Earnings+More - Jun 29: UK set for slot stake limits

Jun 29: UK set for slot stake limitsUK white paper rumors, Bally sells RI casinos, new sector coverage, Web 3 igaming analysis, Entain analyst update +MoreGood morning. On today’s agenda:

Fare thee well, Miss Carousel. Click below: White Paper rumorsSet for publication: The UK government gambling White Paper is set to be published in the next two weeks. The Times reports that key new recommendations will include:

In harmony: The proposal will also include the establishment of a new ombudsman and new rules for land-based casinos to allow them 80 machines each rather than the present 20. D-day? Analysts at Jefferies noted this morning in their note on Entain (see below) that a DCMS Q&A session in parliament is booked for 9am on July 7. Black hole sun: The Sun yesterday reported that UK ministers would recommend a ban on betting promotions and free bets, saying “millions of gamblers could be sucked into black-market betting if government plans to ban freebies go ahead”. ** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club. What we’re readingNailing jelly to a wall: The latest issue of the Pinchpoint discusses the broader questions around affordability Bally casino saleSale! Bally Corporation has completed a sale-and-leaseback of its two Rhode Island properties - Bally’s Twin River Lincoln Casino Resort and Bally’s Tiverton Casino & Hotel - to Gaming and Leisure Properties for $1bn. The two properties are the only gaming establishments in the state.

Consent issue: Bally said the sale was subject to lender consent. Recall, last week reports suggested Bally’s lenders had hired lawyers to represent them with regard to the sale. The suggestion is that they might block the transaction despite Bally offering a 50 basis point fee in return for consent.

Bait/switch: in the event of lender consent not being forthcoming, the deal will instead acquire the Hard Rock Hotel & Casino Biloxi in Mississippi (along the Tiverton property), for a total payment of $635m.

Buyback: Analysts at Jefferies noted that while Bally didn’t specify the use of the proceeds, it recently announced a downsized share buyback of $190m (from the proposed $300m-$500m). “We expect a portion of the proceeds may be used toward shareholder returns,” they said.

In other Bally news: Reports suggest BallyBet will finally launch in New York this coming Friday, It will be the last of the eight licensees to open up for business. New sector coverageJump start: JMP Securities, a part fo Citizens Bank, has issued its initial sector coverage note suggesting the real-money online opportunity will be worth up to $43bn - 45 OSB states by 2030, 15 igaming - but that a crowded OSB field will lead to consolidation, market exits and using sports-betting as a cross-sell to igaming.

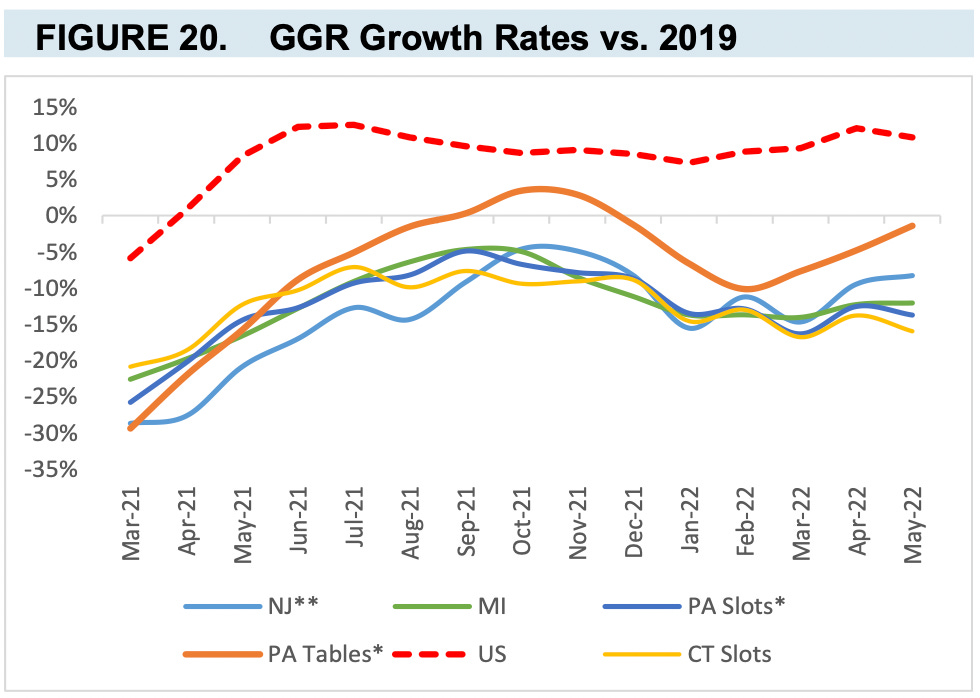

Euro advantage: The JPM team suggest that “decades of expertise of European tech” allows for structural advantages. They add that investors are “underappreciating” the tech capabilities behind BetMGM (via Entain), DraftKings (via SBTech) and Flutter. I eat cannibals: The JPM team also points to evidence that igaming does cannibalize land-based gaming.

Brother can you spare a dime: A recession “could be good for online gaming”, they argue. It’s a “cheap form of entertainment” while hard-pressed legislatures might look to open up online as a source of revenue following a downturn. Entain analyst updateModesty: Entain will publish its Q2 update next week and the Jefferies team said it expects the group to announce a “modest trend improvement” due to a tough trading environment. The good old days: Retail figures are expected to be “almost back” to 2019 levels but the return of double-digit growth “may be under pressure” due to Netherlands licensing delays, slower growth in emerging markets such as Brazil, higher taxes in Australia and UK consumer softness.

Cut: Jefferies has cut the group’s EBITDA forecast by 3%. In January Entain issued FY EBITDA guidance of £875m-£885m. Recall, Entain’s Q1 update showed group NGR was up 31% but online NGR was down 8% with sports down 7% and gaming off by 10%. Web 3.0 igaming analysisCloser than you think: Analysts at Roth suggest the opportunities for igaming investors in decentralized apps (known as dApps in the jargon), crypto-currency betting, blockchain efficiencies and metaverse and NFT benefits might be “closer than investors expect”. Emerging market: They point out that “each of these Web 3.0 components are already emerging within igaming” and point to DraftKings’ recent deal with Polygon in the area of NFTs as a sign of the potentially rapid growth. dApps store: The Roth analysts highlight two decentralized apps that they are aware of - SX.bet and Decentral Games.

The chain: The Roth team notes that igaming dApps can support functionalities yet to be adopted by mainstream OSB and igaming operators.

The catch: The team notes that regulation is the “greatest inhibitor” for dApps. “This comes as KYC can be more difficult when dealing with crypto currencies, limiting transparency in tracking sources of funds,” they note.

California ballot measuresGo time: The California secretary of state has verified more than the 1.09m signatures gathered in favor of the DraftKings and FanDuel-sponsored online sports-betting ballot measure. It will now be certified this coming Thursday, 30 June and is now guaranteed to appear on November’s ballot.

Earnings in briefCamelot: The current UK National lottery provider until Allwyn takes over later this year said sales for the year to Mar22 fell 3.4% to £8.1bn. Instant sales fell 6.6% to £4.6bn which the company blamed on greater competition for consumer spend post-pandemic. The company also noted “growing economic uncertainty”.

Groupe Partouche: H1 GGR increased 21.3% YoY to €290m while turnover rose 33.5% to €187.2m. EBITDA returned to positive territory at €34.2m vs. -€42m loss in 2021. Partouche said the “gradual return to usual casino operations” was a significant factor in the improved results, but ongoing health constraints “continued to penalize attendance”. NewslinesGridRival: the motorsports sports-betitng startup has bolstered its advisory board with Lloyd Danzig being added to its advisory team as well as Joe Solosky, managing director of sports betting at NASCAR and Menlo Ventures partner Mark Siegel. Matchbook: The betting exchange has launched Matchbook Brokerage, a service to match large or bespoke trades that may not be immediately possible on its exchange markets. FansUnite Entertainment said it has received conditional approval to list its shares on the Toronto Stock Exchange. Catch a falling Star: According to reports, Star Entertainment will be found unsuitable for a casino license in New South Wales. This follows a damning report which found multiple AML and fraud failings. Audacious: BetMGM is now the exclusive sportsbook of Audacy’s sports-betting network BetQL. As part of the deal, Audacy will produce content for audiences at BetMGM Sportsbooks at MGM properties. Sportradar has launched its new full-service online sportsbook platform and technology offering Orako. Ohio applicants: Jack Entertainment’s two casinos in Ohio have applied for both online and retail sports-betting licenses. DraftKings has submitted an application for online operations. Genius Sports has partnered with Clue, a provider of investigation software, to launch a new integrity platform to monitor suspicious betting patterns. Paysafe has integrated the real-time payment service Mastercard Send into its UK and EU solutions platform. NeoGames will supply Intralot do Brasil, the lottery operator of Brazil's second-largest state Minas Gerais, with its online lottery and sports-betting solution. On socialUseful once OSB opens up.   Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Jun 27: Gaming stocks stage a rally

Monday, June 27, 2022

The shares week, New York weekly data, Las Vegas analyst update, startup focus - ParlayBay +More

Jun 24: Weekend Edition #52

Friday, June 24, 2022

Fanatics/Tipico rumors, Bally legal threat, Jackpot.com funding news, sector watch - streaming, US gaming update +More

Jun 23: Earnings+More pod #13

Thursday, June 23, 2022

Watch now (25 min) | Here comes summer...

Jun 23: 888 raises debt to fund WHI deal

Thursday, June 23, 2022

888 trading update, Jefferies conference day 2, Fanatics owner sell NBA and NHL stakes to focus on OSB

Jun 27: Evolution to swallow Nolimit

Wednesday, June 22, 2022

Evolution acquires No Limit City, Jefferies conference takeaways, Macau's woes +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏