Bitcoin's On-Chain Distribution Continues To Be More Decentralized

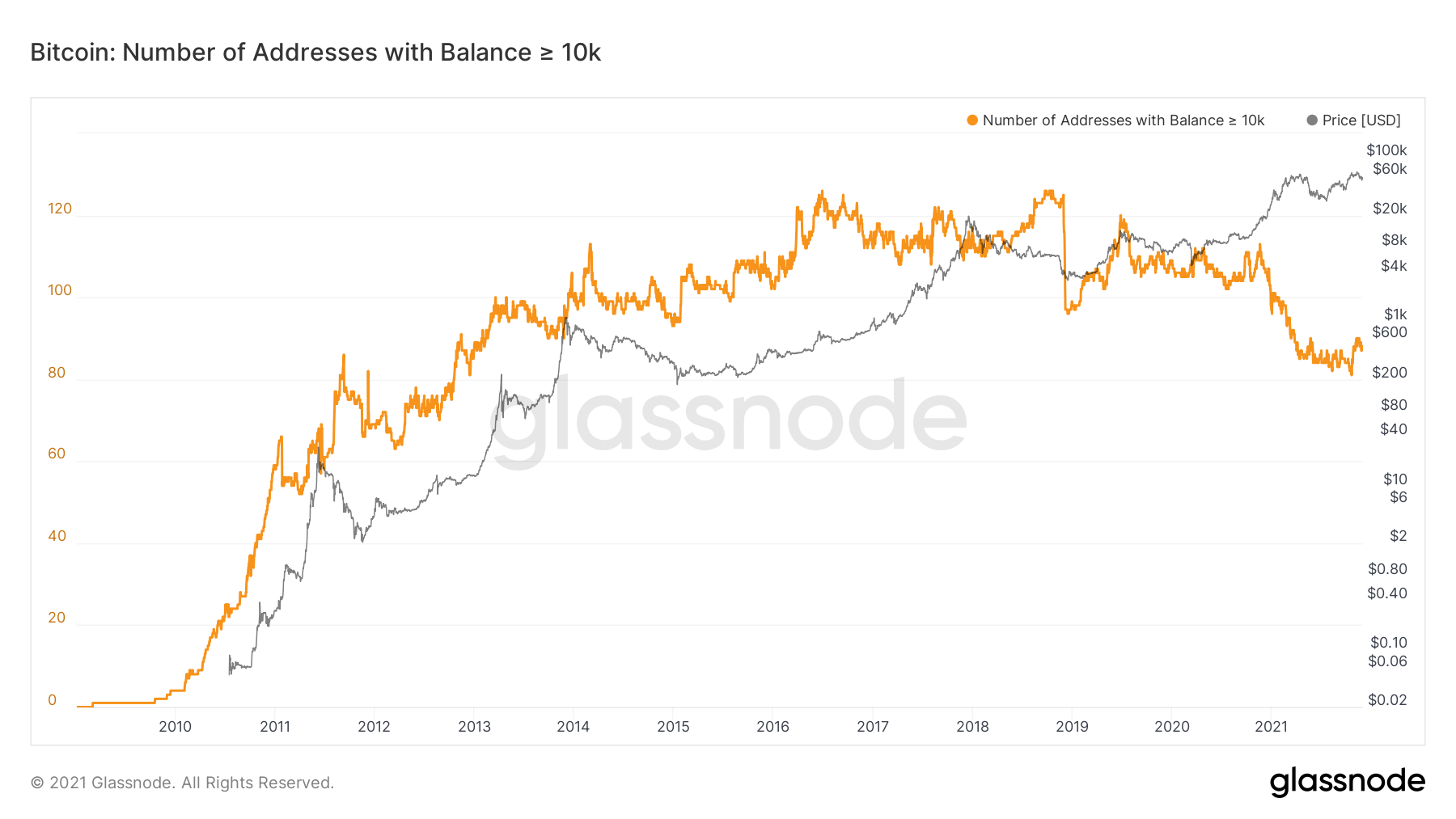

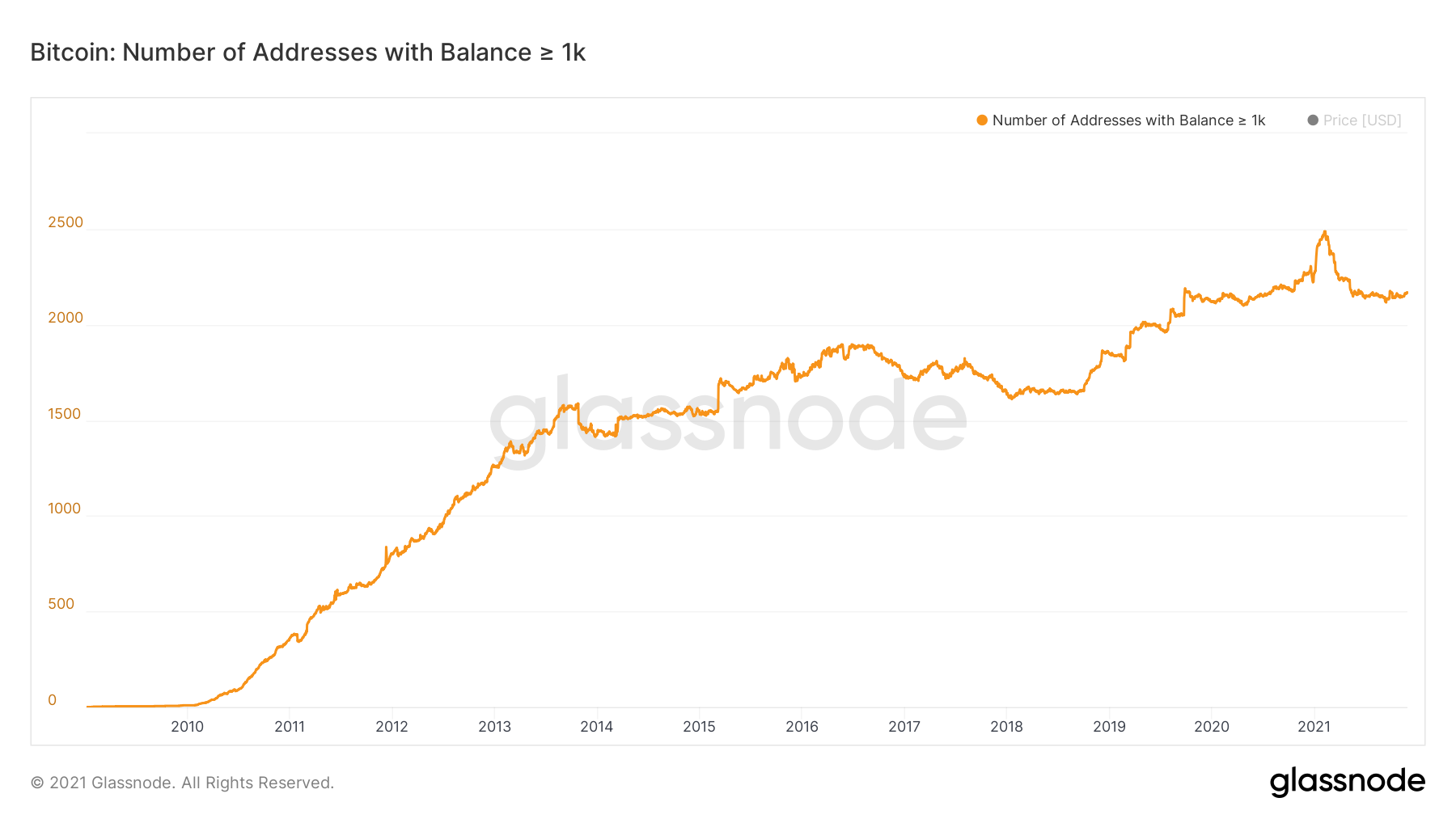

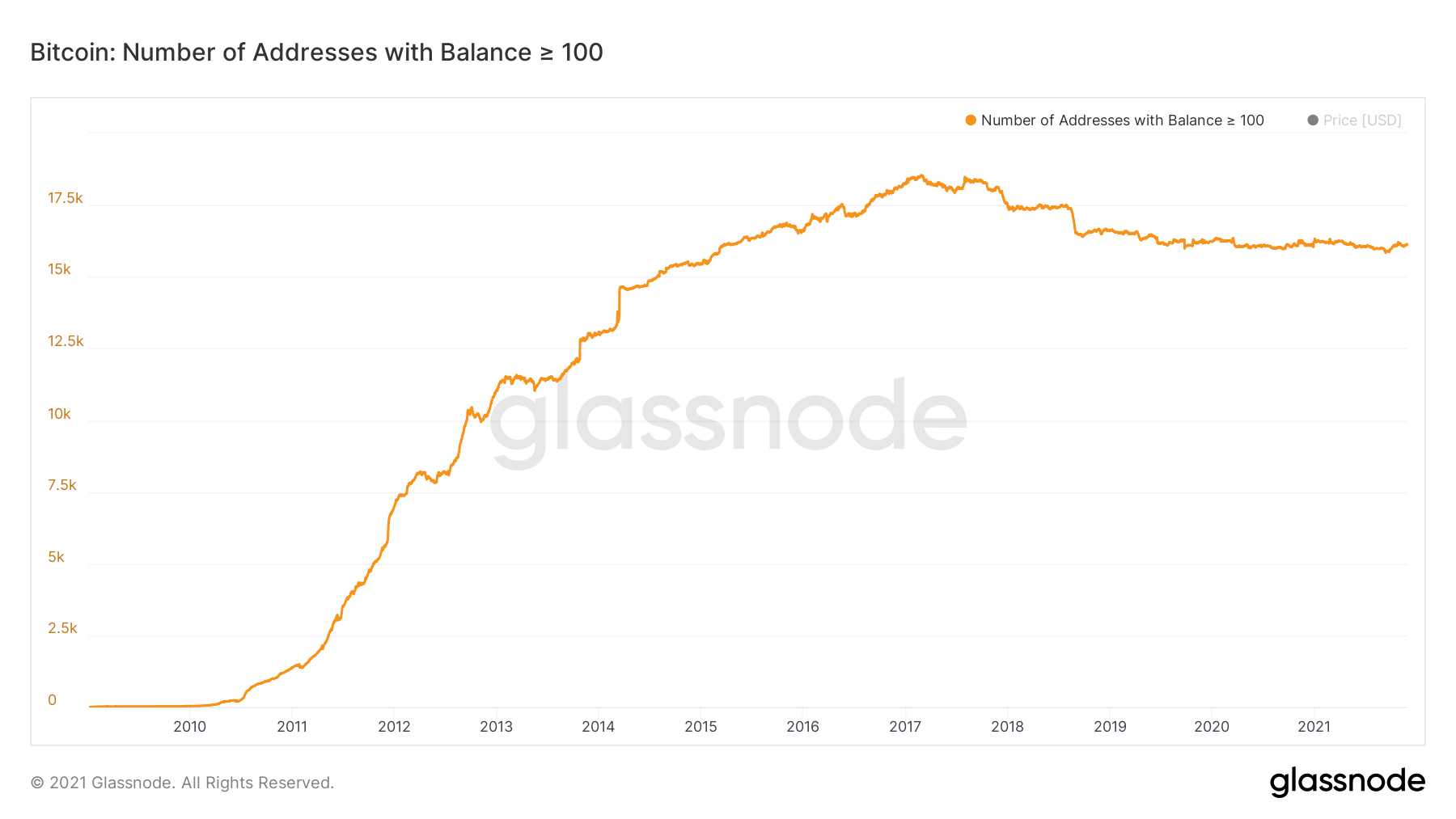

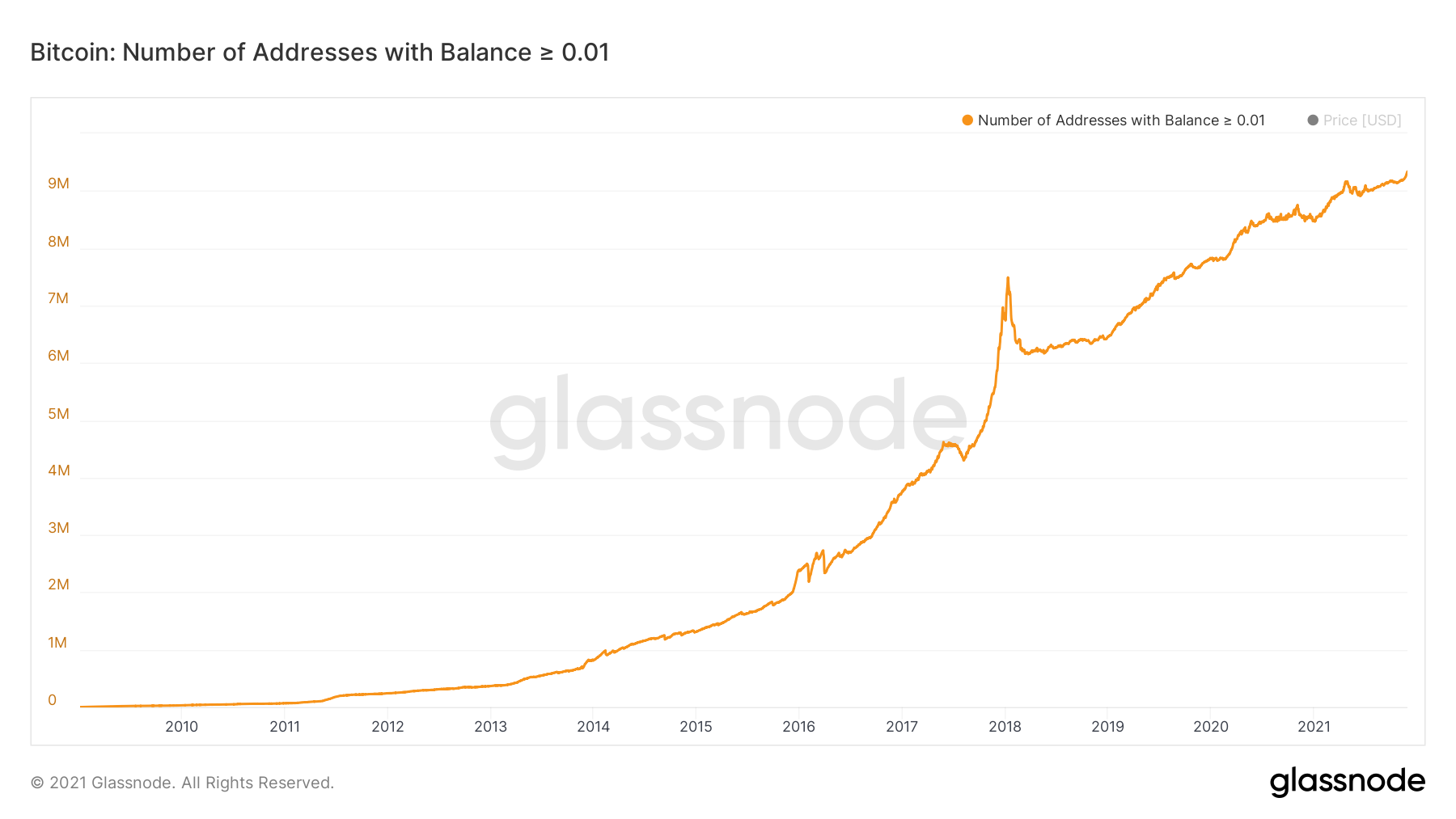

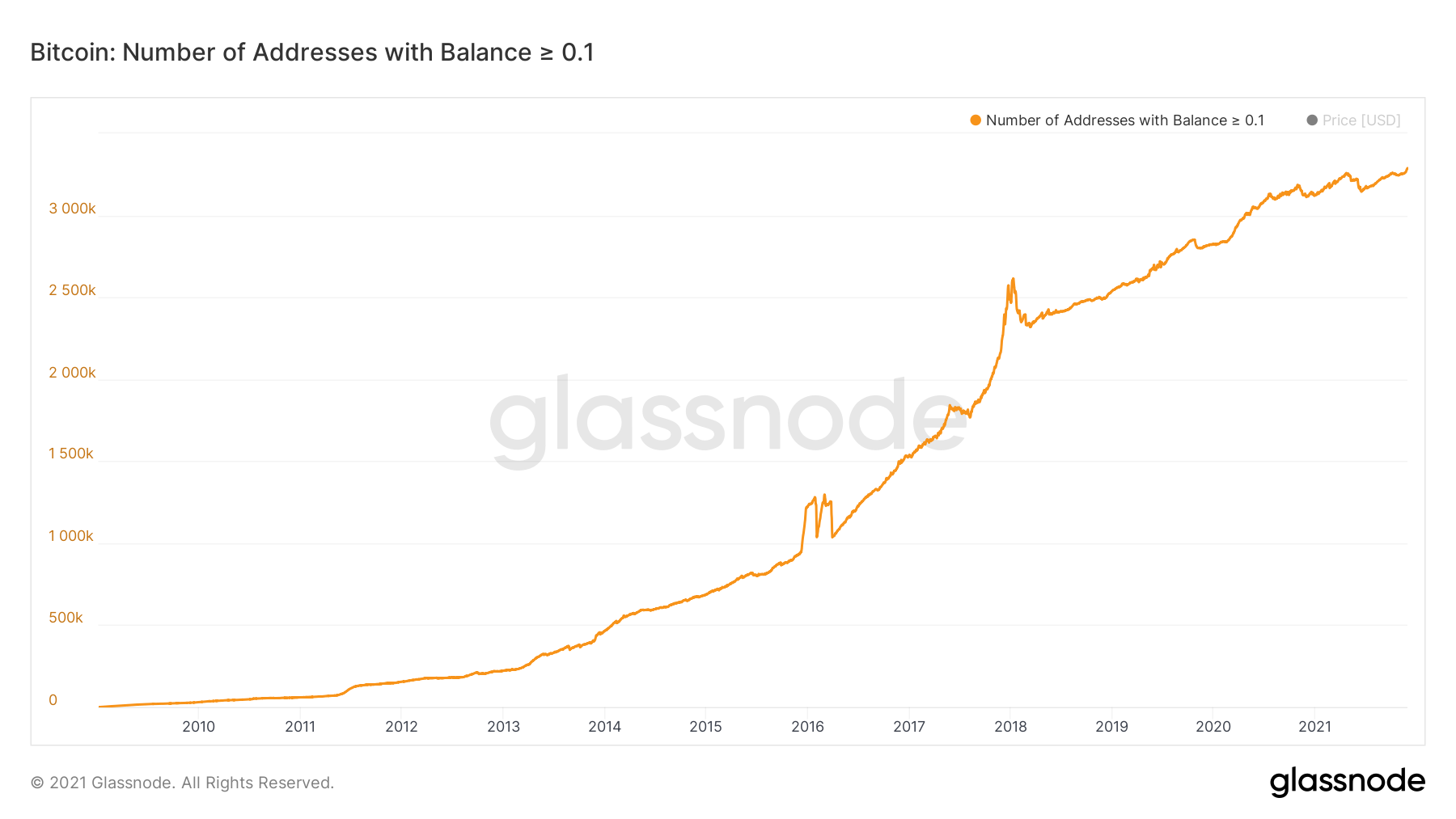

To investors, Bitcoin’s on-chain distribution continues to become more decentralized over time. We can explicitly prove this claim by looking at the on-chain metrics, which offer unique insight into the amount of bitcoin that is held by each individual bitcoin address. First, let’s take a look at the largest holders of bitcoin on-chain. We can see that the number of bitcoin addresses with at least 10,000 bitcoin in their balance peaked in October 2018. Bitcoin's price was ~ $6,500 and we were about to get the final puke down in price of the 2018 bear market. If we look at an order of magnitude smaller, the number of bitcoin addresses with a balance of 1,000 bitcoin or more peaked in February of 2021. There are currently about 2,100 bitcoin addresses that hold 1,000 bitcoin or more, which is very similar to where we were throughout most of 2020. Now let’s take a look at bitcoin addresses with a balance of 100 bitcoin or more. The all-time high for that measurement peaked in February 2017, which was before the craziness of the 2017 bull market. At the time, there were about 18,500 bitcoin addresses that met the criteria, but today we have only approximately 16,100 bitcoin addresses with 100 bitcoin or more. But here is what is really interesting — bitcoin addresses with at least 0.01 bitcoin or 0.1 bitcoin in their balance have continued to hit all-time highs. Today, there has never been more bitcoin addresses on-chain in the 12 year history that hold these smaller amounts of bitcoin. Here is the 0.01 bitcoin balance chart, which shows more than 9.33 million bitcoin addresses: Here is the 0.1 bitcoin balance chart, which shows more than 3.28 million bitcoin addresses: These distribution charts are noteworthy because they highlight a very important part of the bitcoin story. As time goes on, the digital store of value continues to become more decentralized. This increase in decentralized ownership is not only a positive security feature, but it also means that the benefits of economic empowerment that bitcoin presents will eventually be enjoyed by more people globally. You can think of the distribution of bitcoin holders as one piece of a three-legged stool. Bitcoin miners continue to get more decentralized over time and we continue to see more bitcoin node operators popping up around the world. This symbiotic relationship between holders, miners, and node operators allows bitcoin to gain strength, while continuing to run effectively without a CEO or centralized control. Bitcoin’s design is beautiful and things are playing out exactly how they were intended. The electronic peer-to-peer cash system is evolving into a fully decentralized, digital store of value that can’t be debased, censored, or manipulated. Hope each of you has a great start to your week. I’ll talk to everyone tomorrow. -Pomp GET HIRED IN CRYPTO: Are you looking for a job in the bitcoin and crypto industry, but don’t feel like you understand the nuances of the industry well enough to be hired? We have a training program aimed at helping people just like you. The 3 week intensive course was created with the help of the HR teams at top companies in the industry and has seen graduates get hired at Coinbase, Gemini, BlockFi, Kraken, Anchorage, Strike, BTC Inc, and many more. Our next cohort starts November 30th. APPLY HERE: www.pompscryptocourse.com SPONSORED: Gun.io is every fast-growing technology company’s secret weapon. With Gun.io, companies hire world-class developers in a fraction of the time. Finding the right technical talent is hard, especially in this competitive hiring market. Gun.io gives you access to peer-vetted developers who you won’t find on job boards. We combine our industry-leading matching algorithm with human relationships and support to uncover the right developer for your team, fast. The result? No stacks of resumes or endless interviews. Instead, you can have a conversation with the candidate our team of senior engineers believes is perfect for your role within days, not weeks. Whether you’re growing your team, in need of short-term help, or making your first technical hire, meet the right candidate for the job on Gun.io. THE RUNDOWN:El Salvador Buys 100 More Bitcoins as Crypto Market Falls: The government of El Salvador bought 100 more bitcoin, President Bukele tweeted on Friday, while the price of the largest crypto currency by market-cap fell near $54,000. “El Salvador just bought the dip. 100 extra coins acquired with a discount,” Bukele said. Bitcoin price fell about 8% on Friday around $54,237, as broader markets tumble on new COVID-19 variant fear. Read more. Crypto.com to Sponsor Latin America’s Leading Soccer Competition: After renaming the Staples Arena in a $700 million deal in November, Singapore-based crypto exchange Crypto.com will become an official partner of Latin America’s leading soccer competition, CONMEBOL Libertadores. Through an agreement with CONMEBOL, the governing body for soccer in South America, Crypto.com will serve as an official partner of CONMEBOL Libertadores from 2023 to 2026 and as a licensee of the competition’s official non-fungible tokens as of 2022, the company said in a statement Thursday, without disclosing further terms. Read more. Japanese Consortium Plans to Issue Bank Deposit-Like Digital Yen by End of Next Year: A consortium of 74 Japanese firms is planning to issue a digital yen that will work similar to bank deposits by the end of 2022, the consortium’s secretariat, DeCurret, said in a white paper and a progress report published on Wednesday. To ensure the stability of the digital currency, the consortium, dubbed Digital Currency Forum, is proposing a model similar to how bank deposits work, according to the white paper. The digital yen will be issued by banks as their liability, the paper added. Read more. Hackers Are Attacking Cloud Accounts to Mine Cryptocurrencies, Google Says: Hacked Google Cloud accounts were used by 86% of the “malicious actors” to mine crypto currencies, according to a new report. Of the 50 hacked Google Cloud Platforms or GCPs, 86% of them were used for cryptocurrency mining, which typically consumes large amounts of computing resources and storage space, Google’s Cybersecurity Action Team wrote in the report. The remainder of the hacking activities included phishing scams and ransomware. Read more. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Preston Pysh is a financial investor and host of the "We Study Billionaires" podcast. In this conversation, we discuss negative yielding debt, increasing stress on pension plans, and how Bitcoin can solve recent macro economic problems. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

10 Epic Bitcoin Mining Photos

Wednesday, November 24, 2021

Listen now (3 min) | To investors, I thought it would be fun to assemble the most breathtaking photos that I could find related to bitcoin mining as we head into Thanksgiving here in the United States.

Bitcoin City Will Be Funded By Bitcoin Bonds

Monday, November 22, 2021

Listen now (7 min) | To investors, The President of El Salvador announced on Saturday night that he was planning to build the world's first “Bitcoin city,” which would live at the foot of a volcano

Your Portfolio Gains Aren't What You Think They Are

Monday, November 15, 2021

Listen now (4 min) | To investors, Financial markets have been on a tear for the last 12 months. Everything in your portfolio appears to be going up at an exciting rate. If I were to ask each of you

Focusing On What Is Most Important

Monday, November 8, 2021

Listen now (5 min) | To investors, Last week, I told the limited partners at Pomp Investments that I would be returning all outside capital at the end of the year and would be converting my investment

Crypto Equities: One Of The Most Overlooked Corners of the Public Markets

Tuesday, November 2, 2021

Listen now (7 min) | To investors, I was talking to a friend recently about the various investment opportunities in the crypto industry. He kept explaining how much exposure he had to publicly traded

You Might Also Like

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏