First 1000 - 🧑🏻🚀 Fast

🧑🏻🚀 FastA postmortem on the go-to-market strategy for the 1-click checkout solution: Fast

Today’s First 1000 is brought to you by Actiondesk The Actiondesk team went through Y Combinator in 2019 and set out to build a next-generation spreadsheet software. One that would be natively integrated with any data source your business uses, whether an internal database or a SaaS. It works similarly to Google Sheets, so you don't have to go through a steep learning curve.

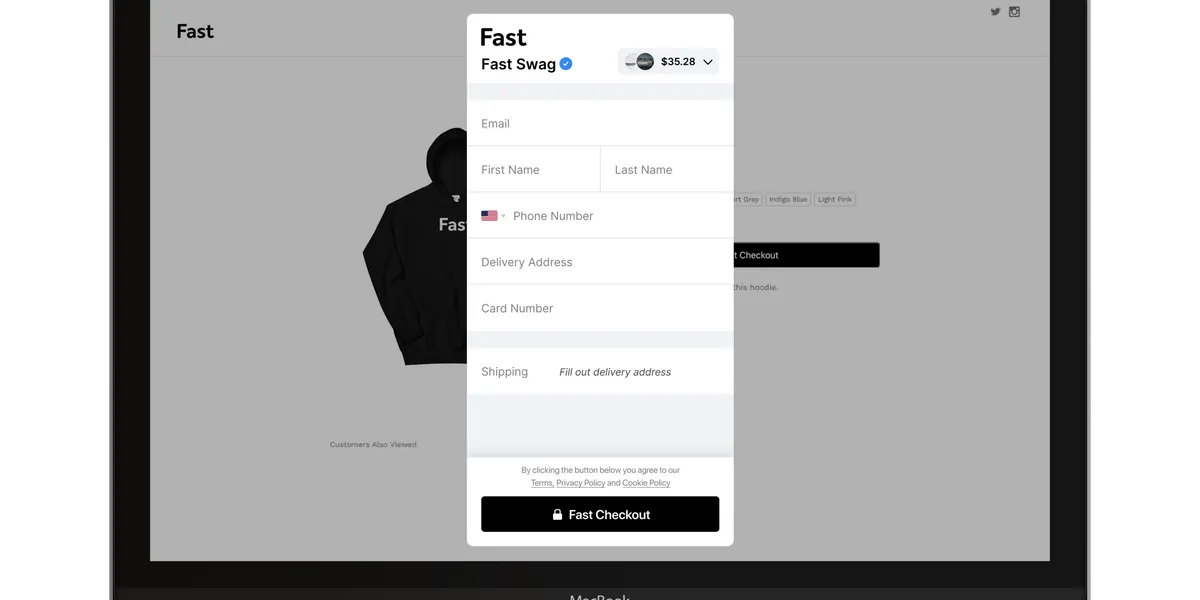

Check out Actiondesk if you are ready to stop exporting CSVs and save 3h / week. Hello Frens 👋. It’s been a couple of weeks, but I am finally back after wrapping up my Master's degree and ready to dive into today’s topic: 👩🚀 Fast! Like many, when the 1-click checkout company shut down 18 months ago after raising $102m, I was surprised and confused. Fast wasn’t another boring fintech company; it was a brand, a movement, a cult even. It was everything I thought a successful startup should be! On 29 March of this year, The Information published an expose highlighting some of the company's struggles, both from a revenue and burn perspective. Two weeks later, the company announced it was shutting down. Motivated by this rapid rise and fall events, I wanted to understand what happened. Before I get started, brew yourself some coffee and come back relaxed and ready to go: this will be a long one! 1. What is Fast?Fast is a 1-click checkout company. People who regularly shop on Amazon are familiar with the concept. Instead of repeatedly re-entering your Name, Address, and Card details with a purchase, I can use their 1-click checkout button to order any SKU, Fast. Fast facilitates product checkouts. If I’m buying a single product, I could check out Fast. But for multiple products, I would have to go through the traditional checkout process. There are a few benefits I believe to being a complementary (rather than replacement) product to existing checkout solutions:

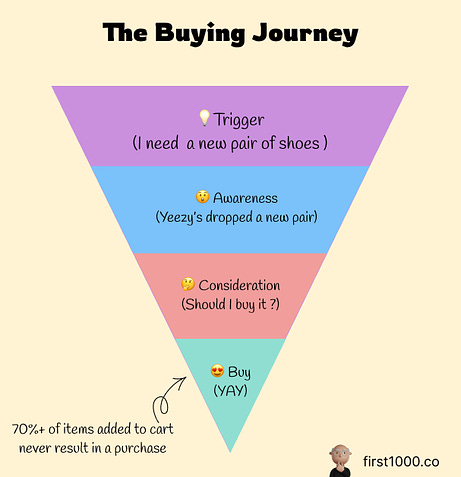

One thing I have to get across, though, when using Fast for product checkouts, it completely replaces the payment provider (Stripe, Braintree, checkout) and all the benefits of the infrastructure those providers have to offer. Fast lives side-by-side with existing checkout solutions, but it does not talk or integrate with them. The two systems have different customer orders if a merchant is running Fast Checkout for buying a single product with 1-click checkout and Bigcommerce Checkout to manage a full cart. The two systems have different integrations they work with and send data to. The bet Fast made is this fragmentation and effort needed to reconcile data from two separate systems is well worth it if Fast improved checkout conversion and netted their merchants more money in their pocket. If a store with a 2% visitor to buyer conversion shot up to 3% or 4% because of Fast, nothing else really matters. If I had a First 1000 store, I am confident I would tolerate more reconciliation work if Fast improves my revenue by 50%-100%. I am sure others would too! 2. The E-commerce Payments Infrastructure MarketOver the years, there have been step-function improvements in every part of the consumer's online shopping journey except for the buying experience. Social Media made it easy to micro-target potential customers. Platforms like Shopify and Woocommerce made it easy to build wholly managed solutions to run an online store. The last piece of the puzzle was to figure out how to get people across the finish line. There has been very little work done there until a few years ago. In the late 2010s, companies like Fast, Bolt, Paypal, PeachPay, Stripe, and even Apple set their eye on optimizing that last piece of the puzzle: the buying/checkout experience. Billions of dollars of investment later, it remains a largely untapped opportunity. 2.1 The Checkout ExperienceThe checkout experience represents an unprecedented opportunity. Bolt, one of Fast’s direct competitors, talked about it at length in their Democratizing Commerce Manifesto:

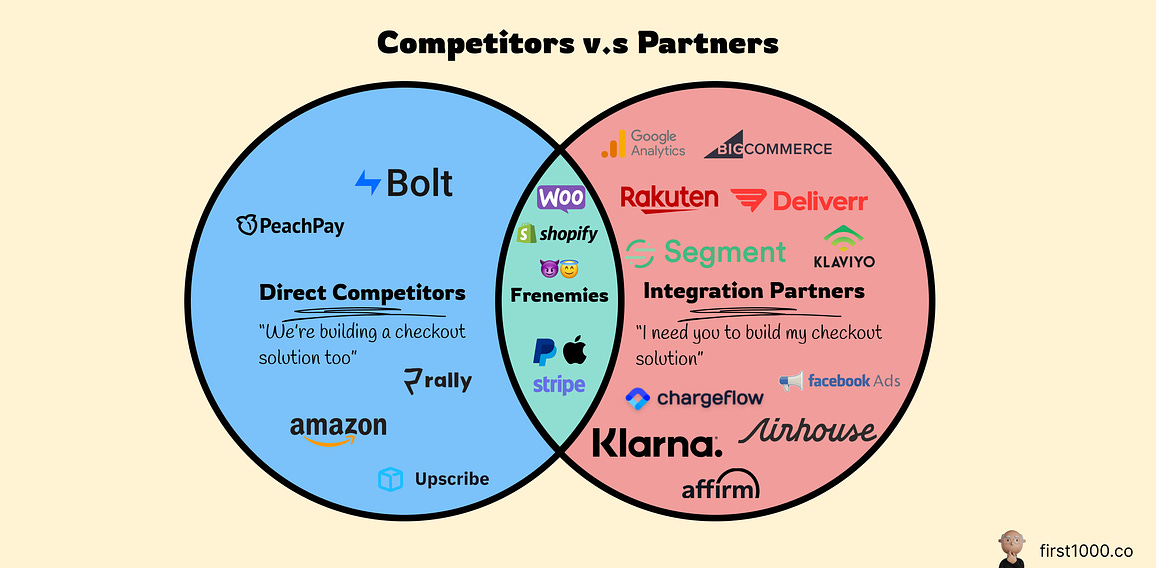

It is not a problem hiding in plain sight; it’s a challenging problem hiding in plain sight. When Amazon’s patent for 1-click checkout expired in 2017, it presented the first opening for companies to build an equivalent solution but for the rest of the internet. The threat of lawsuits from Amazon asides, what was and remained complex about building a better converting checkout solution is the number of integrations needed to make it work. When someone presses the checkout button, 10s, maybe 100s of platforms need to get fed this information. From shipping companies to consumer lending companies like Klarna or Affirm to Accounting software..etc..etc. Building a checkout solution that works with every software provider under the sun— that is needed— during the checkout experience made this a hard, if not an impossible, task. Companies like Fast, Bolt, and others raised hundreds of millions, sometimes even billions of dollars, in their infancy because of the high barrier of entry represented by the sheer number of integrations needed. The only way to get this thing to work at scale is to have an engineering powerhouse! The Integration Paradox.Integration in the checkout space is complicated. Each category is fragmented across 5-10 big players, sometimes even more. By numbers alone, a checkout provider would need anywhere from 100 to 500 different partner integrations to be “viable.” But building 500 different integrations takes time. A lot of time! Even worse, a checkout provider would have to build those integrations repeatedly for every out-of-the-box e-commerce provider (Shopify et al.). Special access and relationships with those gatekeepers are critical to beginning the integration work that may take 3-4-5 years. And It’s a zero-sum game. For instance, Shopify made 68.93% of its revenue from payment processing fees. It is the same fee that alternative modern checkout providers like Fast feast on. To add salt to injury, you also need the Shopifys & Woocommerces of the world to greenlight your solution to get the appropriate access (non-public APIs). This misalignment of interest is what made and continues to make the checkout problem so hard. 2.2 Competition from all sides.As outlined earlier, The revenue source for checkout providers is in kick-back fees from the three payment railways: Mastercard, Visa, and Amex. Companies up the value chain (Shopify) and down the value chain (Stripe) make money from those same fees, forcing competition from all directions. Let’s take a look at the competitive landscape. 2.2.1 Horizontal Competitors (Direct Competitors)Horizontal competitors are checkout providers competing directly with Fast. There are 4 main direct competitors in this space.

2.2.2 Vertical Competitors (Pre-checkout/Post-Checkout solution)Vertical Competitors sit on top or below Fast in the Value Chain. There are three kinds of Vertical Competitors in this space:

Vertical Competitors have leverage over a 1-click checkout provider in the form of economies of scope or consumer-adoption scale. After all, Buy now Pay it later solutions or the suite of products (Tax management, Fraud detection..etc.) that a payment processing provider has either offers some value to the end consumer or merchant. Either way, they move the top-line and help with conversion! A 1-click checkout provider needs to add value on top of those vertical competitors for it to be worthwhile for the merchant. One can’t improve checkout conversion by making the process faster on one end but decreasing it on the other side by not offering a financing solution to the end-consumer that can’t (and maybe shouldn’t) afford to buy the product. So not only does a checkout solution need 100s of integration partners to build a viable solution, but they also need to convince them to partner with them when they have or will very soon have their competing product. 2.3 The Two Sides of the Checkout Market.Both the end consumer and merchants have a different set of priorities. Merchants want fewer carts abandoned, with minimal disruption to their infrastructure and low managing cost. End users want fewer forms and an easy way to manage, track and return their orders. Optimizing for merchants is optimizing in scalable, highly-integrated infrastructure, and optimizing for end-users is optimizing for front-end experiences and user-facing features. 3. Product3.1 One-click checkout [09/20]At the core of Fast is the 1-click checkout solution Fast managed to sidestep the integration paradox I discussed earlier. The 1-click checkout works a little bit differently than one would expect. Fast doesn’t replace the entire checkout process. Instead, it offers an additional button placed under each product. When users press the Fast Checkout under a product, they are taken to the Fast website where their order is confirmed, and all the backend work happens on the Fast infrastructure. However, if they are a first-time Fast user, they are taken to a normal-looking Fast checkout flow where they enter their information to be later saved for future checkouts. You have to be a 2nd+ time user of Fast to experience the magic! Because Fast didn’t have to build all of the integrations, it could just kickback to the old system in examples where those integrations were needed to complete a transaction. For instance, if a person wanted to use consumer lending on checkout or use Apple Pay or use a Coupon or Rakuten, they would have to go to their cart rather than use the Fast Checkout button on the product detail page. But most people won’t even know that is an option if they press the Fast Checkout button! That dual payment infrastructure made it easier to take Fast to market, but at the same time, it meant that every day was another A/B test to see how well Fast stood against the OG checkout system. Instead of overtaking the whole checkout process, Fast took on a small portion, to begin with. Each of their 700+ customers was running two checkout systems in tandem, one for Fast Checkout on a single product and one to manage the whole Cart. 3.2 Fraud Protection & Merchant Improvements [02/21]  5 months after its initial product launch, Fast introduced some merchant solutions such as Fraud Guarantee and instant payouts for its merchants. Fraud Guarantees made Fast more competitive with Bolt, which has been offering fraud guarantees since the early days of its checkout products. Instant Payout was a lever that the salespeople could pull on to close deals. This is well-aligned with their target customers of small SMBs, which I would assume have less than optimal cash conversion cycles. This could (and perhaps was) a big unlock to close customers. 3.3 Headless Commerce [09/2021]In September 2021, Fast released their next evolution: Headless Commerce. Headless Commerce was the Fast button but for ads, events, and Smart TVs. From their Headless Commerce PR Release, the three prominent use cases were:

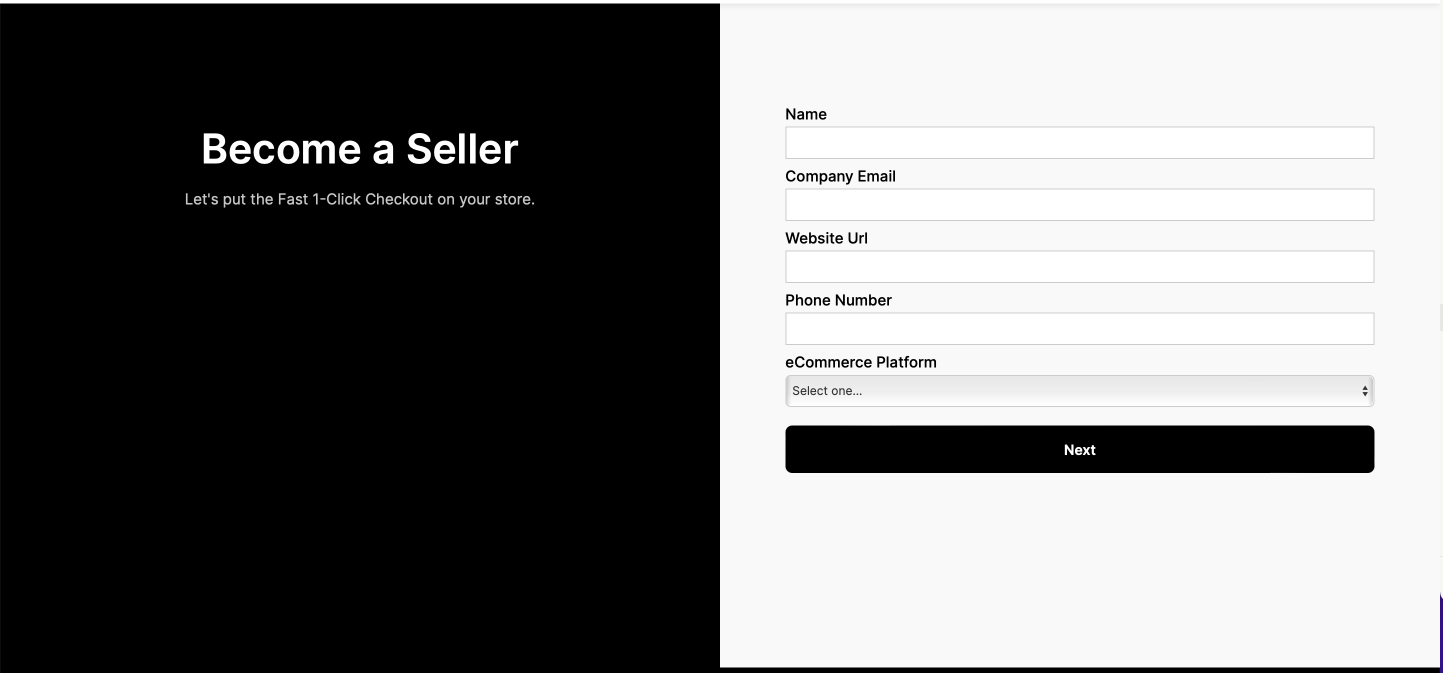

Headless Commerce lowered the barrier for adoption even further; merchants wouldn't even need to touch their website to use Fast. This opened up the doors of opportunities for Fast to go after big wealthy customers! 4. Go To Market Strategy4.1 CustomersFast initially went after merchants with less than 10m in annual transactions. The initial Fast product was lightweight. It didn’t have any of the integrations needed to power a behemoth of an e-commerce store, nor did robust data sharing capabilities. For a store that spends millions of dollars on ads, not being able to track people who went through the Fast Checkout flow but dropped off was a no-starter! Going after smaller clients made sense; they are less demanding and less sophisticated. They can learn and grow together until they build a full-fledged product that they can go up-market with. Fast initially tried to partner with two e-commerce platforms: BigCommerce and Woocommerce, to offer their product. Only merchants whose stores are powered by either of those platforms can use Fast (since each platform requires its own set of integrations). However, Fast quietly killed their Woocommerce plugin soon after the public announcement of a beta. There was no official communication from the company as far I can tell, so what happened there is something only Domm & employees know at this point. If I had to guess, it would be either low-adoption or Woocommerce signing an exclusive partnership with a competitor. The Fast Headless Commerce was their wedge into targeting larger customers with 10+ in annual transactions. Headless Commerce is a fancy term for QR (re)ordering. This was the third (and last) major product release. This opened up a whole new category of clients for Fast to target since it provided a new (non-existent) channel for those merchants to utilize. Merchants like The Honest Company embedded these QR codes on the product packaging for fast re-ordering. The Cleveland Cavaliers added them in their stadium for fans to order merchandise during the game. The risk from a merchant perspective of implementing Fast’s headless commerce pales compared to adding their Fast Checkout button to every product on their web page and dealing with fragmented reporting and lackluster data reporting. It’s a separate flow and would provide incremental revenue instead of eating away from the traffic coming directly to their website, for the most part. 4.2 Distribution Motion:1/ Fast HoodiesOne of the most recognizable things Fast did was $1 hoodie drops. People wore them proudly. Not just employees or customers, random people cheering from the sidelines and tagging along the build-a-company-in-public journey bought these. 10s of thousands of people did just that. The Fast hoodies resembled something. Maybe community, maybe something else. But people didn’t just buy them. They wanted the world to know they had them! Watching this Fast Hoodie movement unfold over the last couple of years was fascinating to watch (I am the proud owner of the light blue edition). Trustpilot alone has over 2700+ reviews of the hoodies. At a conservative estimate, if 5% of buyers left a Trustpilot review, that would mean they sold well over 50,000 Fast Hoodies. Fascinating honestly! That is an achievement for an 18-month-old B2B company with only 700 customers! The hoodies served 3 purposes.

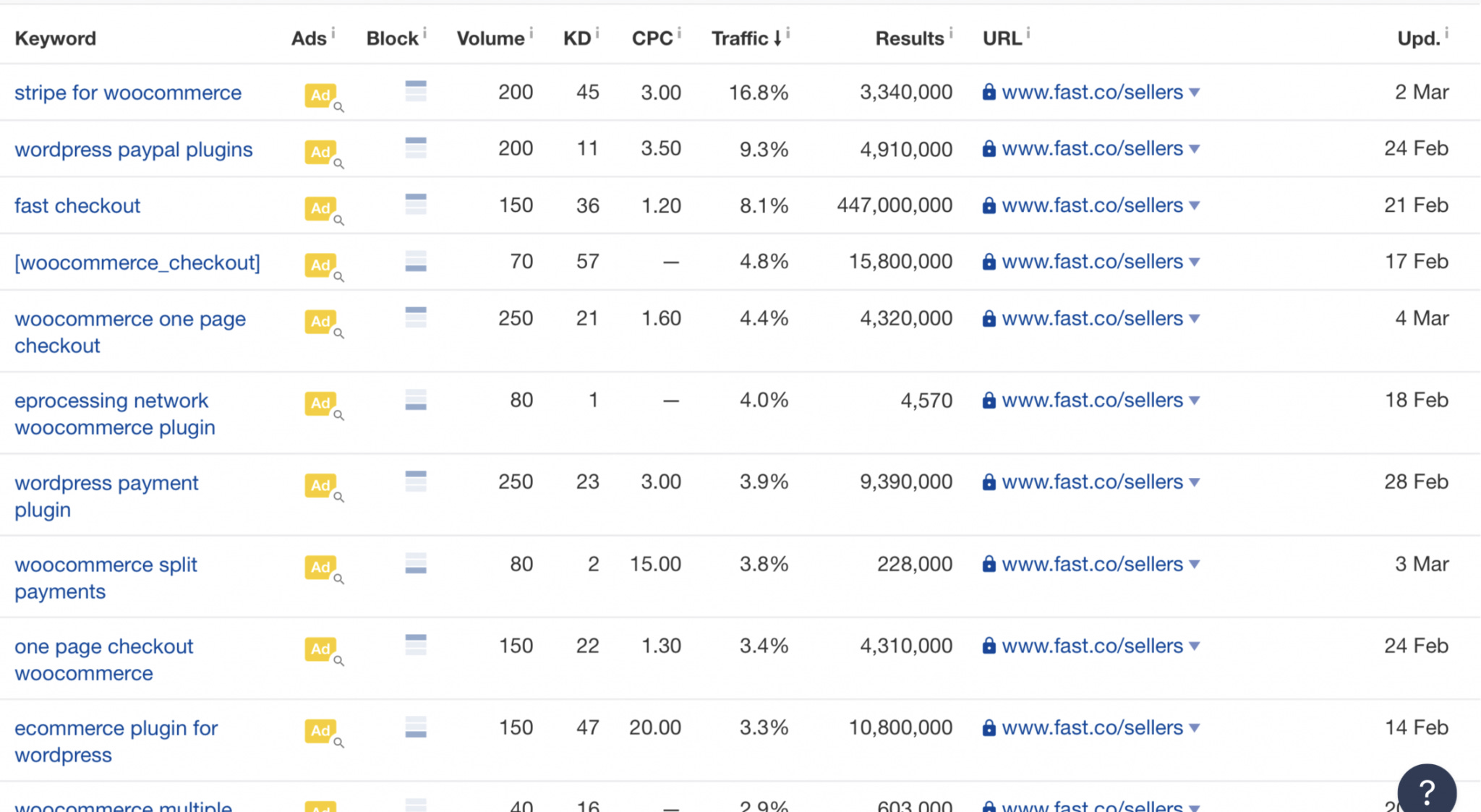

2/ PartnershipsPartnerships sat under the brand awareness umbrella at Fast rather than sales. If you are wondering how a B2B company sold over 50,000+ pieces of swag, the answer is (extremely successful & innovative) partnerships. Their most prominent partnership came from Nascar driver Parker Kligerman. Parker has just over 87k followers on Twitter yet sold over 40,000 Fast Hoodies while being sponsored by Fast. I don’t know how they identified or executed this partnership, but Fast nailed this one out of the park.  3/ Outbound SalesFast focused on outbound sales from day 1. They hired people to go out there, find BigCommerce Merchants with <10m in sales and get them to add that Fast Checkout button under every product. ****And they delivered! Over 700 BigCommerce merchants. From all the merchant reviews out there, Fast's sales and account managers were responsive, helpful, and open to user feedback. Merchants loved working with the Fast sales team! The first two distribution motions (Hoodies and Partnerships) worked on the brand side, but this was the first one that translated to real dollars, revenue, and customers! 4/ Search AdsThis is where things got a little sideways for Fast. Chris Frantz did a deep-dive on Fast, and their marketing spent last year and came out of it with more questions than answers. He writes:

Search ads are great because they capture potential clients at a high-intent moment, but when you are bringing a new product to market, that intent does not exist. Two options exist.

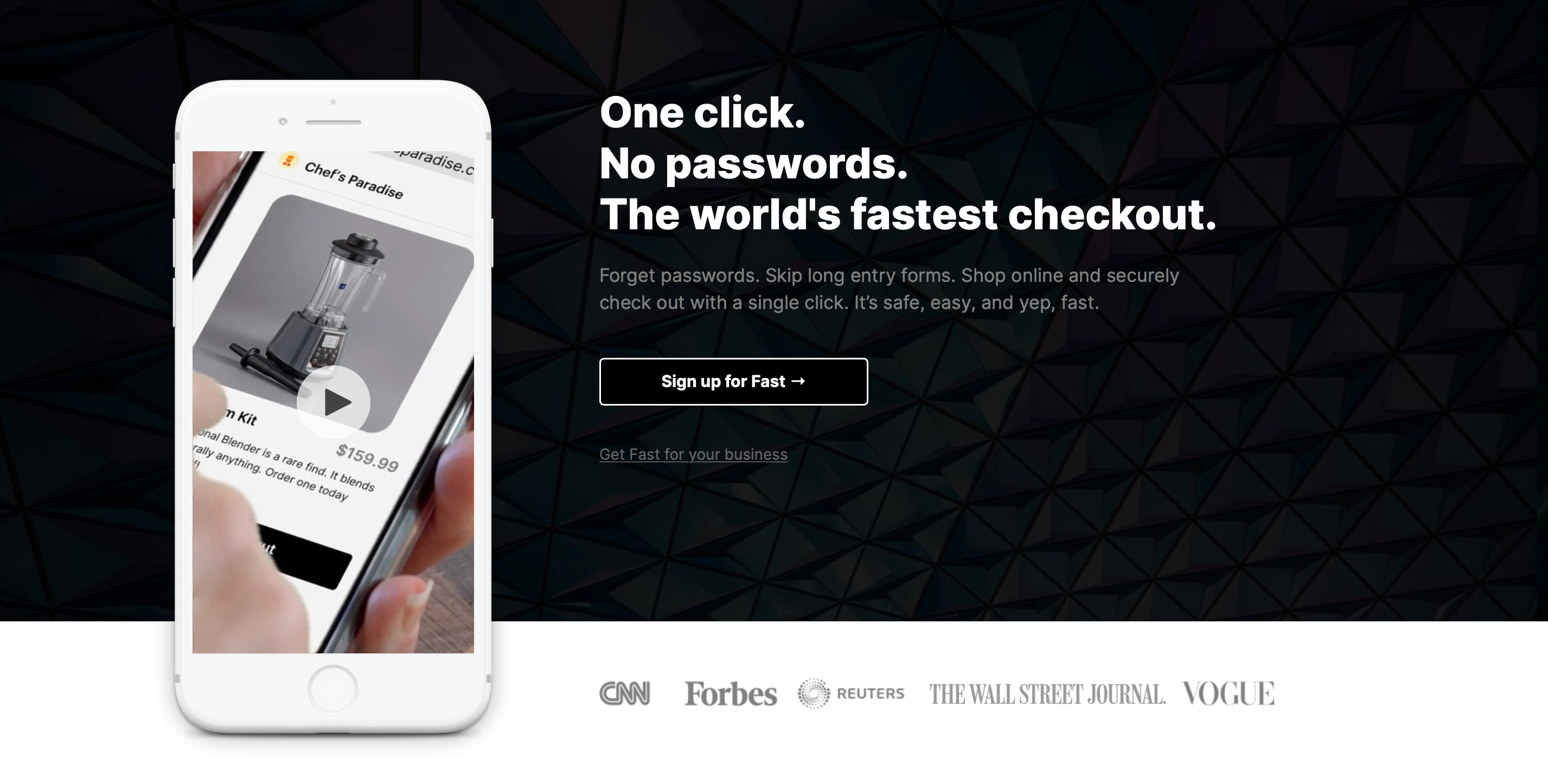

Fast chose the earlier. & it was a costly mistake! 4.3 Product Messaging & PositioningDomm built Fast into a recognizable consumer brand in a record time. Everything on the site was tailored to the end consumer… which I found odd. The landing page is tailored to shoppers, not merchants. They even had testimonials from people who used the “Fast Button” talking about their experiences. The problem is that shoppers are not the customers. The customers are the merchants! And when you land on the Merchant page, you are treated with an ugly form to get in touch with their sales rep. Compare this to what their end-consumer (shopper) landing page looks like. The dichotomy is starting! 4.4 PricingFast charge 2.9% + 0.3C in line with other payment providers such as Stripe. Their biggest competitor at the time, Bolt, charges 0.6-1.8% on top of payment processing fees but later reverted to a similar pricing model. 5. What Happened?Fast outpaced all its direct competitors. They bolted through Bolt and Peachpay to land over 700 clients. A mix of a strong brand that came with strong inbound leads, the credibility of the Stripe investment, and their investment in an outbound sales team early on helped them outpace Bolt and others. But it came in the form of smaller clients with a narrower use-case that did not translate to material revenue. Where I think Fast went wrong was that it was a product-led company when it should have been a growth-led company. Fast should have optimized for GMV (v.s. for number of customers). In other words, Fast was built for the end consumer when it should have been built for merchants. They did an excellent job for end consumers. The branding: on point. The consumer experience: on point. Even features such as managing orders and tracking were: on point (at least from personal experience)! But Merchants gained very little of that love. They were slow to integrate with other merchants' service providers and broke the data reporting for merchants that implemented Fast (since they only reported if and when a purchase happens). While their hoodies had 2700+ reviews on Trustpilot, their actual product had a meager 3 reviews on G2 and the 7 reviews on the BigCommerce store. They put so little effort into building trust, brand, and credibility with the merchant community compared to the end-consumer. On the product side, Fast was fast, but it also needed to be reliable. NPR ran a study on e-commerce stores that used Fast. 38% of those sites never even displayed the Fast button on their product detail page. Perhaps because it did not always function as expected. Chris Frantz came to a similar conclusion in his deep-dive on Fast. A quick scan of the company’s Twitter account also yielded the same conclusion. Fast is fast when it works, but that is a big when! (Additionally, some users on Reddit reported that people who used the Fast Checkout button were confused as to what just happened, perhaps it was also too Fast!) Headless commerce was an excellent product wedge introduced too early! Headless commerce (or (QR express ordering) helped the company move upmarket; they helped them move from scrappy mom & pop shops to giants like The Honest Company & Cleveland Cavelier. But it wedged into nothingness. The core product was not yet ready for mass adoption by the big leagues, and then there is the very limited use-case for QR ordering (it is not an existing user behavior like is the case in China). Even if headless commerce showed promise in conversion or retention for any of the big clients, it didn’t deliver the GMV volume Fast needed (a tiny fraction of orders will ever come from QR codes on the packaging or on a stadium chair), neither did it deliver leads-that-convert to the full checkout process because the integration infrastructure was not there yet. On the distribution front, building a consumer brand did not translate into a B2C2B sales motion (Business to Consumer to Business Motion), similar to other enterprise brands that went after consumers first (Notion, Slack..etc.). The atomic network needed for Fast to realize the network effects benefits is on the scale of e-commerce on the internet v.s. on a scale of a department within a large company. Fast needed a tightly knit group of merchants with considerable overlap of customers to go to market in a bottoms-up end-consumer first approach. Perhaps they should have gone after a sport with a hardcore audience and integrated with the majority of the equipment sellers or after a niche consumer segment (GMO-free products, for instance) and integrated with all the major online DTC sellers. Just any small enough market with a small enough audience that mostly shops across the same stores! However, the brand helped them recruit some of the best people in the business. There is no denying that! And it's a shame we had to say goodbye too soon before seeing what this group working together can do to the world! 6. TakeawaysFrom writing and researching this piece over the past 3 weeks, here are my key takeaways:

Until we meet next Tuesday, Ali Abouelatta |

Older messages

📬 Linkedin: Gamifying Status

Tuesday, May 10, 2022

Delivering single player value for a network-effect based business.

Levels.fyi: Capitalize on Waitlist Momentum

Tuesday, May 3, 2022

A twist on traditional waitlists mechanics

🏌️Curated

Tuesday, April 26, 2022

Today's Issue is brought to you by: Bigin by Zoho CRM: The simplest CRM solution ever! Bigin is the only CRM solution in the market that is built specifically for small businesses, trusted by over

Sick Day

Tuesday, April 19, 2022

:(

💳 Stripe

Tuesday, April 12, 2022

Everything you didn't know about the Stripe 0->1000 story

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏