WTF is Astroport and why it's going to supercharge the Terra ecosystem

WTF is Astroport and why it's going to supercharge the Terra ecosystemA fundamental overview of Astroport ($ASTRO) and what it brings to Terra, $LUNA & $USTIf you are familiar with Uniswap, SushiSwap and Curve Finance, you’ll know how valuable these protocols are to the Ethereum blockchain. On Terra, a void must be filled and Astroport will change the game. To preface this thread, it is important that you understand what Automated Market Makers (AMM) are and why they're important in DeFi. @HideNotSlide explains it very well for the layman to understand:  1. So WTF is Astroport?Astroport is an automated decentralized exchange protocol building on the Terra blockchain, developed by a joint venture entity formed and governed by Delphi Digital, IDEO CoLab, Terraform Labs and Astroport builders.

If you've actually read their litepaper (31 min read), you'll know that Astroport is going to be an ever-expanding blackhole for all liquidity on Terra and beyond. Let me explain why. Firstly to understand Astroport, we need to understand how it stands out from other AMMs in crypto and DeFi. Here are 3 key features we need to grasp:

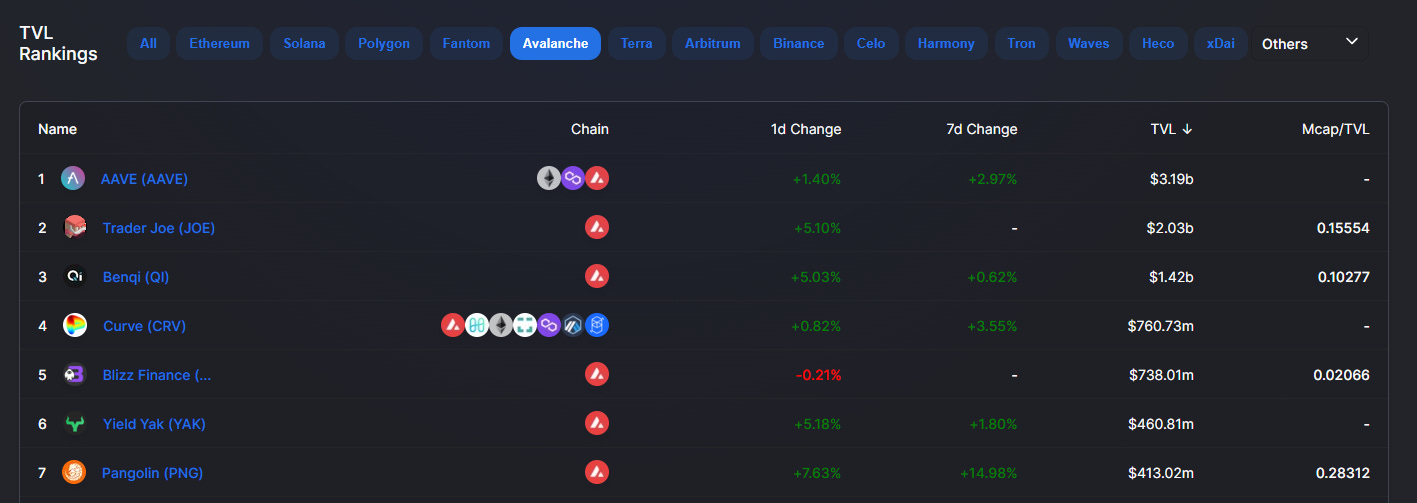

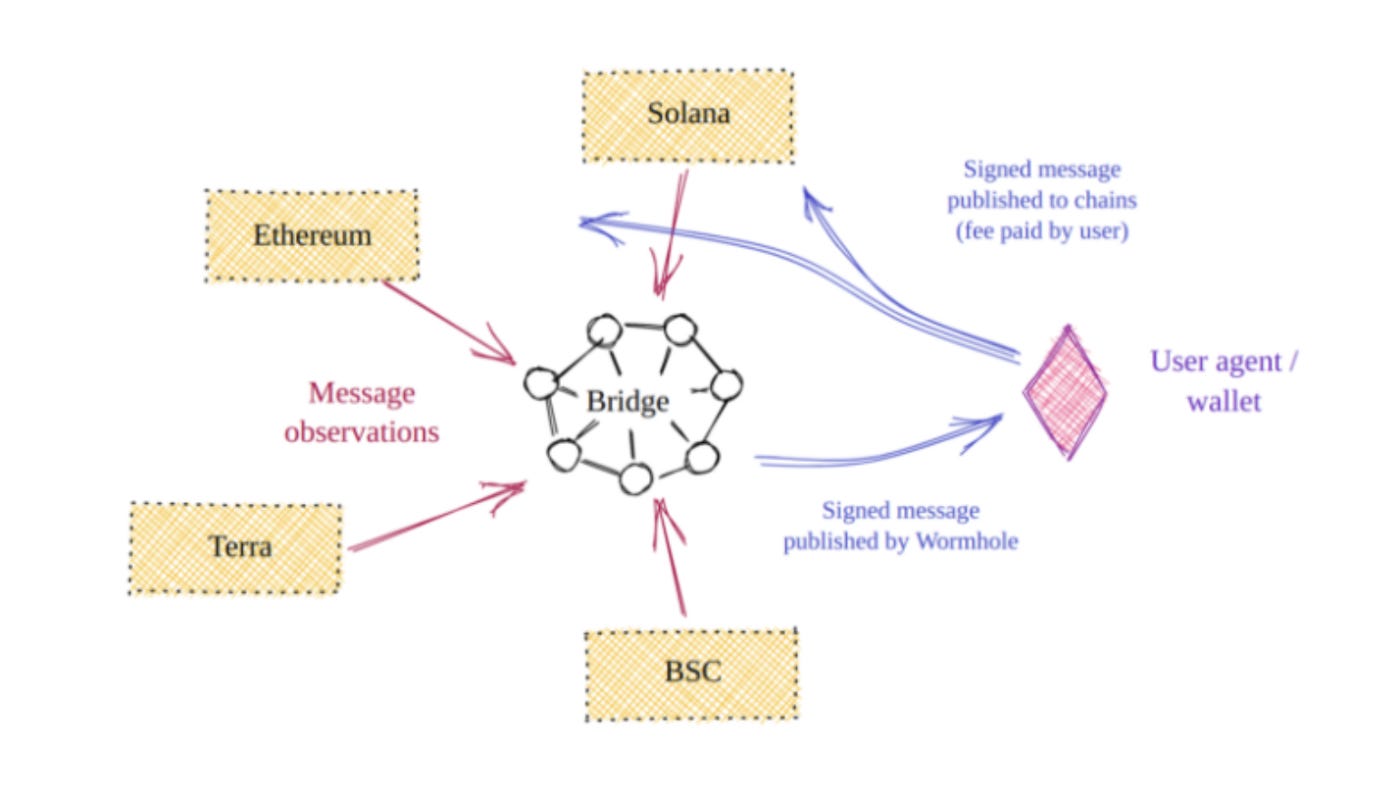

A // Flexible Pool Types I won't go very deep on this but here's essentially what you need to know. Different AMMs use different algorithms to determine token prices based on the ratio of token pairs in a pool. As all tokens have different characteristics, various pool types were pioneered and created to suit different tokens for increased efficiency for both traders and liquidity providers. The following pool type were pioneered by various protocols and are some of the most widely used across token markets:

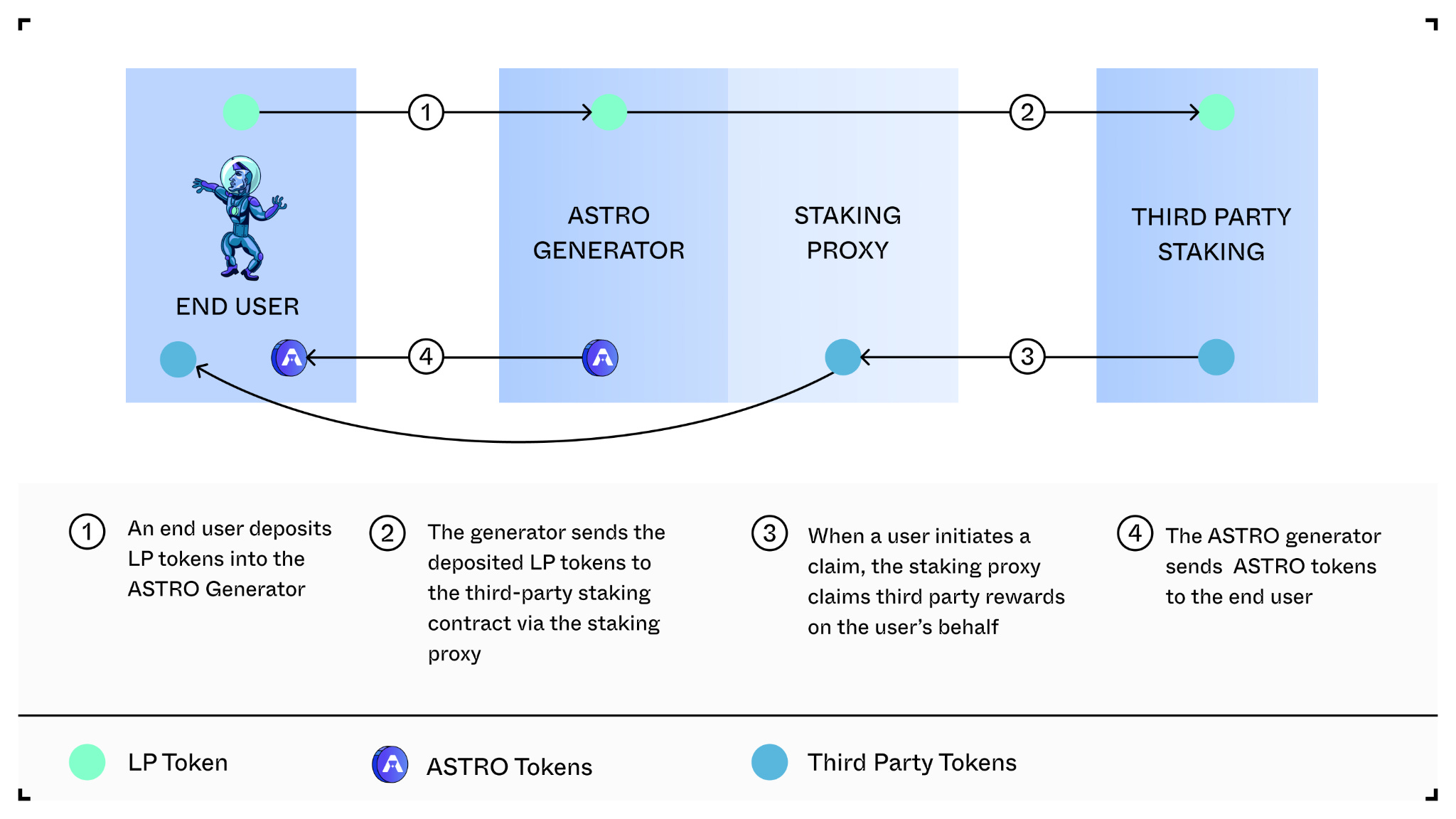

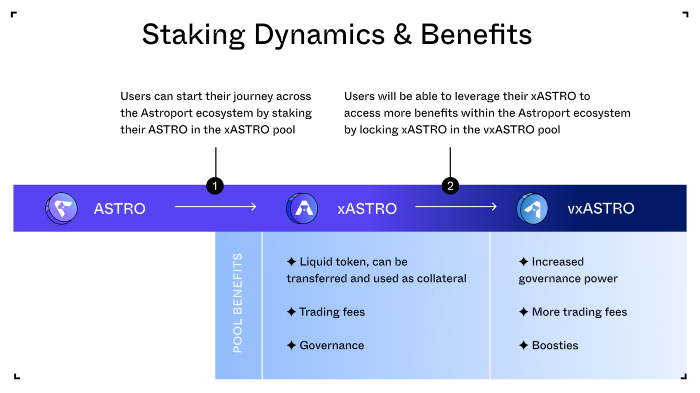

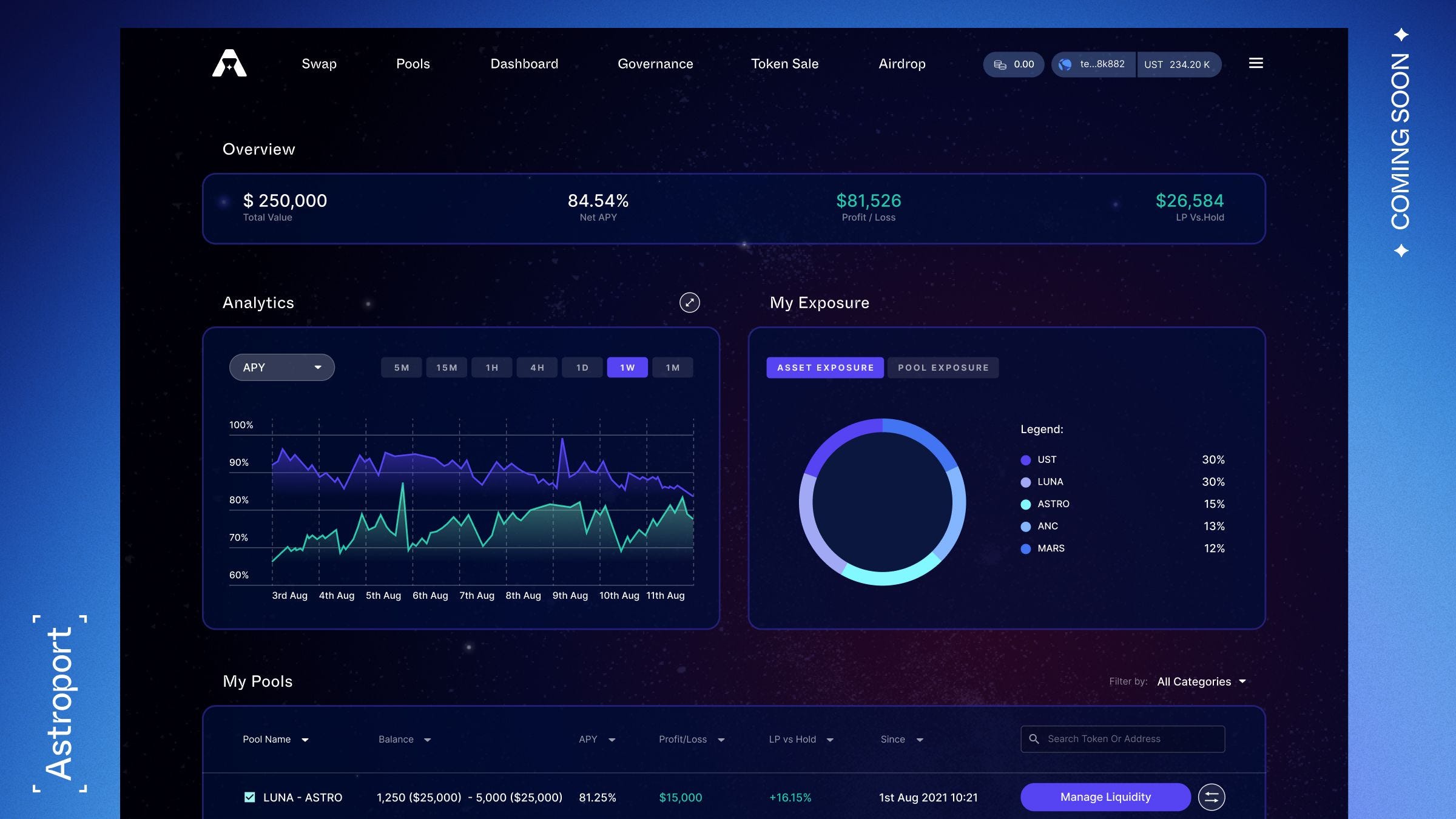

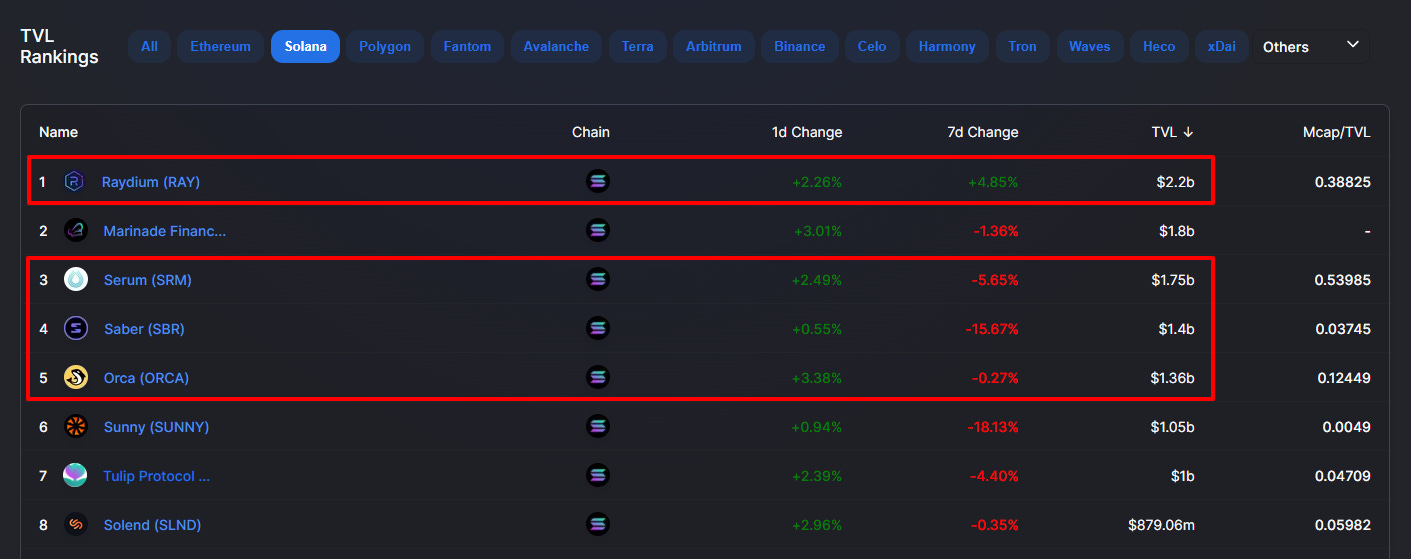

So how does @astroport_fi raise bar? The chads behind Astroport have taken this one step further by creating a flexible architecture to accommodate pool types of any kind AND the ability to seamlessly create new pool types with only minimal changes to the core protocol code. The mad lads have essentially created an amalgamation of the best innovations from the pioneers of AMMs in DeFi: Uniswap, Bancor, Curve Finance, Balancer And we've just scratched the surface. B // Dual Liquidity Mining Gone are the days where liquidity providers need to face the dilemma of deciding where to focus their liquidity mining efforts because Astroport's ASTRO Generators will allow liquidity providers to receive dual governance tokens. This enables simultaneous dual token farming of $ASTRO AND the third-party protocol tokens. For example, when we deposit Anchor Protocol's ANC-UST LP pair into the Astroport's ASTRO Generators, we will receive both $ANC and $ASTRO. Capital efficiency at its finest. C // $ASTRO Governance & Value Accrual Inspired by the gigachads at SushiSwap for their $SUSHI & xSUSHI mechanics; Astroport enables $ASTRO holders to stake their tokens in the xASTRO pool to receive more xASTRO, take part in governance, and accrue a share of trading fees. As if that wasn't enough, the chads behind @astroport_fi (inspired by Curve Finance's veCRV model) enables xASTRO to be locked in the vxASTRO pool to amplify their governance power, receive an additional share of trading fees, AND access to boosted liquidity mining rewards. Not only do $ASTRO stakers earn a share of ALL trading fees, the vxASTRO model fosters a healthy governance system while fairly rewarding both short-term and long-term holders respectively. If you've been paying attention, you start to notice something. The chads behind Astroport are creating a Frankenstein's monster of an AMM protocol, except that they're taking the best innovations of proven and battle-tested AMMs in the industry. 2. Astroport will host a best-in-class UI/UX in any AMM in DeFiHaving the best UI/UX among dApps has always been a key feature of Terra protocols, but Astroport completely changes the game. Not only will Astroport provide traders with a great user experience, but now liquidity providers will actually know how much money they are making through Astroport's personalized user dashboards. Being able to have an overview of all your liquidity pools, know how much impermanent loss you're incurring, and knowing your profit or loss of each individual pool AT A GLANCE is basically a DeFi superpower. You can read more about it in @astroport_fi's Twitter thread:   3. Astroport will be one of the biggest TVL black holes in Terra (and perhaps beyond)If you've used Terra's current offering of DEXes and AMMs, you'll know that they're decent and get the job done, but they could be doing so much more (no dramas, only innovation). Terraswap and Loop Finance combined make up for $1.34 billion TVL in the Terra ecosystem. That's really decent for a growing chain, and Terraswap doesn't even have a governance token! However, let's look at the other Layer 1 Blockchains. Excluding Ethereum for obvious reasons but let's look at alt-chains which have a similar TVL compared to Terra. Just looking at Solana, the combined TVL of $RAY, $SRM, $SBR and $ORCA absolutely dwarfs Terra's $1.34 billion TVL. When looking at Avalanche's native AMMs, the combined TVL of $JOE, $QI and $PNG is already $3.86 billion. Without diving too deep into the numbers, you can see that the Terra ecosystem has some catching up to do in the AMM department. Astroport fixes this. By adopting a flexible architecture for liquidity pools, Astroport greatly expands its Total Addressable Market by effectively catering to token pairs of any kind. Essentially combining the use cases of multiple dApps into one. Lastly, with the implementation of @wormholecrypto's Wormhole V2 in the Terra ecosystem, this opens limitless opportunities for cross-chain capability, allowing users operating on other chains to seamlessly interact with Astroport. Literally a cross-chain space station. 4. So why does this matter to Terra, $LUNA and $UST?An AMM is the most important primitive and is the core building block of any DeFi ecosystem. Allowing assets to freely flow in a trustless and capital efficient manner is paramount in a decentralized economy. Astroport coupled with Columbus-5 and Wormhole V2 will open Terra's floodgates to liquidity from across the metaverse, while enabling $UST pairs for all assets beyond the Terra blockchain. This further increases the ease of access for capital to settle in Terra, amplifying the adoption of Terra stablecoins and ultimately accruing value back to the apex asset $LUNA. TLDR: Numba go up, DYOR, NFA. DISCLAIMERI am in no way related or working with the @astroport_fi team and I have no vested interest in the project and $ASTRO. I am merely interested in the project. However, I am invested in the $LUNA and other projects in the Terra ecosystem. Information written here is purely educational and is my own opinion. Nothing I say should be constituted as financial advice, do your own research, and please consult with a professional before making a particular investment. REFERENCESSome good reads from members of the community that inspired this thread. @TheMoonMidas's "Venice of the Stars":   @ZeMariaMacedo's Astroport alpha leak:   @DeFi_Maestro's TLDR of Astroport’s Litepaper:  @astroport_fi's Token Drop:   Thanks for reading! I’d like to hear your thoughts as well.If you want to see more articles or threads like this, do reach out and follow me on Twitter at @GabrielGFoo! I write about various topics including (but not limited to) Terra, blockchain, NFTs etc. Comment & Earn!Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards. If you liked this post from Cryptowriter, why not share it? |

Older messages

Last 90 Days of Transactions - Terra

Friday, November 26, 2021

Terra Ecosystem - Let's take a look at the transactions for the last 90 days on Terra. Contracts, volume, etc.

Total Volume on Terra NFTs

Friday, November 26, 2021

Terra NFT - Let's take a look at the total volume for the most active NFT marketplaces on Terra!

Hilary Clinton Sees Bitcoin as a Threat to the US Dollar – That’s the Plan Hilary

Friday, November 26, 2021

Bitcoin is a fairer system that will end America's endless wars to protect the dominance of its American dollar.

Cosmos SDK Club: Juno

Tuesday, November 23, 2021

Smart-Contracts

Art of the Chart - TAking Requests!

Tuesday, November 23, 2021

Happy Thanksgiving / Holiday season, everyone! Hope you're all well, and doubling down on peace & gratitude as we enter the Holidays. Trading wise, lets check out the Total Crypto MC first.

You Might Also Like

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏