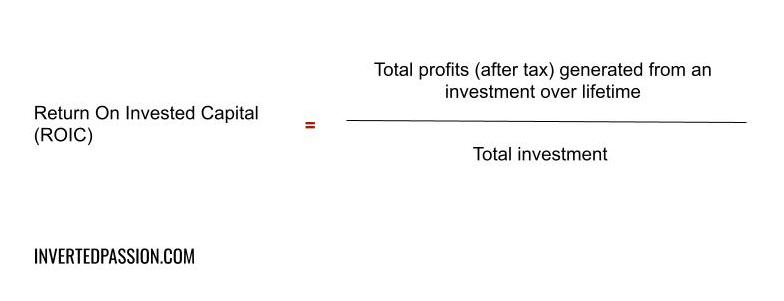

[Inverted Passion] Business quality is determined by one metric: return on invested capital

|

Older messages

[Inverted Passion] Your business is worth all future profits it is expected to generate

Monday, March 21, 2022

Here's a new post on InvertedPassion.com Your business is worth all future profits it is expected to generate By Paras Chopra on Mar 20, 2022 02:40 am It's easy to get bewildered by the billion

[Inverted Passion] Recruit exceptional people by showing them a promised land

Monday, March 14, 2022

Here's a new post on InvertedPassion.com Recruit exceptional people by showing them a promised land By Paras Chopra on Mar 13, 2022 07:12 am A recruitment strategy should be indistinguishable from

[Inverted Passion] Moats for deeptech startups

Friday, March 11, 2022

Here's a new post on InvertedPassion.com Moats for deeptech startups By Paras Chopra on Mar 10, 2022 04:40 am I've written earlier that startups shouldn't solve technically challenging

[Inverted Passion] Raise funding by showing how you can raise even more funding

Monday, March 7, 2022

Here's a new post on InvertedPassion.com Raise funding by showing how you can raise even more funding By Paras Chopra on Mar 06, 2022 01:43 am Fundraising is an exercise in demonstrating how your

[Inverted Passion] Startups shouldn’t solve technically hard problems

Thursday, March 3, 2022

Here's a new post on InvertedPassion.com Startups shouldn't solve technically hard problems By Paras Chopra on Mar 02, 2022 06:25 am 1/ Startups get funded when they're expected to be

You Might Also Like

How to build a $10M ARR B2B AI Startup

Tuesday, March 4, 2025

How I'd get to $10m ARR ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[CEI] Chrome Extension Ideas #180

Tuesday, March 4, 2025

ideas for Figma, GitHub, Job Applicants, and stud ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

500k subs & 7 figs in revenue

Tuesday, March 4, 2025

This founder was still in college when he sold the business ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

1,000,000

Tuesday, March 4, 2025

Taking a moment to celebrate and reflect—and then back to work ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

BSSA #116 - Outsourcing to scale 🚀

Tuesday, March 4, 2025

March 04, 2025 | Read Online Hello everyone! The Wide Event is almost sold out. More than 90% of the tickets have been booked. If you're one of the people waiting until the last minute to purchase,

🔥 The secret factories big brands don’t want you to know 👗👖

Tuesday, March 4, 2025

The best fashion suppliers don't advertise—here's how to find them. Hey Friend , If you've ever struggled to find high-quality fashion manufacturers, there's a reason: The best

Making Wayves

Tuesday, March 4, 2025

+ Girls just wanna have funding; e-bike turf war View in browser Powered by ViennaUP Author-Martin by Martin Coulter Good morning there, Since 2021, VC firm Future Planet Capital (FPC) has secured more

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

/>

/>