The Diff - Buy Now, Pain Later?

You're on the free list for The Diff. Last week was Autos Week. You missed: a look at car companies as banks for their supply chain, the changing economics of car loans, and how EVs, safety features, and more elaborate user interfaces will turn car purchases from a discrete to continuous process. Coming soon: reversing a centuries-old trait of financial systems, a look at another hypergrowth company, a trophy asset with real cash flow, and applying capital allocation wisdom to time. To read these, and to access the back catalogue, subscribe now! Buy Now, Pain Later?Plus! TikTok; Factors; Replacing Passwords, and a Big Tech Truce; Solve for the Disequilibrium

Welcome to the free edition of The Diff. This newsletter goes out to 30,705 readers, up 747 since the last free edition. In this issue:

Buy Now, Pain Later?Two of investors' biggest concerns right now are 1) whether high-growth companies are worth the premium in a world where rates are higher and the present value of future cash flows is correspondingly lower, and 2) the prospect of a normal-looking recession, where fiscal policy is constrained and borrowers have enough time to start defaulting on debts. The buy-now-pay-later space combines both of these risks. Affirm went public at 40x sales, and, for all its innovations, it is in part a subprime unsecured consumer lender, exactly the category that can be brutalized in its first recession. Affirm has returned -57% in the last year, and is down 85% from its peak in November. (In addition to the perfect storm macro problem, they also got 20% of their last fiscal year's revenue from Peloton.) Australia-based BNPL Zip is down 91% from its peak in February 2021. Sezzle is doing even worse, despite benefiting from an acquisition offer by Zip. It's a good time to revisit the business model and get a deeper understanding of what these companies do, why their model exists in the first place, and what drives their results. BNPL Economics—For Borrowers and MerchantsPayments, credit, and marketing are all on a continuum: anything involved in transferring money from one party to another is payments, anything that involves giving someone a benefit upfront in exchange for a cost they may or may not pay later on is credit, and anything that affects someone's odds of spending money (or the amount they spend) is marketing. Credit cards and BNPL nicely straddle this ambiguity. In both cases, the merchant is getting paid faster while a creditor advances money to the customer, and in both cases the presence of this payment option is designed to spur more spending, whether it's through convenience or customer kickbacks. It's worthwhile to break BNPL down a bit to see where this appeal lies:

When a company works with subprime customers, there are two opposite tendencies you want to avoid. The first is to suspect that they're ruthlessly exploiting desperate people who have no other option but to borrow at high rates. The second reaction is contempt for those same customers, who are fixating on a) getting their stuff right now, and b) on monthly payments over APRs. There's a grain of truth to both, but one thing to keep in mind is that there are many people who are financially stressed not just because they don't have much money, but because they struggle to understand how bad some kinds of debt can be. Adult numeracy is probably worse than you think: "Over two in three (70 percent) U.S. adults have sufficient numeracy skills to make calculations with whole numbers and percentages, estimate numbers or quantity, and interpret simple statistics in text or tables." But understanding monthly payments is simpler; they pay rent or car loans, so it's a mandatory concept. Part of Affirm's value is just translating an approximation problem ("How long do I have to save?") into a simpler binary one ("If I pay $x each month, will my checking account be going up or down?"). For merchants, the name of the game is improving a) conversion rates, and b) average order value. All else being equal, adding a payment option that has appeal to a subset of users, and that may be their only payment option, will tend to increase purchase volume. In a Tegus interview, a former Affirm employee says that the impact varies a lot, from 2% to 50%, but probably averages 5-10%. That 5-10% can make a big difference depending on the kind of business involved. A good case study comes from Covid (this quote is from their most recent earnings call):

So it's not just cash management for financially-strapped consumers, but cash-management for high fixed-cost, high-margin businesses, too. They want to keep inventory moving, and when exogenous forces slow that down, they'll pay up to make it happen again. How much they pay varies—split pay is up to 8%, short-term 0% is 4-8%, long-term is 8-15%, and for classic installment loans it's 2-5%. But they do pay, and Affirm can adjust its own economics in response to which buyers are more or less sensitive. This is a business with some advantages for large incumbents, and they're worth going into. One side is simply brand recognition: it's easier to get a merchant or buyer onboard if they've heard of the product. On the merchant side, though, there's also the benefit that merchant-level transaction data is a stronger signal than category-level data. Similarly, a user with a dubious or nonexistent credit profile, but who regularly makes their Affirm payments, is a better credit who can be offered more loans. On the borrower side, where things start to get really interesting is when people are putting a lot of their spending on Affirm: one problem with a split-pay product is that it's breaking a single transaction into four, and that means paying higher relative interchange fees, not to mention higher general back-office costs (four times as many payments is four times as many opportunities for someone to make a mistake somewhere). But once they have multiple payments going at once, it might make sense to batch some of them together. Affirm also offers a savings account, and that's another opportunity to move a transaction from something involving Visa/Mastercard rails to a cheaper database update. And one important feature to remember is that the underwriting is not for a line of credit, but for a specific purchase. So Affirm can adjust its approval based on exactly what customers are buying, and what this signals about them. Perhaps a three-month loan for swimwear today is likely to work well, because the buyer will be wearing the clothes for the next three months and will be happy to pay off the purchase. Maybe suddenly purchasing a suit and tie makes someone a bad credit, because it implies that they're going on job interviews after getting laid off. All these complexities are unavailable to a credit card company that's underwriting a general line of credit (though spender behavior once they have it may affect whether that line shrinks or grows). So the underwriting model is another thing that improves at scale. That's important, because, as Affirm notes, "Underwriting models decay over time as macroeconomic conditions and consumer behaviors change. Even the very best performing ones can lose a few percentage points of their area under the curve every few months. Over the years, we've built special-purpose models that track model decay." Not just credit models, but models predicting the behavior of credit models! That takes a big sample size. For merchants, better payment options start out as nice-to-have and then become business-critical: once they represent enough of revenue, it's hard to cover fixed costs without them. That can be true in different ways for different companies: for a small business that can't access bank loans, it means that Affirm-derived revenue may be how they're paying their fixed costs. For a startup, it can mean that Affirm loans are the only way they hit their growth metrics. (This means that a company that grows on Affirm's platform is better than a company that joins when it's already big, because if it's already big then it will negotiate a tougher deal, and at scale it's probably talking to—or already working with—Synchrony Financial, a company with a eighty more years of experience in this kind of thing. Synchrony is an interesting company in its own right; stay tuned for a future writeup.) Part of what can make Affirm's model work is that there's mutual lock-in. On the consumer side, once they're using a buy-now-pay-later provider, they're probably likely to choose it again over equivalent options. And Affirm's average transactions per user number has moved up over time, from 2.2 each year at the end of 2020 to 2.5 per year at the end of last year. And, of course, being a borrower is a kind of lock-in, where keeping up with the loan keeps them in the ecosystem. On the other side, merchant lock-in starts when they get used to the sales lift from offering buyers more payment options, and with Affirm's acquisition of Returnly, it gets harder to leave without seriously degrading the buyer experience. BNPL Economics—What Drives ProfitsBNPL economics look a lot like a typical platform company waterfall. There's some value transacted, the platform takes a cut, there are some incremental costs associated with all of this (both the cut and incremental costs can fluctuate, but all else equal they grow with the gross value transacted), and operating expenses drive this activity. The way Affirm presents its information leads investors to focus on GMV as the gross indicator, but that's not the ideal way to look at things: GMV captures total volume of transactions, which is a good way to think of Affirm as a payments provider. But if you're modeling it as a lender, you want to think in terms of the total loan value outstanding at any one time. A $50 pay-in-four transaction is paid down over the course of two months, so its average dollar-weighted duration is more like one month. Which means the same $50 of lending capacity gets used twelve times a year, approximately, earning up to 8% in transaction revenue each time. At, say, a 6% average merchant fee, that $50 is theoretically producing $36/year in upfront fees on $600/year in GMV. A $600 two-year loan paying 20% will make Affirm $120/year interest, plus the merchant cut, but it's tying up $600 in lending capacity instead of $50. So the way to analyze a BNPL company is to look at their portfolio rather than GMV, and consider:

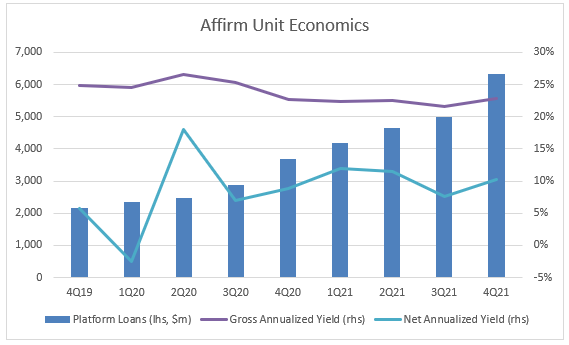

BNPL at scale is solving an optimization problem around these three criteria. But really, you can blend the first two together: if you're confident that you can make a series of positive expected-value bets, whether it's because a customer wants to borrow (and is good for the bill) or because the merchant really wants them to borrow (and, again, they're good for the bill), it doesn't matter in the long run if that income is expressed as a fee or as interest. Where this gets really interesting is when you look at where those loans go. Early Affirm had to lend off its own balance sheet: it was raising venture money and deploying it into lending people enough money to, say, a pair of pants. (Affirm's early reliance on fashion was one of the more eyebrow-raising parts of the business, and fashion is still 21% of GMV. This piece from a few years back talks to people in the industry about how they thought about the model.) Today, though, Affirm has a wild profusion of on- and off-balance-sheet financing vehicles—asset-backed securities it can put its loans into. Their performance is still a concern for Affirm; it has to keep a slice of them for compliance reasons, and they also have to make representations about the contents of the loans—if they get that wrong, they have to repurchase them. What asset-backed securities do is allow Affirm to access someone else's capital when they make their loans. But the asset-backed market puts them in a bit of a bind. Affirm's advantage in underwriting—their ability to make a loan to a 500-FICO borrower who will pay like a 650-FICO borrower, or to avoid lending to a 650-FICO borrower who will probably default—turns into a disadvantage in funding, since asset-backed securities are partly defined by FICO score! So the exact customers where Affirm has an edge—the deep subprime borrowers who pay off like near-prime ones—also raise their funding cost. Enter those high-value, long-term, zero-APR contracts for products like Peloton and Eight Sleep. If you're filling up an asset-backed security with various loans of varying maturities, you have to think of a loan's impact on the total in terms of its dollar-months. So a $50 pay-in-four is about 53 dollar-months of subprime, whereas a Peloton Bike+ Starter bought for $52/month over 43 months is 3,234 dollar-months of what is almost certainly a prime borrower. In one ABS document I looked at (registration required, but no paywall), the credit score for 0% APR loans was 708, compared to 668 for interest-bearing loans. Loans over $4,000 had an average FICO of 741, while loans under $250 averaged 650. So those large, long-term loans are a way for Affirm to get whatever credit mix they want in order to sell asset-backed securities when they're in the highest demand. This gives them a degree of flexibility. As they put it on their earnings call last quarter, "[W]e choose acceptable delinquency rates as an input into our decision-making, based on the pricing our products command with our customers, our view of the macroeconomic conditions and the demand for our loan volume in the capital markets." In the model where they're whirring money in and out and collecting an implicit APR in the 30s, a choice that adds to delinquencies but also accelerates their growth—or that earns them more in incremental merchant fees and interest than it costs in delinquencies, can be perfectly reasonable. You can firm up this model by looking at all of their lending-related revenue—basically everything they do except virtual cards—and comparing it to all of their incremental costs, like credit losses, funding, and servicing (accounting details get hairy here, but many of the complexities net out over time and generally make sense²). The first number gets you a sort of gross yield on the portfolio: irrespective of whether they make money from merchant fees, collecting interest, or selling into asset-backed securities, how much do the dollars in Affirm's system produce for Affirm. The second gets you a net number: if they somehow wished away all of their R&D, marketing, and general & administrative costs, what would Affirm make as purely a balance sheet deployed to certain categories of loans? What you get looks like this (I'm using calendar quarters): So they've built a nice machine that takes in money and, after accounting for all financing-related costs, earns somewhere in the high-single to low-double digits on it. There's a lot of noise around Covid, because they took a big credit reserve when Covid hit and then reversed it once the Covid Boom was on a quarter later. Meanwhile, this funding amount has grown in the 70-90% range.³ Building this kind of machine is hard, because it starts by getting good data on alternative lending models, then deploying them to see what happens. Getting this project funded is a tough pitch for two reasons. Raise money from an equity investor, and they'll see that they're investing in a pool of illiquid subprime consumer loans with a lot of extra operating expense layered on top. No, thanks! Raise the money by borrowing, and you're asking a borrower to front money for a pool of investments with mixed and uncertain credit quality, and upside the lender won't capture much of. Once there's been an initial pool of loans, it's much easier to figure out what their actual returns look like, but achieving statistical significance in lending is a capital-intensive proposition. If you try to do this, I can recommend two powerful hacks that make the job much easier:

If you refuse to follow the simple formula of being Max Levchin and funding a lot of it yourself, it's much harder to spin up a BNPL company that reaches the scale where it can start securitizing loans and accessing other kinds of capital.⁴ Non-Alignment and No ExitCompanies that compete for some of the same relationships that big tech companies do, but that aren't themselves big, often come up with a narrative around this. Smaller adtech companies trumpet the "Open Web," i.e. the part of the web that gets traffic from something other than Facebook and that sells ads but not through Google. In e-commerce, Shopify's CEO has said that "Amazon is trying to build an empire, and Shopify is trying to arm the rebels." One thing the rebels were armed with as of July 2020 was a partnership with Affirm, enabling pay-in-four on Shopify sites. This has been great news for Shopify—it has exactly the sorts of sellers who are too small for Synchrony but getting big enough that they really want to see a performance lift from all the ad dollars they spend. And it was a big deal for Affirm, too; Affirm had 5,700 merchants when the deal was announced, and had 168,000 as of the end of last year. But big deals like this have lots of uncertainty around who the winner will be. It changes both companies, and neither side knows which side will benefit. The classic finance solution to this is known by the delightful term "schmuck insurance": if you're doing a big deal with someone smart, you want to keep a piece of the upside. This is the universal explanation for earn-outs in acquisitions, or deals to acquire, say, 97.5% of a company, or sales followed by rev-share agreements. In Shopify's case, their schmuck insurance consisted of warrants for 20.3m shares at a strike price of $0.01/share. And, a short while later, that leg of the transaction really paid off: those warrants went up in value by $371m on November 11th, 2021, in response to the news that Affirm had partnered with Amazon. A deal with Shopify's long tail of millions of merchants gave Affirm enough leverage to swing a deal with one very, very big merchant, which, naturally, significantly diminished the relative advantage that Shopify had through their Affirm deal. That’s the trouble with schmuck insurance: when it pays off, you still feel like a schmuck. Right now, Affirm is not big enough to qualify as one of the major platforms on its own, but is big enough that some of them would rather deal with Affirm than try to copy its work in-house. Scale is good for many things, but starting a novel lending operation at scale is a way to lose money at scale until the underwriting gets figured out. Amazon's ability to launch this feature, though, probably means they drove a hard bargain. Bigger merchants are not interested in giving Affirm both a healthy upfront fee and high interest payments. (And, true to form, Amazon also got warrants.) On Affirm's last quarterly call, they insisted that the Amazon deal's profits would be more back-end weighted, which is a polite way to say that the merchant cut, after Affirm's incremental costs, won't be much at all and could even be negative. Affirm says its penetration of overall online spending is 1.6%. And the rise of omnichannel marketing means that "online" spending is a fuzzier category than it used to be—there's no reason Affirm can’t popularize chimeric new revenue models like buy-online-pick-up-in-store-pay-later. That growth assumes that Affirm will keep on being willing to lose money from marketing and R&D spend in order to continue expanding its loan book and offering new products. And that's not just a function of the market's patience with Affirm, but Affirm employees' patience with the market. Their equity comp is certainly not doing well right now. All else being equal, it's best to avoid working at a company that will some day lose 85% of its value. But if you must work at such a company, it's a good idea to find one where the CEO has been through this before. Max Levchin was the CTO of PayPal in 2000-1, a time when the company's burn rate was up to $10m a month and the funding market for Internet companies, especially loss-making ones, was dismal. This isn't enough to reverse the feeling of dread from an underperforming stock, but does mean that there's a credible example of grit from the top. One possibility is that Affirm will sell to a bigger company. Shopify and Amazon would love to own it in order to hurt Amazon and Shopify, respectively, and a large financial institution might be able to use it as a growth channel. Max Levchin controls 29% of the votes through super-voting stock, but also has an impressive options grant based on price (always a good sign), giving him up to 12.5m additional shares if the stock hits some (now-implausible) benchmarks. The other path forward is for Affirm to become one of those indispensable platforms—the sort of company that strikes transformative deals with smaller aspiring giants, perhaps taking some warrants in the bargain. Further reading: Daloopa has a free Affirm model available to Diff readers, so you can play around with these assumptions yourself. Tegus calls were particularly useful here, so if you want to learn more—especially about how merchants view BNPL, and how Synchrony compares, sign up for a free trial. (The Diff has a financial relationship with both Daloopa and Tegus, and I use both products a lot.) Thanks to Ethan Monreal-Jackson for some very helpful discussions of the industry and its economics. And for earlier Diff looks, see this writeup from the IPO ($) and this one on their acquisition of Returnly ($). Disclosure: I'm long Peloton Diff JobsDiff Jobs is our matching service, connecting readers to interesting opportunities in the Diff network. We’re working with dozens of companies now, including startups, established firms, and hedge funds. If you’re not quite sure what role you want to do next, feel free to reach out and we’ll see if we have something that’s a fit.

ElsewhereTikTokThe WSJ has a long look at TikTok's often brutal work culture ($). Part of this is from culture clashes—US workers complain that decisions are made in China, and that discussions of them happen in Chinese. (Of course, this is an issue at every multinational, though usually the language is English.) Anecdotes abound:

This kind of story gets written about many hypergrowth companies. And a good sanity check on it is to ask which is more plausible: that a company would grow very fast while everyone had a pretty typical workload, or that it would grow at that pace while keeping employees insanely busy. Calibrating overwork is tricky; the turnover from demanding eighty-hour weeks from everyone is probably high enough that it's cheaper to go a little less extreme. But there does seem to be a connection between extreme inputs and extreme outputs. FactorsBeleaguered systematic fund AQR has put up great results this year as growth funds have suffered ($, FT). A hobby among quantitative investors is looking at fundamental investors' track records and figuring out which factor exposures worked for them. (Some of the enduring successes end up looking like excellent factor-timers: Saturday's link roundup mentioned that Chris Hohn shifted from event-driven to growth at around the time when growth started its phenomenal run.) But factors can also describe a style of creating alpha beyond those factors; a value investor is partly someone who wins and loses based on how much growth is in fashion, but is also an investor who aims for an edge within value. Seeing AQR outperform is a good sign that some market extremes are mean-reverting—and that betting on mean reversion can still work, at least given enough patience and a sufficient bankroll. Replacing Passwords, and a Big Tech TruceOne of the subtle turf wars going on among tech companies is the fight to own logins and passwords. I have a password manager, Chrome tries to autofill, and so does iOS, so in some cases I have to guess a few times before I can find where a password is stored in order to use it with a new device. This first-world problem may be going away, as Apple, Google, and Microsoft are working on device-based authentication instead. That's notable not just because it would be a security improvement, but because all three companies make efforts to own their customers' password and login experience, and all three are conceding that that's a hard fight to win. (For earlier Diff coverage of logins, see this piece on Okta.) Solve for the DisequilibriumAndrew Walker asks why activist investors aren't going after energy stocks. Oil and gas have gotten more expensive, energy equities haven't fully responded, and for many of these companies, it's theoretically possible for them to lock in their entire market value in profits right now by hedging (in practice, there's not much liquidity far in the future, and as commenters point out, they could face margin calls in the meantime). So prices only make sense if investors don't expect them to hedge, and do expect them to waste those profits somewhere else. It's a good open question, but one thing we might expect before that is for other energy companies to start acquiring one another. In the 80s, M&A was cheaper than exploration as a source of oil, and it looks like that dynamic is back. 1 One interesting category here is small business owners, who don't have many sources of capital, can be very cash-conscious, but can plausibly get an incremental return on their investment that justifies the cost. Consider someone who gets into the lawn care business and buys a lawnmower through Affirm, paying 20% interest. If that makes the difference between working for someone else at minimum wage and working independently, that lawnmower can easily produce a triple-digit IRR. Big banks are not incredibly excited to lend money to a small business in search of $200 of startup capital. There are lots of small expenditures that can make the difference between forming an independent business and failing at it, and these kinds of businesses religiously watch their financials—they have the combination of a professional's approach to cash management and an individual's awareness that wasted money is their money. 2 Every financial company produces complicated financial statements, but Affirm probably holds some kind of record for interesting stuff per dollar of market cap (excluding cases where companies financially engineered their way into bankruptcy). For example, take their Shopify deal:

Got that? They traded a warrant (20.3m shares, $0.01 strike,10-year term, i.e. equivalent to equity) for a partnership with Shopify. They then created a balance sheet asset reflecting the estimated value of that cooperation, and then they amortize that asset—i.e. recognize the cost of the warrant—over the four-year period during which they expect to get value from it. This is a nice extra nuance on top of the usual complexity of evaluating merchant fees and interest income (which can move in opposite directions if Affirm's mix of zero-interest and interest-bearing loans changes—which, incidentally, will happen because the Shopify deal will create more small-dollar 0% interest transactions). They have a similar warrant-related marketing asset asset on the balance sheet to reflect the value of their deal with Amazon. 3 All this talk of high-growth subprime lending fueled by asset-backed securities will of course bring back some bad memories. BNPL might make consumer credit a safer asset class if its broad availability is a factor in default rates. (Car loans and credit cards defaulted at a higher rate during the subprime crisis in part because of a broader recession, but also because at least a subset of them were being serviced through cash-out mortgage refinancings.) If there are more providers of credit, and they think in different ways—like startups instead of bankers, for example—then swings in credit availability won't be quite so monolithic. 4 Levchin as a CEO also seems ideally suited to a business that rewards nerding out. At one point, while describing the company's ability to control many different variables at once to drive the outcomes it's looking for, he simplifies things for analysts by saying "think of it as a curve that's differentiable at every point, basically." You’re a free subscriber to The Diff. For the full experience, become a paid subscriber. |

Older messages

Longreads + Open Thread

Saturday, May 7, 2022

Uber, Arbs, Memorization, Misconceptions, Dashboards, Toyota, Cars

Cars Manufacture the Modern Middle Class

Monday, May 2, 2022

Plus! Not Enough Housing; Durable Network Effects; VPN Integration; Reserve Currency Problems; Movies

Longreads + Open Thread

Saturday, April 30, 2022

Netflix, Dueling, Value, Covid Zero, Aging, Japan, Fiat

Refactoring Restaurants

Friday, April 29, 2022

Plus! 401(k)s With Chinese Characteristics; Middlemen and Leverage; Concentration; A Mixed Trucking Recession; Deglobalization in Autos

Longreads + Open Thread

Saturday, April 23, 2022

Hacking, pathogens, fakers and haters, AI monks, scarcity, sweat, Ford

You Might Also Like

Eight days in and things are already changing

Wednesday, January 8, 2025

plus Tomdaya + birdwatching ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤩 Nvidia takes the stage

Tuesday, January 7, 2025

Nvidia headlined in Vegas, the Pentagon added to its companies blacklist, and an unexpectedly amazing beach destination | Finimize Hi Reader, here's what you need to know for January 8th in 3:11

It’s time to get rid of debt

Tuesday, January 7, 2025

Here's how to find the right debt solution for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Retirement Is the Right Call

Tuesday, January 7, 2025

Avoid work for the sake of work ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What America’s Top Economists Are Saying About AI and Inequality

Tuesday, January 7, 2025

Planet Money attended the annual meeting of American economists — and the most popular topic this year was artificial intelligence. View this email online Planet Money AI Was All The Rage At AEA 2025

This new Tesla strategy is crushing its stock returns.

Tuesday, January 7, 2025

A smattering of winners thanks to shares of TSLA ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Launch of the 2025–28 Bank of England Agenda for Research

Tuesday, January 7, 2025

Misa Tanaka Today the Bank published the 2025–28 'Bank of England Agenda for Research' setting out the key areas for new research over the coming years and a set of priority topics for 2025.

🎰 The AI bet paid off

Monday, January 6, 2025

Foxconn's latest win, a potential IPO revival, and call it "ginger ale-titude" | Finimize TOGETHER WITH Hi Reader, here's what you need to know for January 7th in 3:09 minutes.

Investing through it all

Monday, January 6, 2025

Take financial stress off your plate in 2025. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Are you taking a cruise soon?

Monday, January 6, 2025

Travel insurance could save you a ship-ton of hassle ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏