May 2: MGM makes online move with LeoVegas offer

May 2: MGM makes online move with LeoVegas offerMGM resorts offers $607m for LeoVegas, betting and gaming's earnings week, Gaming and Leisure Partners Q1, MGM Resorts analyst upgrade, startup focus - OneComply +MoreGood morning. On today’s agenda:

Wimoweh. Click below to subscribe: BREAKING: MGM makes $607m offer for LeoVegas

The game’s afoot: Hints that something was afoot came on Sunday evening when LeoVegas brought forward its Q122 results statement by three days. MGM says the deal offers “strategic opportunities” in online casino and sports-betting with a “strong” ex-US customer base.

Going global: On the call, Gustav Hagman and chairman Per Norman went through some of the thinking behind accepting the MGM offer. “MGM is also very clear in its belief that it will create a unique opportunity for LeoVegas to create a global offer,” said Norman.

What MGM is getting into: Hagman had some interesting commentary around the issues LeoVgeas has faced, successively, in the UK, Germany and the Netherlands.

Analyst reaction: Regulus said LeoVegas has “a lot more to recommend it to MGM than a similar leonine logo”. “In an online gaming environment too often driven by bonuses, VIPs, and churn, LeoVegas has built a strong brand and effective growth business by focusing on product and customer service.”

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. Its industry-leading Superfeed is used by the biggest betting brands in the world including bet365, Flutter and Entain. The content engine powers on-site engagement by delivering impartial expert betting insight for 20 sports in 70 languages. For more information visit: spotlightsportsgroup.com Betting and gaming’s big earnings weekThe first-quarter earnings season moves into top gear this week with MGM Resorts kicking things off later today, a call which has become just that bit more interesting.

Things to look out forMacro backdrop: Commentary so far on the impact of economic uncertainty on the gaming sector suggests it has yet to lay a glove on the prospects for the year ahead.

Sports-betting profitability: This is the first earnings season which will give a sighting of how the market is progressing for the major players in New York. Whether this leads to any revenue upgrades is uncertain; Morgan Stanley actually cut its DraftKings Q1 forecast a fortnight back.

Flutter’s trans-Atlantic balancing act: Best of times/worst of times analogies are appropriate for Flutter which will be facing questions over the future of FanDuel in the US while facing up to the imminent publication of what will be potentially revenue-harmful UK government white paper.

Share slump: The elephant in the room for FanDuel’s rival DraftKings is the share price performance, down over 50% this year and over 75% down on the year-on-year chart.

Newsletter schedule: Tuesday, Wednesday, Thursday morning pod, Thursday afternoon Penn and Bally earnings extra, Friday Weekend Edition and Friday afternoon DraftKings earnings extra.

Gaming & Leisure Properties Q1

Bullet-proof: Gaming veteran Peter Carlino, previously CEO at Penn National Gaming and now in charge of the gaming REIT GLP, was keen to emphasize the “bullet-proof” nature of the gaming sector.

Hope and glory: So confident is the company about its near-term prospects that Carlino told analysts GLP would be increasing its dividend. Another goal is to “see what monies we can put to work with our strong tenant grouping”.

Growth: Carlino noted on the call that when GLP was spun out of Penn National in 2011 it had 24 properties but now it has 55. “That number will surely grow over the next year,” said Carlino. Further REIT news: VICI on Friday completed its $17.2bn acquisition of MGM Growth Properties and at the same time closed a $5bn senior unsecured notes offering. MGM Resorts analyst upgradeI'm gonna keep on the run: The team at Jefferies took the unusual step of upgrading their estimate for MGM a matter of days ahead of the results (due later today), suggesting that the accelerating trends in Las Vegas meant they were out of step with consensus.

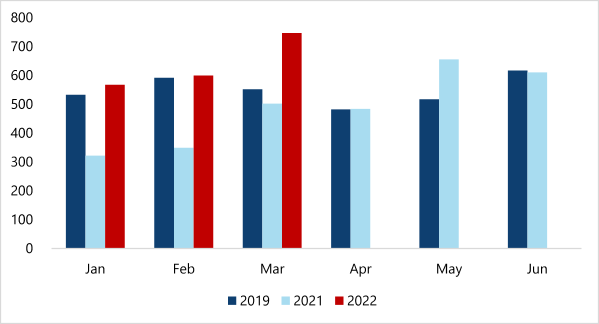

I'm gonna have me some fun: Strip revenue in March of $746.2m was up 35% YoY and 25% MoM, helping Q1 Strip revenue to over $1.9bn, or down just 9% on Q421 despite the Omicron-hit January.

Las Vegas Strip GGR trends ($m) MGM call guide: Jefferies say they will be looking to get further comment on capital allocation (post-MGP divestiture), greenfield opportunities in New York, and digital developments following Ontario and the “overall path to profitability critical”. LeoVegas and online questions will obviously be the fore. Churchill Downs Q1 callPPE: Asked about share buybacks in light of its agreement to acquire the casino and racetrack operator Peninsula Pacific Entertainment for $2.48bn, CEO Bill Carstanjen said:

50/50: CFO Bill Mudd said online wagering on horse racing had settled at “close to 50%” of the group’s players from “early-to-mid third quarter” 2021, having gone from 40% to 60% from the outset of the pandemic in 2020.

Further reading: Improvements M&A and forecast-busting earnings. Earnings in brief

Startup focus - OneComplyWho, what, where and when: Co-founded by CEO Cameron Conn, a third-generation gaming industry executive in September 2019, the automated compliance business has offices in Vancouver and Las Vegas. Funding backgrounder: The business has recently completed its Seed financing round, led by Warner Investments with participation from gaming industry experts including Katie Lever, Benjie Cherniak and Quinton Singleton. So what’s new? OneComply is enhancing its functionality for licensing management, to provide oversight and automation for a company’s occupational licensing and certifications, plus any technical/product licensing required to operate their business. The longer pitch: “The expansion of gaming and sports betting has created a highly interrelated industry, where your license can be impacted by your partner’s or vendor’s non-compliance,” says Conn. “Whether it’s key persons, licensed employees, the entity itself or the critical systems and platforms a company utilizes, they all have an ongoing compliance component that needs to be effectively managed and monitored.”

Regulatory roundup

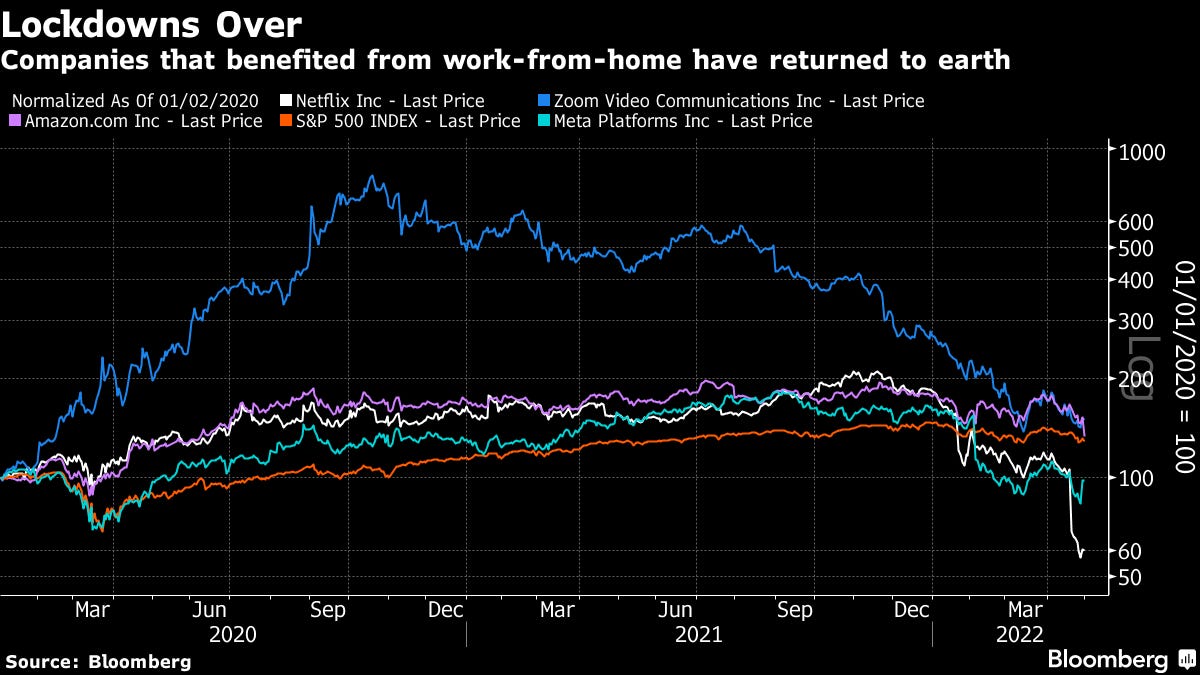

DatalinesMacau: GGR of ~$335m was 68.1% down YoY and a 27.1% sequential decline. The total also represents an 88.7% decline on Apr19. NewslinesCheerio: Marco Blume, the long-standing trading director at Pinnacle, is set to leave the company, he has confirmed to WE+M. It is not known where he is heading next. Can’t pay, won’t pay: The Seminole Tribe has stopped its quarterly payments to Florida as part of its revenue-sharing agreement with the state, citing the unresolved situation regarding its 2021 gaming agreement. US Integrity Partners has announced a comprehensive partnership with Penn National Gaming. What we’re readingMake it mean more: The NY Times on how sports seems secondary. “The solution to… sports’ failure to satisfy our diminished attention spans or the modern expectation that we somehow be involved in everything we watch — lies in the gamification of ‘every drop, jab, hook, hit, steal, save, knuckle, meat,’ as the narrator proposes.” Wheels within wheels: The NFL has swapped its 32% interest in luxury hospitality company On Location for a 1.5% stake in Endeavor. In Sports Business Journal. Chart of the weekJohn Authers: “The extreme punishments meted out to Meta Platforms Inc. and Netflix Inc., both trading below their pre-pandemic prices, have also shown that the market had somehow assumed that lockdown-like conditions would continue indefinitely.” On socialThe last word on earnings  Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Apr 29: Weekend Edition #44

Friday, April 29, 2022

Pointsbet Q3, Las Vegas Sands analyst reaction Churchill Downs analyst call, GAN debt raise, sector watch - streaming +More

Earnings +More podcast #6

Thursday, April 28, 2022

Watch now (26 min) | Kambi, Boyd Gaming, DAZN and the streaming marketplace

Apr 28: Evolution: ‘We should take a bigger cut’

Thursday, April 28, 2022

Evolution Q1, Kindred Q1, Betsson Q1, Las Vegas Sands Q1, Churchill Downs Q1, Rivalry Q4, March US sports-betting estimates +More

Apr 27: Kambi: clients up, profit down

Wednesday, April 27, 2022

Kambi Q1, Boyd Q1, Morgan Stanley SB Q1 preview, Ontario app update, BlueBet US launch +More

Apr 25: Fuel prices cloud gaming outlook

Monday, April 25, 2022

Sub-head: IGT UK lottery lawsuit, the week ahead, the week in shares, startup investor focus - Benjie Cherniak +More

You Might Also Like

🔥 20 Spots: Private Chat with Flippa's CEO (This Might Not Happen Again)

Monday, January 6, 2025

Just locked in an intimate session with Flippa's CEO (20 spots only)... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Crystal ball 🔮

Sunday, January 5, 2025

Marketers' 2025 predictions View in browser hey-Jul-17-2024-03-58-50-7396-PM I went to a psychic when I was 22. She told me I was "about to take a long journey across the Atlantic." While

🦄 WTF is a pattern interrupt

Sunday, January 5, 2025

A stop you in your tracks style of attention grabbing and why you need to implement it. 👀

🦅 Masterclass with Jesse Pujji

Sunday, January 5, 2025

Add the event to your calendar ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 He built a $20 million company through social posts

Sunday, January 5, 2025

Discover Jesse Pujji's growth system ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🎙️ New Episode of The Dime How Do We Get to a $100 Billion Market? Growth Predictions, Market Consolidations ft Ben Burstein

Sunday, January 5, 2025

Listen here 🎙️ How Do We Get to a $100 Billion Market? Growth Predictions, Market Consolidations ft Ben Burstein Why does it feel like the hemp industry is exploding while regulated cannabis remains

Why 2025 Should Be Better Than 2024

Sunday, January 5, 2025

And the top SaaStr news of the week To view this email as a web page, click here This edition of the SaaStr Weekly is sponsored by Stripe 2025 Should Be Better Than 2024 For Almost All Leading Public

Marketing Weekly #213

Sunday, January 5, 2025

I Tried All Social Media Platforms for My SaaS, Here's What Actually Works • If Your Emails Aren't Printing Money, You're Doing This Wrong. • How to Build a RELEVANT Audience • How I Found

Sunday Thinking ― 1.5.25

Sunday, January 5, 2025

"You don't have to be perfect to help people. All you do is have to be real."

TA #178: ✅ ❌ What's In, What's Out in 2025

Sunday, January 5, 2025

[Ann's version] Click here to read this on the web. Ann Handley's biweekly/fortnightly newsletter, "Total Annarchy" What's in, what's out: Ann's list Welcome to Issue 178