Accelerated - 🚀 My biggest misses of 2021

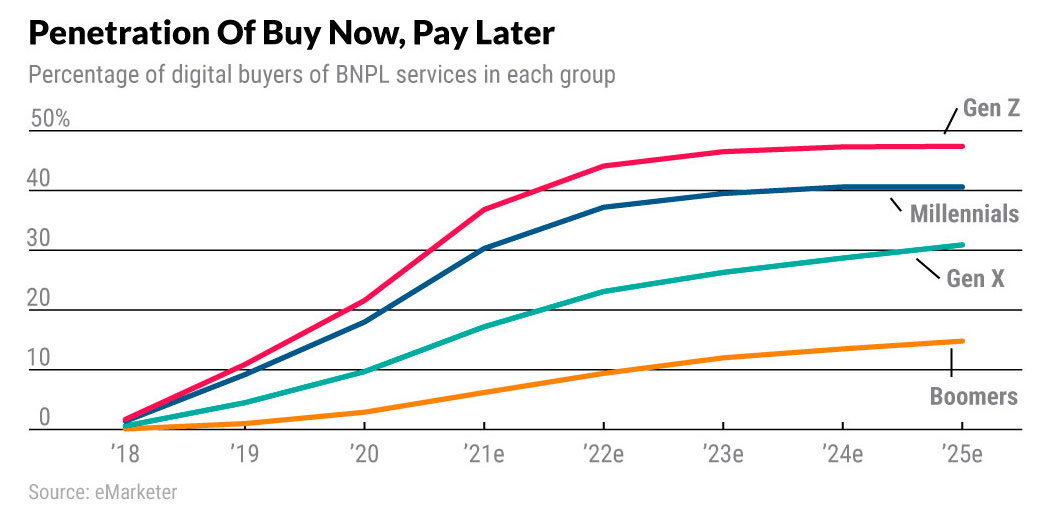

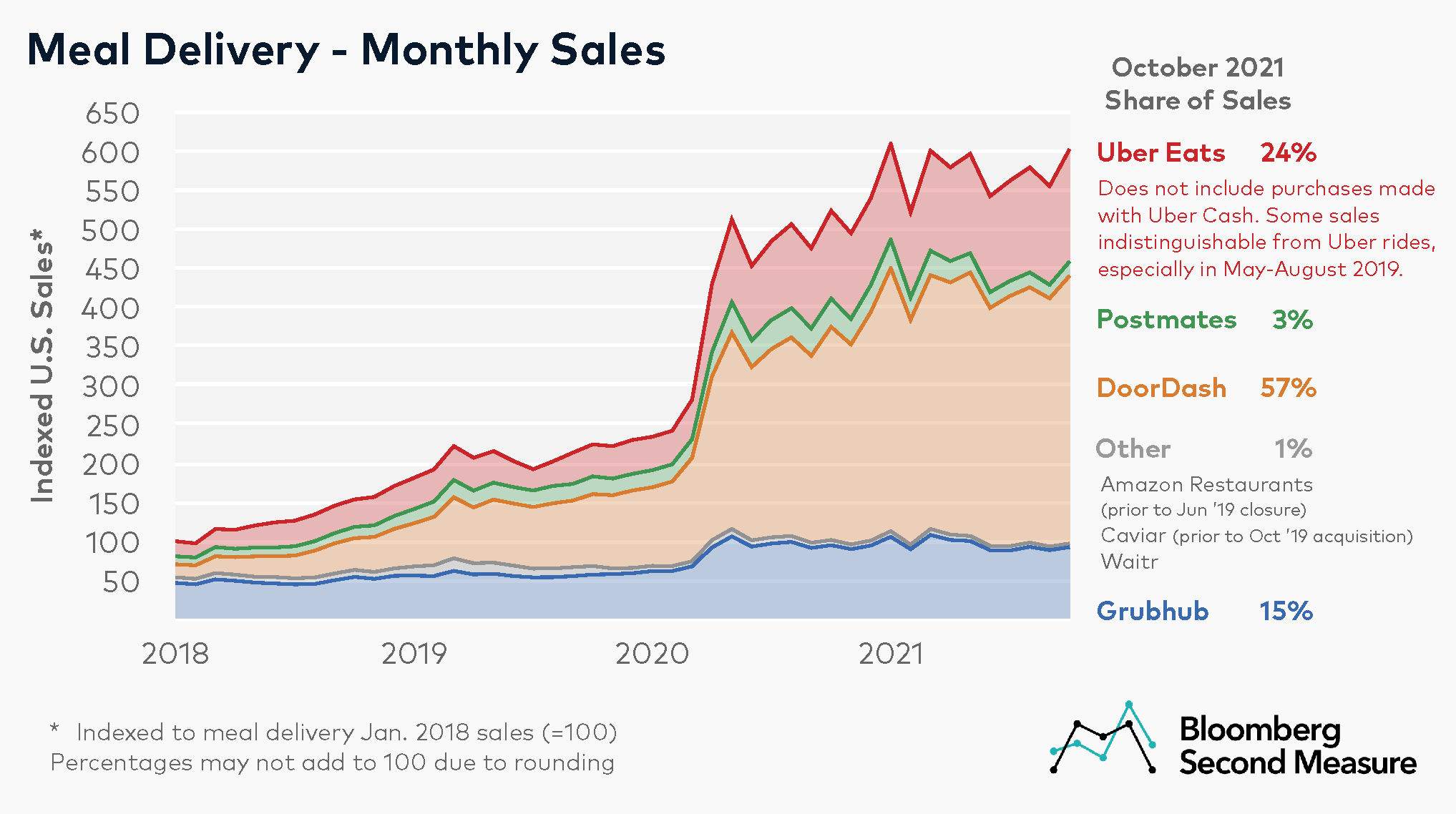

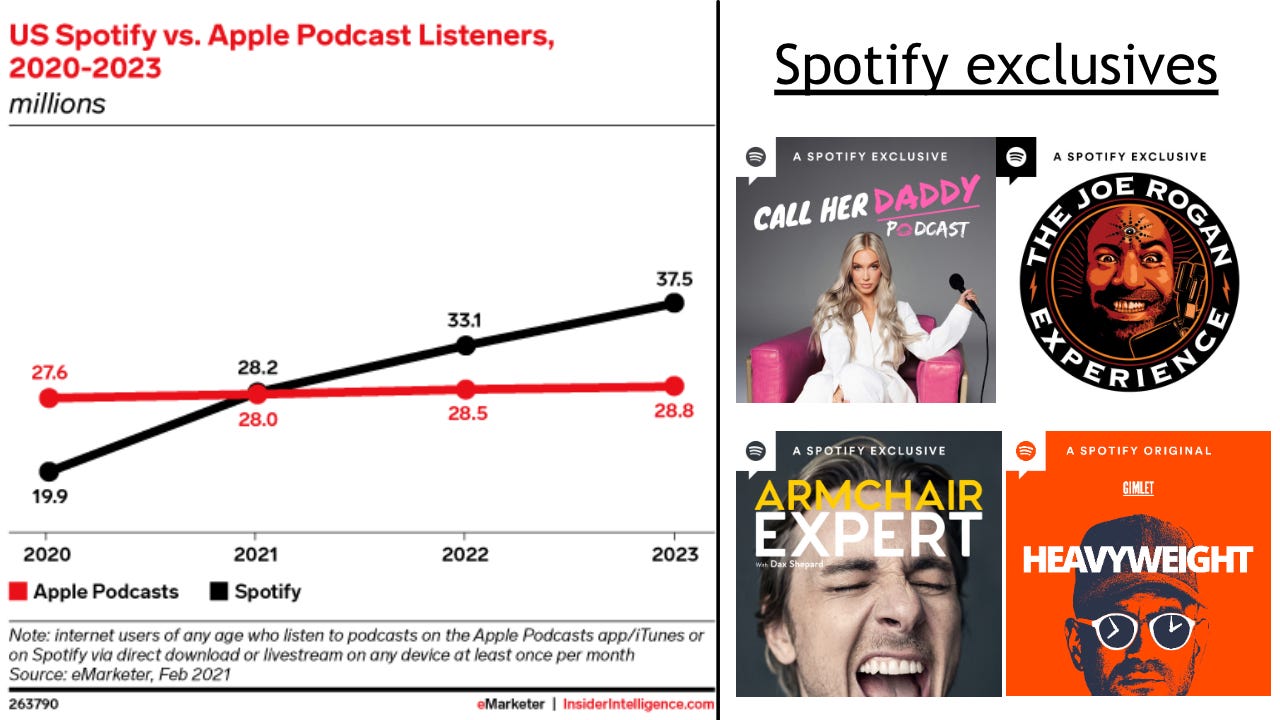

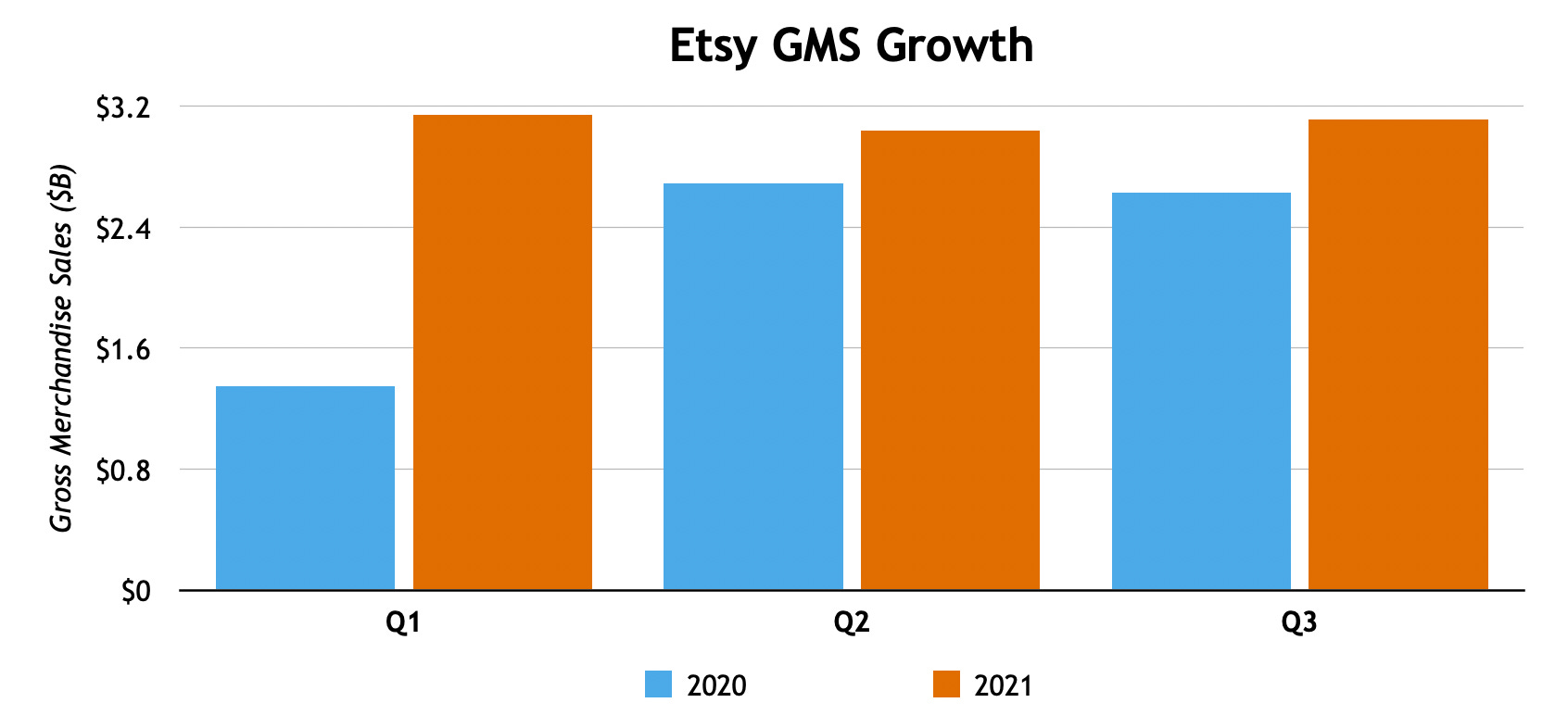

🚀 My biggest misses of 2021It's my "anti-portfolio" of predictions - 5 things I got wrong this year!Hello, readers! 👋 I hope you are having a lovely December. As the end of the year approaches, news is getting less and less frequent. So instead of recapping weekly happenings, I plan to use the next few weeks to dive into trends of the past year + what I hope to see in 2022. what I missed this year 👩⚖️You’ve probably started seeing a flood of 2022 predictions - I thought it would be fun to do the opposite! This week, I’m recapping five things I was wrong about this year. I focused on public companies because it’s easier to track their metrics and measure whether or not my predictions were correct. Here we go: 1.) BNPL keeps climbing 💳Despite the success of companies like Affirm and Klarna, I’ve been skeptical about BNPL (buy now, pay later). It just didn’t make sense to me - why would you want to delay payment for items on a one-off basis instead of getting a credit card? 2021 was the year that definitively proved me wrong! Why is BNPL so popular? The obvious reason is no fees - most plans don’t charge consumers anything, while credit cards have high interest. They’re also more flexible (you can customize payment timing) and more accessible. You can get approved instantly with no hard credit check, and don’t have to wait for a card in the mail. It’s particularly hard for young people to get credit cards, as they have little to no credit history. BNPL apps have blown up among Gen Z - ~37% of U.S. Gen Zers who buy products online have used BNPL. And 70% of their BNPL-funded purchases are <$100, which means that it’s a regular habit (not just for occasional large purchases). I wouldn’t be surprised to see BNPL replace credit cards for Gen Alpha and beyond! 2.) DoorDash gains market share 🥡As a DoorDash fan and DashPass subscriber, I’ve been happy to see the company have a strong year. But I have to admit - I’m a little surprised at just how well it’s doing. According to the most recent Second Measure data, DoorDash now comprises nearly 60% of U.S. meal delivery sales. To put this in perspective - Uber Eats, the second most popular option, is at 24%. Postmates, once considered DoorDash’s biggest rival, is at just 3% (though it’s likely been deprioritized post-Uber acquisition). I thought DoorDash might lose a bit of market share this year. The company went public last year and is now under more pressure to eventually become profitable. Meanwhile, food delivery has become more of a priority for Uber - it’s now larger than ride hailing. But DoorDash continues to eat up this market (I’ll see myself out 😂), growing from ~50% market share last December to ~60% today. 3.) Spotify wins podcasts 🎧Did I know that people listen to podcasts on Spotify? I guess. Did I believe that a lot of people do this? Absolutely not. As a longtime Apple Podcasts user, I assumed the app would continue to dominate - it’s pre-installed on every Apple device. Over the past decade, many apps have tried & failed to take meaningful market share from Apple. And Spotify is a newer entrant, only making a real push into podcasts in 2019. But it finally happened! In October 2021, CEO Daniel Ek announced that Spotify took Apple’s crown as the #1 podcast listening platform in the U.S. And this should continue - it seems like every time Spotify releases earnings, the company discloses that podcast listening hit an all-time high (in % of total hours on the platform). Why is Spotify crushing it in podcasts? The company has spent $$ to build a content library, buying studios like The Ringer and Gimlet and acquiring exclusive rights to shows like Armchair Expert and The Joe Rogan Experience. Perhaps more exciting, I suspect Spotify has added net new listeners to the ecosystem - music fans who haven’t tried podcasts before. Spotify has an incentive to do this, given that margins are much higher for podcasts than for music. More on that here. 4.) Twitter shakes it up 📱For many years, the eternal joke about Twitter was that it never changed. As CEO Jack Dorsey said earlier this year, the company was often criticized for being “slow” and “not innovative” - the last major update was doubling the character limit in 2017. And I honestly expected it to stay that way! 2021 was the year everything changed. The product team launched a flood of new features, from Spaces (audio rooms) to a newsletter platform (by acquiring Revue) to Communities. And this doesn’t even include all the new creator monetization tools - Tips, Super Follows, and Ticketed Spaces - or Twitter Blue, the paid subscription that unlocks additional functionality. This feels like the most exciting time to be on Twitter in a while. And with a new CEO, I’m expecting even more changes next year. His first interview already reflects his desire to move quickly and make things happen. My take on what he’ll prioritize? The three C’s: crypto (beyond BTC tipping), commerce, and communities. 5.) Etsy keeps pace 📈I was never a big Etsy buyer, but I knew the company had a killer 2020 - largely due to the insane demand for face masks, which Etsy’s home sellers could fulfill. Masks became such a significant % of Etsy’s business that the company starting breaking out mask vs. non-mask metrics (and still does!). As more people got vaccinated and masks became widely available from other retailers, I expected Etsy to have a weaker 2021. But I’ve been pleasantly surprised. Etsy has still grown GMS (gross merchandise sales) each quarter compared to last year - and GMS per active buyer continues its impressive ascent. Potentially even more exciting is Etsy’s acquisition strategy. The company bought Gen Z resale app Depop and Brazilian craft marketplace Elo7 this year in its quest to build a “house of brands.” I thought the Depop acquisition was a particularly smart buy - very few companies have captured such meaningful mindshare among Gen Z (more here from Olivia on how Depop did it!). jobs 🎓Loom - Chief of Staff (Remote) Dave - Strategic Finance Analyst (Remote) Darwin Homes - Strategy & Analytics Associate (Remote) Flexport - Associate Product Manager (SF) Evergrow - Chief of Staff (SF) Helix - Strategy & Biz Ops Associate (San Mateo) First Round Capital - Healthcare Investor (NYC) Amex Ventures - Investment Analyst (NYC) Balderton Capital - Analyst (London) internships 📝Affirm - User Research Intern (Remote) Zendesk - Market Intelligence Intern (Remote) Contra - Community Intern (Remote) Curology - MBA Growth Intern (SF) Roche - Venture Intern (SF) Skydio - Spring Product Strategy Intern (Redwood City) Instagram - MBA Product Marketing Manager Intern (NYC) Peloton - PM Intern (NYC) Snap - MBA PM, Revenue Strategy, Partnership Strategy & Ops Interns (NYC) Datadog - Marketing Intern (NYC) puppy of the week 🐶Meet Zora, an eight-month-old Vizsla that lives in York, England. She enjoys playing in the snow, sleeping on furniture, and going for walks in the forest. Follow her on Instagram @zora.vizsla! Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 The artist formerly known as Square

Sunday, December 5, 2021

Plus, an exclusive preview of Andrew Chen's "The Cold Start Problem"!

🚀 Who will build the next Pokémon GO?

Sunday, November 28, 2021

Plus, announcing an investment in a startup that makes real estate social.

🚀 Meme culture makes history

Monday, November 22, 2021

A crypto collective's bid for the US Constitution.

🚀 Would you pay for Twitter?

Sunday, November 14, 2021

Plus, you can now own a stake in creators' future earnings 👀

🚀 Battle of the Birds

Sunday, November 7, 2021

Plus, which nostalgic online games are making a comeback?

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏