The Daily Gwei - Proof of Revenue - The Daily Gwei #412

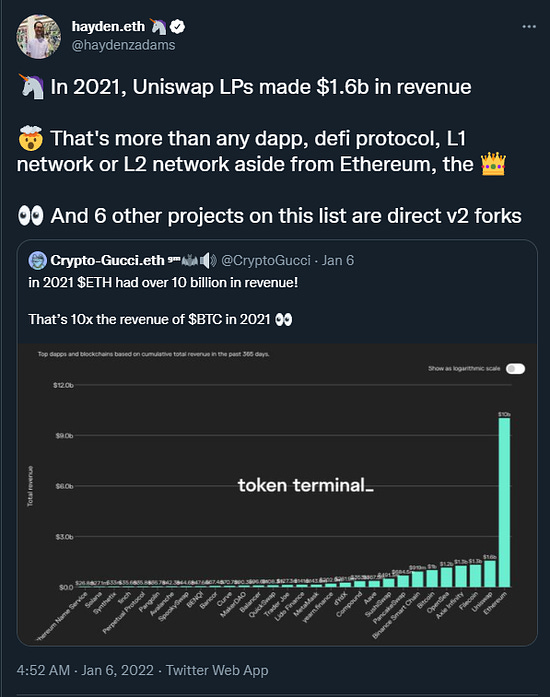

At this point I’m sure you’re all well aware of just how much fee revenue the Ethereum network generates every day - it’s anywhere from $30 million to $80 million depending on network use for that day. Of course, this fee revenue is paid in ETH and most of it (70-80%) is burned thanks to EIP-1559 which makes this is a pseudo-dividend that is paid out to all ETH holders. Ethereum isn’t the only revenue powerhouse though - there are plenty of applications that also generate a healthy amount of revenue. When looking at revenues for applications there needs to be a delineation made between protocol revenue (earnings) and supply side revenue (sales). A simple example of this is a protocol like SushiSwap that pays 0.25% of the 0.3% trading fee out to liquidity providers (the supply side) and 0.05% to the protocol which then goes to SUSHI stakers. You can further break down this down depending on the protocol to account for the revenue that token holders/stakers get, the revenue that the protocol DAO gets, and the revenue that goes to any other related entities. What I love about Ethereum applications is that everyone can see the revenue numbers in real time and they cannot be faked. This is because it’s all on-chain, publicly verifiable and available in real-time using numerous different data sources. This is very different to the traditional investing space (stocks/equities) because usually investors need to wait for quarterly earnings to be released in order to get an up-to-date view of company earnings and profits. What makes this even cooler is that there are tools like Dune Analytics that allow anyone to build their own customized dashboards using public on-chain data that they can share with the world. I find it funny that even though investors have access to this plethora of information, the crypto markets still revolve around marketing and narratives above all else. I mean, there are plenty of DeFi projects with very low price/earnings (PE) ratios but they are ignored because they are considered “boomer” projects because most participants are interested in the more “degen” projects. There’s also a popular “suits vs frogs” movement where retail investors (the frogs) are rallying against the VCs/funds/insiders (the insiders) and one form of protest is to not buy the tokens that they consider to be too heavily insider-allocated (even if they are good buys). I can sympathise with this fight, but I think once more traditional investors start seriously allocating to this ecosystem they will want to invest in things that they can easily analyze using the tools and metrics that they are used to. The crypto markets are probably going to remain wildly inefficient and marketing/narrative/meme driven for quite a while. I actually wonder sometimes if the crypto markets will ever become efficient and if we’ll ever have a top 10 that makes sense based on fundamentals - maybe not for a decade or longer. It’s not all bad news though - if you know how to play these narratives then you can have a very profitable experience - but you best stay on your feet when doing so because the metagame is always changing. Have a great weekend everyone, Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox! Join the Daily Gwei EcosystemAll information presented above is for educational purposes only and should not be taken as investment advice. If you liked this post from The Daily Gwei, why not share it? |

Older messages

Degen vs Boomer Mindset - The Daily Gwei #411

Thursday, January 6, 2022

Don't lose that degen spirit, kids.

L222 - The Daily Gwei #410

Wednesday, January 5, 2022

Will 2022 be the year of layer 2?

Caught in a Web2 - The Daily Gwei #409

Tuesday, January 4, 2022

You either die a hero or live long enough to see yourself become the villain.

Shifting Narratives - The Daily Gwei #408

Monday, January 3, 2022

Like sands through an hourglass, so are the narratives of crypto.

Cheers to 2021 - The Daily Gwei

Thursday, December 30, 2021

So long and thanks for all the ETH.

You Might Also Like

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏