Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #289

What's 🔥 in Enterprise IT/VC #289Why lead investors matter + simple portfolio triage for seed investors

Once we cycle out of this 🐻 market, perhaps we can all focus on going back to basics starting with round construction. These are the times I encourage founders to remember that the relationship between investors and founders is a marriage that one should enter carefully. During the last two years, both sides optimized for speed, FOMO, and price over relationship. Moving forward, I hope we can learn from this current correction and come to a more balanced approach and take the time necessary to truly find the right partner and not just capital. To that end, I hope that founders have a lead investor and an experienced one at that. One that can help them feel like this when everyone else is panicking.  Founders need investors who CHEER when times are tough, CHALLENGE when things are looking too good, and CHILL when founders sometimes need downtime.  What I saw in multiple downturns in the past was that those that optimized for as many influential firms and angels on their cap table were also the same companies that did not have great stewardship and governance as no one had enough skin in the game to view the investment as more than an option.  Secondly, when choosing a lead investor, I highly suggest founders ask their investor what the cash reserve strategy is to help support founders on the way up as well as when times are tough…assuming they are doing what they need to do 🧵  Finally, seed investors, I hope you are triaging your portfolio and monitoring cash and operations from the top down so you never feel like you’re in panic mode. A great and simple start is that you should have a list of companies triaged by runway in months: < 12 mos <18 mos <24 mos >24 mos. Along side that, you should also have a sheet Pre-PMF <$1M ARR <$5M ARR <$10M ARR >$10M ARR The second set of metrics will allow you to align runway to stage of company. Armed with this data, you can constantly triage and help founders think through milestones to get funded and prep them well in advance of where we are today. With simple monitoring you would have already figured out who is best positioned to raise an outside round now, who you should invest more into proactively and double down to save founders time from a raise and give more room to hit milestones, and finally figure out which teams need tough ❤️. Remember creating new categories is brutal and rule #1 is to never run out of 💰.  The spigots are now closed for anything past Series C and folks are adjusting to round sizes at Series A. If you’ve already been well prepared and have plenty of runway this is going to be great time to hire A+ talent and build your business while many pullback. May next week be mostly in the 🟩 📈. Scaling Startups

Enterprise Tech

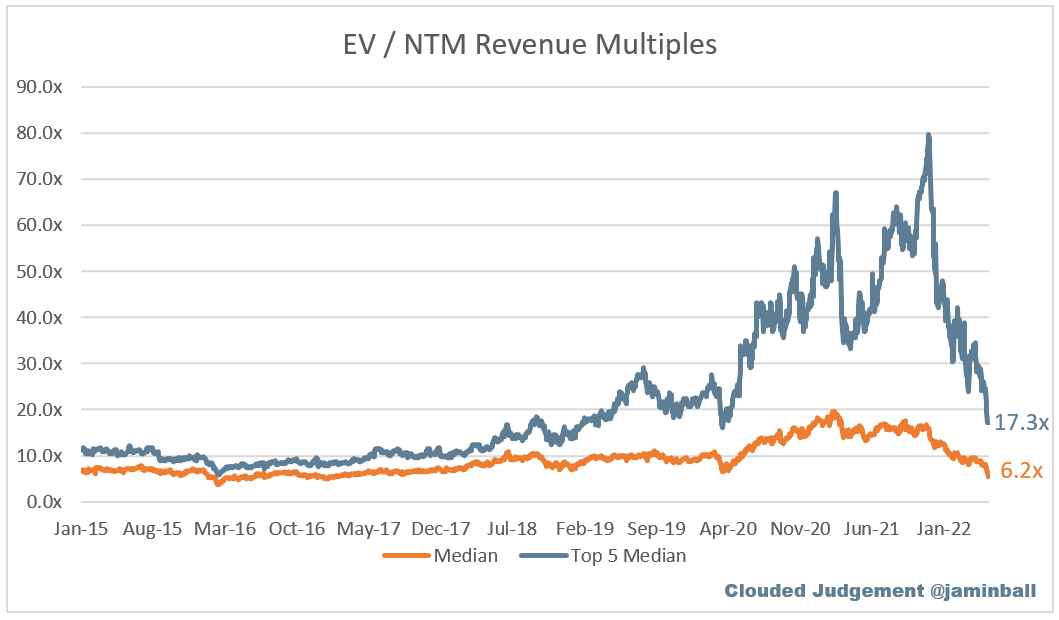

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #288

Saturday, May 7, 2022

Stay calm and carry on, growth at all costs is over, the prudent ones can keep building 🏗️

What's 🔥 in Enterprise IT/VC #287

Saturday, April 30, 2022

Building in a 🐻 market and getting ahead while you have the 💰

What's 🔥 in Enterprise IT/VC #286

Saturday, April 23, 2022

Miami 🌴 Tech Week 🔥 - some observations - need more founders!

What's 🔥 in Enterprise IT/VC #285

Saturday, April 16, 2022

Developer first & PLG founders - quality before quantity, no 🪄number to get to Series A

What's 🔥 in Enterprise IT/VC #284

Saturday, April 9, 2022

Bitcoin ⚡️ Miami - traditional finance everywhere...and IT Spend 📈

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏