Why Terra ($LUNA) is unique and should not be compared to other blockchains like Ethereum, Solana and BSC

Why Terra ($LUNA) is unique and should not be compared to other blockchains like Ethereum, Solana and BSCA fundamental overview of Terra, $LUNA and $UST.If you’ve heard of the Terra blockchain and its ecosystem, you’ll know that it is often compared to other Layer 1 Blockchains like Ethereum, Solana and Binance Smart Chain. However, what Terra is and what it is trying to be is often overlook. Here are 3 ideas you should understand: 1. Terra is not competing against other L1 blockchains to be the best blockchain. It is competing to be the best form of decentralized money.In his podcast with @delphi_digital, Do Kwon, Co-Founder and CEO of Terraform Labs (@stablekwon) encapsulates the entire ethos that Terra is built on:

The phrase "For everything else it's just a means to an end." really struck a chord with me. While it is true that us #LUNAtics always harp on the point that more than 100+ dApps are in the pipeline waiting to launch with Columbus-5 being the catalyst, tons of new use cases However, we tend to forget the fundamental question of: "Why does it matter?" Every dApp launching on Terra (or dApps which have already launched) makes Terra stablecoins better to hold, easier to spend, and more attractive to invest. That's why we have world-class dApps like @anchor_protocol, @mirror_protocol, #CHAIPay, @pylon_protocol and many others waiting to launch like @mars_protocol, @prism_protocol, @astroport_fi, @alice_finance creating countless use cases for the Terra ecosystem and its stablecoins. Ultimately, every dApp built on Terra is all just a means to an end; and that "End" is to create the most decentralized and useful form of money there is. 2. Terra is chain agnostic.

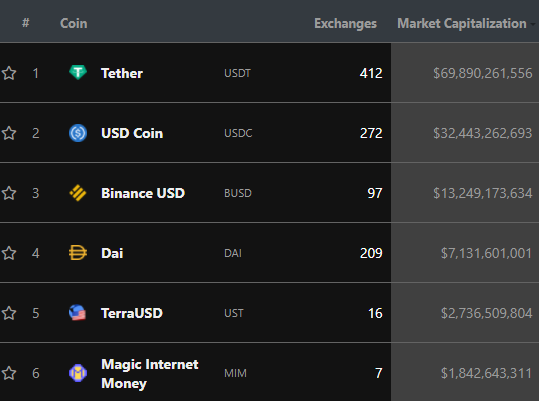

The beauty of Terra is in the simplicity of its price stability mechanism: For every $UST minted, the equivalent dollar's worth of $LUNA is burned. It does not matter where $UST is used, be it on other L1 blockchains like Ethereum and Solana, or even centralized exchanges like Binance. As more $UST is minted, $LUNA will be increasingly becoming more scarce as more LUNA will need to be burned. With Columbus-5 and the implementation of Wormhole V2 and @cosmos's IBC, we can expect to see the Cambrian explosion of $UST being used in every exchange, decentralized and centralized. A bet on LUNA is a bet on the success of its stablecoins. 3. Terra's total addressable market is every sovereign currency in the world.Creating the most decentralized and best form of money is not exclusive to the USD-pegged $UST stablecoin. Anyone can create Terra stablecoins pegged to any currency on the planet. I'll let you do your own research on the world's total market cap of all fiat currency, but to put things into perspective: The Top 3 Stablecoins by market cap (as of 21 October 2021) has a combined market cap of about $115 billion, while $UST has a market cap of $2.7 billion. That being said, there are still major obstacles that Terra and its stablecoins will need to overcome to achieve widespread mainstream (e.g. building infrastructure and global acceptance) but I'll save that for another thread. Disclaimer: I am heavily invested in $LUNA and its ecosystem, but this should not be taken as financial advice, do your own research and come to your own conclusions. Thanks for reading! I’d like to hear your thoughts as well.If you want to see more articles or threads like this, do reach out and follow me on Twitter at @GabrielGFoo! I write about various topics including (but not limited to) Terra, blockchain, NFTs etc. Comment & Earn!Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards. If you liked this post from Cryptowriter, why not share it? |

Older messages

Confused about ‘Technical’ Taproot?

Tuesday, November 23, 2021

What does it actually mean for the average Bitcoin user?

EOSweekly: BountyBlock, Chintai, Bullish, Cryptowriter, WG+, Pomelo

Sunday, November 21, 2021

There's a BountyBlok out on EOS NFTs. The ENF restructures mainnet development with Working Groups. Get ready cause here comes Chintai. Pomelo's halftime show starts with a spectacular session.

Watch out. Bitcoin Could Do the Unexpected, Soon

Sunday, November 21, 2021

Every time you say "bitcoin can't do that," you make it slightly more likely to do exactly that

Space Toadz - Mint Overview

Thursday, November 18, 2021

Terra NFT - Space Toadz stealth-launch NFT mint via the Galactic Punk team was a big success. Let's go over those details in a breakdown via Flipside Crypto data!

Community, Support, and Funding Making EOS Attractive Again

Thursday, November 18, 2021

EOS DAWN was a breath of fresh air for those frustrated by slow Bitcoin and Ethereum applications. Veteran crypto users may have even felt as if they'd been teleported into the future. Transaction

You Might Also Like

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏