The Pomp Letter - Inflation Is Out Of Control

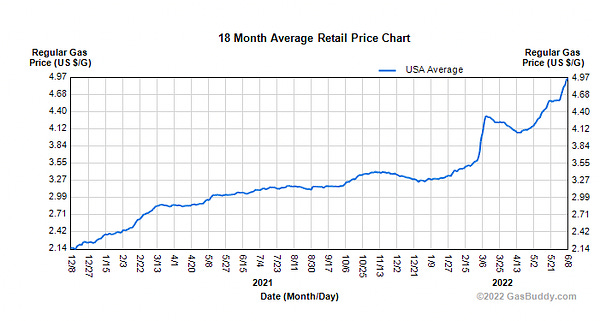

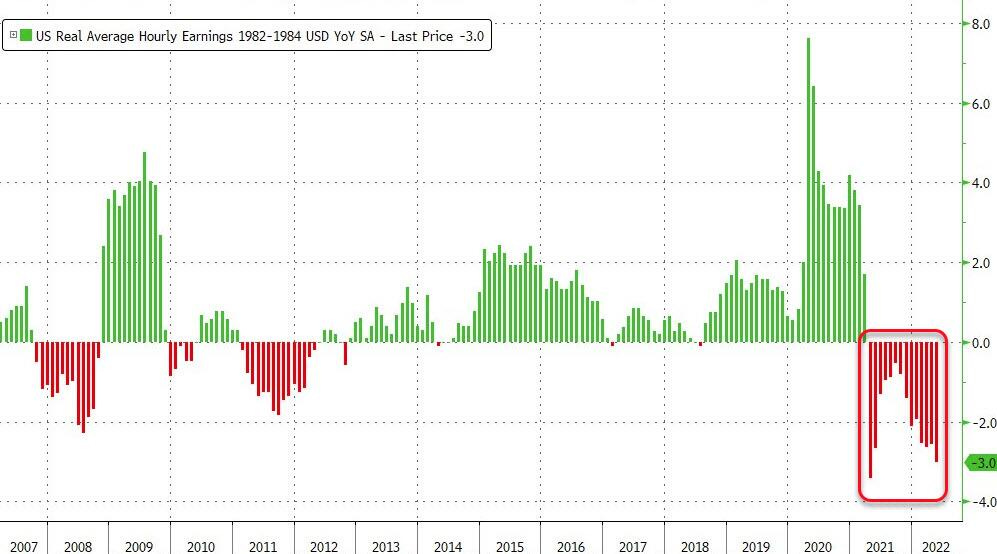

To investors, Inflation in the United States was reported at 8.6% this morning. This is the fastest year-over-year growth in over 40 years. The most concerning part of this report is that economists and market analysts believed that inflation had peaked in March at 8.5% and was going to start trending downward in April and May. We saw 8.3% in the April report, but the May numbers surprised these “experts” to the upside. Inflation hasn’t peaked and is continuing to accelerate higher. There is plenty of debate on why inflation is occurring. Is it undisciplined monetary and fiscal policy? Is it supply chain disruptions? Is it the Russia-Ukraine conflict? The economy is a complex machine, so each of these situations likely plays a role. Rather than debate how we got here, we need to be focused on what can we do moving forward. The average American family is getting decimated financially right now. The cost of eating food at home has increased 11.9% over the last 12 months. Gasoline is up nearly 50% in the same time frame. That is almost impossible for a family to withstand, especially when wages aren’t growing at the same rate.  But this data is not telling the full story. Take gasoline as an example — prices have doubled in the last 18 months. Speaking of methodology, many people may not realize that the last time inflation was this high in America, the methodology and calculation of the CPI metric was changed. In layman’s terms, CPI was historically calculated by simply measuring the increase in price of various goods over time. If an item cost $1.00 a year ago, and now it costs $1.10, the inflation reading would be 10%. Starting in 1980, and numerous times afterwards, the CPI metric began to change as the Bureau of Labor Statistics attempted to more “accurately” measure inflation. These changes included an assumption that people would stop buying expensive items during high inflation and swap them out for lower cost items. There is also a focus on incorporating changes in quality into the calculation. Regardless of whether you think these changes are good or bad, it is hard to see a world where the average American family is only experiencing the numbers that are being reported officially. This brings me to my last point. Wages in America have failed to keep up with the historic levels of inflation. In fact, the inflation-adjusted average hourly earnings of American workers has been negative for more than a year. The cost of goods and services are increasing, while wages are not keeping pace. This is disastrous for millions of families. These folks don’t want to take over the world. They simply want to build a life of happiness and financial security for their loved ones. Without the right education, the bottom 45% of Americans get financially damaged during these high inflation times. They have no investable assets and then live with 100% of their life savings in US dollars. The Federal Reserve is backed into a corner now. You have Q1 GDP contracting. Inflation hasn’t subsided even though the Fed has been increasing interest rates and conducting quantitative tightening. They don’t have many more options other than to simply put their foot on the gas. The Fed could try to accelerate the interest rate increases, both in speed and severity, along with accelerate QT. I’m not sure that they will do it, but there aren’t many other avenues to pursue. If the Fed does nothing, the real situation on the ground is not going to get any better for the average American. Inflation reports may start to look like numbers are falling, but much of that will be due to the base effect of increasing inflation starting last summer. People need help. Undisciplined monetary and fiscal policy created this mess. We just have to be careful that a continuation of bad decision-making doesn’t create an even worse situation. Hope each of you has a great day. I’ll talk to everyone on Monday. -Pomp If you are not a subscriber of The Pomp Letter, join 220,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. SPONSOR With Brave Wallet, you can buy, store, send, and swap assets. Manage your portfolio & NFTs. View real-time market data with an integrated CoinGecko dashboard. Even connect other wallets and DApps. All from the security of the best privacy browser on the market. Protect your crypto. Whether you’re new to crypto, or a seasoned pro, it’s time to ditch those risky extensions. It’s time to switch to Brave Wallet. THE RUNDOWN:Key US Senators Introduce Crypto Bill Outlining Sweeping Plan for Future Rules: CFTC Chairman 'Encouraged' by Bill in Congress to Give the Agency More Crypto Oversight: Marathon Digital Bitcoin Production Weaker Than Hoped in May: Circle’s Disparte Calls CBDCs ‘a Preposterous Idea’ in Digital Dollar Debate: Darius Dale is the Founder & CEO of 42 Macro, the leading macro risk manager adviser. In this conversation, we discuss the macro economy, what's happening in the financial markets, how Darius is looking at various metrics, and what you should be considering as you're investing your capital. USC Professor: The US Dollar Is Broken Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

The Key Data Driving Monetary Policy, Yields & Asset Markets

Wednesday, June 8, 2022

Investors, Below is a guest post from Caleb Franzen, senior market analyst and author of Cubic Analytics, exploring the key data driving monetary policy, yields, and asset prices. I keep hearing from

Podcast app setup

Thursday, June 2, 2022

Open this on your phone and click the button below: Add to podcast app

VIX Creator Wants GBTC Converted To ETF

Thursday, June 2, 2022

Listen now (7 min) | To investors, The Grayscale Bitcoin Trust (GBTC) is the single largest bitcoin fund in the world. With more than $19.25 billion in AUM, they hold over 640000 bitcoin inside the

Jerome Powell Is Being Called To The Principal's Office

Tuesday, May 31, 2022

Listen now (6 min) | If you are not a subscriber of The Pomp Letter, join 220000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, President

Ransomware Is A Growing Problem

Friday, May 27, 2022

To investors, There has been an increasing threat of cyber attacks on critical infrastructure in the United States. Remember the Colonial Pipeline attack or meat processor JBS Foods? This problem was

You Might Also Like

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 How to create a unicorn

Sunday, March 9, 2025

Vanta opens up about building a security game-changer. 🔐

Brain Food: Guts Over Brains

Sunday, March 9, 2025

Your reputation isn't just what people say about you—it's the position from which you make every move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏