DeFi Rate - This Week In DeFi – June 17

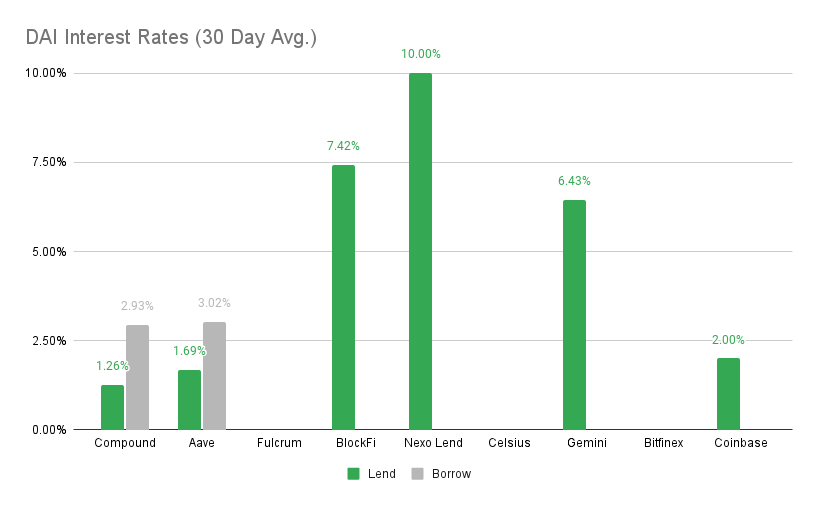

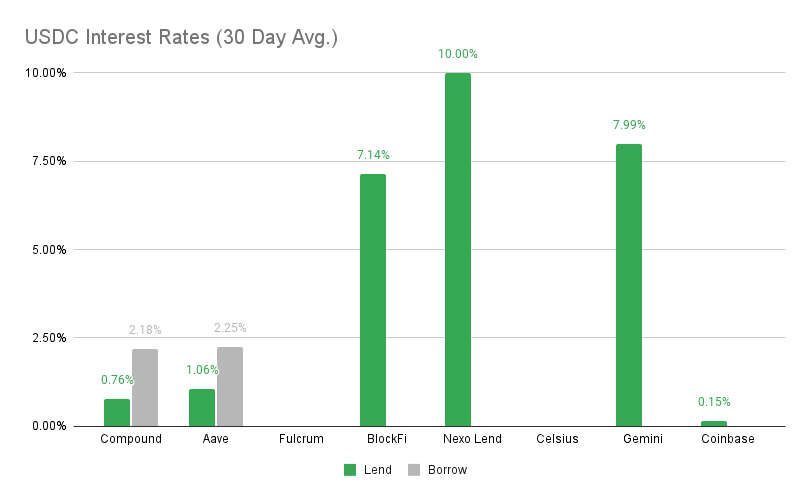

This Week In DeFi – June 17This week, Circle announces a new euro-pegged stablecoin, while Celsius and Three Arrows battle solvency issues – also involving stETH.To the DeFi community, This week stablecoin issuer Circle has announced the launch of Euro Coin (EUROC), a new stablecoin pegged to the euro. The new token will be available as of June 30, beginning as an ERC-20 token on the Ethereum network and expected to expand to other blockchains later in the year.   Centralized lending platform Celsius froze user withdrawals this week, citing turbulent market conditions. The move has triggered widespread concern throughout the ecosystem, due to the company’s known liquidity issues and Celsius’ significant size. CEO Alex Mashinsky says the company is working “non-stop” to address the issues, while regulators for several states have launched investigations into the firm.  Crypto hedge fund Three Arrows Capital (3AC) is the latest large-scale entity facing solvency issues, as the firm reportedly fails to meet margin calls on positions on multiple platforms. Sources say that FTX, Deribit and BitMEX have all liquidated 3AC positions, while the fund has reportedly hired legal and financial advisors to assist with plans to repay creditors.  Lido Staked ETH (stETH) continues to cause concern as its value deviates from ETH, while liquidity continues to dry up for the token. Both Celsius and 3AC have been recognized as large holders of stETH, which could result in somewhat of a self-reinforcing downward spiral for stETH if further holdings must be liquidated. The crypto market cleanse appears to have reached critical mass, as the cracks begin to show in over-leveraged and mismanaged firms across the industry. These are no small entities, either – first was TerraUSD, then Celsius, now Three Arrows. All three being multi-billion dollar mammoths whose issues are being felt across the entire ecosystem – affecting several other market participants along the way. The market has already witnessed an incredible sell-off with force, while some more pain may be yet to come as stETH price discovery develops. One key question arises for investors and traders alike: Has the market already oversold, pricing in potential damage? Or is the worst yet to be felt as the giants are yet to finish falling? Bitcoin and Ether are already down around 70% and 80%, respectively, from all-time highs with little to no relief in terms of short-term bounces. How much short-term downside is left? How many more insolvent projects are there left to be squeezed? Despite the pain, this market cleanse was likely necessary, needed to remove unsustainable and hazardous pieces from the crypto puzzle. Lessons will be learnt, systemic risks will cause their chaos then finally burn out. It may take some time – but we will be left with a cleaner, more honest and more resilient ecosystem for the next phase of web3. Among the rubble we will find new opportunities, true value and true innovation. The only question is, who will stick around to build it? Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.42% APY Cheapest Loans: Compound at 2.93% APY, Aave at 3.02% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Gemini at 7.99% APY Cheapest Loans: Compound at 2.18% APY, Aave at 2.25% APY Top StoriesDow Jumps 300 Points After Powell Says Fed Could Hike Rates By 75 Basis Points Again In JulyMastercard to allow 2.9B cardholders to make direct NFT purchasesRegulators Need To Establish Whether MEV Is Illegal: BIS ReportMetaMask, Phantom Fix “Demonic” Vulnerability in Browser WalletsStat BoxTotal Value Locked: $38.49B (down 21% since last week) DeFi Market Cap: $35.2B (down 28%) DEX Weekly Volume: $30B (up 172%) Bonus Reads[Ezra Reguerra – CoinTelegraph] – USDD stablecoin falls to $0.97, DAO inserts $700M to defend the peg [Samuel Haig – The Defiant] – MakerDAO Votes to Freeze Aave’s Direct Borrowing of DAI [Andrew Hayward – DeCrypt] – Solana’s New Gas Fees Won’t Make the Network 'Expensive,' Says Co-Founder [Andrew Rummer and Adam Morgan McCarthy – The Block] – Babel Finance suspends withdrawals, citing 'unusual liquidity pressures' If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – June 10

Friday, June 10, 2022

This week, Ethereum completed its Ropsten testnet merge, Wintermute unveiled its DEX aggregator and TronDAO decides to overcollateralize USDD

This Week In DeFi - June 3

Saturday, June 4, 2022

This week, Binance Labs raises $500M for a new web3 fund, Ethereum prepares for its testnet merge and the Lightning Network sets a new record.

This Week In DeFi - May 27

Friday, May 27, 2022

This week, a16z raises a record $4.5B for its fourth crypto fund, Terra 2.0 is on the way and StarkWare reaches an $8B valuation.

This Week In DeFi - May 20

Friday, May 20, 2022

This week, the Terra community votes on a hard fork, Robinhood announces a web3 wallet and Aave launches its social media platform.

This Week In DeFi - May 13

Friday, May 13, 2022

This week, LUNA and UST enter a death spiral, Aurora launches a $90M development fund and Bancor 3 goes live.

You Might Also Like

Bitcoin sell-side liquidity hits lowest level since 2018 fueling BTC rally

Tuesday, January 7, 2025

Whales quietly accumulate as sell-side liquidity hits five-year low, driving new BTC highs. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s 16th Birthday

Tuesday, January 7, 2025

Celebrating 16 years since the inception of a novel asset class ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How does Bybit's CEO Ben view memecoins, listing strategies, and the insistence on applying for a Hong Kong licens…

Tuesday, January 7, 2025

Recently, Bybit held an online media conference where CEO Ben Zhou and Shunyet Jan, Head of Institutional and Derivatives Business, shared updates on Bybit's current development and outlook. ͏ ͏ ͏

MicroStrategy buys 1,070 BTC as Saylor declares interest in Bitcoin advisory for Trump

Monday, January 6, 2025

MicroStrategy's Bitcoin investment soars, yet company flags risks of debt reliance and unstable crypto markets. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed…

Monday, January 6, 2025

US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank; Crypto.com launched Crypto.com Custody Trust Company ͏ ͏

Wu Blockchain Year-End Dialogue: Solana Foundation, TON Foundation, Dragonfly, OKX Ventures

Monday, January 6, 2025

In this episode, the guests engaged in an in-depth discussion about key events and trends in the Web3 space for 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

TGEs Look To Heat Up Crypto In 2025

Monday, January 6, 2025

Monday Jan 6, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR TGEs To Heat Up Crypto In 2025 Solana Remains Skeptical About AI Agents BTC Looks To Regain Momentum, DOGE & SUI Surge UK

Asia's weekly TOP10 crypto news (Dec 23 to Jan 5)

Sunday, January 5, 2025

The South Korean government has imposed sanctions on 15 North Korean individuals and one entity for their involvement in illicit cyber activities, including cryptocurrency theft. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

VanEck CEO recommends investors to double down on Bitcoin as hedge in 2025

Saturday, January 4, 2025

As gold and Bitcoin register a bull market, Jan van Eck stated that these assets are essential for any portfolio. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Aave Reaches Record High in Net Deposits, Vitalik Adopts MOODENG, Binance Launches New Tok…

Saturday, January 4, 2025

Telegram has rolled out its first update for 2025, introducing third-party account verification, message search filters, and the ability to convert gifts into NFTs. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏