Net Interest - Positioning for Rising Rates

Positioning for Rising RatesPlus: Sculptor Capital Management, Maker DAO, Credit Suisse

Welcome to another issue of Net Interest, my newsletter on financial sector themes. We’re going deep into the mechanics of banking this week. When I launched Net Interest in May 2020, it was with the aim of discussing all aspects of the financial services industry. Since then, we’ve spent a lot of time looking at financial technology because it’s one of the most important agents of change in the industry. We’ve also explored how key segments of the industry work: investment banking, clearing, prime brokerage, private equity, hedge funds, mortgage lending. In between, we’ve analysed case studies, bringing to life the stories of companies like Citi, Wells Fargo and NuBank. One area we haven’t explored much is old-fashioned retail/commercial banking. And in particular, how this type of banking is impacted by interest rates. There’s a lot of confusion over how the industry responds to changes in rates, and with interest rates on their way back up, I thought this would be a useful topic to unravel. If it’s not your bag, don’t worry! Next week, I’ll be back with a briefing on PayPal. I’m currently reading an advance copy of Jimmy Soni’s book, The Founders, which reveals some fascinating insights on the company. PayPal is no longer bigger than most banks, its market cap down 60% from the peak, but it remains a formidable competitor in payments; next week we’ll take a look. In the meantime, if you want to get up to speed on any of those other segments of the industry, be sure to sign up as a paid subscriber. As well as supporting my work, you will get access to a full archive of material. As growth gives way to value in investment markets, banks and financial companies come back into frame. Paid-up subscribers include some of the world’s top investors in this neglected sector. Positioning for Rising RatesThe simplest model of banking is the 3-6-3 model: borrow at 3%, lend at 6% and be on the golf course by 3pm. It harks back to the glory days of the 1950s and 1960s when banking wasn’t all that competitive. As a model of how banks make money it offers a fairly good description. Rather than widgets, banks trade in money: they buy it low and sell it high and therein lies their margin. Sadly for bankers, competition now keeps them off the golf course. There’s no use charging borrowers 6% for a loan if other banks are charging 5%. Nor does competition come exclusively from other banks. In the deposit gathering business, banks compete with money market funds, and in the lending business they compete with bond markets. The change from those glory days came via deregulation. In the US, the spread between the cost of money and the rate of return on assets was preserved by a regulation known as Regulation Q, phased out in the 1980s. In China, a similar regulation was phased out more recently. When the Chinese banks came to the market via IPO in the mid 2000s, their margins were as good as set in stone. Banks could lend out money for three years at 6.5% and pay for similar duration funding at a rate of 3.7%, thus locking in a spread not dissimilar to the golfing spread of yore. (Although at the time, there were only around 240 golf courses in China, so Chinese bankers didn’t have the capacity to enjoy it.) Today, like in most deregulated banking markets, Chinese banks are free to set their own rates. Banks around the world do this with one eye on the market rate for money – the interest rate typically set by central banks. This rate establishes a benchmark across the various channels through which money changes hands. Right now, these benchmark rates are headed higher:

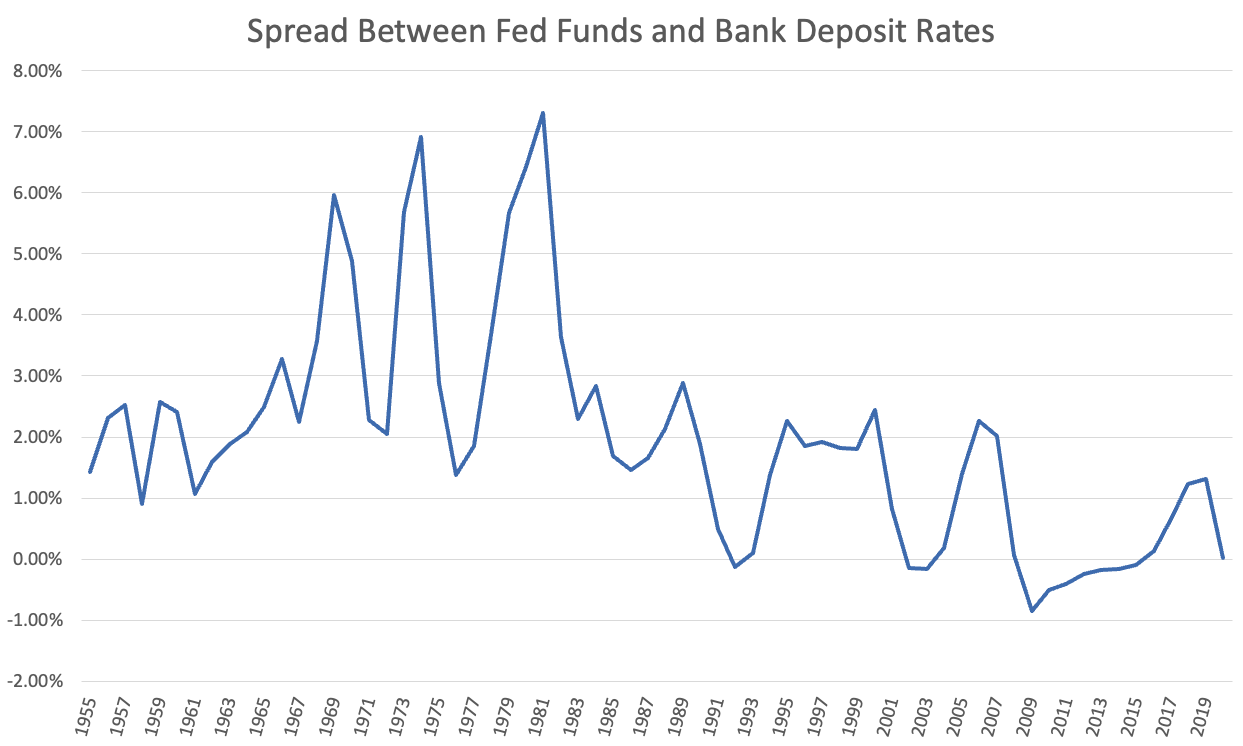

The question facing bank investors is what this all means for bank profitability. It’s a question that attracts much debate. This is one investor’s perspective:    It’s not the right take, but there are two reasons the author may have come to it. One is that he’s taken a look at Eurozone banks’ balance sheets and seen a whole lot of fixed income securities there – loans, sovereign bonds and the like – typical fare on the asset side of a bank’s balance sheet. Being versed in bond math, he knows that when rates go up, the value of bonds goes down. Two is that he estimates the interest expense banks pay for their funding will rise faster than the interest income they earn on their assets; in other words that the 3% in the golfing model goes to 4% more quickly than the 6% goes to 7%. ¹ That second explanation is what happened to US savings and loans institutions in the 1980s. And they really were “fuct”. These banks had fixed rate mortgages on the asset side of their balance sheet and customer savings on the liabilities side. As rates rose during the Fed’s (last) inflation-fighting campaign, their funding costs went up but their fixed-rate mortgages didn’t reprice quickly enough. Margins collapsed and so did many of the banks. In total, nearly 750 of them had to be taken over by the government at a total cost to the taxpayer of $124 billion. These days, banks manage their interest rate exposures a lot more carefully. Higher rates aren’t necessarily bad, because any drag on one side of the balance sheet is offset by a benefit on the other side. But if the duration of one side is different from the other, that is a situation that may need managing. And sure enough, it’s one that banks are exposed to. Some of the 3% net spread they take in the golfing model compensates them for taking credit risk, some is payment for the security they provide on customer savings, but some comes because funding is short-term while lending is long-term – and short-term rates tend to be lower than long-term rates. This maturity transformation is a defining feature of banks. It’s important because companies want long-term credit and households want short-term liquidity; banks sit in the middle allowing everyone to get what they want. The maturity transformation feature gives rise to a better model of banks’ interest rate sensitivity, one that looks at the yield curve rather than the absolute level of rates. As Barrons puts it: “Banks lend money on the long end of the yield curve and borrow on the short end of the curve… Any steepening of the yield curve is a welcome sign for banks as they make their money on the spread between loans and deposits.” While useful, this take is not perfect either. The reason is that although in theory sight deposits are very short-term – by definition, a customer can demand them on sight – they don’t behave very short-term. One analysis of European banks estimates that the duration of retail sight deposits is more like two years and for corporate sight deposits it’s around a year. That’s because deposits are quite sticky – not especially subject to switching. A recent survey of 124,000 consumers in the UK found that only 8.9% take any action to move their savings account balances to higher-paying equivalent products even at the same institution, despite an average increase in first-year interest income of $190. Such stickiness means that when benchmark rates go up, banks don’t need to pass rate hikes onto depositors to keep their customers. Indeed, in the 1994 and 2004 rate tightening cycles, US banks passed on only 50% of the rate increases. Then, in the 2016 cycle, it took a year and a half before they even passed on 10% of the rate hikes; by the time rates peaked in 2018, they had passed on only 40%. This time around, so-called “deposit beta” is expected to be even lower, as banks are flush with deposits they don’t need. There are currently around $18.1 trillion of deposits sloshing around the US banking system, up almost $5 trillion from the end of 2019. As a result, most US banks self-declare as “asset sensitive”, which is banker-speak for being a net beneficiary of rising rates. Bank of America says that a 100 basis point parallel increase in interest rates would boost net interest income by $6.5 billion over the next 12 months; that’s a 15% jump on the 2021 level. It’s not clear what deposit beta the company is baking into this estimate but its CFO said on his recent earnings call that in the prior tightening cycle, the bank had a deposit beta of between 20% and 25% and “we’d like to think this time around, it will be something similar, hopefully a little bit better.” Indeed, US banks have never been so geared into rate rises. In the past, some of them preferred rates going down and some of them preferred rates going up, depending on their business mix (an issue we’ll touch on further down). Now, they’re pretty much all rooting for higher rates. Another way of thinking about it is to consider the value that can be extracted from a deposit franchise. If, rather than run a lending operation, a banker simply took in deposits and invested them at the Federal Reserve, they wouldn’t be doing very well right now. Before the pandemic, when rates were higher, they would have earned an unlevered return of ~1.3% a year via such a strategy; now, nada. It’s the same story in Europe, with the added twist that negative policy rates in the Eurozone have been especially punishing on banks. While some banks have been able to pass negative rates on to customers by charging them to hold their deposits – notably banks in Germany, Netherlands and Denmark – many have not. As we discussed in our piece on Irish banks, two foreign banks exited the Irish market last year as the cost of maintaining a deposit franchise grew too high. The (two) banks that remain profit from rising rates. One of them, AIB Group, reckons that a 100 basis point rise in rates would boost its revenues by between €250 million and €260 million, equivalent to around 15% of current net interest income. While most banks’ deposit businesses will benefit from rising rates, the overall impact is a function of their wider business mix. In particular, interest rate sensitivity depends on how much of a bank’s assets are floating-rate and how much are fixed-rate. In the US, most commercial lending is floating-rate and so it reprices upwards very quickly when rates change. By contrast, mortgage loans are fixed-rate and so only reprice as they mature and new, higher-rate loans are put on in their place. In Europe, mortgages work differently between countries. In some (including France, Belgium, Germany and the Netherlands) mortgages have historically skewed more fixed-rate; in others they tend to be more variable-rate. Italy and Spain tend to have loans which are mainly short-term floating rate in nature. Banks’ interest rate sensitivity is also influenced by tactical decisions made by management. Deposit growth has vastly outstripped loan growth over the past two years, so management teams have had to choose how to invest their excess liquidity. US banks could leave it at the Fed for not very much money, or they could invest in longer-dated securities for a fixed rate that may yet go higher. Managing a bank’s treasury operation is like managing a vast fixed income fund where timing trades can influence returns. As Jamie Dimon, Chairman and CEO of JPMorgan, said on his recent earnings call: “There’s $500 billion or $600 billion of those cash or marketable securities that could be deployed in higher-yielding assets or loans when and if the time comes.” Bank management may also choose to hedge their interest rate exposure. They can swap fixed-rate loan exposures into floating-rate to better match their funding sources. Or they can hedge their deposit franchise to mitigate against a decline in rates. Transparency varies around the deployment of these strategies, but NatWest in the UK provides good disclosure. My career as a banks analyst began in the mid 90s. I arrived too late to witness the fallout from Alan Greenspan’s surprise rate hike in 1994. Bond markets plunged and bank earnings suffered. But the Federal Reserve’s communication infrastructure was not in place back then, and the hike was greeted with surprise, not least by banks who were unprepared for it. This time, they are not only prepared, they are eager for it. Paid subscribers are reading on to enjoy discussion about Sculptor Capital Management, Maker DAO and Credit Suisse. To join them, sign up here:1 The author is an accomplished investor – his fund was up over 100% in each of 2020 and 2021. Proof that a disregard for banks hasn’t placed a drag on anyone’s performance over the past few years. You’re on the free list for Net Interest. For the full experience, become a paying subscriber. |

Older messages

Follow the Money

Friday, February 4, 2022

The Story of Swiss Private Banking

The Power Law

Friday, January 28, 2022

Plus: Robinhood, Credit Rating Agencies, Foreign Travel

Great Quarter, Guys

Friday, January 21, 2022

Plus: CBDCs, Insurtech, Bank Regulation

From Co-ops to DAOs

Friday, January 14, 2022

Plus: Citadel Securities, JP Morgan, BlackRock

TPG: A Tale in Five Trades

Friday, January 7, 2022

Plus: CUSIP, Western Union, Banker Bonuses

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏