Lenny's Newsletter - Lessons from 140+ angel investments

This is a peek at today’s subscriber-only post. Subscribe to get access to the full issue, plus every ever. Lessons from 140+ angel investmentsBiggest surprises, how to get started, what to look for when evaluating companies, plus a ton of advice from many smart investors👋 Hey, I’m Lenny and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about product, growth, working with humans, and anything else that’s stressing you out about work. Send me your questions and in return I’ll humbly offer actionable real-talk advice.

Over the past five years, I’ve angel invested in over 140 companies. Twelve have grown into unicorns, 10 more are on track to get there this year, and I suspect many more will get there eventually. I’ve invested my own cash, scout checks, with the Airbnb alumni syndicate, and the Airbnb alumni fund. AngelList recently shared that I was in the top 20 investors on their platform. All of that is not to say I’ve got it all figured out but rather that I’ve been very active, things seem to be going in the right direction, and, most importantly, I have a bunch of first-party data to learn from. To answer your question, I’ve spent the past week reviewing all of my past investments, and below I’ve laid out my seven biggest surprises about angel investing so far. I’ve also included advice about getting started, a bit about how I evaluate startups, and, as a bonus, I’ve roped in a ton of my favorite angel investors to share their insights throughout. Disclaimers:

Thank you to these amazing investors for contributing their insights to this post: Aaron Schwartz, Alexis Zhu, Andrew Chen, Ann Miura-Ko, Austin Rief, Brian Nichols, Brett Berson, Charley Ma, Christopher Fong, Cristina Cordova, Dan Becker, Daniel Rumennik, David Breger, Harry Stebbings, Jack Altman, Jamie Quint, Jeff Chang, Jeff Kozloff, Jonah Greenberger, Jules Walter, Julia Lipton, Julian Shapiro, Leo Polovets, Louis Beryl, Packy McCormick, Sharrifah Lorenz, Sriram Krishnan, Todd Goldberg, and Varsha Rao 🙏 Let’s get into it. My biggest surprises about angel investing so farIf you think about it, angel investing is an amazing deal. You give a bit of cash to someone who will work the hardest they’ve ever worked in their life, for years, and if they can make it work, you make a lot of money. Seems almost unfair. But it’s not all rainbows and butterflies. Most startups fail, most angel investors lose money, and it’s a very expensive hobby. Looking at my 140+ investments, here are my biggest surprises so far. 1. I’m usually wrong about which investments will do bestWhen I invest in a startup, I make sure to record how confident I am in that investment—OK, Good, or Great. Looking back, only a third of my best investments—the companies that are on track to drive the biggest returns—I rated as Great at the time of investing. Meaning, if I invested only in companies I had Great confidence in, I’d have missed out on two-thirds of my biggest successes. I obviously thought they were a good enough bet to invest in, but I didn’t have 100% conviction in most of the companies I’ve invested in. And it turns out that’s the right move as an angel investor.

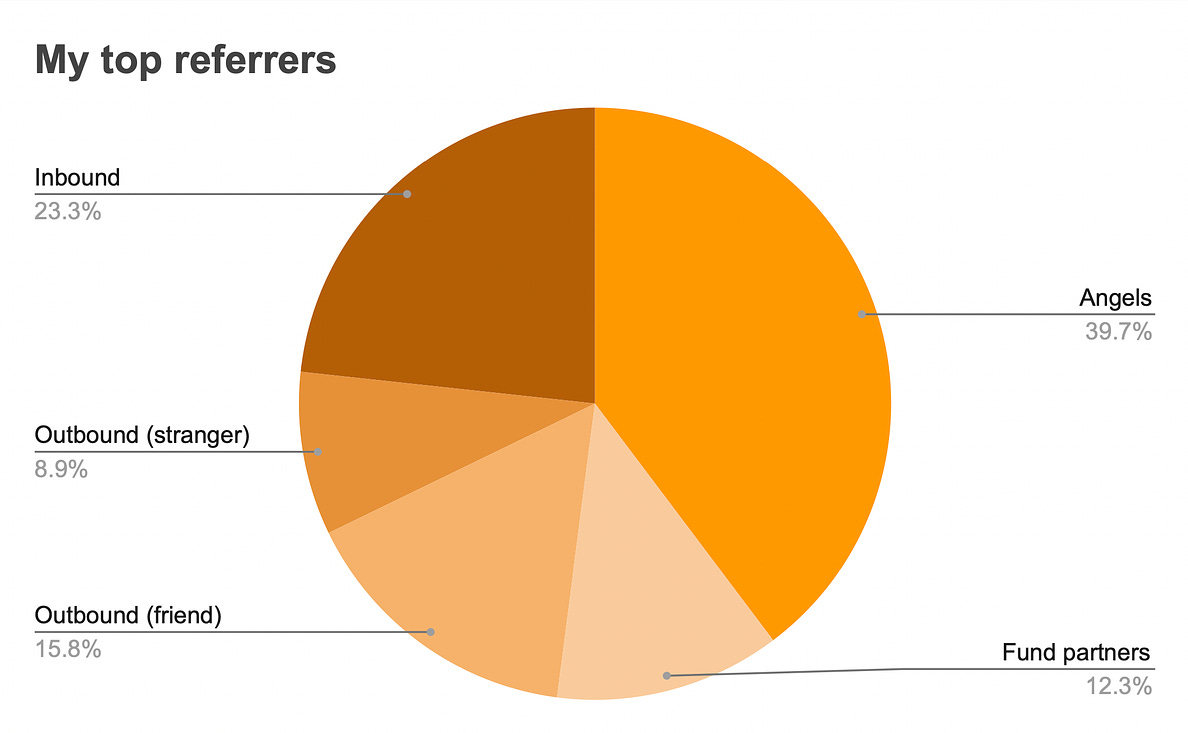

Angel investing is much more about not missing the big winners than it is about avoiding losers. And as AngelList found, early-stage investors do best if they invest in every credible deal vs. trying (and usually failing) to pick the few winners. This is also why the general advice is to invest the same check size into every deal—two of my largest markups are also my smallest checks :( Takeaway: If you see something special about the startup, and there’s a path to a 100x exit, consider investing even if you don’t have full conviction. 2. Most deal flow comes from other investors—not founders, friends, or colleaguesSeven of my first 10 deals were in my friends’ companies. The other three came from other investors sharing a deal with me. As I’ve gotten more active, that ratio has reversed. Now the majority of investments I make come from other investors (mostly angels and solo capitalists). Takeaway: Increase your deal flow by building relationships with other active investors. The two best ways to build relationships are to:

Special shoutout to Sriram, Dan, Jamie, Todd, Siqi, and Julian for sharing the most deals I’ve invested in 🤜🤛 3. Great deals are currency among investorsTo build on the above learning, the best way to build relationships with other investors, and thus deal flow, is to share great deals with them. The more great deals you share, the more deals they’ll share with you—simple as that. This isn’t always the case due to status differentials (e.g. I share many deals with Sequoia and it has never once shared a deal with me, lol), but in general this holds true, especially with angels and solo capitalists (where most of your deals will likely come from).

Takeaway: Seek out three to five awesome angel-investor friends and share everything you see with them. Two tips:

Note: If a founder asks you to keep their round confidential, you need to respect that. But in most cases, if you ask, founders are happy to meet more awesome angels. 4. Angel investing is more about access than pickingThere are three parts to angel investing: capital, access, and picking. Based on my experience, access is by far the most important part. If you have access, you can raise capital, and generally the most popular deals (i.e. the ones already discovered) also end up doing well. So picking becomes secondary.

Looking at my own data, over two-thirds of my biggest winners were “hot” deals at the time, and similarly, over two-thirds of the hot deals I’ve invested in have gone on to do very well. Not all investments in hot deals will do well, but broadly, getting access to hot deals is key. For that reason, much of angel investing these days is marketing yourself as an investor and getting founders to take your money.

One way to track your “access” is: whenever you see a big fundraising round or great exit, to ask yourself—did I have a chance to invest in that company? All that being said, your picking skills are still important to build over time. A third of my best investments weren’t in hot rounds, and not all hot deals do well. Even top VCs often make terrible decisions. It’s wise to place a portion of your bets on under-the-radar deals that you’re excited about. Especially if you have unique insight into the opportunity that other investors may be missing. Takeaway: Work on building your ability to get into hot deals, and don’t stress out about not being able to pick, especially early on. 5. It’s mostly about becoming someone founders want on their cap tableTo build on the above point, the best way to get access, and thus accelerate your angel investing career, is to become a person founders want to have on their cap table. There are four paths to this:... Subscribe to Lenny's Newsletter to read the rest.Become a paying subscriber of Lenny's Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The inside story of Facebook Marketplace

Tuesday, January 18, 2022

A guest post by Deb Liu

The top 5 things PMs should know about engineering

Thursday, December 16, 2021

Guest post by Justin Gage, writer of Technically and growth at Retool

The Atomic Network

Thursday, December 9, 2021

Exclusive excerpt from Andrew Chen's new book, The Cold Start Problem

A founder’s guide to community

Tuesday, November 30, 2021

When to invest in community, how to get started, setting goals, crafting a strategy, hiring, scaling, and much more—guest post by David Spinks

Lenny’s holiday gift guide

Thursday, November 25, 2021

50+ gift ideas for your friends, family, and coworkers

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏