The Bitcoin Espresso ☕#12 — Rio Investing in Bitcoin, Intel entering Mining Business & Bitcoin’s Energy Use and th…

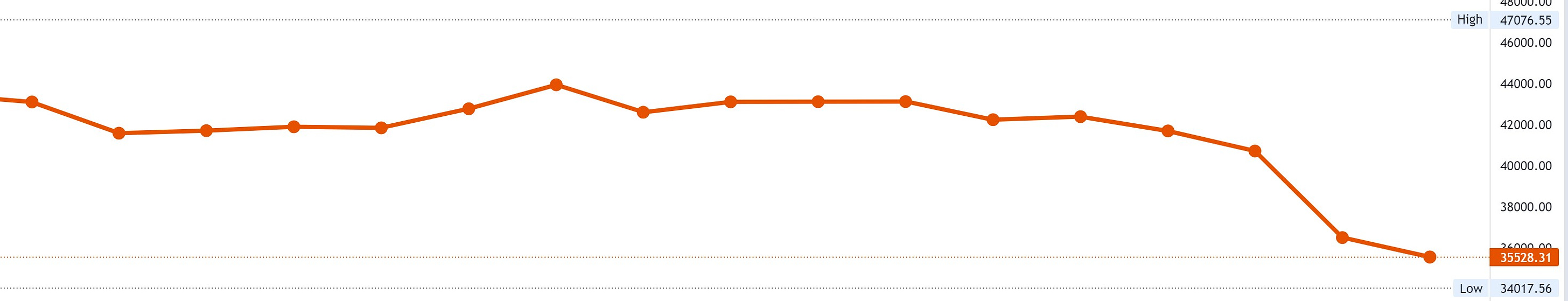

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters. Weekly Summary: Amongst a flourish of bullish news, Bitcoins price nevertheless joined the markets with a significant price drop. The general sentiment seems to be a risk-off move because of an anticipated price hike by the Federal Reserve. If you followed ‟Keeping an eye on Bitcoin with TradingView″ from The Bitcoin Espresso #4, you observed similar movements on the S&P 500 and NASDAQ. The correlation to stocks is so apparent that even the IMF acknowledges it. For today’s news, Twitter has turned on NFT verification, Rio de Janeiro plans to invest in Bitcoin, and Intel is suspected of entering the Bitcoin mining market. This edition’s focus topic covers Bitcoin’s Energy Use and the Difficulty Adjustment Mechanism. A quick tip: There’s an explanation of words and abbreviations in the Fundamentals Glossary at the bottom. 📰 Essential News

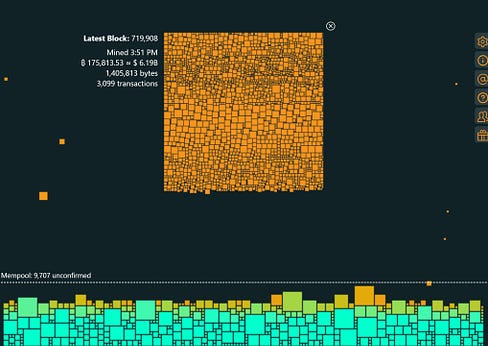

🎯Focus: Bitcoin’s Energy Use and the Difficulty Adjustment MechanismThe most controversial topic surrounding Bitcoin is its energy use. Contrary to most articles, I do not endeavor to convince you of a particular opinion. Instead, this article will inform you about a fundamental mechanism built into Bitcoin that is crucial to understand discussions about the topic and form your own opinion — Bitcoin mining difficulty adjustment. Systems in our day-to-day life often consume more energy to increase their performance. Older bicycle dynamos would shine brighter or longer the faster you pedaled your bike (= provided energy). Cars use more fuel if driven at higher speeds. Bitcoin is not a system with this property. If most of the global Bitcoin mining network would shut down, the network would still process as many transactions at the same intervals it does now by running on a few regular laptops, hardly using any energy. This is precisely how it worked at Bitcoin’s creation in 2009. You might be perplexed now. Don’t you read everywhere that Bitcoin requires enormous amounts of energy? Phrasing energy use as a requirement could be reasonably condemned as an intentional media bias. Bitcoin adjusts to the energy it is given. Its speed is independent of the energy used. I believe the confusion arises from a general lack of knowledge about mining difficulty adjustment. Bitcoin’s blocks, which contain the transactions, are generated every 10 minutes on average. Every 2,016 blocks, the network decides how hard it should be to create a block to achieve the desired 10-minute average timespan. The Bitcoin network adjusts to the currently available computing power. You can confirm this behavior in the publicly available Bitcoin source code. Therefore, the computing power and the electricity provided to Bitcoin are independent of the number of transactions processed. Mining is a mechanism to keep Bitcoin working without a central authority and defend against attacks (read more about this in The Bitcoin Espresso #6). It doesn’t meaningfully affect transaction size or speed. In that sense, the commonly presented metric of energy use per transaction is more akin to a sample of the energy humanity decides to provide to Bitcoin rather than a consideration of scalability or speed. This is why I consider it highly misleading. If you want to dive deeper, read this chapter from Mastering Bitcoin. Even if you skip the source code samples, it’s a great source to gain a solid understanding of the topic. Furthermore, if you want to see Bitcoin mining in action, check out @mononauticals visualization here. It shows incoming transactions on the blockchain trickling down before being collected and executed by the latest block. I hope this introduction gave you a new perspective on this complicated topic and contributed to more informed Bitcoin energy-use discussions. Did you recently discuss Bitcoin with someone who might like The Bitcoin Espresso? And if you haven’t yet, sign up for The Bitcoin Espresso now! Can’t get enough of reading newsletters? Check out The Sample 💌, which sends you newsletter recommendations based on your interest. 💡 Fundamentals GlossaryBlockchain … the digital ledger that the Bitcoin network collectively manages as a shared database of transactions Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin. Fed (Fed) … The Federal Reserve System is the central banking system of the US. International Monetary Fund (IMF) … an institution of the United Nations looking to secure financial stability amongst other goals. Mining (Bitcoin) … The CPU (processing power) intense activity to process transactions in the Bitcoin network to get rewarded in Bitcoin. NFT (Non-Fungible Token) … digital proofs of ownership of unique items. Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Give feedback or comment on this post to make this the best newsletter possible. The Bitcoin Espresso does not constitute financial-, tax- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions. The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein. Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements. |

Older messages

The Bitcoin Espresso ☕ #10 — EU Crypto Regulations & What happens when all 21 million Bitcoin have been mined?

Friday, January 21, 2022

Welcome to this week's The Bitcoin Espresso! Whether you're interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is

The Bitcoin Espresso ☕ #11 — Lightning, Paypal, JPMorgan & Reporting Tax with Accointing

Friday, January 21, 2022

Welcome to this week's The Bitcoin Espresso! Whether you're interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏