |

Older messages

Just Make It Easy

Wednesday, October 6, 2021

How to get what you want from busy people

The Deal Flow Triangle

Thursday, September 30, 2021

A Simple Framework For Diversification In Startup Investing

Why Send Forwardable Intro Emails?

Friday, September 24, 2021

The Operating System For Transferring Trust

Be Anyone

Wednesday, September 15, 2021

Why To Make It On The Internet

I'm Coming to NYC!

Monday, September 13, 2021

Hey everyone, Wanted to drop a quick note saying that I will be traveling to New York City at the end of this month and will be hosting a meetup…

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏