Jan 18: Achievable aims: NeoGames buys Aspire

Jan 18: Achievable aims: NeoGames buys AspireNeoGames buys Aspire Global, 888 trading update, Truist sports-betting survey, Ontario tax objections, +MoreGood morning. Today’s headliners:

You can get it if you really want. Click below: NeoGames buys Aspire GlobalThe top line

Reach for the top: Aspire Global CEO Tsachi Maimon said his company had been on an “amazing journey” and one which involved the company transforming into a solely B2B provider of sports betting and igaming backends. This followed the sale of Aspire’s B2C operations to Esports technologies for €65m ($74m) in October last year. Aspire’s operation consists of BtoBet and PariPlay. Moti Malul, CEO at NeoGames, said the acquisition would “significantly increase” his company’s addressable market opportunities. Multiple differential: In Q3, Aspire’s B2B operations saw revenues rise 40.5% to €42.6m with EBITDA rising 45.4% to €8m, CAGR for the B2B business between 2017-20 was 35.7%. Aspire said that over two-thirds of its shareholders will accept the full settlement in shares and that the LTM EBITDA multiple on this basis was 16.8x; the multiple for those accepting cash and shares is 13.6x. Two tribes: NeoGames said its positioning as a leading provider to lotteries in the U.S. would “accelerate” Aspire’s entry into the market. Maimon had said previously Aspire was aiming at the tribal market. Should have seen this coming: Barak Matalon, currently a director at NeoGames, is the founder of both that company and Aspire Global. Talking point: Following the recent news on GiG buying Sportnco, it suggests the betting and gaming space is now going through a period of consolidation as much as B2C. Recall, Aspire itself acquired PariPaly in late 2019 and BtoBet the next year. Investor call: A conference call will be hosted at 8:30am ET. 888 trading updateThe top line

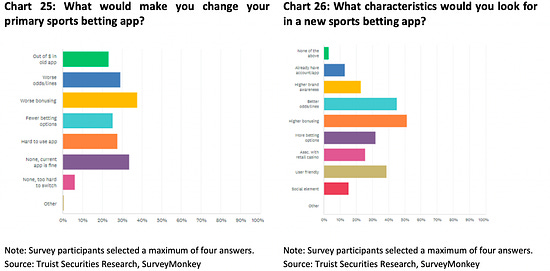

No expectations: 888 said the Q4 revenue drop was in line with expectations and reflected a “tough” comparative period and the impact of regulatory changes, including its Netherlands exit and marketing investments in Colorado following the launch of the SI Sportsbook. The impact of new regulations in Germany was “partially offset” by strong FY growth (+74%) in regulated markets such as the UK, Italy, Romania and Portugal. Progress update: Highlights included the sale of 888’s bingo business for $50m, the launch of 888Sport in Germany and the $500m cash raise 888 is undertaking to close the acquisition of William Hill in Q222. CEO Itai Pazner said 2021 had been “a year of outstanding strategic progress” and the sale of its bingo business would enable 888 to focus on its “B2C and US growth plans”. Truist sports-betting surveyBonus culture: A survey of 500 adults across four states undertaken on behalf of the analyst team at Truist found that sign-on bonuses and ongoing customer benefits remained a “very important factor” for prospective sports betting and igaming customers.

Survey highlights:

Stuck on you: The survey found that FanDuel had the greatest stickiness in sports. Of the 34% of the total respondents who said they were happy with their primary app, 43% of FanDuel primary users said they wouldn’t switch. That percentage was 30% for DraftKings. I’m with Dave: The survey found that of the 51% of respondents who were familiar with Dave Portnoy at Barstool, 65% either strongly or mildly liked him while 10% said they disliked him. A majority of 53% of all respondents said their opinion of him would not affect whether they used the Barstool app while 25% said it would. Of the respondents who used Barstool as their primary app, 83% were favorable to Portnoy and 8% held an unfavorable view of him. Ontario updateTaxing issues: A report by Great Canadian Gaming, Ontario's largest brick-and-mortar casino operator, has claimed the province could lose C$2.8bn in revenues over the next five years because of players visiting newly-regulated online casinos. The tax rate for online operators has not been announced yet, but it is believed that it will be around 20%, compared with 55% for GCG. The group said the province could lose out on CA$550m in annual tax revenues as a result. DatalinesNew Jersey 2021: Land-based casinos, sports betting and online wagering operators generated revenues of $4.7bn in 2021. Revenues for the state’s nine physical casinos were up $1bn vs. 2020 to $2.55bn, but this was a drop from the $2.68bn recorded in 2019. Internet gambling brought in $1.3bn, Resorts Digital was the top online casino with $450m GGR; followed by Golden Nugget Online Gaming at $380m and Caesars Interactive with $112m. Online sportsbooks recorded $816m in GGR over LTM, from a handle of ~$11bn and average margins of 7.1%. NewslinesEmpire building: BetMGM went live in New York yesterday. The launch comes nine days after the first wave of legal online sportsbooks debuted in the State. Top five: The PGA Tour’s VP for gaming told Golf Week that he hopes that golf will be among the “top four of five” sports bet-on by 2025. Too Shay: The former CEO at Entain Shay Segev has become the sole CEO at DAZN after having previously shared the role with the sports streaming company's founder James Rushton since he joined the business at the start of last year. Conference newsSBC has announced that CasinoBeats in Malta has moved to May 24-26, in case your May diaries were lacking a betting or gaming conference. What we’re readingThe vanishing: Yabo Sports, now you see them, now you don’t. On socialSpeaking of Dave… Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Jan 14: Weekend Edition no.29

Friday, January 14, 2022

Sub-head: Super Group fireside chat, FuboTV fireside chat, Evolution/LVS analysis, gaming sector analyst note, Playmaker acquisition, XPoint funding news, sector watch - tokens +More

Jan 11: Analysts predict FOX/Flutter 'unwind' in ‘22

Tuesday, January 11, 2022

FOX's strategic options, Zynga sale, New York share price reaction, FuboTV Q4 earnings pre-release +More

Jan 10: NY eclipses PA and NJ on opening weekend

Monday, January 10, 2022

Good morning. In today's email; Four books in New York get off to a flyer. Wells Fargo and Credit Suisse make their top picks for '22. Jefferies meets with Scientific Games' management. A

Jan 7: Weekend Edition no.28

Friday, January 7, 2022

New York launch, Playtech takeover delay, Inspired analyst reaction, single game parlay analysis, startup funding news, Sector watch - affiliates +More

Jan 3: Rush Street co-founder Carlin quits

Monday, January 3, 2022

Rush Street co-founder quits, Arizona and Nevada data, Run It Once Poker pivot, Entain/Sisal analyst reaction, Macau update, Startup Focus +More

You Might Also Like

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Simple hack to get 4x more shares

Sunday, December 22, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

I built an online tool site in 5 minutes

Sunday, December 22, 2024

AI tools are getting even more incredible

How to Describe a Hallucination

Saturday, December 21, 2024

If hallucinations defy the grasp of words, how should we try to describe them?

+28,000% Engagement with Pinterest?

Saturday, December 21, 2024

Exploding impressions and engagement