Cryptowriter - Stop Dollar-Cost Averaging Into Bitcoin

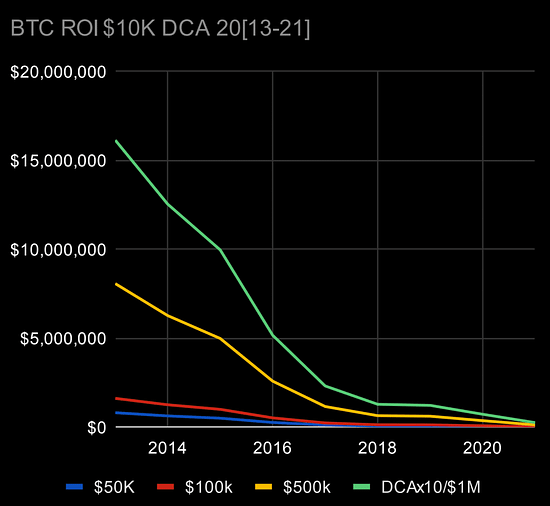

Do you buy the same amount of bitcoin on a fixed schedule regardless of price? For example, $20 every payday or $10 each week? I get it. Everybody’s telling you to do it. Sometimes you buy high, sometimes you buy low, but you’re always stacking sats no matter what the price is doing. When the price drops, you get a little extra bitcoin. When the price goes up, your existing bitcoin gets more valuable. Beats trying to time the market. Which is true. It’s a great approach. Nobody goes broke dollar-cost averaging into bitcoin. You always come out ahead over time. Over time. Opportunity LostBitcoin’s price went up 60% in 2021. If you dollar-cost averaged that whole time, odds are you’re down on your investment. The average daily cost of a bitcoin was $47,400 in 2021. The year-end price was 46,100. Today’s price is $42,000. You’re almost certainly doing better than you’d have done trading the market. No worries, no stress, no fuss. Also, no gains. Bitcoin went up 60% last year and your ROI was negative.  Even in good years, you’re struggling to get ahead. At this point in the evolution of the market, dollar-cost averaging is not going to give you the returns you’re probably expecting. Ten years ago, sure. Five years ago, probably. Not now. One of my readers sent me this pattern of DCA returns since bitcoin’s inception: Each passing year, the returns drop exponentially. DCA into altcoins?Maybe you think you’ll make up for it with altcoins? The entire altcoin market went up 5x in 2021. It’s up +30x since the start of this bull market in December 2018. What about averaging into those? Sure, over the long run, some altcoins will do way, way better than bitcoin. Will yours? What happens if you dollar-cost average into a dying altcoin? Many of the top 50 altcoins fit that description. Bitcoin will never fit that description. Assuming you pick a winner, can you do that and avoid rug-pulls, pump-and-dumps, and ghost chains? Can you outpace the creative destruction of projects in a competitive and speculative market? No altcoin has outperformed bitcoin from one market peak to the next, only at various intervals in between. When you dollar-cost average into altcoins, you risk pouring money into projects that trail the overall market forever. An alternative: buy low and save for the next opportunityWhat can you do instead? Buy when the market’s down. Once bitcoin’s price goes up a certain amount, stop buying and save for another opportunity. In other words, concentrate your buying efforts on times like these, when the market seems destined to fall off a cliff (and might). Rarely buy any other time. How can you tell when those buying opportunities start and end? Follow my plan. It’s three lines on a chart. Those lines change with bitcoin’s price (you don’t have to keep track of them). Just average into the market when bitcoin’s price is in the buying zone. Get some altcoins, too. Then, whenever bitcoin’s price goes outside the buying zone, save your money for another opportunity. You may want to convert your cash into stablecoins and move them to a savings platform for 7-20% interest while you wait. What to do with your money instead of DCA?Enjoy your life. Maybe even use your crypto! Let time and the natural growth of this market lift your investments higher. Your portfolio will fluctuate wildly but the value of your investment will usually go up and when it does go down, won’t stay down for very long (probably a few months). As of today, anybody following my plan would be down 20% at most, possibly up as much as 650% since I first posted my plan in 2020. Most people fall somewhere in between, slightly up on their investment. True, you’d sit on your hands for months at a time while the market seems to go “only up.” And you’d buy when it seems bitcoin’s price will keep going down forever. You’d still have beaten dollar-cost averaging in almost every scenario I could find—with the same amount of money and effort (possibly less). Give it a shot! Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio. Follow Me on Twitter.Learn how to earn…Become part of our community.Follow our socials.Subscribe to our podcast.Subscribe to this publication.

If you liked this post from Cryptowriter, why not share it? |

Older messages

EOSweekly: Everything EOS, Name Service, EVM+, WAX Swaps, Greymass, UNDRGRND

Sunday, January 16, 2022

Everything EOS is back! EOS names getting a makeover. ENF camp provides ETH-EOS mediation and Defibox reunites WAX-EOS. Greymass progress report. Sub-second finality coming to EOS? Couple of UNDRGRND

Round 27 Cryptowriter NFT Engagement Winners!

Sunday, January 16, 2022

Top 10 Most Engaged Users The top 10 most engaged users across our entire publication. Our analytics take into account the total amount of likes, comments, and shares. Most engaged winners receive 1

8 Unknown Facts About Bitcoin

Thursday, January 13, 2022

#1: A bug created 184 million BTC in 2010.

EOS 3.0 and the New Breed of Dapps: Gamebox, 100x, EOS Support, Violet Garden

Thursday, January 13, 2022

The Eden governance protocol hit the ground running. After just one official election, arguably more has been done for EOS within the past couple of months than over the past couple of years. ClarionOS

What Price Will You Pay for Bitcoin?

Tuesday, January 11, 2022

You will always get the price you choose to pay

You Might Also Like

Your bi-weekly crypto insights 📊

Thursday, April 25, 2024

Top data-driven insights from across the crypto space, to keep you ahead of trends. This week's top insight: Sei TVL per active address grew 10x since Flipside Crypto Onchain Insider Your bi-weekly

BlackRock’s historic 71-day streak ends as IBIT Bitcoin ETF sees zero inflows

Thursday, April 25, 2024

Fidelity and Ark only ETFs to record inflows as Bitcoin ETFs begin to cool off. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Your Last Chance to Make BANK on Crypto

Thursday, April 25, 2024

Open This or Miss Out

Inside Parcl: Trade Real Estate Like Never Before?

Thursday, April 25, 2024

Parcl, a pioneering Solana-based platform, aims to revolutionize the real estate market by introducing liquidity to this traditionally illiquid asset class. It created a comprehensive real estate index

Reminder: The 2024 Bitcoin Halving Has Successfully Been Completed

Thursday, April 25, 2024

We bring you the top stories in crypto every week! Stories like... Monday April 22, 2024 Sign Up Your Weekly Update On All Things Crypto TL;DR The 2024 Bitcoin Halving Has Successfully Been Completed

April 30 set for historic launch of Bitcoin and Ethereum ETFs in Hong Kong

Wednesday, April 24, 2024

Competitive fee structures revealed for new Bitcoin and Ethereum ETFs in Hong Kong. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly - 💧Ethereum Liquid Restaking Drives DeFi TVL to 2-Year Highs

Wednesday, April 24, 2024

Ethereum liquid restaking drives DeFi TVL to 2-year highs. Cronos unveils Spring Odyssey campaign powered by Galxe. Runes launch fueled Bitcoin miners' earnings to surge. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly - 💧Ethereum Liquid Restaking Drives DeFi TVL to 2-Year Highs

Wednesday, April 24, 2024

Ethereum liquid restaking drives DeFi TVL to 2-year highs. Cronos unveils Spring Odyssey campaign powered by Galxe. Runes launch fueled Bitcoin miners' earnings to surge. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

OKX Web3 On-Chain Anti-Phishing Security Trading Guide

Wednesday, April 24, 2024

Aurthor: OKX Web3 As we enter a new cycle, the risks of on-chain interactions are becoming increasingly exposed with the rise in user activity. Phishers typically use methods such as creating

You’re Not Going to Believe This

Tuesday, April 23, 2024

Massive Surprise Inside