DeFi Rate - This Week In DeFi - May 13

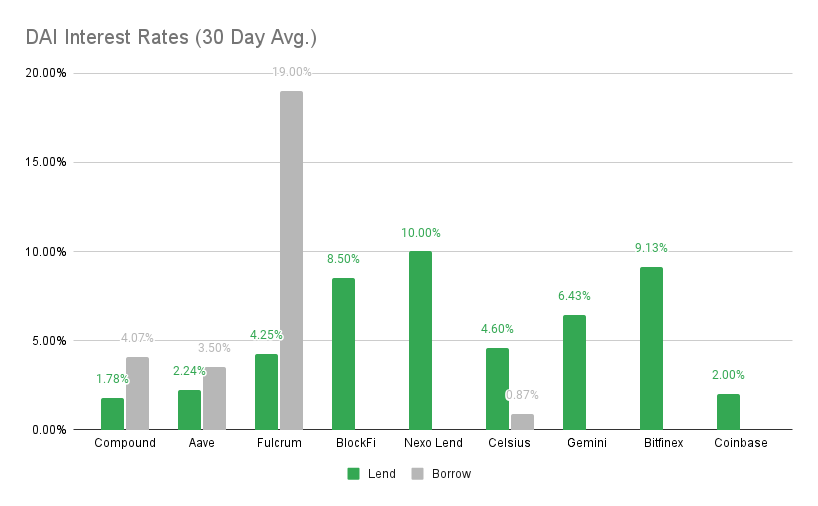

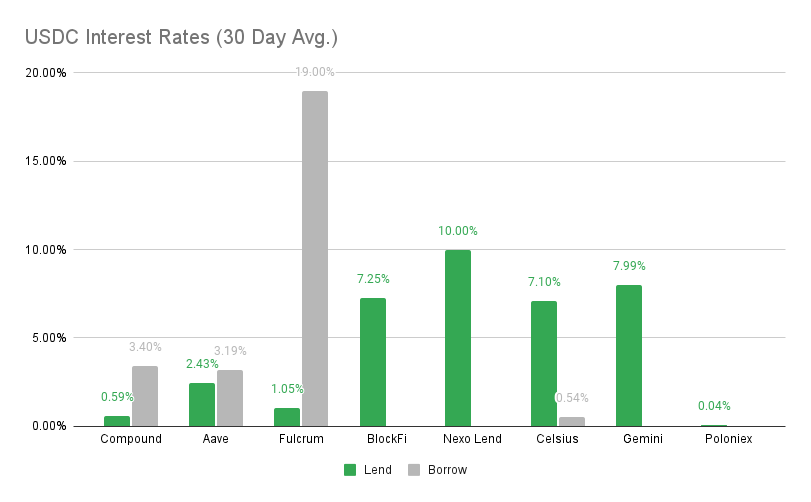

This Week In DeFi - May 13This week, LUNA and UST enter a death spiral, Aurora launches a $90M development fund and Bancor 3 goes live.To the DeFi community, This week, TerraUSD took center stage for unfortunate reasons, as the third-largest stablecoin lost its peg – sending Terra’s native LUNA token into a “death spiral”. Kick-started by an apparent attack on the system, a significant de-pegging of UST to the dollar resulted in a rush to the exits by token holders. The outcome was a minting of an exponentially-increasing quantity of LUNA tokens as UST was redeemed, diluting the price to a mere fraction of a cent as supply reaches the trillions. A potential bail-out fell through, while selling reserves wasn't sufficient or quick enough to stop the bleeding. The Terra team has since accepted its unfortunate fate, making adjustments to protect the network and ultimately accelerate the UST exit process for holders. Aurora, the EVM layer on NEAR Protocol, has launched a $90 million developer fund to boost DeFi adoption on the network, in an attempt to bring on more Ethereum-based developers. NEAR Protocol’s DeFi arm, Proximity Labs, will manage the funds and provide grants to developers building DeFi DApps on Aurora.  The latest version of the Bancor protocol, Bancor 3, has gone live. The new protocol boasts 100% impermanent loss protection for liquidity providers, single-sided staking (as with Bancor 2) and lower gas fees. It will also have an auto-compounding mechanism, ensuring that fees and rewards are auto-compounded without transaction costs.  Bancor @Bancor 1/ Bancor 3 is here! The Ultimate DeFi Liquidity Solution empowering DAOs and their token holders to drive healthy liquidity and access safer, more sustainable yields that are 100% protected from Impermanent Loss. See what’s new 🧵 or dive right in 👉 https://t.co/SSNm5KiXQ7 https://t.co/SfACrF6Lo3Shiba Inu has provided an update on new developments, which are full of active planning and development. Plans for the ecosystem include a Layer-2 scaling chain for Ethereum, as well as a “SHI” stablecoin that is reportedly close to completion. Interestingly, the SHI stablecoin appears to be targeting a peg of one cent, rather than one US dollar. The crypto bear-market cleanse is in full swing, as unviable projects begin to be weeded out from more sustainable protocols amidst market volatility and real world stress-testing. The first major casualty came sooner than expected, as Terra's LUNA and UST reach the conclusion of their grand experiment with an unfortunate de-pegging and inflationary spiral. Multiple protocols and crypto-related funds also suffered immensely from the Terra contagion. Regulators are taking keen notice of these downside risks coming to fruition, with a lot of commentary arising following the UST collapse. Tether also appears to be continuing its opacity over reserves, which may eventuate in an interesting story. Expect fresh regulation and new market rules on the horizon, as regulators across the world collaborate to put some reigns on the crypto world. It's not all bad news, however, as development and innovation continue under the radar across the industry. Bancor 3, fresh funding for new projects and entire ecosystems are still chugging along. The cleanse will eventually provide us with truly valuable and sustainable projects emerging from the rubble – while the rest take their tumble. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 8.50% APY Cheapest Loans: Celsius at 0.87%, Aave at 3.50% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Gemini at 7.99% APY Cheapest Loans: Celsius at 0.54%, Aave at 3.19% APY Top StoriesUK Promises New Laws to Promote, Seize CryptoUS Treasury Secretary reaffirms need for stablecoin regulation following UST crashGlobal Crypto Regulatory Body Is Coming Soon, Says Top OfficialInstagram to Test NFTs This Week, Zuckerberg ConfirmsStat BoxTotal Value Locked: $61.56B (down 18% since last week) DeFi Market Cap: $50.3B (down 53%) DEX Weekly Volume: $39B (up 129%) Bonus Reads[Ryan Weeks – The Block] – Chainflip Labs secures $10 million for cross-chain DEX [Tom Farren – CoinTelegraph] – PancakeSwap governance proposal set to cap CAKE supply at 750M [Brian Quarmby – CoinTelegraph] – dYdX releases an app: Why haven’t more DeFi protocols followed suit? [Adam Samson – Financial Times] – Tether declines to reveal details on $40bn Treasury cache after dollar peg snaps If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - May 6

Friday, May 6, 2022

This week, Tron launches its USDD stablecoin with 30% interest, Opera integrates BNB Chain and a Virginia County pension fund looks to DeFi.

This Week in DeFi - April 29

Friday, April 29, 2022

This week, Optimism announces its new governance system and $OP token distribution, Asymmetric announces a $1B crypto fund & 0x raises $70M.

This Week in DeFi - April 22

Friday, April 22, 2022

This week, Tron announces a stablecoin with 30% yield, Optimism may by launching a token, and Framework Ventures announces a $400M web3 fund.

This Week in DeFi - April 8

Friday, April 8, 2022

This week, UST and FRAX take on DAI on Curve, a new token standard is created on Ethereum and NEAR Protocol raises $350M.

This Week in DeFi - April 1

Friday, April 1, 2022

This week, the Fantom Foundation launches a $500M incentives program, 1inch releases a wallet for Android, and DeFi TVL recovers.

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask