Fidelity Brings Bitcoin To Retirement Accounts

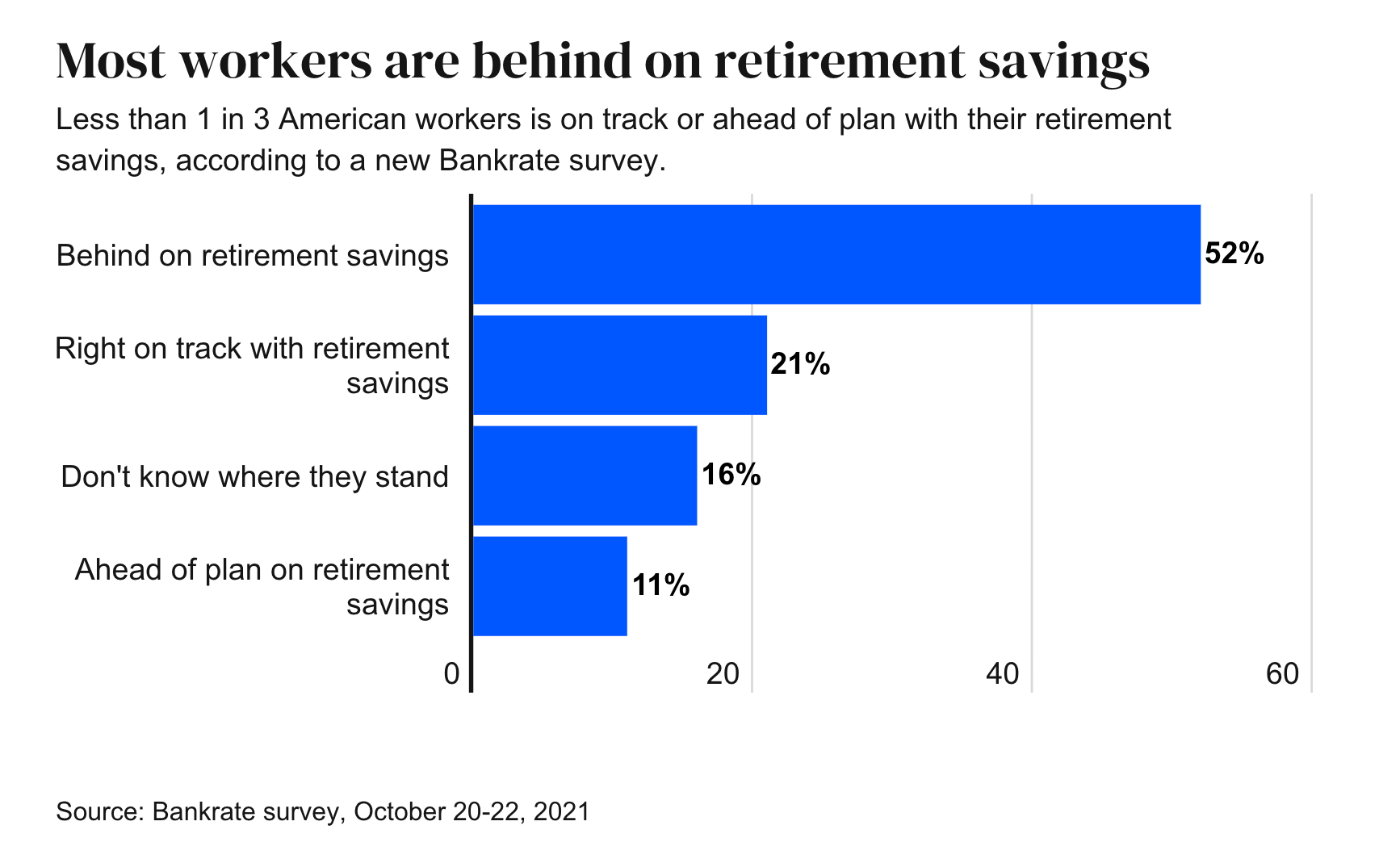

To investors, The retirement situation in America is dismal. According to a recent Bankrate survey, more than 50% of US workers say that they are behind on their retirement savings. At least 1 in every 3 people report that they don’t even have a retirement account. To make the situation worse, 51% of Americans say that they have previously taken an early withdrawal from their retirement savings and the economic chaos caused by COVID-19 hasn’t helped either. One strategy to help lessen the blow of financial duress later in life led to the creation of pension plans. The idea was that employees and employers would put money in, the investment teams would grow the money over time, and the employees would get paid out a portion of the proceeds in retirement. This is a great idea on the surface, but the main problem is that most pension plans have been drastically underperforming their target investment returns, which means that they won’t have enough money to pay retirees when the bill comes due. According to Richard M. Ennis, a prominent institutional investment consultant who was previously CEO of the respected consulting firm EnnisKnupp and edited the prestigious Financial Analysts Journal, said in an interview with Marketwatch:

If the public pension funds have a tough time underperforming standard benchmarks, while simultaneously missing their actuary rate of returns, there is a risk that the 25+ million Americans counting on their pension fund for retirement will get an unwelcome surprise. So what exactly is the solution to the retirement problem in America? I wrote a letter to each of you in December of 2018 titled “Every pension fund should buy bitcoin.” In the letter, I argued the following:

I then went on to discuss a potential solution being the purchase of bitcoin:

Obviously bitcoin’s price has not yet reached $100,000, but the rise to $40,000 means that a 1% allocation would have increased a pension fund’s assets by 10% so far. This would close the underfunding gap for a large portion of pensions in the United States. While we wait on more pensions to purchase bitcoin, there is a light at the end of the tunnel for individuals. Fidelity announced this morning that they will be the first major retirement plan to allow investors to put bitcoin in their 401k plans. According to the Wall Street Journal coverage, “Employees won’t be able to start adding cryptocurrencies to their nest eggs right away, but later this year, the 23,000 companies that use Fidelity to administer their retirement plans will have the option to put bitcoin on the menu. The endorsement of the nation’s largest retirement-plan provider suggests crypto investing is moving further into the mainstream, but it remains to be seen whether employers will embrace it for their workers.” A quote in the article stuck out to me as well. It came from Dave Gray, head of workplace retirement offerings and platforms at Fidelity, saying:

Whether you think bitcoin is a great investment or not, it is interesting to see that Fidelity wants to increase the optionality for clients. They realize that there is a significant problem around retirement preparation and bitcoin could provide a solution. My guess is that we will see every retirement platform follow suit and start offering bitcoin to their clients. The older clients may refrain, but this will likely be adopted in mass by the younger generations. For better or worse, this younger generation doesn’t want to hold gold, bonds, or cash. They treat bitcoin like a reserve asset and ultimately see a big reason (inflation) to be invested fully in the market. There are few better ways to gain investment exposure than through a tax-advantaged account. Now Fidelity may be the first large retirement plan to offer this solution, but they aren’t the first. There are options like Choice by Kingdom Trust, BitcoinIRA, and many others who pioneered this idea. This combination of incumbents and startups bringing this opportunity to market signals that the trend is only beginning. Bitcoin is not the solution to everything and it may not be the complete solution to the retirement crisis in America, but it can definitely have a positive impact. It is encouraging to see Fidelity creating solutions to help investors pursue this path if they desire. Hope each of you has a great start to your day. I’ll talk to everyone tomorrow. -Pomp SPONSORED: Do you want to use crypto to place bets? Then look no further than BetOnline.ag!

THE RUNDOWN:NFL Draft Goes NFT: Football League Releases New Collection on Polygon: The National Football League is once again dabbling with non-fungible tokens (NFT), launching a series of card-themed collectibles tied to its upcoming player draft on Thursday. The collection is live on the league’s Polygon-based marketplace, which it unveiled in November 2021 and has since been used for various playoff game ticketing promotions. The NFTs will also be given out to members of this year’s “Inner Circle” club, which includes fans selected to represent each team on draft night. Read more. New York Lawmakers Advance Mining Moratorium Bill to Full Assembly: New York lawmakers have advanced a controversial bill that aims to put a two-year moratorium on select proof-of-work crypto mining operations in the Empire State. Members of the New York Assembly’s Ways and Means Committee considered the bill at a meeting on Monday afternoon, ultimately voting to send the bill to the floor for a vote by the full Assembly. Read more. Twitter Accepts Elon Musk’s Buyout Deal: Twitter’s board has accepted an offer from billionaire Elon Musk to buy the social media company and take it private, the company announced Monday. The stock closed up 5.64% for the day after it was halted for the news. “Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated,” Musk said in a statement included in the press release announcing the $44 billion deal. Read more. Moonbirds COO Leaves Project for New Fund – With $1M in NFTs in Tow: Ryan Carson, the chief operating officer of the popular non-fungible token collection Moonbirds, announced on Twitter on Monday that he has left the project to start his own NFT venture fund. The news garnered an immediate and negative reaction from the broader NFT community, with many voicing frustrations that Carson purchased hundreds of thousands of dollars worth of Moonbirds before his exit, possibly using insider knowledge to poach undervalued editions. Read more. Chris Power is the Co-Founder & CEO of Hadrian, a brand new 21st Century software enabled, manufacturing facility focused on the aerospace industry. In this conversation. we discuss building this new manufacturing model, space travel, going to Mars, Elon Musk, advancements in the aerospace industry, and the current macro economic climate. Listen on iTunes: Click here Listen on Spotify: Click here My Thoughts On Elon Musk Purchasing Twitter: Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

Elon Musk Is The Greatest Entrepreneur Of All Time 🐐

Thursday, April 21, 2022

Listen now (4 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, Electric

Is The Federal Reserve Preparing To Increase Their Inflation Target?

Tuesday, April 19, 2022

Listen now (5 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, There has

Free Speech Is For Sale

Monday, April 18, 2022

Listen now (7 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, People

Inflation Is Here And Putin Didn't Create It

Tuesday, April 12, 2022

Listen now (5 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, Inflation

Strike Is Bringing Freedom To Retail Merchants

Friday, April 8, 2022

Listen now (4 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, Jack

You Might Also Like

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.

Athletes Are Making Their Own Chip Deals 🥔💰

Monday, March 10, 2025

Athletes turning snacks into serious cash 🚀🥔

🔔Opening Bell Daily: Investor jitters grow

Monday, March 10, 2025

Traders keep selling stocks and US indexes are lagging the rest of the world.

A shellacking

Monday, March 10, 2025

Gaming share prices crater on US consumer fears ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏