Earnings+More - May 27: Weekend Edition #48

May 27: Weekend Edition #48DraftKings analyst update, gaming sector analyst update, Rivalry Q1, Lottomatica Q1, sector watch - crypto +MoreWhere are we on the hope/despair pendulum? The gaming sector’s gyrations in the last few weeks - indeed just in this week alone - have been dizzying. As is discussed below, Las Vegas remains robust with no sign of a slowdown as yet. Yet the European online picture is less rosy - see Super Group’s somewhat enigmatic earnings statement this week. Given the febrile markets, it seems likely volatility will be with us for a while. I’m just second hand news. Click here: DraftKings analyst updateUneasy lies the head: The team at Jefferies came away from a meeting with senior management at DraftKings believing the bear case of needing extra cash is “not a likely outcome” and they “continue to expect a sentiment shift on the shares”.

Dream on: A “topical issue” - and then some - is the prospects in California. DraftKings repeated to Jefferies their thoughts that the two proposals - a tribal retail-only question and the mobile solution pushed by DraftKings et al - can co-exist.

Panning for gold: Jefferies say the acquisition of Golden Nugget remains a “critical opportunity” for DraftKings to enhance its icasino positioning. “It presents greater access to a broader demographic with higher LTVs and higher profitability,” they suggest.

** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club. What we’re sayingThis week’s Earnings+More podcast is available now via yesterday’s newsletter. You can also download it via YouTube, Spotify and Apple. Gaming sector updateTimewarp: Having returned from a trip to Las Vegas, the Deutsche Bank team note there are no signs of slowdown as yet, even if it “might not be an if, but when situation”.

Draft excluder: Despite the NFL predicting over 600k visitors to Las Vegas during the Draft proceedings, DB suggest the actual figure was around 300k. They noted that given the nature of the free event, they do not believe it drew in a crowd with a “high gaming-spend propensity”.

On the sidelines: The team noted that the “disconnects” between the broader macro picture of the demands of sellers on price, the team “don't get the sense that the broader M&A landscape is active”. Datalines - Nevada Apr22

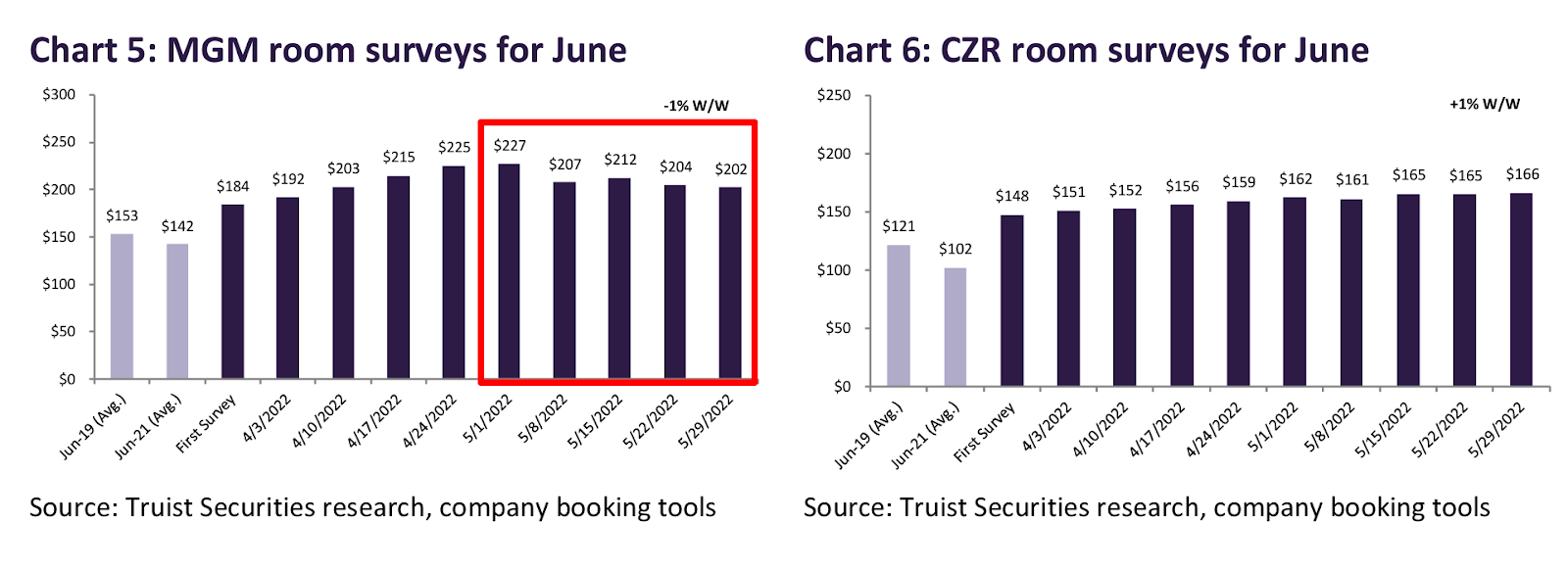

Summer down: The team at Truist said Strip RevPAR was up +13% MoM and LV visitation levels were up 31% YoY, with its “room-rate survey showing strong but somewhat decelerating growth as we head into the summer months”, although there were signs of those revenues stabilizing, it added.

Rivalry Q1

Market entry: Steven Salz, CEO, noted the Q1 results don’t include any revenues from its new launches in Ontario and Australia. “In many ways (our market entry strategy) is the inverse of our peers.”

Money cannon: In Ontario Salz suggested the promotional environment had seen operators compete to see ”who could subsidize the customer the most”. In comparison, he suggested Rivalry was also to pace its spend.

Data point: Salz noted that esports-betting was worth ~90% of handle. Tailored: Analysts at Regulus noted Rivalry has “thus far championed low consumer acquisition costs, with a tailored product to an esports audience”. Compare/contrast: The Regulus team suggest there are comparisons to be drawn between Rivalry and Esports Entertainment which earlier this week said it was writing down the value of some of its esports assets. They note that Esports Entertainment’s Vie.gg esports-betting operations in New Jersey reported minus revenues of $23m Lottomatica Q1

Back up and running: After the forced Covid closures of Q121, the company behind Lottomatica Scommesse and Goldbet said that against Q119 comparatives, EBITDA was ahead by over 52% while retail betting EBITDA was ahead 60% pro forma on Q119 and online betting was up a pro forma 290%.

Feeling the pinch: Asked on the call about any signs of a consumer slowdown, CFO Laurence van Lancker repeated the message from elsewhere about resiliency in the gaming space. “So far, spending is holding up well. We’re not seeing a pinch on the consumer, yet.” Feeling the heat: CEO Guglielmo Angelozzi said that the worst of the energy price shock could also be mitigated by the retail betting and gaming machine outlets where energy consumption could be “fine-tuned”.

Earnings in briefSTS: The Polish sports-betting operator grew first-quarter EBITDA 17% to $16.7m on revenue that grew 6.3% to $65.6m. The company said a decline in actives was due to the company pushing its customer acquisition into the second half due to the timing of the World Cup. LVS and IGT analyst updatesSingapore sling: Credit Suisse analysts say Las Vegas Sands is “increasingly attractive” based on its ~$6.5bn of cash and the potential for high growth in Singapore and New York.

Idea generation: The team adds that IGT is “still one of our best ideas” and that despite the stock volatility, “nothing fundamentally has changed”. Italy trends should improve sequentially and capital return should accelerate as IGT pays down debt (payments sale).

TLC analyst updateNo scrubs: The team at Macquarie the creation of the pure-play The Lottery Corporation (TLC) was positive for “other lottery exposed companies within our coverage, such as IGT and NeoGames”. Don’t go chasing waterfalls: Having listed on the Australian Stock Exchange on May 24 with an initial market value of AU$10.5bn, Macquarie said the group is trading at 18x and 17x its ‘22E and ‘23E EBITDA estimates.

Crazysexycool: Lotteries are “remarkably stable and consistent” and “have grown at a 3.6% CAGR over the past 15 years, proving resilient even during the GFC and COVID”.

Sector watch - cryptoLuna landing: The collapse of the stablecoin Terra has led to fears of another crypto winter, according to Coinbase CEO Brian Armstrong.

Untethered: The wave of selling forced Tether, the biggest stablecoin in the market, to ‘depeg’ from USD for a short while. The market has apparently stabilized now, but the value of cryptocurrencies is very much linked to tech and US equities and the crypto contraction has happened at the same time as the broader selloff of tech and digital stocks in the past two months.

Now you tell me: The Terra disaster cast a spotlight on the crypto exchanges which have helped promote the many thousands of crypto currencies now available on the market. Binance, for instance, promoted terraUSD as a “safe” investment just weeks before the collapse.

What’s a ponzi scheme again? “While terra did have an ecosystem with some use cases, the speed of growth of the ecosystem did not match the speed of the incentives used to attract new users.” Further reading: Crypto exchanges and the key role they play when it comes to listing coins. NewslinesKambi: A spokesperson offered no comment on recent share-price movement which has prompted speculation linking the sports-betting backend provider with pretty much every other company in the sector. King’s Gambit: Gaming affiliate provider XLMedia has appointed David King as CEO and joins the group on 1 July. King was most recently CEO at JPIMedia and succeeds Stuart Simms. Virgin territory: The 888-powered SI Sportsbook has gone live in Virginia. The launch follows that of the Sports Illustrated-branded online sportsbook in Colorado in September. Slam dunk: NBA franchises cleared $1.2bn in sponsorship revenues during the 2020-21 season and were bolstered by sports betting spending, according to the latest Marketing & Partnerships Annual Report by consultancy SponsorUnited. Get off of my cloud: The Champion’s League final will be the biggest event in crypto-betting history according to Cloudbet. What we’re readingThis can only end well: Kalshi, a new prediction market, lets people bet big and as the article notes, Commodity Futures Trading Commission concerns were “overruled by the agency’s politically appointed commissioners, one of whom has since joined Kalshi’s board”.

What we’re writing: Clear as mud. Super Group results lead to even more questions. On social

Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Earnings+More podcast #10

Thursday, May 26, 2022

Watch now (30 min) | Super Group, Catena Media, Better Collective, UK white paper

May 25: Super Group shares crash on forecast warning

Wednesday, May 25, 2022

Super Group Q1, Scout Gaming cash call, Esports Entertainment earnings warning, Better Collective analyst update +More

May 23: Catena considers breakup

Monday, May 23, 2022

Catena Media strategic review, Sportradar analyst reaction, Startup Focus - Fliff, the shares week +More

May 20: Weekend Edition #47

Friday, May 20, 2022

Playtech TTB deadline, Aristocrat H122, MGM analyst update, Sportradar analyst reaction, sector watch - payments +More

Wagers.com Earnings+More podcast #9

Thursday, May 19, 2022

Watch now (29 min) | Everything FanDuel, all at once

You Might Also Like

The Biggest News of 2024!

Friday, December 27, 2024

Over the past year, there has been some pretty big SEO and digital marketing news that has impacted bloggers and content creators. Since its the end of the year, Jared and I decided to sit down and

Online Sales Grew This Much During the Holidays [Crew Review]

Friday, December 27, 2024

You're an Amazon whiz... but maybe not an email whiz. Omnisend makes setting up email for your brand as easy as click, drag, and drop. Make email marketing easy. Hey Reader, Merry belated Christmas

A strategy for more prospects in 2025

Friday, December 27, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's Make Cut Out Snowflakes Day, Reader... Let your inner child out to play!

Influence Weekly #369 - TikTok At A Crossroads: 23 Experts Weigh In On The Ban, ByteDance, And What’s Next

Friday, December 27, 2024

Social Media as a Recruitment Tool: School Bus Driver Influencers

Issue #48: When Hardware Hits Reality

Friday, December 27, 2024

Issue #48: When Hardware Hits Reality

The UGLIEST website ever? (He paid $55k for it)...

Friday, December 27, 2024

You have to hear this story, it's crazy. View in browser ClickBank Day 3 of Steven Clayton and Aidan Booth's '12 Day Giveaway' celebration has just been published. Click here to find

"Notes" of An Elder ― 12.27.24

Friday, December 27, 2024

Life is too precious to be lived on autopilot.

10 busiest VCs in supply chain tech

Friday, December 27, 2024

9 VCs that ruled 2024 fundraising; aircraft parts market becomes a hotbed for PE; EMEA's 10 biggest buyout funds Read online | Don't want to receive these emails? Manage your subscription. Log

🔔Opening Bell Daily: Housing Outlook 2025

Friday, December 27, 2024

Mortgage rates have climbed as the Fed has cut borrowing costs, and unaffordability will likely persist in the new year.

There's no point in being Data-Driven if your data actually sucks

Friday, December 27, 2024

On strength of schedule, better decision-making and a major trend of 2024