This is a free preview of a subscribers-only post.

Everyone loves to hate the champ. The king must be dethroned, the leader replaced.

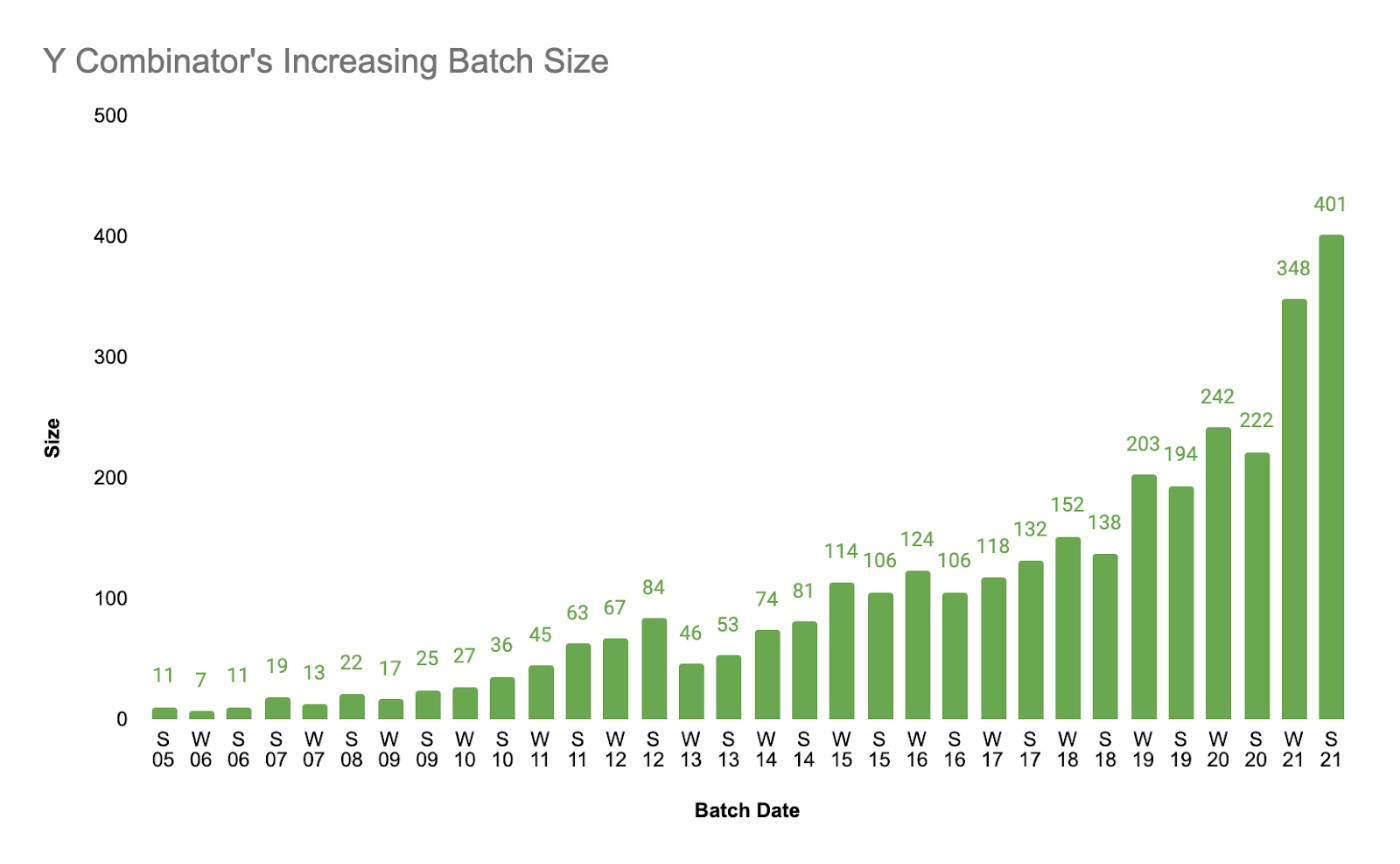

In Silicon Valley there is one institution that has resided at the top of the early-stage funding game for the last 10 years: Y Combinator. Their portfolio boasts over $400B in value, with 160+ companies valued at $150M+. What is even more impressive (at least to the strategy writer who runs this publication) is that they are the venture firm with the strongest network effects. A typical venture firm may compete on their ability to deploy capital quickly or on the clout of their partners. Y Combinator is different. By operating on an accelerator model, they make it such that the more companies that they fund, the stronger their network becomes. Each additional company means another potential customer and another expert that incoming CEOs can learn from. YC has leaned hard into that power, with an ever escalating number of startups running through their program.

They seem to be untouchable. They are so confident in their power that they have recently instituted new funding terms that crowd out seed investors (their partners of yesteryear). Previously, Y Combinator offered $125K for 7% of the company. Now, their new terms are still $125K for 7% and then another $375K at the next round of funding. This means that they’ll push out helpful angel investors and frustrate seed funds with ownership targets. You don’t have to trust me on this one for the Napkin Math—take a look at the NM done by a seed stage investor on Twitter:To me, this seems like the clear move of a monopolist, a king, who can take what they want because they know they are indispensable.

The new funding terms alone would be an interesting story for Napkin Math, but what makes this truly fascinating is that they are making this move at the most competitive point in their history. There are numerous well-funded competitors (who also have network effects), all while the market for seed startups is, counter to popular narrative, shrinking in volume.

So the question is, is Y Combinator a despot blinded by hubris on the brink of losing its throne? Or is the company truly as powerful as it appears?

If you would like to unlock the rest of the article, which includes profiles of 6 accelerators (including their AUM, funding, and strategy), the 4 avenues of attack that YC is under, and whether I think YC is doomed, please subscribe below. Your support enables me to act as an independent researcher in the space. As a special treat, if you subscribe using the button below, your first two weeks are free.