DeFi Rate - This Week In DeFi – June 24

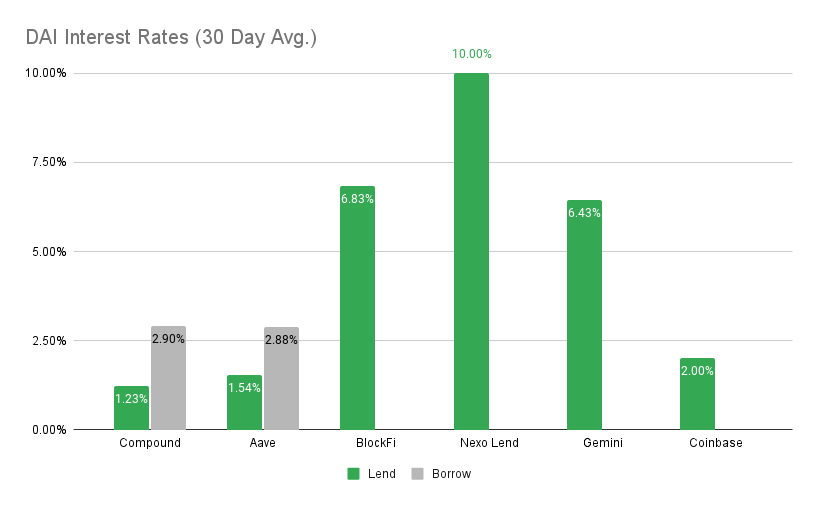

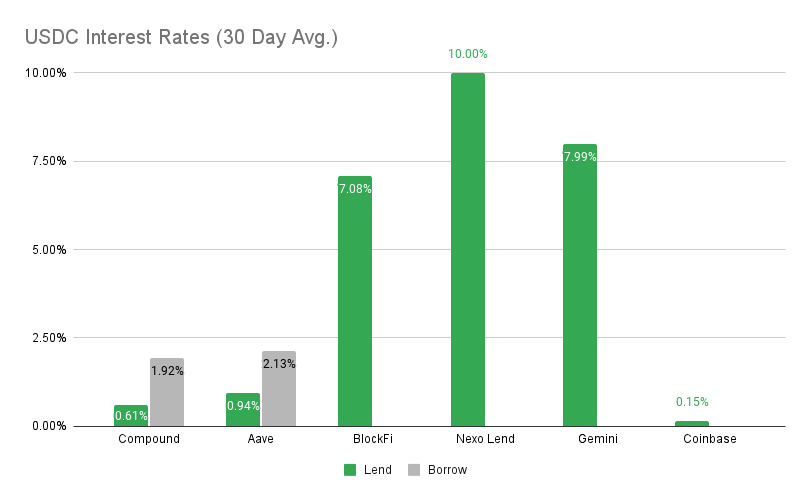

This Week In DeFi – June 24This week, dYdX decides to ditch Ethereum scaling for its own chain on Cosmos, Solend stirs up governance drama and Uniswap steps into NFTs.To the DeFi community, This week decentralized derivatives platform dYdX decided to create its own applicaiton-specific standalone chain, as part of the Cosmos ecosystem. The move will also complete the decentralization of the platform – marking an important milestone for dYdX once the transition is complete. dYdX developers reasoned that no L1 or L2 solution they found could handle the throughput required to run a competitive trading engine, leaving Cosmos chain customizability as the best option for its needs.   Solana DeFi protocol Solend sparked controversy within the wider community after an attempt to take over a whales funds – an effort to avoid major issues from a large potential liquidation. The Solend team argued that the $108 million loan would be better liquidated over-the-counter, rather than via the on-chain mechanism with insufficient liquidity. The team received a ton of backlash on the move, particularly after a single address made up 88% of the voting power to pass the proposal. In response to the community’s reaction, the protocol ran a second proposal to undo the initial vote, with 99% support for reversing the granted “emergency powers”.  Uniswap has decided to venture further into the NFT space with an acquisition of Genie, an NFT marketplace aggregator. Genie provides users with the ability to browse and transact with NFTs across multiple different NFT platforms, as well as batch-buy multiple NFTs within a single transaction. The acquisition also comes along with a surprise airdrop of USDC to previous Genie users.   Decentralized exchange Bancor has moved to pause impermanent loss (IL) protection within its protocol, after identifying large-scale sales of its native BNT token. The protocol had a mechanism in place to subsidize IL through newly-minted BNT token rewards, however it appears to have caused an acceleration in the fall of BNT price during the latest leg down in the market.  Hasu⚡️🤖 @hasufl @DeFi_Dad except Bancor doesn't *actually* reduce IL in any way. Like SUSHI, they just throw more incentives at the problem to compensate LPs. this strategy will always collapse at scale.We've completed yet another week of turbulent market activity, beginning with a steep market drop over the weekend (and subsequent recovery!). Continued selling pressure and panic has provided an extended stress-test of platforms and protocols, both centralized and decentralized. Lending platforms in particular continue to bear the brunt of the market tension, suffering further from the contagion of the demise of TerraUSD and Three Arrows Capital. Lending platforms Celsius and Babel Finance continue to face liquidity issues, while Voyager Digital has placed limits on customer withdrawals to prevent a run on accessible liquidity. On the decentralized side, Solana DeFi lending platform Solend almost went as far as throwing decentralization out of the window to manage the potential liquidation of its largest whale. Bancor was forced to turned off its impermanent loss mitigation mechanism, in an effort to save its native BNT token from catering in price. As expected, the market is poking holes in the feasibility of all areas in the sector – exposing what is truly economically viable, and what is not. It is also revealing the true extent of decentralization (or lack of it) within many major projects in the ecosystem. Although painful for many stakeholders and developers alike, the lessons being learnt are extremely valuable, and they will effect the success and durability of our protocols moving into the future. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.83% APY Cheapest Loans: Aave at 2.88% APY, Compound at 2.90% MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Gemini at 7.99% APY Cheapest Loans: Compound at 1.92% APY, Aave at 2.13% APY Top StoriesVoyager Digital cuts withdrawal amount as 3AC contagion ripples through DeFi and CeFiCBDCs, Not Crypto, Will Be Cornerstone of Future Monetary System, BIS SaysChina’s WeChat bans crypto and NFT-related accountsBinance-owned Trust Wallet adds buy option via Binance ConnectStat BoxTotal Value Locked: $39.52B (up 2.7% since last week) DeFi Market Cap: $38.4B (up 9.1%) DEX Weekly Volume: $19B (down 37%) Bonus Reads[Andrew Rummer and Adam Morgan McCarthy – The Block] – BlockFi secures $250 million bailout from FTX [Michael McSweeney – The Block] – Harmony's cross-chain bridge hit by ETH theft worth nearly $100 million [Aleksandar Gilbert – The Defiant] – Tether To Issue Sterling-Denominated Stablecoin [Yogita Khatri – The Block] – Crypto lender Babel Finance announces steps to improve its liquidity situation If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – June 17

Friday, June 17, 2022

This week, Circle announces a new euro-pegged stablecoin, while Celsius and Three Arrows battle solvency issues – also involving stETH.

This Week In DeFi – June 10

Friday, June 10, 2022

This week, Ethereum completed its Ropsten testnet merge, Wintermute unveiled its DEX aggregator and TronDAO decides to overcollateralize USDD

This Week In DeFi - June 3

Saturday, June 4, 2022

This week, Binance Labs raises $500M for a new web3 fund, Ethereum prepares for its testnet merge and the Lightning Network sets a new record.

This Week In DeFi - May 27

Friday, May 27, 2022

This week, a16z raises a record $4.5B for its fourth crypto fund, Terra 2.0 is on the way and StarkWare reaches an $8B valuation.

This Week In DeFi - May 20

Friday, May 20, 2022

This week, the Terra community votes on a hard fork, Robinhood announces a web3 wallet and Aave launches its social media platform.

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask