Trump's new media company is a $1.6 billion mirage

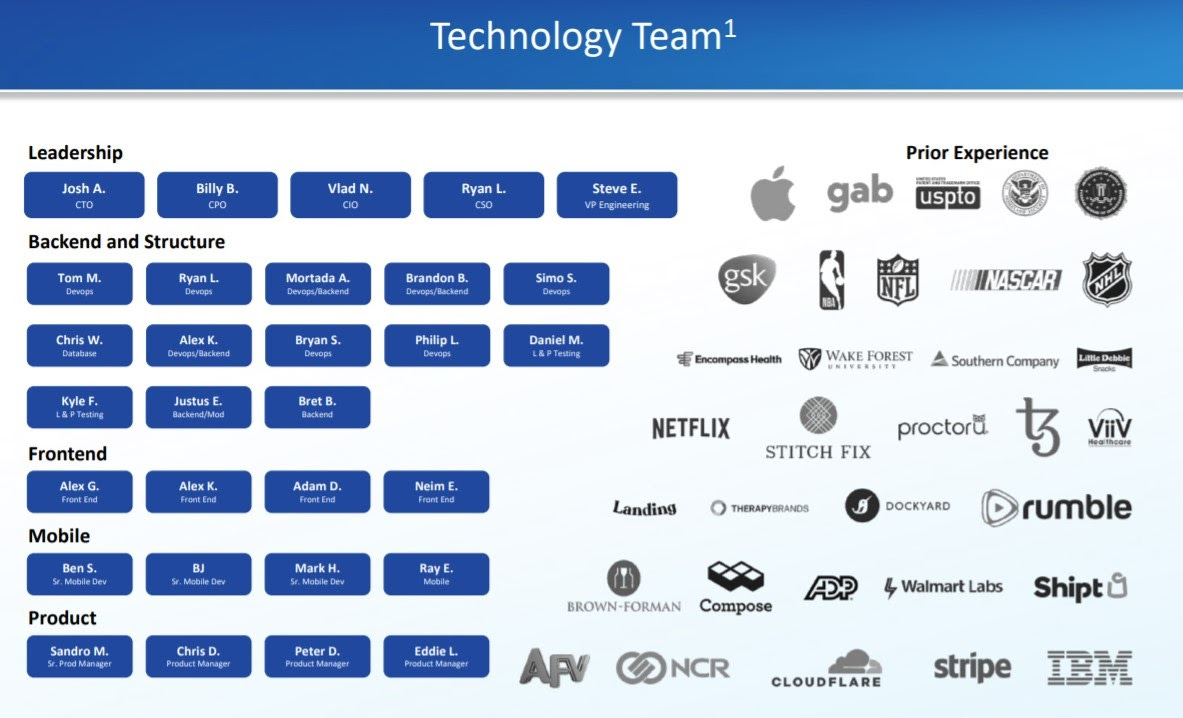

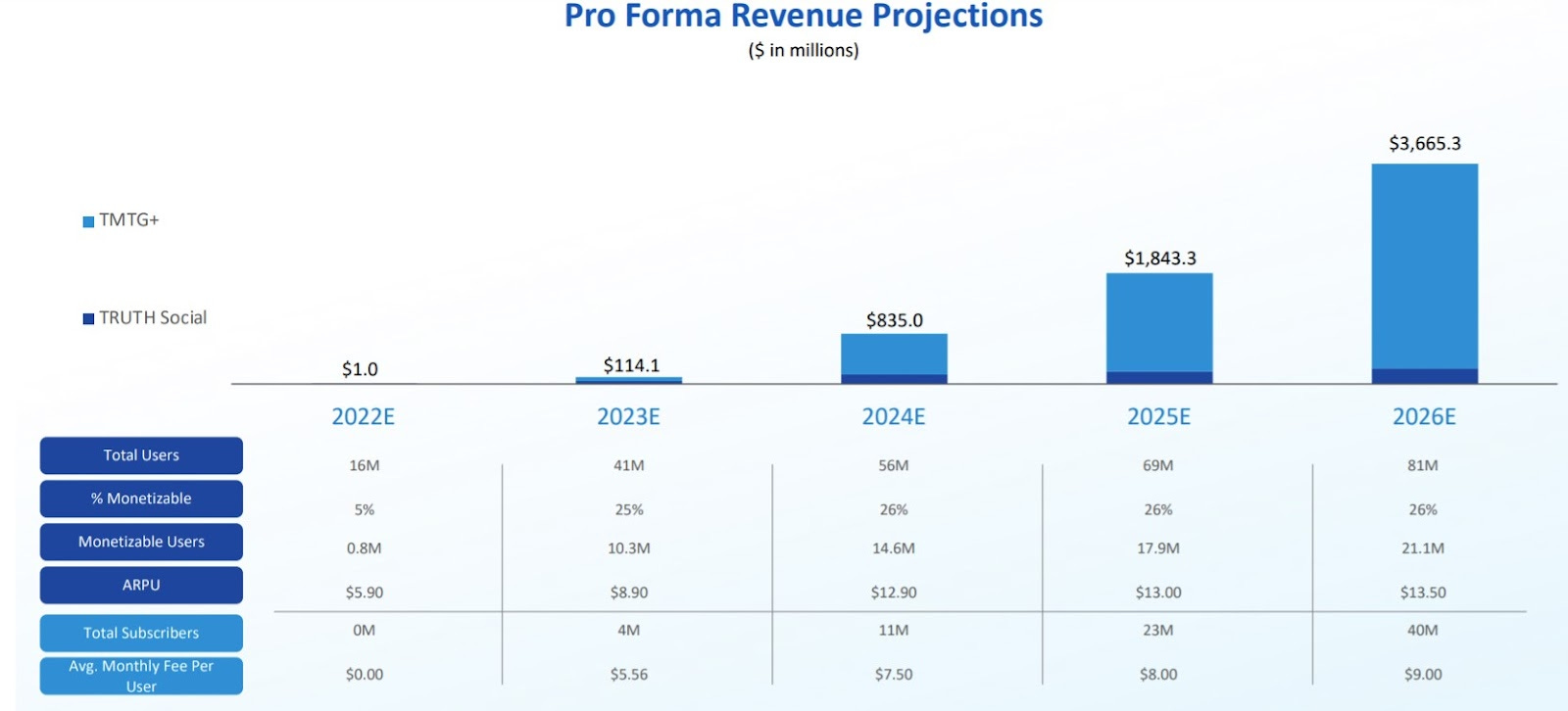

Welcome to Popular Information, a newsletter about politics and power — written by me, Judd Legum. In October, former President Trump announced the creation of a new company, Trump Media & Technology Group (TMTG). Its signature product is a new social media site, Truth Social. According to an investor presentation, Truth Social and the larger company will "be a fountainhead of support for American freedoms as the first major rival to 'Big Tech.'" TMTG will "even the playing field" of a media landscape that "has swung dangerously far to the left." Initially, TMTG suggested that Truth Social was based on "proprietary" technology. It was later forced to admit that the code was taken from Mastodon, an open-sourced decentralized social network that anyone can use. Gab, an existing social media network geared toward the far right, already uses Mastodon. So neither the technology nor the concept is new. TMTG promised that "TRUTH Social plans to begin its Beta Launch for invited guests in November 2021." But November 2021 came and went without the Beta Launch or any update from the company. The Truth Social homepage is a single static page that collects email addresses. TMTG was also subject to criticism for failing to announce "anyone involved in building its supposed technology." The only people identified as involved in the company's operation were Trump and Scott St. John, a game show producer that will supposedly be involved in TMTG's streaming service, TMTG+, which is supposed to launch sometime in 2023. An updated version of the TMTG investor report lists a "Technology Team," but the members of the team are identified only by their first name and last initial. TMTG's Chief Technology Officer (CTO) is Josh A. Who is Josh A? He may have worked for Apple, or Little Debbie Snacks, or Gab. TMTG does not specify. The "Technology Team," TMTG warns, is "subject to change." But don't worry, if Josh A departs for greener pastures, TMTG can rely on their Chief Product Officer (CPO) Billy B. On Monday, TMTG announced that Congressman Devin Nunes (R-CA) will be retiring from Congress to become the company's CEO in January. Nunes has no experience in the media business and once sued a fictional cow for making fun of him on Twitter. Writing in Bloomberg, Matt Levine concludes there is "almost no sign that TMTG is actually building a social network or a streaming platform or anything else." Nevertheless, TMTG projects 121 million monetizable users and $3.6 billion in revenue by 2026. (In 2021, it more conservatively projects $1 million in revenue.) Will TMTG's rosy predictions come true? It seems very unlikely. But, critically, Trump does not have to meet these projections — or even stand up a real company — to make lots of money. SPAC to the futureJust a few weeks after TMTG launched, it announced that it was merging with Digital World Acquisition Company (DWAC), which is a publicly-traded Special Purpose Acquisition Company (SPAC). A SPAC, also known as a blank check company, is formed specifically to merge with another company and take it public. In this case, investors in DWAC would pay Trump $293 million in exchange for 18% to 25% of TMTG, which doesn't really operate yet as a business. Prior to merging with TMTG, a share of DWAC was valued at $10. Shortly after the merger was announced, DWAC stock, perhaps buoyed by Trump fans, was trading as high as $175 per share. It has since settled in at around $43, which still values TMTG at almost $1.6 billion. That's not bad for a company that has no product, no users, no publicly identified executives, and no revenue. It is trading at $43 because that is what people are willing to pay for it. TMTG has not "completed its merger with DWAC or made associated securities filings." But if the deal closes in the first quarter of 2022, Trump and DWAC investors are likely to make a lot of money. Trump will get the proceeds from the initial deal and the investors will be able to realize a return by selling their shares. Trump will collect his money long before anyone figures out if TMTG is a real company — much less a profitable one. The SEC has questionsIn its initial SEC filing, DWAC represented that it had "not selected any specific business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any business combination target." Multiple media outlets, however, reported that DWAC CEO Patrick Orlando was involved in discussions with Trump months before DWAC began trading. The SEC is now seeking information "about [DWAC's] trading policies and communications between the SPAC and Mr. Trump’s company." If the investigation determines that the deal between DWAC and TMTG was agreed to in advance, DWAC’s SEC filing could be considered "false or misleading with respect to [a] material fact." That could be a violation of federal securities laws. The money PIPEThe SPAC deal, if it is completed, will earn Trump $10 a share. But the company is currently trading at over $40 a share. How does Trump capture even more of that cash as soon as possible? While the merger is pending, a SPAC and its target have the ability to privately sell more shares to raise capital. This is called a Private Investment in Public Entity (PIPE). On Saturday, TMTG announced a $1 billion PIPE investment. These shares will be purchased at a substantial discount from the current retail trading price. That means Trump, before TMTG has a single product or subscriber, could collect $1.3 billion. But who is investing $1 billion in Trump's virtually non-existent company? TMTG does not say. They identify the source of the cash as "a diverse group of institutional investors." The identity of the investors is critical in light of Trump's future political ambitions. He may run for president again in 2024. What if, for example, the investors include the Saudi sovereign wealth fund? The structure of the PIPE deal, however, suggests that these investors are less interested in influencing a future president than fleecing retail traders for a quick buck. Levine notes that typically "in SPAC mergers, the PIPE investors can’t sell their stock the day after the merger closes." Rather, the PIPE investors need to wait "a couple of months." In this case, however, "DWAC and TMTG have promised the PIPE investors that they’ll be able to freely resell their stock the minute the merger closes." In other words, there seems to be a real push by these investors to flip these stocks immediately. The investors, whoever they are, seem to be keenly aware that time is not on their side. They want to be able to cash out before anyone gets too much information about how the company actually performs. It's a deal that makes Trump money and the investors money. The people holding the bag will be retail investors paying premium prices for a mirage of a company because they like Trump. That group includes Marjorie Taylor-Green (R-GA), who bought between $15,000 and $50,000 worth of DWAC on the day it announced its merger with TMTG. She paid somewhere between $67.96 and $175 per share. That means she's probably already lost about half of her investment — and possibly a lot more. I have a slightly alarming fact to share with you. As you may know, Popular Information uses the Substack platform to publish this newsletter. Substack publishes a leaderboard of the top newsletters, across various categories, ranked by total revenue. Popular Information ranks tenth in the politics category. Not bad! But four places ahead, in sixth place, is a newsletter by Alex Berenson. Who is Alex Berenson? He is one of the leading sources of COVID disinformation on the internet. OK, I get it. In a list of the world's injustices, this would rate very low. But the fact is Berenson has more resources at his disposal to spread dangerous misinformation about COVID than Popular Information has to uncover the truth. Since the start of the pandemic, Popular Information's reporting resulted in the nation's largest restaurant chain providing paid sick leave to all its employees, improved working conditions for cable technicians, and pressured large corporations to return tens of millions of taxpayer dollars intended for struggling small businesses. You can help expand our capacity to do this work with a paid subscription. It's just $6 per month or $50 for an entire year. By supporting Popular Information, you are lifting up information everyone can trust. We've been awarded a 100% rating by NewsGuard, an independent organization that evaluates media outlets for credibility. To stay completely independent, Popular Information accepts no advertising. This newsletter only exists because of the support of readers like you. |

Older messages

New Hampshire bill would require teachers to put a positive spin on slavery

Monday, December 6, 2021

What is being promoted as an effort to stop Critical Race Theory (CRT) from indoctrinating K-12 students is actually a push to censure truthful information about American history. A new "teacher

Inflation exposed: The REAL reason prices are going up

Thursday, December 2, 2021

A few weeks ago, Popular Information revealed how powerful corporations are driving inflation. Companies like Procter & Gamble and PepsiCo are not simply increasing prices to cover higher input

"Moms For Liberty" says book about MLK violates new law banning CRT in Tennessee

Wednesday, December 1, 2021

In May, Tennessee passed a law banning Critical Race Theory in K-12 schools. The state is already seeing the ugly consequences of the law. And things are likely to get worse. While Critical Race Theory

Olympic sponsors stay silent on Peng Shuai

Tuesday, November 30, 2021

On November 2, Peng Shuai, a Chinese professional tennis player who was once ranked #1 in the world in doubles, accused a powerful Chinese politician, Zhang Gaoli, of rape. "I never consented that

A tale of two thefts

Monday, November 29, 2021

In the United States, only certain types of theft are newsworthy. For example, on June 14, 2021, a reporter for KGO-TV in San Francisco tweeted a cellphone video of a man in Walgreens filling a garbage

You Might Also Like

Monday Briefing: How Trump re-wrote Jan. 6

Sunday, January 5, 2025

Plus, the end of an era for Hong Kong's cabbies View in browser|nytimes.com Ad Morning Briefing: Asia Pacific Edition January 6, 2025 Author Headshot By Justin Porter Good morning. We're

GeekWire's Most-Read Stories of the Week

Sunday, January 5, 2025

Catch up on the top tech stories from this past week. Here are the headlines that people have been reading on GeekWire. ADVERTISEMENT GeekWire SPONSOR MESSAGE: GeekWire's special series marks

For an organized closet

Sunday, January 5, 2025

Plus, how to donate clothes responsibly View in browser Ad The Recommendation January 5, 2025 Ad Today we'll walk you through some of our best advice for organizing your closet—and what to do with

Icy Roads, Popeye in the Public Domain, and Christmas Trees for Elephants

Sunday, January 5, 2025

Manhattan Judge Juan M. Merchan plans to impose no punishment for President-elect Donald Trump's hush-money conviction, given concerns about his immunity from criminal prosecution upon taking the

☕ No appetite

Sunday, January 5, 2025

A famed Roman fountain gets a new coat of paint... Morning Brew Presented By Huel January 05, 2025 | View Online | Sign Up | Shop A hot-air balloon rises during the international hot-air balloon

Can the U.S. outpace China in AI? Microsoft offers a blueprint

Saturday, January 4, 2025

What happens when AI teams up with a vintage drum machine ADVERTISEMENT GeekWire SPONSOR MESSAGE: GeekWire's special series marks Microsoft's 50th anniversary by looking at what's next for

Pompeiian Sugarplum

Saturday, January 4, 2025

Today, enjoy our audio and video picks. Pompeiian Sugarplum By Caroline Crampton • 4 Jan 2025 View in browser View in browser The full Browser recommends five articles, a video and a podcast. Today,

9 Things Christian Siriano Can’t Live Without

Saturday, January 4, 2025

From Camper boots to travel-size hair spray. The Strategist Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate commission.

YOU LOVE TO SEE IT: In With The Good Energy, Out With The Bad

Saturday, January 4, 2025

California looks to the renewable future, while New York probes the polluted past. In With The Good Energy, Out With The Bad By Sam Pollak • 4 Jan 2025 View in browser View in browser A wind turbine

The 6 best men’s jeans

Saturday, January 4, 2025

Lookin' good View in browser Ad The Recommendation January 4, 2025 Ad Men's jeans we love A person wearing a pair of jeans and a white tee shirt. Michael Murtaugh/NYT Wirecutter No other piece