Inflation Is Here And Putin Didn't Create It

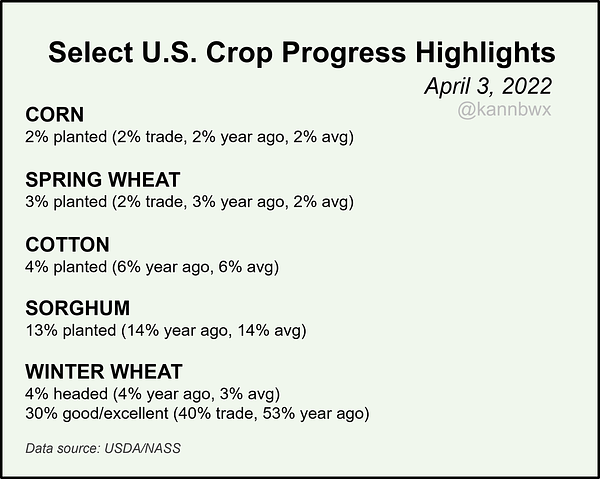

If you are not a subscriber of The Pomp Letter, join 215,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, Inflation was reported at 8.5% this morning, which is the highest inflation reading in 40 years. Core inflation was also high at 6.5%. These are obviously astronomical numbers and highlight a dire financial situation for hundreds of millions of Americans. Here are the drivers of these alarming numbers:  Given that the Russia-Ukraine conflict has had a material impact on oil and natural gas prices, it is not shocking to see gasoline prices up nearly 50% in the last year. The price of gasoline had already been elevated so the conflict only exacerbated the situation. The most shocking number to me is the food at home. This 10% increase means that the average American family is paying materially more just to eat, which is obviously unsustainable for long periods of time. The current number is bad and the concern is that the increased prices in fertilizer, lack of high quality wheat exports from Russia/Ukraine region, and supply chain disruptions are only going to drive food prices even higher in the coming months.   We can analyze the official inflation numbers until our eyes bleed, but there is no way that the majority of Americans are living with 8.5% inflation. Most of the population is likely experiencing double-digit inflation. For example, a new decentralized inflation dashboard (Truflation) measures the current situation at 13.5%. Is this a perfect measurement? No, it is nearly impossible to be perfect when measuring something as complex as inflation, especially when it is accelerating so rapidly. But 13.5% is likely closer to reality than 8.5% based on what the average citizen is experiencing on a day-to-day basis. This brings me to another point — the talking points around this inflation signal that politicians think the American public is stupid. The White House is now claiming that inflation is the result of a “Putin price hike” and they are refusing to claim responsibility, either directly or indirectly, for the current economic crisis. The use of Vladimir Putin as a scapegoat is as lame as it sounds. It is absurd to argue that the highest inflation in the last 40 years was caused by actions that are less than 6 weeks old. The administration knows this, the public knows this, and the media knows this. But everyone keeps playing this game of charades hoping that no one will call anyone else on it. This is ultimately the problem with politicians in the current environment. They aren’t incentivized to solve the problem, but rather they spend their time trying to figure out the right messaging. If wealthy people and politicians were suffering from high inflation, this nonsense would be over tomorrow. A concerning aspect of the current economic environment is that the Federal Reserve, our elected officials, and business leaders globally have no ammunition left to curb inflation without forcing the United States and other global economies into recession. Every tool that can be used to address the high inflation will only accelerate slowdowns in the economy. That is normally a good option when these inflation-fighting tools are used early on in an inflationary situation, but the tools are too little and too late now. So the only thing that the average American can do now is survive. Ask their boss for a raise. Try to move their assets into inflation hedge allocations. Prepare to weather the storm ahead, including potential stock market crashes, devaluation of the dollar, and crypto volatility. No one has a crystal ball. No one can predict the future. But we do know that our leadership is in an impossible situation — they are faced with a lose-lose decision. Double-digit real inflation was previously reserved for third world countries and dictatorships who lost monetary discipline, but now it has invaded the United States. We are at war with an invisible enemy and we have no line of sight to material solutions. While politicians and central bankers kept telling us not to worry about inflation, that it was transitory, or that it was even good for us, bitcoiners were yelling from the rooftop about what was likely to occur. The Jack Dorsey hyperinflation tweet was mocked endlessly. Time will tell if we ever meet the true definition of hyperinflation, but it is obvious that “high and accelerating” inflation is here to stay for the short term. I highly suggest you read Ray Dalio’s new book Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail. The more things change, the more they stay the same. Have a great day and I’ll talk to everyone tomorrow. -Pomp If you are not a subscriber of The Pomp Letter, join 215,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. THE RUNDOWN:New York Senate Authorizes NYDFS to 'Assess' Crypto Companies: The New York State Senate is boosting the state’s Department of Financial Services (NYDFS) efforts to oversee the cryptocurrency sector. The Senate passed its fiscal year 2023 budget early Saturday, which included a provision tasking NYDFS with developing a new “assessment” or charge for the cryptocurrency companies it oversees to bring its oversight mandate in virtual currencies in line with how the regulator oversees more traditional banks and financial services firms. Read more. New York Senate Authorizes NYDFS to 'Assess' Crypto Companies: The New York State Senate is boosting the state’s Department of Financial Services (NYDFS) efforts to oversee the cryptocurrency sector. The Senate passed its fiscal year 2023 budget early Saturday, which included a provision tasking NYDFS with developing a new “assessment” or charge for the cryptocurrency companies it oversees to bring its oversight mandate in virtual currencies in line with how the regulator oversees more traditional banks and financial services firms. The assessments are meant to “defray operating expenses,” according to the text of the budget reviewed by CoinDesk, and are only meant to cover expenses tied directly to the oversight of crypto companies. Read more. GOP Policy Arm Releases Paper Exploring Benefits, Risks of Crypto: The policy arm of U.S. Senate Republicans has issued a policy paper on crypto, signaling the GOP is making its way toward a more unified approach to crypto regulation. The Senate Republican Policy Committee (RPC), chaired by U.S. Sen. Roy Blunt (R-MO), works to form legislative policy goals for the party, as well as provide research and analysis on a variety of subjects. Read more. Russians’ EU Crypto Investments Capped at 10K Euros: Russian payments to EU crypto wallets will be capped at €10,000 ($10,900) under sanctions measures published in the European Union's official journal Friday. The limit is intended to stop wealthy Russians from circumventing a cap on investing in the EU introduced in the wake of the Ukraine invasion. Read more. Peter McCormack is the host of the "What Bitcoin Did" podcast and is the new owner of the Real Bedford Football Club. In this conversation, we discuss the Bitcoin Conference, Peter's thoughts on toxic Bitcoin maximalism, concerns with El Salvador, and the progress on Real Bedford F.C. since acquiring the team. Listen on iTunes: Click here Listen on Spotify: Click here Bitcoin Has Been Highly Correlated To Nasdaq 100: Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

Strike Is Bringing Freedom To Retail Merchants

Friday, April 8, 2022

Listen now (4 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, Jack

Takeaways From My Conversation With Chris Larsen, Co-Founder of Ripple

Thursday, March 31, 2022

Listen now (6 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, There was a

There Is Not Enough Bitcoin Available In The Market

Tuesday, March 29, 2022

Listen now (3 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, It is

Free Markets vs Market Interventionists

Monday, March 28, 2022

Listen now (5 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, There are

The $10 Billion Bitcoin Bet On Stablecoins

Monday, March 21, 2022

Listen now (8 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, Algorithmic

You Might Also Like

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.

Athletes Are Making Their Own Chip Deals 🥔💰

Monday, March 10, 2025

Athletes turning snacks into serious cash 🚀🥔

🔔Opening Bell Daily: Investor jitters grow

Monday, March 10, 2025

Traders keep selling stocks and US indexes are lagging the rest of the world.

A shellacking

Monday, March 10, 2025

Gaming share prices crater on US consumer fears ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏