Jack Dorsey Thinks Bitcoin Will Replace USD – It’s a Strong Possibility, but the Road Is Still Long

Jack Dorsey Thinks Bitcoin Will Replace USD – It’s a Strong Possibility, but the Road Is Still LongThe world will need a neutral, apolitical reserve currency sooner or later.At the end of November 2021, Jack Dorsey announced on Twitter that he was leaving his position as CEO of the company he founded. Some people wondered what were the reasons that pushed Jack Dorsey to leave his position as CEO. In the days since he departed from Twitter, we've gained some insight into the reasons behind Jack Dorsey's decision. A long-time Bitcoiner, Jack Dorsey has decided to move on to the next level as 2021 comes to a close. The electronic payment company Square, which he co-founded and serves as CEO, was renamed Block in the process. Square's crypto division, meanwhile, has been renamed Spiral. These changes had been in the works for many months, but Jack Dorsey heard the right timing to announce them. His departure from Twitter was the right time for him. Square is renamed Block ...If Square is renamed to Block, the goal of Jack Dorsey's company will always remain the same:

Block is going to be an umbrella brand covering various types of the group's businesses: Tidal, TBD54566975 (the non-name for its planned decentralized exchange for Bitcoin), Cash App, Square, and Spiral. The corporate name Block chosen by Jack Dorsey owes nothing to chance:

... And all the efforts of Jack Dorsey will now be directed towards Bitcoin so that its revolution benefits the greatest numberFor Jack Dorsey, all his efforts will now be directed towards Bitcoin. For those who still doubt it, just look at the updated description on his Twitter profile: #Bitcoin. So you can expect Block to offer more and more services and products built on top of the Bitcoin Blockchain to accelerate the adoption of the digital currency invented by Satoshi Nakamoto by facilitating the user experience at all levels. Now that he has left his position as CEO at Twitter, Jack Dorsey is freer to communicate as he sees fit on Twitter. This is exactly what he has been doing since the beginning of December 2021 by being much more active than in the past. On December 21, 2021, the rapper Cardi B, who has more than 20 million followers on Twitter, asked a simple question:

Jack Dorsey gave an unequivocal answer:

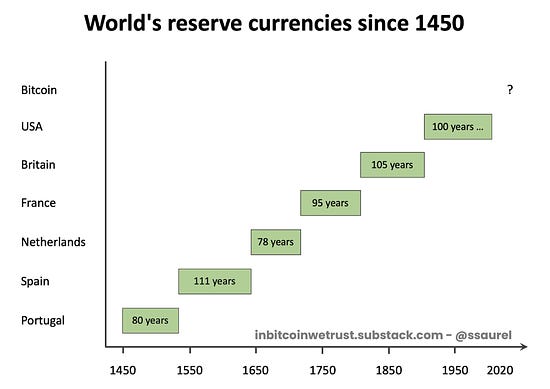

You can imagine that a message of this type posted by Jack Dorsey was going to make some noise. And this is indeed what has been happening since then, with articles multiplying in the specialized and general media. I'm writing an article on the subject myself. However, I will try to make you think about the subject by bringing you a different vision than what you can find elsewhere. At least, I hope so. Jack Dorsey thinks Bitcoin can replace the American dollar, and he's not the only one!So Jack Dorsey thinks that Bitcoin will replace the US dollar as the world's reserve currency. The first thing that inspires me is that he is not alone. I've written about this in the past: “Can Bitcoin Be the Successor to the U.S. Dollar As the World’s Reserve Currency?”.And I'm not a visionary, since other Bitcoiners had also written about this scenario. It starts from a simple fact: the world's reserve currencies hold their status for an average of 100 years. The US dollar has been the world's reserve currency for 101 years now: It, therefore, seems logical that the domination of the US dollar will come to an end sooner or later. The hegemony of the U.S. dollar is becoming more and more troublesome around the world. China realizes that it cannot become the world's leading power as long as the US dollar is at the center of the monetary and financial system. Russia wants to better protect itself from US economic sanctions by moving away from the US dollar to gold while increasing its trade with China in yuan. More and more countries would like to put an end to the exorbitant privilege represented by the US dollar as the world's reserve currency. America will do everything to keep its currency at the center of the game, even if it means waging wars if necessary. This has been done many times in the past. However, the question will come sooner or later. Behind the US dollar, no one sees a credible alternative among the fiat currencies. The euro has never succeeded in supplanting the US dollar so far. And behind the euro, there is a complete vacuum. China has launched its e-CNY initiative, which aims to eliminate cash from its territory in the long run, while trying to benefit from the first-mover advantage in the field of CBDCs (Central Bank Digital Currencies). The goal is to impose the e-CNY along its Belt and Road Initiative (BRI) to weaken the domination of the American dollar over the world. Nevertheless, many countries will refuse to leave one master and simply go to another. In the future, the world will need a neutral, apolitical reserve currency. Bitcoin will be there to meet that need.That's where Bitcoin comes in. Bitcoin is a leaderless, neutral, and apolitical currency. On top of that, Bitcoin is hard money. In a future world where everything will be digital, Bitcoin has only advantages for replacing the U.S. dollar. Not for America, which would lose its hegemony over the current system, but for other countries, which would see it as a way to restore greater equity in the global monetary and financial system. The adoption of Bitcoin as the world's reserve currency in the more or less distant future is therefore a possible scenario. The road will be long of course, but it is possible. What Jack Dorsey says makes sense. While the road will be long, I think that before it gets there, Bitcoin will first have to continue its mass adoption by the general public to become a true alternative system allowing everyone to choose. Choose between the fiat system and the Bitcoin system. Until bitcoin reaches this stage, it is illusory to think that Bitcoin can dethrone the US dollar. However, no one can rule out this scenario for the future. It is a possible scenario, but one of many. Jack Dorsey is right to mention it, but we should not get carried away. The road ahead will be long, and the Bitcoin revolution must continue to advance block by block. This is what it has been doing since January 3, 2009, and will continue to do in the future. In Bitcoin We TrustComment & Earn!Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards. If you liked this post from Cryptowriter, why not share it? |

Older messages

Gamebox Poised to Reinvent How We Play

Thursday, December 30, 2021

Online communities demand independence. Virtual currencies that hold no real value are ludicrous in an industry with trillions of dollars at stake. Cryptocurrencies can solve both problems. At the

Cosmos SDK Club: Osmosis (Part 2)

Wednesday, December 29, 2021

How to use Osmosis

If You Can’t Kill Bitcoin, Join Bitcoin – Central Banks Will Follow the Same Path As Private Banks

Tuesday, December 28, 2021

If Bitcoin does not need central banks, central banks will need Bitcoin.

Is Terra ($LUNA) Still Undervalued?

Tuesday, December 28, 2021

My thesis on why we are still early.

Angel Protocol

Tuesday, December 28, 2021

Give once, give forever.

You Might Also Like

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏