Snap: The Relentless Quest to Own the Interface

Welcome back to the free edition of The Diff! Subscribers-only posts this week include: the economics of prestige assets, or Meme Stocks for the 0.01%; why it's so hard to profitably scale a product that focuses on retail investors; and why adverse selection is so powerful. Coming up in the next few weeks: how demographics can reverse a law of the financial universe (in the developing world, except for Japan), how to invest your research time, and the new life of the productivity paradox. Snap: The Relentless Quest to Own the InterfacePlus! Media Convergence; What's Still Fundable; The Piracy Continuum; Crypto Relearns Regulation; Shrinking Alpha

Welcome to the free edition of The Diff. This newsletter goes out to 31,677 readers, up 458 since last week. In this issue:

Snap: The Relentless Quest to Own the InterfaceWhat makes a company Big Tech? It's not just size: IBM did $58bn in revenue in the last year, and they're not Big Tech at all. In practice, the description that fits these companies is that they're in an industry that changes rapidly (hence the "tech") part, and that they have some ability to control their own destiny. A business that is entirely downstream of Google or Facebook traffic, or that exists only on top of AWS or Azure, might be big and it might be tech, but it probably won't be described as Big Tech. In that model, Snap Inc. might qualify as the smallest of the Big Tech companies. With an enterprise value of $37bn and trailing 12-month revenue of $4.4bn, it's a fraction of the size or importance of Alphabet or Meta, but it's a company that has been uniquely focused on ensuring that the rules that affect it aren't made by some external platform. Snap still gets bucketed into the social media category, where it usually looks like a small player but comes out ahead in categories like Gen Z users. While the company certainly benefited from hype around social media while it was raising money, and while its product is deeply informed by older social products, Snapchat itself doesn't have many viral mechanisms that can surface content based on user recommendations. It's social, but it's not a network. The company has another way to describe itself: since 2016, the partly line has been that Snapchat is "a camera company." They could be the next Kodak! But they're probably aiming to be the next Polaroid. Before that company's downfall, it was both a cultural phenomenon and a hot stock; it made photography cheap and fun, and also grew sales from $6m in 1950 to $466m in 1969, while its stock price rose from $2 to over $100 in the same period. Polaroid was an oddly modern company: founded by a Harvard dropout who continued to focus on product throughout his career, Polaroid had a continuing revenue stream from selling film in addition to cameras. The company was basically a prototype for modern growth stocks, and like those stocks it illustrates how quickly things can turn bad when a company misses an important technical transition.¹ The camera-company branding is important. Snap grew in the shadow of Facebook's colossal success, and was valued partly as a faster-growing comparable business and partly as a strategic acquisition. And they did in fact turn down a $3bn offer from Facebook in 2013. But Snapchat was partly a reaction to Facebook. One of the things that fast-followers can do is assess what fundamental, hard-to-fix mistakes their immediate predecessors made. From Snap's perspective, what Facebook got right was that people want to live a lot of their social lives online, and will do so by taking and sharing photos, and later videos. But what Facebook got wrong, at first, was that this would happen on a single platform, and that there'd be a binary between public and private. This was a forgivable mistake, and in some ways a lucrative one: Facebook beat older social networks by being tied to real-world identities, but as it turns out we don't all want to be our real selves to everyone we meet. This leads to two problems:

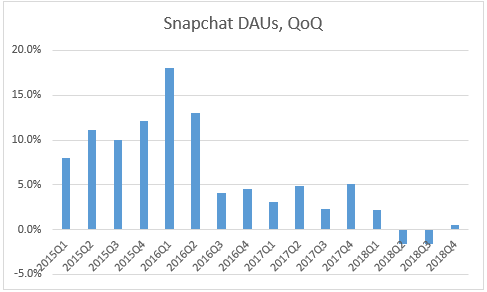

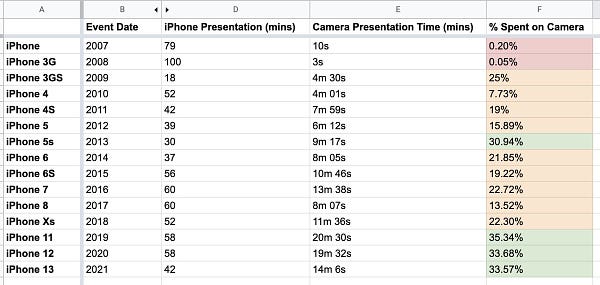

Both Facebook and Snapchat have tried to minimize the friction of posting. Instagram, for example, uploaded photos in the background when users opened the app, so posting was marginally faster. One of Snapchat's first hacks was finding a way to get rid of the shutter animation the iPhone used to use while taking photos. And, famously, Snapchat opens to a camera, not to a feed—it's upload-first. All social apps try to make things seamless, but the trouble with an unpruned social network is that you don't want things to be too seamless; Facebook made it easy to add friends, and was excellent at making recommendations, but that meant that being able to instantly share thoughts or pictures at, say, 3am on a Saturday could lead to trouble. Snapchat deliberately went for low-stakes and lo-fi images. There's a nice way to map their strategy to the early days of the software industry, where the companies that won were the ones that expected hardware's price to asymptotically approach zero. Snapchat and Instagram were both bets on cameras, but Snapchat's bet was that the cameras would continuously get better, while Instagram's was that bad cameras and bad photos could be made decent through filters. What that meant was that Instagram established a higher standard for aesthetics early on, while Snapchat was better for realism. And higher-quality cameras made realism better while revealing blemishes in curated-for-Instagram content. As it turns out, this was the right bet: the cameras keep getting better, so the app whose behavior was optimized around low-quality cameras was the one that constantly had to catch up:   Which it certainly tried to do. In August 2016, Instagram launched a copy of one of Snapchat's core features, Stories. This was actually one of several efforts; Facebook launched an ephemeral messaging app, "poke," in 2012, and launched another one, Slingshot, in 2014. (Slingshot's default interaction was that users couldn't view the messages they received until they'd sent one themselves. Great for maintaining a viral loop, but annoying—making laggy-Zoom-call-audio the standard communications mode is annoying.) Facebook has argued that Stories represents a standard kind of communication, and that it was "copied" in the same way that likes/faves, friending, and feeds were "copied" by just about every social app. (Well, almost everyone; Bloomberg is a messaging product but did not launch stories or emoji reactions. At least not yet.) And what really set Instagram’s Stories launch apart from other efforts to kill Snapchat is that, for a while, it actually worked: Snapchat's sequential user growth fell off a cliff in the last half of 2016: By late 2018, Snap shares were trading at under $5, compared to a close of $24.48 the day of its March 2017 IPO. The joke going around at the time was that Evan Spiegel was the busiest person in tech, since he was not only the CEO of Snap but also the Chief Product Officer of Facebook. Negative sequential growth is a very bad sign for a product with network effects. If new users make the product better, the user attrition makes it worse. But that better/worse terminology reveals something important: a product suffering from the death spiral of a network effect under net attrition can still survive if it continuously improves. And Snapchat does continue to launch new features at an impressive pace. The app is surprisingly feature-dense for the level of UI clutter, and that's both a deliberate choice and one that persistently mystifies new users. Discoverability of interface means the company can pack in more features without getting cluttered. There's always more an app can do, but every new option either crowds out other ones or requires the app to add nested menus. Users rarely memorize the entire path to doing something (if they do it that often, it should be a top-level option, anyway), so the next best choice is to split one app into several.² This has the added advantage of Eminent Domaining the user's home screen; the 4x7 grid of apps on an iPhone's home screen is very valuable real estate, and capturing more of it is always nice. But Snap can avoid a lot of that by burying features in a way that users either discover by accident or hear about from their friends. This ties in to one of the most powerful parts of the Snapchat system: there isn't a direct way to go viral on Snapchat, so the fastest path to being Snapchat-famous is to get famous and then talk up your Snapchat. By reducing virality within the app, they push the viral urge to get lots of attention outside the app, recruiting users as marketers. Some of the tools Snapchat added revolve around locations—Snapchat has lots of location-specific filters and a nice map search product. Those location features, incidentally, make their way into Snapchat ads: the app can be used to target users based on exactly where they are, not just where they live. This is good for some app use-cases, like advertising ride-sharing outside of event venues right after an event. And it ties in very nicely with the increasingly omnichannel approach that retailers use: the context in which someone might order something to their home versus ordering it for pickup can be different, and more granular targeting helps with that. Augmented reality is another area where Snap has made immense investments, and gotten a critical mass. They cite 6bn daily uses of their lens feature for augmented reality, and note that over 250,000 users have built 2.5 million lenses. Applying augmented reality to people is hard, because of the usual uncanny-valley problems, but applying them in a low-stakes context is a good way to get around that; if the goal is fun rather than photorealism, there's more room for experimentation, and the platform that's best for experimentation is the one that's most likely to develop new killer apps. And Snap has retained its faith in being a camera company after all these years. The company launched Spectacles, its augmented-reality glasses, in 2016, which are currently on their fourth generation. Spectacles are one way to reduce friction and keep photos and videos as natural and spontaneous as possible—they're literally a way to give photo recipients a first-person look at someone else's life. Even more interestingly, the company recently launched a drone, the Pixy, which hovers around users, taking videos that can be edited and shared on Snapchat. These hardware moves are, in part, a way to keep activity on the app higher. But they're also a way for Snap to avoid dependence on the iOS/Android duopoly. Often, companies worry about their reliance on other platforms from the beginning, but it's a long time before they can do anything about it—and of the things that are worth doing, "design something that performs a core function of the iPhone, but better" is certainly an ambitious one. There is another company that's similarly rethought its dependence on the big smartphone ecosystems and decided to escape: that was a big part of Facebook's rebrand to Meta. So maybe the 2018 joke continues: Evan Spiegel is even busier, because in addition to his other two jobs he's Meta's Chief Strategy Officer. Snap is a long way from achieving financial escape velocity. It's technically producing free cash flow of $200m/year, but that's after $1.1bn of stock-based compensation. The company's operating margin has been ticking up, from -64% in 2019 to -34% in 2020 and -17% last year, with a near-breakeven quarter in 2021. And those high operating costs are partly a function of overbuilding; Snapchat has very robust advertising tools, especially around purchase attribution and geographic targeting. That's building ahead of two trends. One is the continued convergence between direct-response advertising and brand advertising, as aggregate purchase impacts get easier to measure at the same time that conversion funnels get harder to track across different platforms. The other is simply scale; Snap's ad tools are overengineered for a company doing $4.4bn in revenue, which means they're about right for a company of that size that keeps on growing. And, the 2016-18 period notwithstanding, Snap has been able to keep on growing. Y/Y daily active user growth was 20% in 2021 and 18% last quarter, with the fairly mature North American market still clocking in a respectable mid-single digit number while Europe is around 10% and the rest of the world grew 41% in 2021 and 35% last quarter. Meanwhile, revenue per user in their mature markets is growing faster (in the 30s for the last couple quarters in North America and Europe, flat in the rest of the world as they a) focus more on growth than monetization, and b) get diluted by lower-monetization markets). Snap says it reaches 75% of 13- to 34-year-olds in more than 20 countries, and that's important for two reasons. First, if users age without aging out of the app, they'll produce more ad revenue because they have more spending power. But second, the fact that young users are still signing up for a product that's over a decade old is a sign that they've been able to maintain some level of coolness for longer than social networks typically do. Snap does face challengers. They're not the only company trying to build hardware and software for augmented reality, and they're not the only growth company with reliance on short-form videos. But when they compare themselves to TikTok, they can take note of the fact that TikTok is not a communications app, but a broadcast product; it's something they're free not to copy, or to copy only in limited ways, because it doesn't compete with their core viral loop. That's a good position to be in. Big companies that serve every use case find themselves assailed by smaller competitors that focus on just one, so big companies end up with growing R&D budgets that service smaller and smaller markets; Meta and Alphabet may ultimately spend more money defending their existing markets than growing into new ones. But the market for communication, especially personal and less polished communication, is harder to disrupt, because it's a human network, not a list of features. The camera company built something that competing headsets and cameras will have a hard time killing. Further reading: Diff readers can get a free financial model of SNAP from our advertiser, Daloopa. Expert calls were very useful on Snap, particularly around how advertisers see them; Tegus has transcripts of calls with experts, and readers can get a free trial. And Billy Gallagher's How to Turn Down a Billion Dollars is a fun look at Snap's origins. Diff Jobs

ElsewhereMedia ConvergenceIn 2008, digital ad agencies founded the NewFronts to compete with TV's longstanding upfronts for pre-selling the year's ad inventory. But it's getting harder and harder to tell them apart: in this year's upfronts, most of the legacy broadcasters focused on their streaming businesses, and YouTube joined the upfronts for the first time. Changes in distribution tend to create winners who understand that distribution model exceptionally well, but those winners only persist if they start creating good content. There are some formats that work well with online distribution but don't translate well to older versions of the movie business—we won't be going to theaters to watch two and a half hours of TikTok any time soon—but a lot of the content that people want to watch for half an hour to several hours in the evening will be similar regardless of delivery mechanism. As content and consumption patterns converge, the business models do, too. What's Still FundableVenture rounds have slowed down quite a bit, but are still happening. Quality companies with plausible paths to profitability are still able to raise, even if valuations are less generous and expectations are more stringent. And in some categories, funding might be getting easier: a SaaS spend management platform just raised $26m, for example. Spend management is a useful category; when companies scale, they tend to have generous expense-management policies, and it's hard to cancel subscriptions without accidentally breaking something. Better expense management, though, ends up being bad news for existing software companies: one element of their net dollar retention is that it's easier to keep existing customers than to sign up new ones, and some of the customers these subscription products keep are the ones who probably ought to churn. So this ties in with the thesis that a slowdown in venture funding is especially toxic to high net dollar retention companies, since they're the ones whose model is most predicated on customer growth. If their customers are still growing, but at 15% rather than 50%, a net retention rate of 130% can quickly get chopped down to roughly breakeven—which leads to lower customer lifetime values and then lower growth, reinforcing the cycle. The Piracy ContinuumJapanese movie studios are suing people who condense long movies into ten-minute summaries and upload them to YouTube ($, FT). This is interesting in several ways. First, it recalls the problem music studios ran into in the 90s: they kept suing their customers, which made piracy feel virtuous instead of shady. It takes a lot of effort to trim a movie down like that, and the people who go that effort like the content, even if they're not especially respectful of intellectual property. It's also evidence that there's more value to the IP than the studios realize. If condensed versions of movies are popular enough to sap demand from the real thing, instead of stimulating it the way trailers do, then there's room for a new product category that appeals to busy completists. Crypto Relearns RegulationA longstanding view on crypto is that it's relearning the last century of financial regulation in record time. And my longstanding rejoinder to this is: if the current state of regulations is an optimum, then they'll get there soon or at least rapidly approach the asymptote, but if not, then crypto's pace of learning implies that it will go far past the current state of regulation. Time will tell, and for now this theory comes up when crypto companies learn about rules that exist for a good reason: several crypto wallets have been identified based on their pattern of trading tokens ahead of being added to major exchanges ($, WSJ). Exchanges will generally have a policy against this, but the decentralized nature of crypto means that it's hard to identify perpetrators. (The exchanges could do a sting operation, giving different suspects different dates or tokens, but if they do this it will be done quietly and reluctantly—if there are five suspects who might control one wallet, then four innocent people are being implicitly accused. And if more than one employee is involved, they can compare notes.) There are a few workarounds, though. Exchanges can set more formal inclusion criteria, which would turn these bets from something insider traders do into something quants reverse-engineer instead. And they could create long timelines for tokens that are at various stages of review. The nice thing about volatile assets is that you don't have to weaken a signal or stretch out its timing too much to make it all but worthless. Convert an expected 50% change on a specific day into five ~10% changes that happen on a somewhat random cadence over the course of a month, and you make exploiting that signal sufficiently risky and tedious that it's not worth the effort. Shrinking AlphaThis piece is a good overview of a longstanding phenomenon: the amount of exploitable alpha in the market is diminishing as a share of market capitalization. Everyone I've ever met who has been trading the same asset class for over a decade or so laments that we're no longer in the good old days, when easy money abounded. Some of this is from better information; academic research converts an edge into just another risk premium. And some is due to more competition. An important side note here is that risk-adjusted returns are maximized, not when the market is as inefficient as possible, but when it's getting more efficient, because that creates catalysts. The process of reducing available alpha creates alpha since asset prices converge on where they should be. So the prospects for better returns are even worse than they look; the best times for active managers come from when easy money is getting harder to find. 1 I'm certainly not the first person to draw this parallel. Steve Jobs and John Sculley made a pilgrimage to visit Polaroid's founder, Edwin Land, in the 1980s, where Land and Jobs rhapsodized about how fun it is to create a completely new product. 2 One exception here is radically extensible products like IDEs, or products with a ridiculous profusion of features like Excel. For both, though, navigating through menus is part of discovery, not part of regular usage; power users memorize keyboard shortcuts, so the menus are actually more of a reference tool than a regular interaction. It’s notable that many of the most scriptable software products are also the ones where users memorize elaborate keyboard combinations without really trying to; muscle memory is a scripting language that runs on any device. Keyboard shortcuts don't naturally translate to mobile, but Snap's approach is arguably close. You’re a free subscriber to The Diff. For the full experience, become a paid subscriber. |

Older messages

Longreads + Open Thread

Saturday, May 21, 2022

Regulatory Arbitrage, Mean Reversion, Replication, Bees, Specialization, Snap

$1 Trillion Worth of Risky Loans Packaged Into Highly-Rated Securities is not the End of the World

Monday, May 16, 2022

Plus! Diff Jobs, Netflix's Explore/Exploit Strategy; EVs and Platforms; Third-Party Sellers; An Entrepreneurial Country

Longreads + Open Thread

Saturday, May 14, 2022

Housing, Chips, Books, Yandex, Hedge Funds, Bonds

Buy Now, Pain Later?

Monday, May 9, 2022

Plus! TikTok; Factors; Replacing Passwords, and a Big Tech Truce; Solve for the Disequilibrium

Longreads + Open Thread

Saturday, May 7, 2022

Uber, Arbs, Memorization, Misconceptions, Dashboards, Toyota, Cars

You Might Also Like

🤩 Nvidia takes the stage

Tuesday, January 7, 2025

Nvidia headlined in Vegas, the Pentagon added to its companies blacklist, and an unexpectedly amazing beach destination | Finimize Hi Reader, here's what you need to know for January 8th in 3:11

It’s time to get rid of debt

Tuesday, January 7, 2025

Here's how to find the right debt solution for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Retirement Is the Right Call

Tuesday, January 7, 2025

Avoid work for the sake of work ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What America’s Top Economists Are Saying About AI and Inequality

Tuesday, January 7, 2025

Planet Money attended the annual meeting of American economists — and the most popular topic this year was artificial intelligence. View this email online Planet Money AI Was All The Rage At AEA 2025

This new Tesla strategy is crushing its stock returns.

Tuesday, January 7, 2025

A smattering of winners thanks to shares of TSLA ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Launch of the 2025–28 Bank of England Agenda for Research

Tuesday, January 7, 2025

Misa Tanaka Today the Bank published the 2025–28 'Bank of England Agenda for Research' setting out the key areas for new research over the coming years and a set of priority topics for 2025.

🎰 The AI bet paid off

Monday, January 6, 2025

Foxconn's latest win, a potential IPO revival, and call it "ginger ale-titude" | Finimize TOGETHER WITH Hi Reader, here's what you need to know for January 7th in 3:09 minutes.

Investing through it all

Monday, January 6, 2025

Take financial stress off your plate in 2025. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Are you taking a cruise soon?

Monday, January 6, 2025

Travel insurance could save you a ship-ton of hassle ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Credentialism and the Money Illusion

Monday, January 6, 2025

Plus! Diff Jobs; Capacity Constraints; IPO Window; Strikes and Opportunity Costs; The Upside and Downside of Ads; Backcasting Returns Credentialism and the Money Illusion By Byrne Hobart • 6 Jan 2025