Bankless DAO - The Stablecoin Edition | DeFi Download

The Stablecoin Edition | DeFi DownloadYour Trusted Source for 101s, Project Announcements, and Tokenomics Tutorials.Dear Bankless Nation 🏴, It’s not often that we get to include a birth announcement with our newsletters, but today is different, as we are launching a new newsletter: the DeFi Download 🎉. The DeFi Download will initially ship once per month and focus on the major areas of DeFi, such as stablecoins, AMMs, lending markets, and staking. We’re excited about our new newsletter, and we hope you are too. Welcome to the Bankless family, DeFi Download! Initially aimed at those who are new to DeFi, this newsletter is for people who want to review its foundational concepts, crave information on the latest DeFi projects, are curious about tokenomics, need to up their DeFi security game, and want to gamify their DeFi knowledge though a BANK-inspired portfolio challenge. As we ship more issues, we’ll steadily increase the complexity of the topics, building upon our prior work. At its core, the goal of the DeFi Download is to move the reader from DeFi novice to a competent, engaged user of decentralized finance protocols. For the inaugural issue of the DeFi Download, we just had to start with stablecoins. Stablecoins are the foundational DeFi money lego, the base denomination of DeFi — the core primitive. Stablecoins normally experience very little volatility, are the basic composable building block for simple and more complex financial products, make up the foundation of liquidity pools, provide us a familiar method to transfer capital and store value, are easily bridgeable to traditional finance, and they let you exit positions on chain by providing a safe haven in times of market volatility There is no right way to consume the DeFi Download. You can pore over it all in one afternoon or consume it in more digestible bites (a la carte style). Our goal is for the DeFi Download to become a go-to resource for all things DeFi. We hope you find great value in this first issue, and we’d love to hear your feedback on how to make the DeFi Download a trusted companion on your Bankless journey. Contributors:

|

|

The DeFi Download Guide to Stablecoins

|

Beginning with the origins of stablecoins, moving to the basics, breaking down the various types and risks, and then looking to the future, the DeFi Download Guide to Stablecoins will catch you up to speed on this most fundamental DeFi money lego.

The History of Stablecoins – Class of 2014

Stablecoins are a specific category of cryptoassets

Why the World Needs Stablecoins

The ability to maintain dollars on the blockchain while trading removes the friction of transferring back and forth to bank accounts, reducing fees and time. Bank deposits from exchanges take days to clear and can be slowed down by holidays and weekends, but the blockchain operates 24/7/365.

These problems create the optimal use case for stablecoins: frictionless, secure, and low-fee transfers of money around the world. Many people living abroad send money back home to friends, family, or business connections, and sending money via wire transfers is orders of magnitude more difficult than using blockchain technology.

Not only is the transfer of money cheaper, it is also MUCH faster, with transactions completing in seconds or minutes rather than the two to five days for traditional remittance methods.

The blockchain offers a much higher level of security than the traditional banking system, with transactions being cryptographically secured and sent directly to users’ wallets. To complete a transaction over the blockchain, all you need to do is enter your wallet address properly, and the transfer is guaranteed with no risk of theft. The only risk is user error as you do not have an intermediary (the bank) to rewind any mistakes. This personal accountability is a security boon and a human error risk; the new world of crypto transfers requires personal accountability.

Stablecoins Come to Market

Stablecoins were brought to market in 2014 with the introduction of BitUSD, NuBits, and RealCoin (Tether). What differentiated the three was the pegging mechanism used to collateralize the stablecoin. RealCoin (Tether) used fiat money and other assets such as commercial papers, treasury bills and bonds to collateralize its stablecoin; BitUSD used the Bitshares native token and other cryptocurrencies; and NuBits was the first ever algorithmic stablecoin, created and burned based on a complex set of algorithms in a smart contract. Fast forward to 2022, and there are numerous cryptocurrency projects issuing stablecoins. But what happened to the OGs such as BitUSD and NuBits?

Let’s start by reviewing the three stablecoins that were issued in 2014 — the “Class of 2014”. Spoiler: only one of them is still trading on markets, has seen tremendous growth, and is currently the third largest cryptocurrency by market cap.

The Class of 2014

BitUSD

BitUSD’s peg broke in 2017, caused by high overall crypto market volatility and instant liquidations, and the token is no longer actively traded.

NuBits

The below price chart from CoinMarketCap shows the suffering of NuBits during high volatility in overall crypto markets.

NuBits’s peg first broke in May of 2016

Tether (RealCoin)

A More Stable Future

Stablecoins are here to stay, and they have come a long way since they were first introduced to the crypto markets in 2014. Investors and traders use them to park their money into less volatile assets and to trade on exchanges. Being aware of the risks that come with an investment in stablecoins is indispensable. In times of high volatility, the chances of breaking the peg increases, especially for those stablecoins that are not sufficiently backed by assets in their treasury. This is particularly concerning when we realize that high volatility in crypto markets is very common. However, as the overall crypto market grows in market cap and treasuries diversify their holding to back up their cryptocurrencies, the problem of stablecoins losing their peg should eventually decrease over time and crypto can look forward to a more stable future.

Off-Chain Collateralized Stablecoins

These are stable coins that are backed by traditional assets, such as securities and commodities, that require a custodian for safe-keeping. These backing assets are in the possession of the stablecoin issuer.

Off-chain collateralization is one of the most capital efficient stablecoins, because they do not require the over-collateralization of assets like DAI. These off-chain collateralized stablecoins are backed by a variety of assets like USD, bonds, loans, or other cash equivalents.

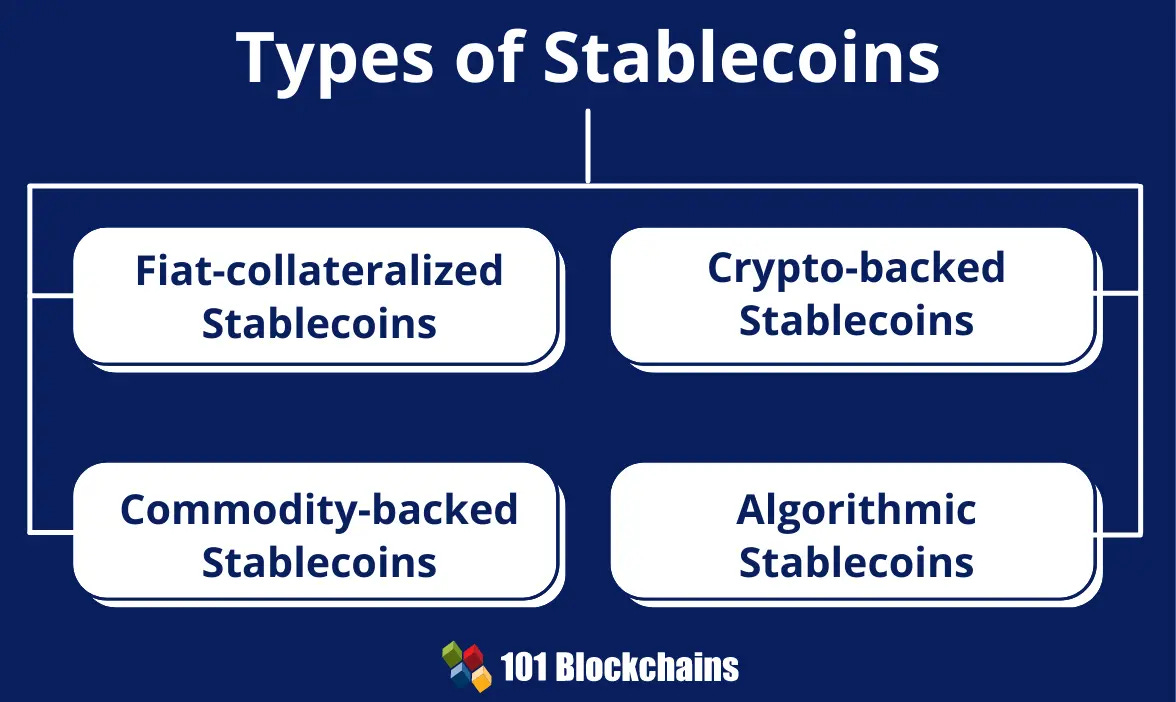

We have different classes of the off-chained collateralized stablecoins which are;

1. Fiat Collateralized stablecoins

2. Commodity Collateralized stablecoins

Fiat Collateralized Stablecoins

Fiat-backed stablecoins are the most used and most common stablecoin in the crypto ecosystem which maintains a fiat currency reserve, such as pounds or U.S dollar. The idea behind fiat-backed stablecoins is that for every unit of fiat, a dollar of stablecoins should be created. Meaning that there should be an equal ratio of fiat currency in reserve for the stablecoin to ensure its peg is maintained. There are other stablecoins that are pegged to the euro, Japanese yen, and other major currencies.

Tether, being one of the first stablecoins, was created in 2014 and has since kept rising to the highest capitalization as it has occupied the 4th rank among all cryptocurrencies and is the largest stablecoin by market cap. It has also been the focus of regulatory scrutiny due to its alleged affiliation to bitfinex and because of its history of opaqueness regarding its collateral.

USD Coin (USDC) is another popular stablecoin. USDC is managed by Center, a consortium created by the Circle, which includes members like Coinbase and Bitmain. USDC is a private company that is not to be mistaken with a central bank digital currency (CBDC). Center intends to transform the global financial landscape, by connecting every person, merchant, financial service, and currency on the planet. Their website states that they are backed by “fully reserved assets”. Circle is known for their transparency in sharing what assets back their coins.

Other fiat-backed stablecoins include BUSD, True USD and PAX.

Commodity Collateralized Stablecoins

These are stablecoins that are backed by other kinds of interchangeable assets such as gold, precious metals, oil, and real estate. These stablecoins give investors the opportunity to trade tangible assets, along with the ability to accumulate value over time. As many of these types of collateral are commodities, they are hard to transport and store. Some argue that these commodity-backed stablecoins offer the best of the physical and digital worlds. It gives investors the opportunity of investing in these commodities by making them more accessible.

One of the most common examples of commodities-backed stablecoins would be the PAX Gold, which is a digital asset. Each pax token is backed by one troy ounce of a 400 oz gold bar.

Stablecoin Risks

Stablecoins are affected by the health of the asset they’re pegged to. If the value of the USD is debased, it affects the value of USDT and other off-chain collateralized stablecoins.

Regulation always poses a risk with these centralized, off-chain collateralized stablecoins. The US Securities and Exchange Commission (SEC) can have a huge influence on the value of an off-chain collateralized stablecoin because of its ties to the US government. For example, Basis, a non-collateralized stablecoin that raised $133 million in December 2018, was forced to shut down and return the funds when regulatory guidelines made it clear that it could not avoid being categorized as a security under US Securities law.

There's always counterparty risk when it comes to off-chain collateralized assets. If the company's cash reserves don't exist, the value of the stablecoin will spiral downwards. Users should take note of transparency reports. Some stablecoins like TrueToken and the Winklevoss Gemini Dollar produce these regular transparency reports to ensure users that they have the assets that back their tokens.

Price attack(price manipulation attack) is also a risk on stablecoin, often known as secondary market manipulation. Since the attack on Tether in October 2018, A crypto analyst known as Steven has been following developments in the market and has projected that further attacks on stablecoins would become more common.

Stablecoin Basics

Author: Shame

|

Crypto-collateralized Stablecoins

Crypto-collateralized stablecoins, like the name suggests, are stablecoins that are backed by on-chain crypto assets. These assets could be coins like Ether (ETH), stablecoins such as USDT & USDC, or even LP tokens and other yield-generating tokens. Unlike fiat-collateralized stablecoins which are issued by a central entity, crypto-collateralized stablecoins are decentralized, meaning they’re minted (created) by users that deposit crypto-collateral into a DeFi protocol.

For example, the most popular crypto-collateralized stablecoin currently is DAI, which is minted by users who deposit assets like ETH and USDC as collateral into the Maker protocol. In doing so, users effectively take out a loan in DAI by collateralizing their crypto assets.

Since crypto assets are generally volatile, crypto-collateralized stablecoins are over-collateralized to ensure that they maintain their peg to the US dollar. For example, to mint $100 of DAI, you need to deposit more than $170 worth of ETH as collateral. This ensures that there are still enough assets to back DAI’s peg if ETH crashes in price.

Strengths

Trustless

Permissionless, censorship—and regulatory—resistant

Due to the decentralized nature of how the stablecoins are minted and governed (through DAOs), crypto-collateralized stablecoins are generally resistant to censorship and government regulation. This means that:

No one can stop you from using these stablecoins

It’s very hard for governments to shut down these stablecoins

Weaknesses

Difficulties with Maintaining the Peg and Tradeoffs to Overcome It

For example, Maker introduced their Peg Stability Module, which allows users to swap other stablecoins (mostly fiat-collateralized) directly for DAI instead of taking out a loan by depositing crypto-collateral. Along with this, they’ve also introduced fiat-collateralized stablecoins such as USDC and GUSD as allowed collateral types for DAI. This reduces the friction involved in minting DAI and helps DAI maintain its peg. However, DAI also has to take on the counterparty and regulatory risks of these centralized stablecoins. If USDC or GUSD were to lose their peg or get shut down, DAI’s price peg would also be affected.

Capital Inefficient

Capital efficiency in this context refers to the amount of collateral that must be locked up to back a stablecoin. Crypto-collateralized stablecoins are the least capital efficient type of stablecoin because they need to be over-collateralized. To mint $1 worth of DAI, you’d need approximately $2 worth of ETH (or even more if you want to play it safe to protect yourself against liquidations).

Algorithmic Stablecoins

This is the most complicated type of stablecoin out of the three. To understand what algorithmic stablecoins are, let’s first define what an algorithm is. An algorithm is a list of instructions that a computer uses to complete a certain task. The task that needs to be completed is usually repetitive. As the name might suggest, algorithmic stablecoins take advantage of algorithms that maintain the price peg. They do this by modulating the supply of stablecoins through various mechanisms. The most adopted mechanism used by algorithmic stablecoins is seigniorage.

Seigniorage Algorithmic Stablecoins

Seigniorage is the difference between the face value of a currency and the cost to produce it. For example, the seigniorage for a $10 USD bill would be $10 minus the material and printing costs associated with producing that bill. If the cost to produce a $10 bill is $0.01 the seignorage of that bill is $9.99 USD.

This concept has been applied to algorithmic stablecoins by creating a mechanism that allows people to mint or burn stablecoins at the cost of $1. When the stablecoin’s price fluctuates away from $1, the seigniorage creates an arbitrage opportunity that once acted upon, pushes the stablecoin back to $1.

The most popular example of a seigniorage algorithmic stablecoin can be seen In the Terra ecosystem (blockchain), where there are two main tokens that are related to each other: LUNA (the native coin of the Terra blockchain, analogous to ETH), and UST (the native stablecoin of the Terra blockchain).

Each UST can be minted by burning $1 worth of LUNA. In the event that UST loses its dollar peg and is more than $1, people who hold LUNA are incentivized to burn LUNA to mint UST, then sell that UST to profit from the seigniorage. It costs $1 worth of LUNA to mint 1 UST, which is currently worth more than $1, so if they sell the UST in the open market, they would make an arbitrage profit. The selling pressure pushes the UST price back down to no less than $1, as once UST is back at $1, the seigniorage process would no longer be profitable.

On the other hand, $1 worth of LUNA can be minted by burning 1 UST. When UST is below $1 (e.g. at $0.95), people would be incentivized to burn UST and reduce its supply to mint LUNA, profiting from the seigniorage of LUNA (a profit of $0.05 would be made for every UST burnt. The supply contraction of UST pushes its price back to no more than $1, as once UST is back at $1, the seigniorage process would also no longer be profitable.

From the two-way seigniorage mechanism, it’s clear that if it works as intended, the UST price would always reach an equilibrium of $1.

Strengths

Trustless

Just like crypto-collateralized stablecoins, algorithmic stablecoins do not have counterparty risk. The seigniorage mechanism is defined by audited, open-source, smart contract code that can be viewed by everyone.

Capital Efficient

Weaknesses

Untested and High-Risk

Many algorithmic stablecoins have gone and passed. Stablecoins such as the Empty Set Dollar (ESD) relied on incentives that were unsustainable to keep its price peg, and have lost most if not all of their value (ESD is now trading at <$0.01).

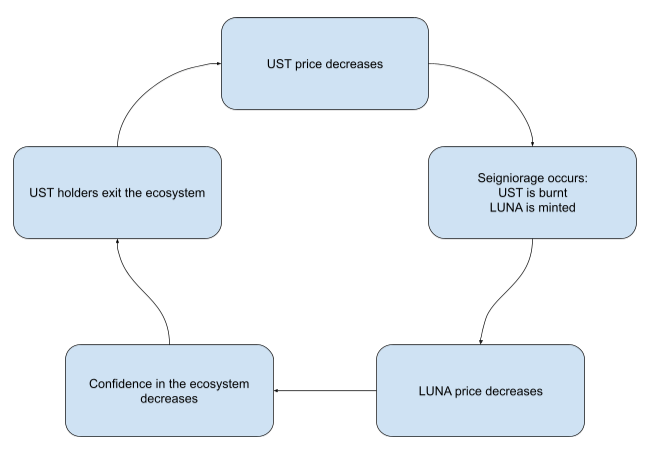

The most recent and largest algorithmic stablecoin collapse was UST on May 9th, when a large sell-off into the open markets pushed its price to $0.70. As mentioned above, a depegging below $1 would trigger arbitrageurs to burn 1 UST to mint $1 worth of LUNA, reducing UST supply to push its price back up to $1. However, Terra stakeholders began to lose confidence that UST would regain its peg as the amount of seigniorage would begin to hyperinflate LUNA’s supply. This resulted in the negative feedback loop shown below.

Similarities With Fiat Money

Following the collapse of UST, there has been a fair amount of criticism against algorithmic stablecoins and whether they are actually ‘stable’ at all. The confidence and faith required to keep the stablecoin pegged to a dollar has resulted in comparisons of algorithmic stablecoins to fiat currencies, which also aren’t backed by any hard assets. In the case of UST, Terraform Labs was analogous to the U.S. Federal Reserve, but without the virtually unlimited amounts of capital that would be needed to maintain the peg of a faith-based currency.

The Future of Stablecoins

Despite the volatility that the crypto market is known for, the growth of the stablecoin market is unphased by this unpredictability. Market capitalization growth is at an exponential pace despite the extremely low adoption outside of the crypto industry.

Let's break down what activities make up the different phases of adoption as we focus on the innovators, early adopters, and early majority.

Innovators

Trading pairs for crypto exchanges

Transfer funds between exchanges and wallets

Early on, stablecoins were introduced as a method to peg value against assets outside of the crypto ecosystem, such as the US dollar, so that crypto exchanges could offer a digital asset for trade settlement dollar. While some traders continue to trade purely crypto-asset pairs, such as BTC and ETH, one could argue that offering the dollar peg opened digital asset trading to a broader market.

Being able to have a digital form of dollar-pegged currency also opened the ability for traders to transfer dollar-based assets between exchanges and wallets, laying the crude foundation for stablecoin-based commerce. For the first time ever, crypto users were using digital dollars in a literal sense.

Early Adopters

Remittances and cross border business to business payments

Payroll

Participation in international capital markets

Decentralized finance adoption

With the ability to move dollar-based digital currency using blockchain, future use-cases began to take hold. In Southeast Asia, businesses have started to incorporate the use of stablecoin transfers between suppliers in different countries to provide a cost-effective and quick method of sending funds across borders.

New end-users were attracted to the stablecoin market as a method of sending funds to family members internationally. Often banking fees are expensive, and the time to send funds spans many days making the process of sending money unnecessarily difficult and slow. Crypto has enabled a new solution where we have seen the digital remittance market valued at $15 billion in 2021, with a total global remittance market of $701 billion.

As the growth of decentralized autonomous organizations takes hold, the need for digital payroll has become a key requirement. If the organization is on-chain, then it only makes sense to run the treasury and payroll in this fashion. Early adopters of the crypto payroll system are from the Web3 world.

With the introduction of decentralized finance, there formed an opportunity to democratize access to truly international capital markets. For regular individuals, this means that organizations can store their stablecoins for yield that is often better than bank rates or use collateral to get loans at competitive rates.

Without stablecoins, there would be no pegged currency to transition in and out of on the blockchain. On centralized exchanges, you could argue that stablecoins aren’t required, but when using the blockchain, there is no other way to represent fiat assets.

Early Majority

Merchants accepting stablecoin payments

Stablecoins are used to transfer money between people

We are starting to see the roots where different fintech companies integrate blockchain payment rails into point-of-sale technologies and end-user products such as credit and debit cards. In order to drive adoption, these technologies will be key in making stablecoin use easy and transparent to the end-user.

Once the merchant infrastructure is in place, the transfer of assets between individuals will quickly follow as trust is built with these new payment solutions. Again, it will come back to user experience and establishing a trust to push stablecoins further along the adoption curve.

Where Are We?

The early adoption phase has occurred among innovators, and we are starting to find ways of “crossing the chasm” as we see solutions that are more deeply integrated with business and individual needs. As we build a track record of trust and improve the user experience, the adoption of stablecoin technology will transfer to the early majority.

Centralized Finance

Institutional Adoption

Institutional adoption has been hindered by the lack of regulatory clarity and lack of adoption amongst their peers. With increased institutional exposure to decentralized finance, we can expect to see stablecoins on their balance sheets getting yield alongside other digital assets.

As payment networks evolve, they may opt to transfer funds as stablecoins between consumers, businesses, and government institutions, and this is likely to spur the use of digital wallets and the need for institutional custody of digital assets.

Exchange Asset Diversification

Centralized exchanges are diversifying assets that are available as a way of de-risking their markets from issues that may arise if a stablecoin loses its peg or encounters a significant event that disrupts the operation and trust in the token. USDC has been the most successful at displacing USDT, but UST is making inroads into the centralized exchange ecosystem.

In order to keep users on their platform, many centralized exchanges offer programs to deposit stablecoins for yield. While the experience is much like decentralized finance, the underlying method of getting yield is not.

DeFi Trends

Capital Inflows to DeFi

Growth in DeFi and stablecoins has been on a macro uptrend. Decentralized finance has been more open than centralized exchanges and has offered the widest range of stablecoin offerings to diversify into and get yield from. Users in DeFi choose stablecoins as a safe haven in bear crypto markets or from the general volatility in the crypto market.

High Yield Protocols

Some of the newer protocols on the market entice users with high APY on their investments to attract capital to build out the protocol further and help it mature. While there is merit in this approach, specific projects can get a great deal of attention over safety concerns.

For example, the Anchor protocol is currently offering variable interest of almost 20% on Terra’s UST. There are ways to further leverage your investment up to 100% interest but there is an underlying risk. Further to the argument is the robustness of the asset peg UST uses if a sudden shock to the market happens.

The above is an oversimplification of the bear argument, but until proven over time, there will be passionate debates over new protocols and stablecoins. Most notably, it will be about stability as that is the core function of the asset and the trust that the community has around it.

Stablecoin Trends

Inflation Pegged Assets

To further innovate on this token idea and the idea of creating an asset that combats inflation was introduced called the Frax Price Index, or FPI. Using a similar design to the FRAX stablecoin, the value of the token is controlled to match inflation.

Although the asset protects against inflation, there are questions as to how the asset would be used in the context of DeFi to get yield. Since it is a new space, there will be more work ahead to prove the utility of these tokens.

Institutional or Private Stablecoins

Institutions may also opt to create their own private stablecoins for their own transactions. While end-users may not have direct custody of these assets, they may be used to modernize back-end banking processes, especially when involving multiple parties that don’t necessarily fully trust each other.

Fractional Reserve

An area that has not been fully explored in stablecoins has been the idea of fractional reserve stablecoins. While we do rely on a fractional reserve banking system for traditional fiat currencies, the implementation of a fractional reserve cryptocurrency has yet to be implemented.

The idea of using institutionally issued fractional stablecoins is not unheard of and, in some circles, considered a superior economic instrument to traditional stablecoins. This viewpoint is founded upon the fact that unstable assets such as Bitcoin will not be used as a method of transferring value because the value of the asset has so much volatility. The vision is to have fractional reserve banks providing innovative stablecoin payment solutions offered by these banks.

Central Bank Digital Currencies

CBDCs can be a complex subject because there are many different interpretations as to what that could be in terms of scope and implementation. For example, a CBDC may require its own blockchain, which may not necessarily be public or decentralized. The CBDC may not have privacy and could have censorship controls on the network and currency.

Because of all the considerations, many western nations are still evaluating the position of choosing to implement a CBDC or not. To traditional finance, the advantages of a central bank digital currency have doubts, and that is also compounded by disagreement in the digital finance world.

One potential narrative that hasn’t played out is the potential to influence by essentially establishing a digital economy for facilitating more than consumer transactions involving cross-border trade. More notable is the ability to send monetary aid to other countries around the world in a few minutes. Crypto may disrupt the SWIFT banking system as nations build out alternate economies based on their CBDC.

China most notably has moved quickly to deploy its e-CNY digital currency prior to the 2022 Winter Olympics. North America, Europe, and the Middle East are areas to watch for new CBDC implementations.

Risks

Custody

The vast majority of stablecoins offer many different custody options from using centralized exchanges to cold wallets. However the assumption that you can have custody over the stablecoin isn’t a given with every design. For example, a financial institution may use a stablecoin to conduct transactions on your behalf but the actual custody of the stablecoins is retained by the institution.

Regulation

The crypto industry is seeking consistent and clear regulation across many different jurisdictions that span not just countries but smaller jurisdictions such as states and provinces, which further complicates compliance. Modernization of regulatory frameworks needs to recognize the unique properties of digital assets while understanding that many of the products that exist are designed to be truly decentralized being trusted at an international scale.

Until laws are reworked, or new laws are introduced, the crypto industry still faces a degree of uncertainty until more clarity is in place. The crypto industry is more advanced these days, and lobby groups are more common to advocate for the use of digital assets and finance.

Governance

Compromise of the stablecoin can be caused through a failure in governance to act in the best interests of the stablecoin. If the coin has treasury reserves that are managed in secrecy and do not have transparent audits can be a concern for holders as this can be viewed as being less transparent than central banking.

Crypto collateralized stablecoins offer transparency into the governance and treasury but if they are using on-chain governance it is possible to game the governance model and effectively take control of the protocol managing the stablecoin treasury. On-chain governance has been exploited with devastating effects bringing attention to the due diligence that needs to be taken with all on-chain aspects of the stablecoin.

Smart Contract

Because in the world of smart contracts the idea that code is law the stablecoin behavior is governed by the smart contract that defines it. Using smart contracts brings a unique set of risks to the table ranging from treasury management to censorship.

Centralization Risk

Because certain stablecoins have the capability to censor users the use of them may not be desirable as this is the same effect as having your assets frozen. Fiat collateralized stablecoins tend to have a corporate presence and have a censorship mechanism built in which has been used most notably with USDT and to a lesser extent USDC.

Treasury Management

The smart contract controlling the coin can be compromised in such a way that the treasury could be mismanaged. This manipulation could include the hyperinflation of the currency or possibly the removal of treasury funds.

Oracles

For stablecoins backed by crypto assets it is important for the smart contract to get timely and accurate data about asset prices so as to maintain the peg. Not all Oracles are equal and some can be more experimental than others. Understanding the dependencies on Oracles helps us understand the maturity of the stablecoin and potential risks that may exist to maintain the peg.

Central Bank Denominated Currencies

Depending on your jurisdiction, the government may opt to ban certain digital assets in favor of government-issued tokens. China most notably banned crypto before introducing the e-CNY. While it has to be seen if this is a larger trend amongst jurisdictions, there is a risk that governments may opt for technology managed by the state.

Institutional Tokens

Institutions may decide that they do not want custody of public forms of crypto but want to capitalize on the strengths of crypto by using private blockchains and tokenized assets defined by an institution or group of institutions such as banks.

In the case of J.P. Morgan, the JPM coin exists on a permissioned blockchain that they control as a means of conducting payment and cross-border trade. Some institutions might prefer this solution, but likely will not disrupt the larger market of tokens based on permissionless public networks.

Market Volatility

Over the course of stablecoin history, many different tokens have failed to maintain their peg to the US dollar. As a result, there is a sense of doubt that has been cast over the industry. To some investors having a proven track record that the pegging mechanism can be trusted in times of uncertainty is often paramount and newer assets may have trouble gaining that trust.

Protocol

Protocol risk has been something that has taken more of an interest as users chase high returns on their assets. For example, users are often chasing the highest returns in DeFi for their assets, and new protocols such as Anchor have attracted an enormous amount of capital as a result.

The bear case is that the interest rate being offered is unsustainable and will have to be lowered, causing a massive sell-off of UST assets. The argument is that change in the protocol could end up destabilizing the very stablecoin it uses and possibly pose a risk to the broader crypto ecosystem.

Stablecoins Will Evolve

Stablecoins is seen as an asset class with the potential to be as large as other major digital assets such as BTC and ETH. The challenge at this point is to temper expectations with where we are in the adoption of stablecoins as part of everyday life if we think back to Crossing the Chasm. Added to the mix are more modern crypto backed stablecoins that use algorithms to manage the pegging mechanism.

Some of the more innovative stablecoin designs will experience setbacks or outright failure as different models are used to provide pegged assets. Many new projects will offer high yields to attract capital but the fundamental properties of the stablecoin and how yield is being produced should be analyzed up front.

Most stablecoins have a limited history and with lack of legal clarity stablecoins has been a hot topic for debate in both crypto and traditional finance. Even with the disagreements payment providers and institutions are evaluating and building solutions using crypto payment rails to optimize what is a multi-party transaction using conventional means.

It is expected that clarity will be reached for stablecoins with centralization and therefore more easily regulated which should be the green light for institutional offerings. But there are so many broader questions about CBDCs and the role they will play in the crypto ecosystem. Will governments lean toward digital currencies that they can control or will the broader market of stablecoins be allowed to co-exist?

There will always be an incentive for politicians to regulate in the name of consumer protection and that is a strong theme in the rhetoric that is being used. But as governments grapple with the concept of digital money there will be stablecoins that aim to be fully decentralized and immune to regulation. Once again regulators and the crypto industry are at another important junction where adoption needs to be met with well thought out regulation.

While different countries are on different paths to regulation, many are looking to the efforts happening in the United States as the Biden administration issued an executive order to evaluate cryptocurrencies. Many are anticipating legislation to follow but one point that many overlook is the examination of a CBDC. Will the United States follow China into creating digital currency or will the United States refrain?

The idea of CBDCs being needed is a debated topic but where the value lies is influence. Being able to optimize inter-bank commerce is great but having your own way of transferring value to foreign governments (i.e. aid) is enormous. The economic landscape is changing with currencies and the US dollar is likely headed toward decline as treasuries diversify. Not having a digital US dollar CBDC isn’t the end for the US dollar, but foreign currencies may go digital earlier to differentiate themselves.

Actions steps

Project Releases 🎉

Hand-picked updates to help you understand the current state of the DeFi ecosystem

Robinhood Wallet

Multi-chain, self-custody wallet

Access DeFi protocols

Trade NFTs

Coinbase Wallet Updates

Web3 browser built into the Coinbase app

Coinbase released a semi-custodial wallet where users have keep some key material and Coinbase keeps the other to help you recover your funds if you lose/mismanage your keys.

Secure Multi-Party Computation (MPC) wallet that supports using dApps, DEXes, storing and trading NFTs, voting in governance, yield farming, web3 games, etc.

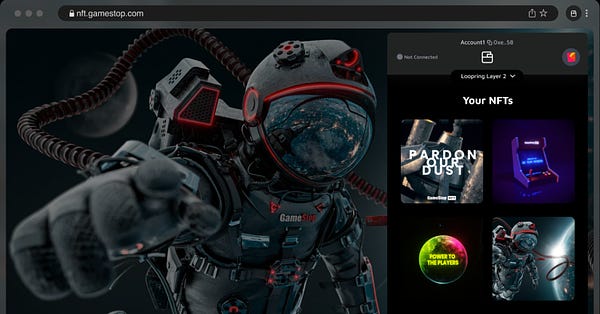

GameStop Wallet

Layer 2 browser walletpowered by Loopring’s zkRollup technology Buy crypto with Apple Pay or credit/debit cards directly on L2

Send and receive tokens like ETH, ERC-20, ERC-721, ERC-1155

Swap between Loopring L2 and Ethereum L1

Alluvial: Liquid Staking for Institutions

New liquid staking protocol for institutions

Backed by Coinbase Cloud and Figment

Tracer Perpetual Pools V2

Launching Perpetual Pools V2 on Arbitrum

No minimums to get into leveraged position (enter or exit at any size)

Plug in a price feed to Tracer and create a perpetual pool for that market

Long-term tokens to avoid volatility decay

Quiz to earn POAPs and learn about perpetuals

Terra 2.0

Terra is being resurrected as Terra 2.0

Re-launching as an L1 withoutthe algorithmic stablecoin Old chain: Luna Classic; New chain: Luna

New token distribution after the Luna collapse

Sense Finance: Ethereum Bonds

Defining a new risk-free rate of capital using “The Internet Bond” (ETH)

Earn trading fees by LPing wstETH

Lock in fixed rates with sP-wstETH

Speculate on Ethereum yield rates with sY-wstETH

View yield curve of Ether for 2 months, 6 months, 1 year, and 5 years

Immutable Launches Protocol Fees

Immutable protocol fees are live

Capture the value of activity on the Immutable network

Maker x StarkNet DAI Bridge Goes Live

DAI can be transferred between Starknet and Ethereum

New MEV Explorer Tool

Look at past MEV opportunities on Ethereum, Polygon, and Arbitrum

🐦 Chirping Birds

🔥 and 🧊 tweets from across the DeFi ecosystem

superphiz.eth 🦇🔊🐼 @superphiz

Token Terminal @tokenterminal

🚀 Tokenomics 101: Fair Launch

Many new projects are launching with a tokenomics strategy that they are calling a “fair launch”, but is this just a marketing ploy or is a fair launch truly possible? Tokens are the foundation of almost every project, some tokens give project members governance rights, others access to protocol revenues, others participation in gated communities, and some tokens do all three.

What is a fair launch?

A key theme of fair launch allocation of these tokens is distribution. Distributing them to stakeholders in a way that is unbiased, or through a fair launch, is crucial to gain support from the community. A common misconception is that all tokens must be available to the public, but this is not necessarily the case. For example, take one of the first fair token launches by Yearn Finance where no founding member received tokens for their early contributions.

Tokens should be distributed to both core members and the community at large based on their impact on the project's success. This implies that it is perfectly fine to reserve tokens for key insiders, such as the founding team or advisors, as long as it aligns with the project's values and mission.

The purpose of a fair launch is to give tokens transparent price discovery in order to encourage the project to grow organically and reward stakeholders for the risks they take while working on the project. While this might seem like a simple concept, project complexity makes the design of each fair launch unique. While there are many potential strategies for token distribution, one simple approach is to identify all the project stakeholders and their incentives to help the project succeed. In order to better understand the concept, here are some examples from real fair launches.

Thanking Initial Community

By holding an airdrop, 30% of the total supply of all BANK tokens were distributed to early community contributors that either held POAPs, donated through Gitcoin Grants, owned Bankless merch, or were premium Substack members. This part of their fair launch was to thank the early contributors for their support and give them an incentive to stay involved in the community that they helped create.

Aligning Future Contributors

Another example can be seen with Vesta Finance, which held a portion of their launch tokens to incentivize the growth of their protocol. Vesta is a layer 2 lending protocol that creates the maximum amount of liquidity against their collateral without paying interest. With this in mind, Vesta left 11% of their initial token allocation for future core contributors and 47% in their community treasury. With a vesting period of two years and a six month cliff, the core contributor allocation ensures strong developers can devote more time to developing the protocol by giving them a stake in the protocol's success. Additionally, their allocation to the community treasury incentivizes community contributions and partnerships, fueling the protocol’s overall operations and development. This large allocation back to the community is a strategy for Vesta Finance to capture the capital that their token has created and give it back to their community to fuel the future development and success of the protocol.

Recognizing Past Users

One of the most ubiquitous examples of a fair launch was Ethereum Name Service when the team retroactively awarded users for early participation in the application. ENS is a protocol for mapping human-readable strings to wallet addresses on the Ethereum blockchain. Without initial users believing in and buying ENS handles there would be few reasons for others to join.

In recognition of the support that early users provided for the protocol, ENS took 25% of their initial total token supply and performed a retroactive airdrop per account that interacted with the protocol, and even took steps to reward power users by creating a 2x multiplier for users that set their Primary ENS Name (aka Reverse Record).

Now that users have governance power, there’s a financial incentive to give feedback and engage in discussions about how to improve the protocol.

Attracting Future Users

Lastly, let's take a look at Curve Finance and how their protocol’s launch strategy has incentivized future users. Curve is an automated market maker that uses proprietary algorithms to ensure high liquidity, low slippage, and low fee transactions for ERC-20 tokens. One of the essential qualities that keep the protocol healthy is having adequate liquidity. That is why their token distribution allocates 62% of the total supply of $CRV back to their community’s liquidity providers. They came to the conclusion that it was in the protocols best interest to give back the financial and governance rights of their protocol back to their most important users.

Where are fair launches headed?

Like we mentioned early, there is no exact formula for a “fair launch” but hopefully these gave a good understanding of how one might approach one. Ultimately, project teams should listen to their community to understand who their key stakeholders are and discover what aligns these stakeholders with the project's goals.

⚠️ Security Scares: Beanstalk and UST

The music never stops in DeFi, even as protocols and blockchains are attacked or facing bank runs. The last month in particular resulted in billions of dollars being siphoned into hacker wallets or taken out of the market entirely, in addition to the general downturn in markets. The past month had been a notable one in the realm of attacks on stablecoins, starting things off with the governance attack on Beanstalk ($BEAN) and the death spiral of Terra's native tokens, $UST and $LUNA.

Beanstalk - The Governance Attack

Beanstalk is a decentralized stablecoin protocol that suffered a governance attack on April 17. This was performed through flash loans that allowed the attacker to have an outsized number of governance tokens, enough to approve two malicious governance proposals that were prepared by the attacker in the previous day. After the dust settled ~$77M in assets were stolen at the time of the attack, where 24,830 WETH was sent to the attacker - and ultimately through Tornado cash - and $250K USDC sent to Ukraine's government's donation address.

Key Safety Takeaways

Do not put in more than you are willing to lose into new protocols, even if they have assurances such as security audits.

Hedge your bets and spread you risk; don’t go all-in on one stablecoin protocol if you are providing collateral or just holding the token.

Do the project owners understand the risks involved in governance if a party, or many coordinated actors, gain outsized voting power through flash loans, bribes or other means?

Terra - The Death Spiral

Terra was the programmable blockchain that powers two tokens native to its ecosystem: UST, an algorithmic stablecoin, and LUNA, the native token used in staking, governance and paying for transactions on Terra. Both tokens work in tandem through a mint and burn mechanism so that more LUNA can be printed or removed from supply to support UST's peg to the US dollar. BTC and AVAX were also added as reserve currencies that could be used to restore UST's peg, should a large enough downtrend in UST's price arise.

Starting on May 9, the peg of UST and the price of LUNA fell due to weak market confidence in not only crypto, but particularly UST. This led to the hyperinflation of LUNA due to the increased supply needed to support UST’s peg through arbitrage. Many events transpired over the subsequent days that resulted in tens of billions of dollars being cleared out of Terra’s ecosystem of tokens and projects.

Key Safety Takeaways

With UST being another example of algorithmic stablecoins not being able to face negative market conditions, take extra caution should you consider purchasing similar ones down the road unless they have a significantly different design or are collateralized by relatively safer assets

Attracting unwanted attention may come back to bite a community. Terraform Labs' co-founder Do Kwon and the “Lunatic” community drew not only the ire of those within the crypto ecosystem, but also those outside it that were waiting for an opportunity like this to not only short the ecosystem but use Terra as an example for why regulation is needed. Watch out if you own a token with a team and community so bullish that they end up painting a target on the tokens' back, as little sympathy will be given in the aftermath. Many new FinTech companies were being built on top of Terra, that not only introduced great onboarding and payment UX but also the technical risks inherent in programmable blockchains. Always read the fine print and know how your money is being stored and used, even if the veneer looks as polished and trustworthy as you would find in TradFi.

Moving Forward

Both of these events show how important it is for all protocols and blockchains to exhaustively consider all attack vectors or ways that markets could negatively affect the health of their projects.

Stablecoins in particular will continue to be a high-profile target for those wanting to damage the reputation of the crypto space, as their wide adoption will naturally lead to questions about regulation should they fail to remain pegged to their target currencies. These projects need to act accordingly and make sure they are not used as examples in the public media and hearings about why this space is dangerous.

🛠 BANK Utility (BanklessDAO token)

⚖️ Balancer

Balancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools.

🍣 SushiSwap

SushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity.

⏛ Rari Fuse Pool

The Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool

🦄 Uniswap

The Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity.

🪐 Arrakis

You can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards.

♛ Stablecoin Tactics

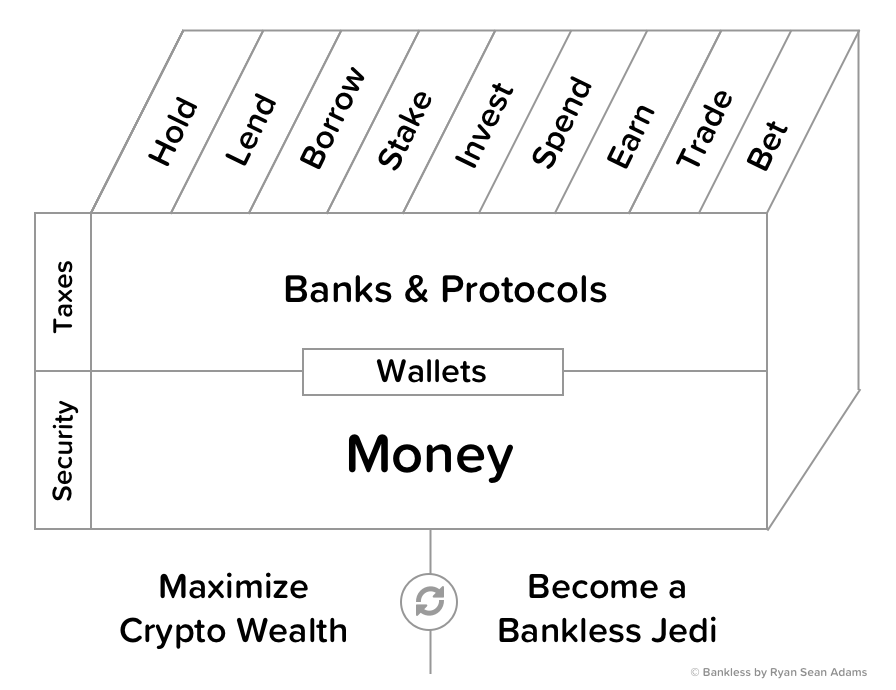

Going Bankless: The Ultimate Guide

How to build a portfolio like a crypto native

5 ways to earn fixed-rate yields on DeFi

How to borrow and lend any token

How to earn yield with Frax Finance

🏆 BanklessDAO Cryptocurrency Challenge

Alright bDAOers this is the Cryptocurrency Challenge brought to you by the DeFi Download Newsletter. Imagine you’re holding 5k BANK hovering around $0.025, and you’re ready to invest it on mainnet.

WHAT DO YOU DO?

Our mission at bDAO is to get more swimmers into the Bankless waters, and this challenge is an invitation to dip your toes. It’s fun to compare investing talents across guilds while building self-sovereignty. AND….

The winner takes home 5000 BANK!

The form

Option 1: BANK

. Your strategy is clear. HODL. Option 2: BANK ACCELERATED

: Deploy your BANK on Rari Pool #182 to leverage for more BANK. And more BANK. Option 3: BANK MINOR

: Pool portfolio 50%/50% BANK/Stablecoin. Keep half your BANK, and swap the other half for DAI or USDC. Option 4: Bankless DeFi Innovation Index (GMI)

: Hold a basket of high growth, early stage DeFi 2.0. Option 5: GELATO BANK/ETH POOL

: Deposit funds on Gelato to earn returns.

For the purposes of the Challenge, we are taking a few liberties to facilitate calculations and record-keeping. For example, Rari #182 has borrowing turned off, but we will turn it back on. We will confirm all methods in the mid-season update.

Get Plugged In

Event Highlights

Consensus 2022

🧳 Job Opportunities

Solidity Developer

Sr. Backend Engineer (Python)

Frontend Engineer (React/Typescript)

Executive Assistant (❌ technical)

Sr. Copywriter (❌ technical)

2D Graphic Designer

Quantitative Analyst

🙏Thanks to our Sponsor

Oasis.app

Oasis.app was born as the frontend to access Maker Protocol and create DAI. It allows you to borrow DAI, exchange your tokens internally and multiply the exposure to your collateral (among the 30 available cryptoassets). Oasis.app is now the most trusted entry point to the Maker Protocol. The long term mission is to allow users to simply and easily deploy their capital into DeFi and manage it in one trusted place.

If you liked this post from BanklessDAO, why not share it?

Older messages

Optimism Powers Crypto’s Newest Collective | State of the DAOs

Wednesday, June 1, 2022

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Forbes Influencer Launches Native Language NFT | MetaMask Fights Scams | Decentralized Arts

Monday, May 30, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

Permission to Vibe | BanklessDAO Weekly Rollup

Saturday, May 28, 2022

Catch Up With What Happened This Week in BanklessDAO

Decentralized Finance | Decentralized Law

Thursday, May 26, 2022

BanklessDAO Legal Newsletter

The Brave Pixel Artist Who Could | Decentralized Arts

Tuesday, May 24, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask