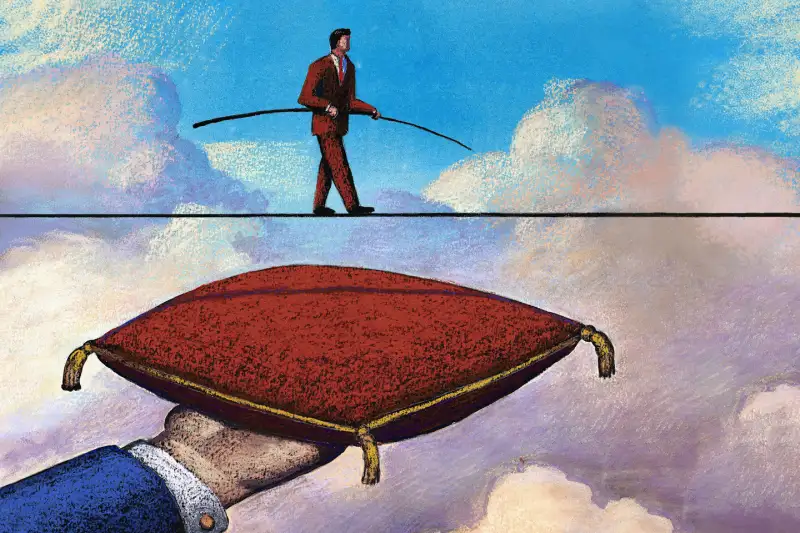

Daily Money - Annuities May Be Coming to Your 401(k)

|

|

| |

|

| |

|

|

|

|

|

Older messages

"Keep calm and carry on" is my new inflation motto

Wednesday, December 1, 2021

plus firetruck pig + Paris Hilton December 1, 2021 • Issue #122 Dollar Scholar Dollar Scholar Hi y'all — Have you ever heard the phrase “looking out for No. 1”? It's a tongue-in-cheek way to

What Does Omicron Mean for Stocks?

Tuesday, November 30, 2021

A new student loan repayment program November 30, 2021 Stock investors don't like to get caught off guard. The market can tolerate bad news as long as investors see it coming, and they bake it into

The Best Black Friday Deals We Could Find

Wednesday, November 24, 2021

Amazon, electronics, TVs, and much more! Nov 24, 2021 Amazon's Best Black Friday Deals for 2021 Black Friday sales are well underway at Amazon, and we've been seeing particularly good deals on

Pivoting from personal finance to Instagram influencing

Wednesday, November 24, 2021

plus Nacho Libre + a canine homeowner November 24, 2021 • Issue #121 Dollar Scholar Dollar Scholar Hi y'all — Happy Thanksgiving! I'm thankful for my family, my friends, Dylan O'Brien,

Here’s How Much People Have Saved for Retirement

Tuesday, November 23, 2021

Preparing for the return of student loan payments November 23, 2021 There's reportedly a Chinese proverb that says the best time to plant a tree was 20 years ago, and the second best time is now.

You Might Also Like

Why I'm loving tech stocks right now (It's not about AI)

Sunday, January 12, 2025

I'm bullish on MRVL. Here's why... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Cement Wars

Sunday, January 12, 2025

A Few Days in India ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Tap into your home equity

Sunday, January 12, 2025

Here's a smart way to leverage your home's value ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, January 11, 2025

Longreads * Gwern has a lengthy meditation on effort, specifically the kind of effort involved in doing what was previously thought to be impossible [https://gwern.net/on-really-trying]. It's not

Are these the two best trading hours?

Saturday, January 11, 2025

Brand New Genesis Algo ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌭 America gets the works

Friday, January 10, 2025

The US added a lot more jobs, TSMC posted strong results, and plumbing the depths | Finimize Hi Reader, here's what you need to know for January 11th in 2:57 minutes. The US economy ended the year

A Page From Uber's Playbook: Disrupting Social Media Marketing

Friday, January 10, 2025

Read the whole story here ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Design Your Dream European Getaway

Friday, January 10, 2025

Enter to win a chance to win a $20000 trip to Europe for free. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📉 Bonds saw a selloff

Thursday, January 9, 2025

Global investors dumped government bonds, UK shoppers got a break for Christmas, and Encylopedia Britannica became an AI company | Finimize Hi Reader, here's what you need to know for January 10th

Could private student loans help you?

Thursday, January 9, 2025

Find out if you qualify and compare rates today. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏