Popular Information - Decisions have consequences

Welcome back to Popular Information, an independent newsletter dedicated to accountability journalism — written by me, Judd Legum. A core component of President Biden's failed Build Back Better plan was the extension of the expanded child tax credit. The American Rescue Act, which was signed into law in March 2021, expanded the child tax credit for one year. The credit was expanded in three ways:

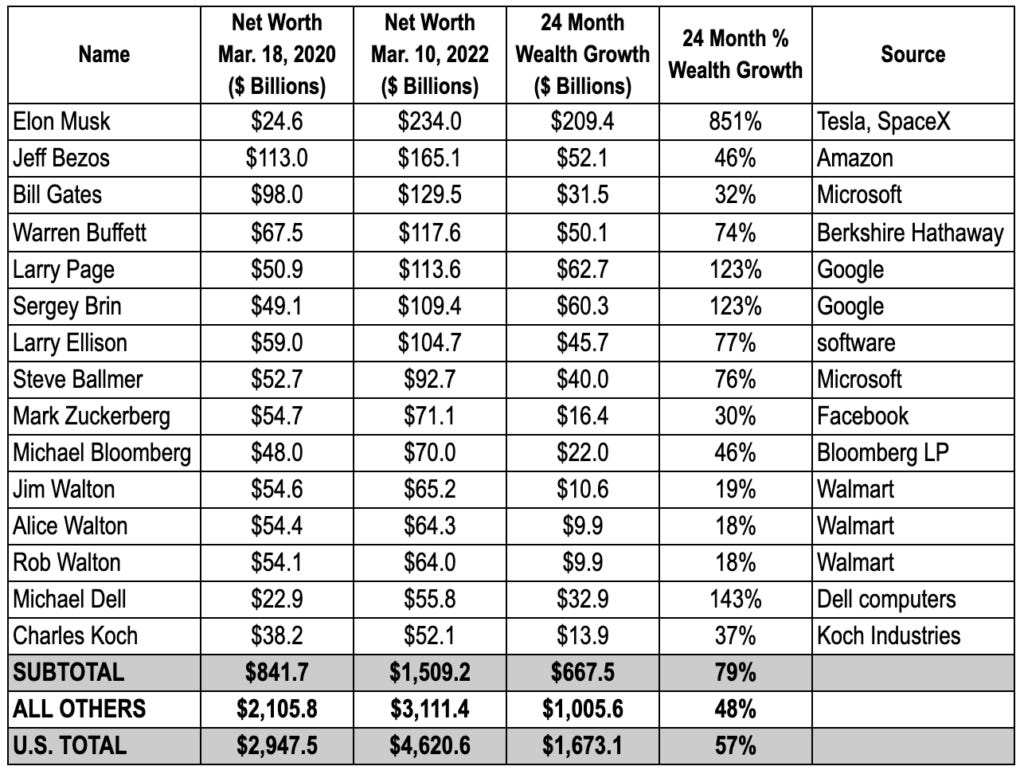

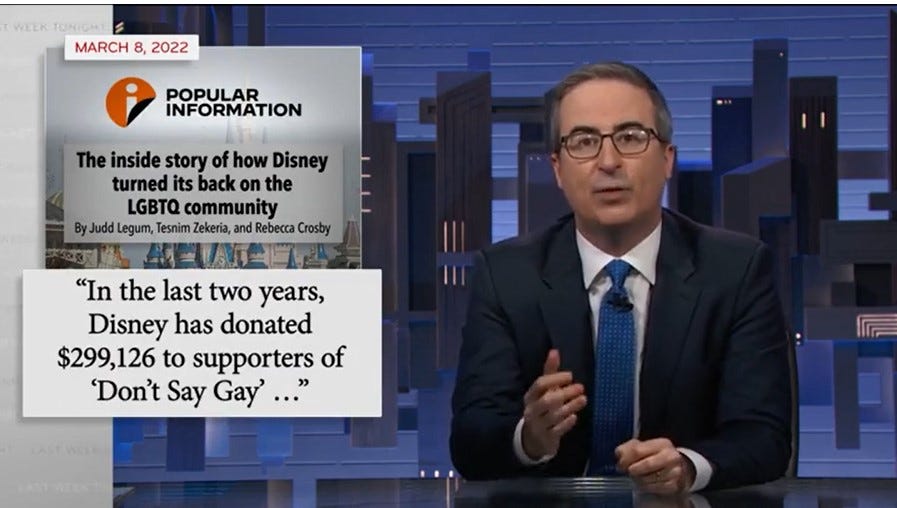

Biden initially proposed extending the expanded child tax credit until 2025. When Senator Joe Manchin (D-WV) and other Democrats objected to the overall size of the bill, Biden proposed extending it one year. The cost of extending the child tax credit varies depending on exactly how it is implemented, but costs around $100 billion per year. There were various proposals to offset the cost of the expanded child tax credit and other provisions in Build Back Better. One proposal that gained traction for a time was a billionaires' tax. That proposal, championed by Senator Ron Wyden (D-OR), would have imposed a 23.8% tax on the unrealized gains of extremely wealthy people. Currently, billionaires are able to accumulate massive wealth without paying taxes by never selling their stocks. They borrow against their assets whenever they need cash. This tax avoidance strategy has a name: buy, borrow, die. The new tax would have only applied to "individuals with at least $1 billion in assets or $100 million annual income in three straight taxable years." Wyden estimated it would have impacted just 700 people. Wyden's proposal would have raised $507 billion over 10 years, more than enough to offset a four-year extension of the expanded child tax credit. $275 billion would have come from the ten richest billionaires. Ultimately, however, the proposal was dropped due to opposition from Manchin and a few other Democrats. "I don’t like the connotation that we’re targeting different people," Manchin said. There were other proposals, including a 5% surtax on income over $10 million and an 8% surtax on income over $25 million. That would have raised about $230 billion over ten years, more than enough to cover the one-year extension of the expanded child tax credit. None of this, however, was enough to win over Manchin, Senator Krysten Sinema (D-AZ), or any of the 50 Senate Republicans. Instead, Manchin, Sinema, and the Senate Republicans decided not to increase taxes on billionaires and have the expanded child tax credit expire on December 31, 2021. That decision has had immediate consequences. 3.7 million children fall into povertyAs a result of the decision to let the expanded child tax credit expire in December, 3.7 million children fell into poverty, according to a study by the Center on Poverty and Social Policy. The child poverty rate increased from "12.1 percent in December 2021 to 17 percent in January 2022" — a 41% increase. The monthly payments, which have now stopped, were spent "on basic household needs and children's essentials: the most common item is food." The payments were effective in meaningfully reducing "family food insufficiency, particularly among children in families with low and moderate incomes." After the July payment alone, "food insufficiency rates among families with children dropped by 24 percent." After two months of payments, "2 million fewer adults report[ed] that their children, specifically, did not have enough to eat." Other top categories for spending the child tax credit payments were bills, clothing, rent, and school expenses. According to a September 2021 survey by the American Enterprise Institute, 62% of families "across all income levels said the Child Tax Credit was 'somewhat important or very important' or meeting day-to-day expenses." Children living in poverty experience "hunger, illness, insecurity, instability" on a daily basis and are also "more likely to experience low academic achievement, obesity, behavioral problems and social and emotional development difficulties" over time. The 15 richest billionaires are now worth $1.5 trillionThe failure to pass a billionaires' tax has allowed the nation's richest people to accumulate even more wealth with little to no taxation. According to a new report from Americans for Tax Fairness, the 15 richest billionaires are now worth more than $1.5 trillion dollars. The wealth of this group has increased 79% ($668 billion) since the start of the pandemic two years ago. Tesla CEO Elon Musk, for example, saw his wealth increase from $24.6 billion to $234 billion in the last two years. If the billionaires' tax had passed, he would have owed about $50 billion, which would reduce his net worth to $184 billion. He would still be the wealthiest person in the world and his contribution would have paid for half of the expansion of the child tax credit for 2022. There are now 704 American billionaires. They are currently worth, collectively, $4.6 trillion. Their total increase in wealth in the last 24 months ($1.7 trillion) would be enough to extend the expanded child tax credit for 16 years. This outcome was not an accident. Rather, many of America's billionaires are current or former executives at companies represented by prominent lobbying groups, including the U.S. Chamber of Commerce and the Business Roundtable. These lobbying groups spent millions to defeat the Build Back Better proposal. Their goal was to stop tax increases on billionaires and corporations. The U.S. Chamber of Commerce specifically argued against extending the expanded child tax credit, saying it was concerned about "large amounts of transfer payments that are not connected to work." Corporate lobbyists won the day. And now 3.7 million children are in poverty. Last Monday, Popular Information revealed that Disney had donated nearly $300,000 to the supporters of Florida's "Don't Say Gay" legislation. Six days later, our reporting was included in an impassioned rant from HBO's John Oliver. Oliver's monologue was part of a flood of coverage — including the Washington Post, the New York Times, LA Times, NPR, Vanity Fair, and many others — on Disney's political giving. It ultimately forced Disney CEO Bob Chapek to reverse course and suspend all contributions to Florida politicians. Popular Information is a three-person newsletter, but our work can rattle the cages of multi-billion dollar companies. You can support our independent accountability journalism — and help us do more of it — with a paid subscription. To stay completely independent, Popular Information accepts no advertising. This newsletter only exists because of the support of readers like you. |

Older messages

Koch Industries continues doing business in Russia

Monday, March 14, 2022

Koch Industries, the conglomerate run by right-wing billionaire Charles Koch, has numerous ongoing business operations in Russia. Since Russia's invasion of Ukraine, Koch Industries has given no

These companies are still doing business in Russia

Thursday, March 10, 2022

Since Russia invaded Ukraine last month, there has been a mass exodus of companies from Russia. The pace of these withdrawals from Russia has intensified as the Russian military adopted increasingly

AT&T breaks pledge, directly donates to Republican objectors

Thursday, March 10, 2022

On January 11, 2021, five days after the attack on the United States Capitol, AT&T announced that it was suspending contributions to all 147 Republicans who tried to overturn the election results:

The inside story of how Disney turned its back on the LGBTQ community

Tuesday, March 8, 2022

Disney is happy to profit off the LGBTQ community. For example, it serves as a host for Gay Days, "an Orlando gathering that generally attracts over 150000 people each June." Disney offers a

The audacity of oil

Monday, March 7, 2022

The American Petroleum Institute (API), the lobbying arm of the oil and gas industry, has intensified its efforts to exploit Russia's invasion of Ukraine to push the United States government to

You Might Also Like

☕ Great chains

Wednesday, January 15, 2025

Prologis looks to improve supply chain operations. January 15, 2025 View Online | Sign Up Retail Brew Presented By Bloomreach It's Wednesday, and we've been walking for miles inside the Javits

Pete Hegseth's confirmation hearing.

Wednesday, January 15, 2025

Hegseth's hearing had some fireworks, but he looks headed toward confirmation. Pete Hegseth's confirmation hearing. Hegseth's hearing had some fireworks, but he looks headed toward

Honourable Roulette

Wednesday, January 15, 2025

The Honourable Parts // The Story Of Russian Roulette Honourable Roulette By Kaamya Sharma • 15 Jan 2025 View in browser View in browser The Honourable Parts Spencer Wright | Scope Of Work | 6th

📬 No. 62 | What I learned about newsletters in 2024

Wednesday, January 15, 2025

“I love that I get the chance to ask questions and keep learning. Here are a few big takeaways.” ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡️ ‘Skeleton Crew’ Answers Its Biggest Mystery

Wednesday, January 15, 2025

Plus: There's no good way to adapt any more Neil Gaiman stories. Inverse Daily The twist in this Star Wars show was, that there was no twist. Lucasfilm TV Shows 'Skeleton Crew' Finally

I Tried All The New Eye-Shadow Sticks

Wednesday, January 15, 2025

And a couple classics. The Strategist Beauty Brief January 15, 2025 Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate commission

How To Stop Worrying And Learn To Love Lynn's National IQ Estimates

Wednesday, January 15, 2025

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

☕ Olympic recycling

Wednesday, January 15, 2025

Reusing wi-fi equipment from the Paris games. January 15, 2025 View Online | Sign Up Tech Brew It's Wednesday. After the medals are awarded and the athletes go home, what happens to all the stuff

Ozempic has entered the chat

Wednesday, January 15, 2025

Plus: Hegseth's hearing, a huge religious rite, and confidence. January 15, 2025 View in browser Jolie Myers is the managing editor of the Vox Media Podcast Network. Her work often focuses on

How a major bank cheated its customers out of $2 billion, according to a new federal lawsuit

Wednesday, January 15, 2025

An explosive new lawsuit filed by the Consumer Financial Protection Bureau (CFPB) alleges that Capital One bank cheated its customers out of $2 billion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏