The Daily StockTips Newsletter 11.11.2021

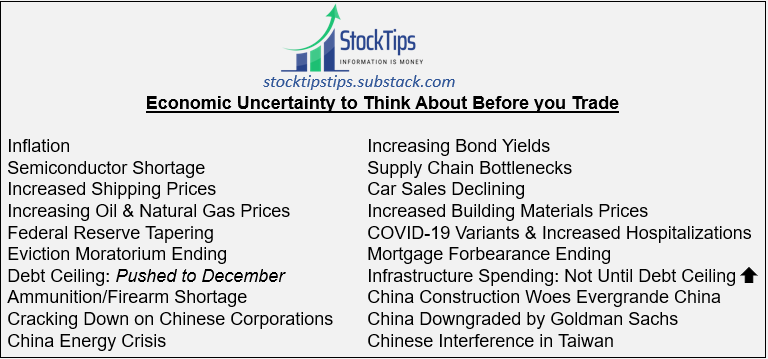

The Daily StockTips Newsletter 11.11.2021I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)Below you will find a list of stocks researched, hand picked & watched by me. I grade, organize, & rank the plays taking into account Risk (R), Value (Va), Growth Potential (G), Intuitional Ownership (I), Volatility (Vo), Earnings History (H), & Market Conditions (M). I then score them, set price targets, & provide a quick thesis about the company. I do not throw stocks up until I thoroughly research them. The way I figure it, I ought not be drawing attention to stocks I'm not confident enough to buy myself. The Stock Tip Report is NOT investment advice, it is strictly to assist you in your own idea generation, & you should always do your own DD. Please read the "Important Disclaimer" at the Bottom of this Page.IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.Before you Trade Today: Know the Economic Calendar! StockTips Market Key Takeaway’s: I expect this earnings season to be forgotten quickly & the uncertainty derived from supply chain constraints, worker shortages, & semiconductor shortages to reclaim market sentiment until next earnings season. Valuations are seriously overpriced right now by any reasonable & historic metric. Be weary of the inflation numbers coming out today! Yesterday: Yesterday CPI (Consumer Price Index) numbers were reported. I was expecting AT WORST 5.8. Inflation instead came in at 6.2% YoY, a 31 year high! Now we need to contend with a few things but some observations are in order. Remember that much of the CPI was affected by energy costs & supply chain bottlenecks. No the CPI does not measure this, however it does measure the price of end products. This will no doubt be temporary, although prolonged. That’s the good news. The bad news is a good chunk of that 6.2% will chip away at peoples wages as they spend money. For example, folks will likely need to economize their needs & cut back on some wants. This will affect markets. That’s the bad news. From a finance standpoint revenues should rise as a result of inflation which may seriously help with much of the current debt carried by some of the companies on our list. Just as the average mortgage established in the 1980’s would cost you around $300 a month today due to the fact that wages have risen considerably since then while the fixed loan remained the same, so too with current company debt with increased revenue. Finally what fell under the radar yesterday was yet another Evangrande scare. China is in all sorts of trouble right now in their real-estate sector. Stay away from China folks! Today: Happy Veterans Day! Valuations right now on many companies are absolutely absurd … but no one ever said that the markets had to make sense. Remember that the more overvalued companies become the harder they will correct on unexpected changes in economic conditions … which is why buying many companies right now, no matter how promising they look, is a risker than usual endeavor. For this reason I will continue to scrutinize value & growth. I will continue screening for the companies the market forgot with a great economic outlook. I have added one stock to the buy list today & I believe it to be a great opportunity to dive into the CDN & Cloud Space at a value with promising growth. Significant News Heading into 11.11.2021:

Todays STOCK TIPS: If its on this list (BELOW), I’m either holding a position or considering it for my own portfolio.Note: I likely have a different trading style than you. Therefore I may look at stocks & approach the market differently than you. I trust the financials. I mostly target reliably profitable growth stocks trading at a value on a dip of no consequence pending favorable economic conditions. I buy in slow, & sell the excess, if necessary, on the parodic pops above my cost basis. I love covered calls on volatile stocks. I build positions by buying in slowly in the red & I’m willing to run the clock on what I see as a promising trade. I also expect & account for uncertainty & constantly re-evaluate. FOMO to me is an F-word. I don't chase & I never buy meme stocks. I am willing to limit profit to guarantee it & there is nothing I love more than a market panic. I outperform impatient folks swinging for grand slams because I hit homeruns while swinging for base hits. Quite often plays can take as long as a quarter, or perhaps more, to pan out. Discipline goes a long way. Discipline, however, is a lot easier if you know what you’re trading.REMEMBER: My personal buy list gets updated early at a zone above my desired buy-in-price so as to react in time when stocks hit the proper price target. The profit/loss percentage as reflected on the “date added” line" therefore does not reflect profit/loss percentage from the desired buy-in price. PAID CONTENT BELOW: 6 Stocks in the Buy Zone (Waiting to Swing), 7 Stocks (Profiting) Above the Buy Zone / 36 Stocks on the Price Based Assessment WatchlistClick HERE if you want to know my process for identifying promising investment & trading opportunities. From 10/22/2021 on I will give specific dates & more detailed Profit/Loss Information. It’s important to demonstrate that my method works. All profit & loss removed from the list will forever be posted below. Please note that the numbers only reflect the difference between the INITIAL buy price & the sell price without credence to the effects averaging down, which I often do. Gains can therefore look much less than what was actually achieved by 1-10%. ... Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

A Message For StockTips Subscribers

Thursday, November 11, 2021

Free Trial Offer & Our Profits Thus Far!

The Daily StockTips Newsletter 11.10.2021

Wednesday, November 10, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

The Daily StockTips Newsletter 11.09.2021

Tuesday, November 9, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

The Daily StockTips Newsletter 11.08.2021

Monday, November 8, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Paid Subscriber Service)

The Daily StockTips Newsletter 11.05.2021

Friday, November 5, 2021

Below you will find a list of stocks researched, hand picked & watched by me. I grade, organize, & rank the plays taking into account Risk (R), Value (Va), Growth Potential (G), Intuitional

You Might Also Like

🇨🇳 The US is out, China is in

Tuesday, March 11, 2025

Citigroup's forecast for US and Chinese stocks, Lego stacked bricks, and Boeing's investigation | Finimize Hi Reader, here's what you need to know for March 12th in 3:10 minutes. Citigroup

The Under-the-Radar Threat to Your Retirement

Tuesday, March 11, 2025

Nearly half of older adults are burdened by bad debt ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

15 Years Since We Bought Our Toxic Asset

Tuesday, March 11, 2025

In a new Planet Money plus episode, former Planet Money hosts David Kestenbaum and Chana Joffe-Walt look back at a pioneering series that sought to explain a major source of the 2008 financial crisis.

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏