First 1000 - 💸 Fractional Investing

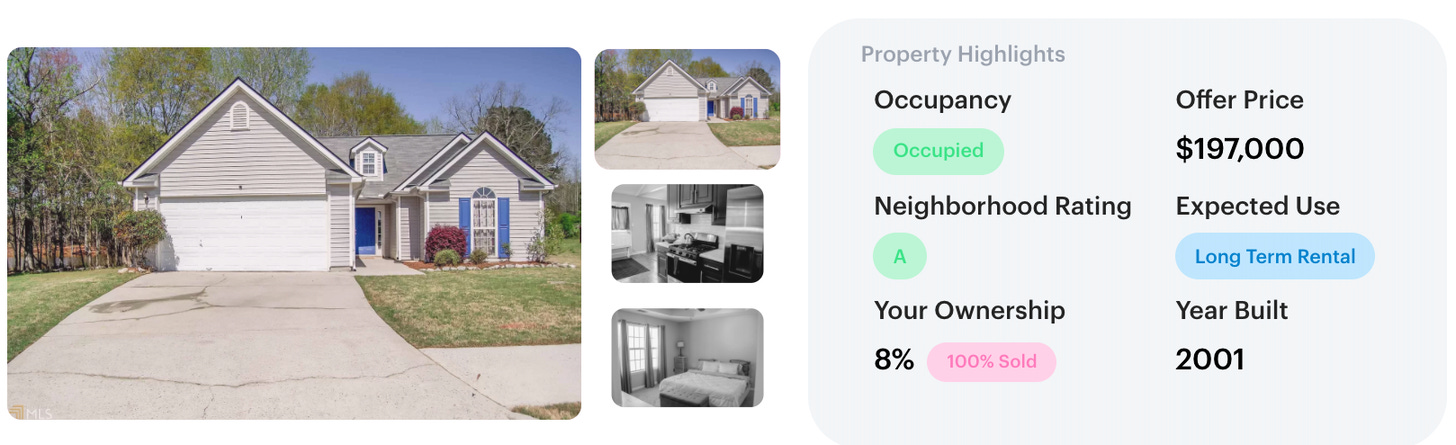

If this was forwarded your way and you wish to sign up to First 1000, you can do so here :) Today’s issue is brought to you by Dover. Hiring top talent is difficult. Dover helps take the guesswork out of it — from narrowing in on the ideal candidate to automating outreach email at scale, to scheduling interviews, they make it easier for you to build your team, faster. The team works with hiring managers and recruiting teams at companies like Stripe, Benchling, and Lattice to fill roles across the company, from engineering to GTM to operations. Hello Frens 👋, By: Leo Luo It’s a simple asset - you buy the billboard, sell ads, and make money passively. The number of billboards in the US has been pretty stable, hovering at around 340,000 over the last few years. Billboards advertising spending belongs to a category called out-of-home advertising, which was growing at 5-7% year-on-year pre-pandemic. Besides billboards, there are countless other alternative assets out there, many of which not only appreciate over time and produce stable cash flow, but they are also a great hedge for a traditional investment portfolio of stocks and bonds. Alternative assets tend not to have a correlation with the broader market and can help an investor to diversify their entire portfolio and reduce the overall risk. I had never really dipped my toes into alternative investing - until I discovered the world of fractional investing. There are now hundreds of platforms that empower average retail investors to gain fractional ownership of assets that are historically owned by the ultra-wealthy. In the past two years, I have had the chance to speak to founders in the fractional investing space, such as Chris from Rally and Stella from Fractional, and feature them on Consumer Startups (learn more about their stories here and here). Recently, I also personally invested in property via Fractional, which helps people co-own investment properties with friends and other investors in the community. The platform removes many of the hassles associated with investing in real estate, such as financing and property management while helping amateur investors such as myself to learn more about real estate investing in a relatively low-risk environment. I put in a small amount of money into an investment property in Georgia (a deal listed on Fractional’s marketplace). The whole process took about an hour in total - 30 minutes of research and one 30-minute call with the Fractional team. Today’s piece is about this fascinating world of fractional investing in alternative assets. Before I continue with the rest, I want to give a special shout-out to my friends Natalie Dillon and Stefan Von Imhof. Natalie is one of my favorite consumer investors, who invested in one of the leading fractional investing platforms, Otis. Stefan is the founder of Alts, the world’s largest alternative investing website. Both of them have given me so much insight into this space. Let’s dive in. The genesis of fractional investingThere are a few macro trends that are fueling the rise of fractional investing in alternative assets. First, there is a lot of cheap money floating around as a result of the historically low-interest rates of the past ten or so years. Investors are looking for more asset classes to allocate their money to. In addition, there is a rising number of retail investors. Previously, people with disposable incomes put their money in the hands of wealth advisors, who tended to invest in conservative asset classes such as mutual funds, hoping to generate 6-10% a year while charging their clients a 1% fee. Money couldn’t even be withdrawn without sending these advisors an email or giving them a call. Subsequently, robo-advisors, such as Wealthfront and Betterment, emerged and promised to deliver the same product at much lower fees. Then, Robinhood was born and started offering everyone free trading, lending, fractional stock investing, and all the tools a retail investor needs to manage money themselves. In addition, there was a mindset shift among younger generations of investors, who now had a new idea about what comprised a valuable asset.

Something that might seem like a hobby for traditional investors such as sneakers can be considered a valuable investment for newer generations of investors. Yet, despite this shift, one problem remained: it was still a challenge to invest in certain things, such as music rights or artworks unless you had enough capital or connections. For a long time, most people could only invest in stocks, bonds, and other traditional asset classes. However, this has also changed. New technologies and regulations are making fractional investing possible. For example, the Jumpstart Our Business Startups (JOBS) Act passed by the Obama administration significantly loosened up restrictions related to offering securities. Regulation A, a rule part of the JOBS Act, allows companies to offer and sell their securities without having to register the offering with the SEC. There are still a lot of hoops to jump through to create a Regulation A offering; however, if you are willing to put in some time and money from a legal standpoint, you can securitize anything in the world and sell fractional shares of any asset. One of the first alternative asset classes to embrace fractional investing as real estate, which historically had a high barrier to entry due to a large amount of upfront capital required, but it is also an asset people are familiar with. Many other asset classes have since followed. I will dive into them in the next section. Alternative assets market mapMore and more asset classes are being disrupted; however, not all are suitable for fractional investing. Ultimately, people invest with the goal of generating a financial return. There are two categories of assets that make sense: 1) assets that generate cash flow 2) and assets that appreciate in value. One asset in the first category is music rights. Record labels are the original music rights investors. They pay for most expenses upfront, such as marketing and production, and in return, they typically get 80% of album revenue. Today, there are platforms such as Vetz or Songvest that allow laymen to invest in their favorite songs or artists. The rise of streaming has also made the payout of music rights royalties more predictable. Each individual stream doesn’t pay a lot, but streaming is consistent, and this consistency in revenue allows investors to value a music catalog without fearing that the revenue will cease or suddenly dip. The assets in the second category are a bit more complicated since they can’t be valued based on cash flow. One example is wine, which has performed surprisingly well in the past decades and which, according to Vinovest, has beat the S&P 500 in recent years. It increases in value because investment-grade wines are only produced in limited quantities (100s or so), which decrease as people drink the wine; demand for wine continues to increase; and the quality of wine improves over time. These factors together make wine a strong candidate for fractional investing. Below is a market map of different alternative assets that are being disrupted by fractional investing: Many other asset classes, such as books, cultural assets, and sneakers, can also be strong candidates for fractional investing. Business strategies and differentiationVertical investing platform vs horizontal investing platform There are two main approaches for companies in the fractional investing space: start a vertical investing platform that focuses on one asset class or create a horizontal investing platform that serves many different asset classes. Most companies that offer fractional investing start as a vertical platform. This can be advantageous because it enables companies to build communities in an authentic way. When you focus on one asset class, you can be more specific with your messaging, be more involved in the investor community you serve and do things that don’t scale to hack initial demand. For example, Rally started as a vertical fractional investing platform for classic cars. To generate initial demand for its minimum viable product, the Rally team rented a showroom in NYC for three classic cars, which allowed it to garner attention from both potential customers and investors.

This showroom also helped the company to attract media attention. It was featured on CNBC, WSJ, Bloomberg, and many other media outlets, which helped it to generate a ton of organic demand. Over the last few years, Rally has slowly added more categories to its platform beyond classic cars, such as sports cards and books, and has become a horizontal investing platform for all collectible assets. This will likely be the trend for many other vertical platforms as they mature and find their footing. For example, Fractional initially focused on single-family properties and is now slowly expanding to multiple-family properties. By going horizontal, you can expand your total addressable market and attract investors who might initially be interested only in certain assets, eventually cross-selling other assets to them as you earn their trust. Furthermore, you can provide a user with more diversification within one platform and become the one-stop shop for all things alternative asset investing. Differentiation strategies Fractional investing platforms have various ways to differentiate themselves on both sides of the marketplace: investors (demand) and original asset owners (supply). On the demand side, the most obvious way to stand out is to have the best deal flow, which means having a steady stream of new and quality assets. By frequently having new assets added to it, a platform can keep investors engaged and increase retention. On the other hand, it is equally important to have quality assets. For example, Masterworks has done a great job of acquiring art pieces from famous artists, such as Monet and Picasso. In an asset class that’s already foreign to most investors, having a list of blue-chip art pieces can be a great way to get people in the door and give additional assurance to those who might be hesitant to invest in art. Besides having a good deal flow, another way to differentiate on the demand side is by providing liquidity for investors. This might be a given in traditional asset classes, such as stocks, but it is a luxury in alternative asset classes, especially those that are not as well-known, such as farmland. Often, there simply aren't enough investors to create a liquid marketplace. But platforms can get creative in this situation and facilitate private transactions. For example, FarmTogether, a farmland fractional investment platform, offers an annual liquidity window. During these windows, it assists investors in finding a buyer for their investment on a "best efforts" basis. Even for markets with a lot of investors, such as sports cards, platforms offer different levels of liquidity. For example, on Rally, investors have to wait approximately 90 days after the initial public offering to sell shares, and purchased shares must be held for five days, while on Dibbs, users can buy tokenized representations of physical cards and trade without any lock-up period at any time of the week since the system is powered by Ethereum blockchain. This liquidity difference could also attract different types of investors. As one Reddit user put it, “I would relate Rally & Collectable to your long-term traditional IRA and Dibbs to your short-term, riskier, day trading brokerage account.” There are also ways to differentiate between platforms on the supply side, the biggest being how the platform acquires an asset from the original owner. One such option is the traditional buyout model. Platforms that adopt this model usually have an expert procurement team. For example, Masterworks has an in-house team that first uses its proprietary data to determine which artist markets have the most momentum and then identifies the valuable pieces in those markets and purchases them outright. Another means of acquiring assets is the consignment model. Platforms that use this model work with the original asset owner to securitize the asset and list it on their platform. In many cases, platforms allow the original asset owners to retain some equity in the asset as a benefit. One good example of this is Otis.

Challenges in the spaceThere are several challenges for players in this space. First and foremost, fractional alternative investments are still fairly new, and investors can be more sensitive to the performance of the assets involved. Most new investors in the space might be less familiar with alternative asset classes, so if prices drop for an extended period of time, there is a higher level of flight risk compared to stocks and bonds, the risks of which are better understood. One way to mitigate this challenge is to educate investors on the risks of the new assets and build trust, but it can still be challenging during a market downturn. Another prominent risk is regulation. Even though there are laws in place that enable companies to securitize assets and sell fractional shares, it is still incredibly difficult and time-consuming to deal with the SEC. Each offering must be filed with the SEC for each asset launched on a platform. Bigger and more mature companies may have an edge due to their familiarity with the rules, but it is always time-consuming. Finally, as the success of earlier platforms becomes better known, more companies will enter the space with their own angles. Existing players will not only face increased competition from new startups but also likely encounter threats from large trading platforms. For example, Robinhood started with stocks and has since expanded to options, cryptos, and non-fungible tokens. It would therefore not be surprising if it started expanding into the alternative assets space, especially as this would align with its mission to “democratize finance for all.” We could see some consolidations in the next two to three years as bigger players start to expand into this space. Some closing thoughtsI am a big fan of this fractional investing space because it allows “regular” people to access high-return alternative asset classes, which were historically available only to the ultra-wealthy. I believe we are at the cusp of this shift and that many fractional investing platforms will emerge in the next 1–3 years. The trend started with real estate and cultural collectibles, but it will eventually expand to all asset classes that can produce stable cash flow or consistently appreciate over time. As more asset classes become available, there will also be a rising number of thematic alternative funds. Instead of just investing in one sector, retail investors will be able to invest in a portfolio of alternative assets that fit into different themes. For example, there could be a Chicago fund that invests in rare Jordan sneakers, certain Chicago commercial buildings, and famous local franchises. Investors would then be able to invest in themes that align with their values and interests. In addition, as I mentioned in the previous section, I believe this fractional investing space will get yet more heated and competitive. As the industry continues to mature, consolidations are likely to occur. Horizontal platforms such as Rally or Otis might acquire smaller vertical players to expand their investable assets. Large trading platforms such as Robinhood could ultimately acquire one of the horizontal platforms as a way to enter the space. I am eager to see how everything shakes out in the near future. It's an exciting time! I am testing out a new referral program for the newsletter, still in beta but you can check it out here. |

Older messages

🕖Waitlists

Tuesday, February 15, 2022

Today's issue is brought to you by Rows Rows is a spreadsheet with superpowers. It has cells and functions you already know but it also has integrations with 40+ business tools like Hubspot and

Brute Forcing Your Way to “Default Alive”

Tuesday, February 8, 2022

Guest Post by Ruchin Kulkarni from Toplyne

🚵♀️ Strava

Tuesday, February 1, 2022

& the Inch Wide Mile Deep go to market

GTM Canon

Tuesday, January 18, 2022

The best GTM content from around the internet

🤷♀️The Trust Paradox

Tuesday, January 11, 2022

How did startups with businesses anchored on overcoming a large threshold of trust acquire early customers when they have no track record to fall back on?

You Might Also Like

🗞 What's New: ~40% of young adults get their news from influencers

Saturday, November 23, 2024

Also: "File over App" for digital longevity ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Initiator Creator - Issue 145

Saturday, November 23, 2024

Initiator Creator - Issue #145 - ( Read in browser ) By Saurabh Y. // 23 Nov 2024 Presented by NorthPoll This Week's Notes: Content-rich designs looks more convincing I just love how Basecamp

🛑 STOP EVERYTHING 🛑 BLACK FRIDAY IS NOW!

Saturday, November 23, 2024

This is your sign to take action—2025 could be your breakthrough year, but only if you start now. Black Friday_Header_2 Hey Friend , This is getting serious. We're handing over $1700 in value as

What’s 🔥 in Enterprise IT/VC #421

Saturday, November 23, 2024

Thoughts from Goldman's PICC + optimism for 2025? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

I'm blue

Saturday, November 23, 2024

Hey, tl;dr – I've decided to delete all my Twitter posts, lock down my account, and leave the platform. And I'm going all-in on Bluesky, which (in the last month) has become 1000x more fun

🚀 Globalstar to the Nasdaq

Saturday, November 23, 2024

Plus $RKLB CEO becomes a billionaire, DIRECTV $SATS debt deal called off, TEC's $160M Series B, and more! The latest space investing news and updates. View this email in your browser The Space

Theory Two

Friday, November 22, 2024

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Theory Two Today, we're announcing our second fund of $450

🗞 What's New: AI creators may be coming to TikTok

Friday, November 22, 2024

Also: Microsoft's AI updates are helpful for founders ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

behind the scenes of the 2024 digital health 50

Friday, November 22, 2024

the expert behind the list is unpacking this year's winners. don't miss it. Hi there, Get an inside look at the world's most promising private digital health companies. Join the analyst

How to get set up on Bluesky

Friday, November 22, 2024

Plus, Instagram personal profiles are now in Buffer! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏