The Daily Gwei - The Modular Era - The Daily Gwei #438

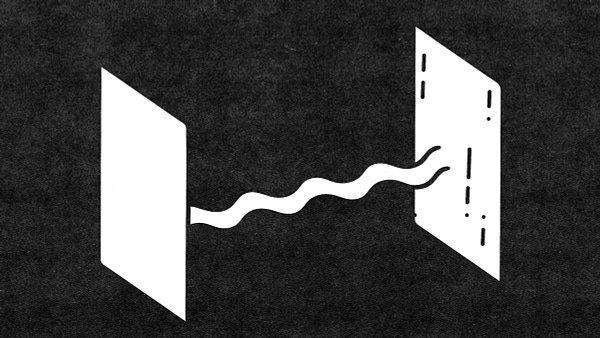

Urbit, a crypto project that’s been around for quite a while now, announced yesterday that they are deploying their own layer 2 rollup that will be secured by Ethereum. I think this is just the beginning of projects spinning up their own layer 2’s and I very much welcome it as I believe the best path forward for Ethereum scalability at this point is to let a thousand execution layers (layer 2’s) bloom.   My thesis is that over the next few years, we will see plenty of layer 2 solutions bloom and they’ll be securing themselves using the world’s best settlement layer - Ethereum. Many of these layer 2 solutions will be forks of existing rollup codebases, some will be new constructions and some won’t even be rollups at all. The through-line here is that the era of the “monolithic blockchain” is now over and we’re now moving into the era of the “modular blockchain” which I’m sure you’ve all heard about a lot over the last few months. The modular blockchain design separates concerns into three main buckets: settlement/consensus, data availability, and execution. The brightest minds in the crypto ecosystem have quickly come to a consensus that this is looking like the best path forward to achieve maximum decentralization, security and scale. Of course, there are other designs that are being experimented with as well, but I do truly believe that the modular design will be the one that wins out over the long-term because it just makes the most logical sense. This means that, much like how the era of spinning up a new PoW blockchain is over, the era of spinning up an entirely new monolithic layer 1 is also coming to an end - and this is a good thing for everyone! On that note, spinning up a layer 2 rollup (the “execution” part of the modular stack) is much easier than spinning up a new layer 1 blockchain (the “settlement/consensus” part). This is because a rollup can basically “outsource” its security to whatever layer 1 blockchain it wants with Ethereum being the most-obvious choice for maximum security and decentralization (and in the future, the cheapest fees for layer 2’s). Ethereum will also be the best, most secure and cheapest place for execution layers (rollups and others) to post their data to once sharding is implemented (hopefully sometime in 2023). Obviously I’m making some assumptions in this piece about how the next few years are going to play out, but I think that the assumptions are based on sound logic. One thing I’ve learned over my years in this ecosystem is that you should never bet against exceptionally smart people - they are usually 100 steps ahead of everyone else. Though at the same time you should still keep an open mind and check your biases from time to time else you end up in an echo chamber and miss out on the “next big thing” in crypto. Have a great day everyone, Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox! Join the Daily Gwei EcosystemAll information presented above is for educational purposes only and should not be taken as investment advice. If you liked this post from The Daily Gwei, why not share it? |

Older messages

Quantifying Adoption - The Daily Gwei #434

Wednesday, February 9, 2022

Contrary to popular belief, there aren't that many actual crypto users.

The Front Door - The Daily Gwei #433

Tuesday, February 8, 2022

The next mega-unicorns are crypto wallets and interfaces.

PvP vs PvE - The Daily Gwei #432

Monday, February 7, 2022

It's a dog eat dog world out there.

Out In The Open - The Daily Gwei #431

Friday, February 4, 2022

Ethereum's open development is both a blessing and a curse.

The Tribes We Form - The Daily Gwei #429

Wednesday, February 2, 2022

Becoming a part of a tribe is inevitable - but you don't have to be toxic about it.

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏