The Daily StockTips Newsletter 06.30.2022

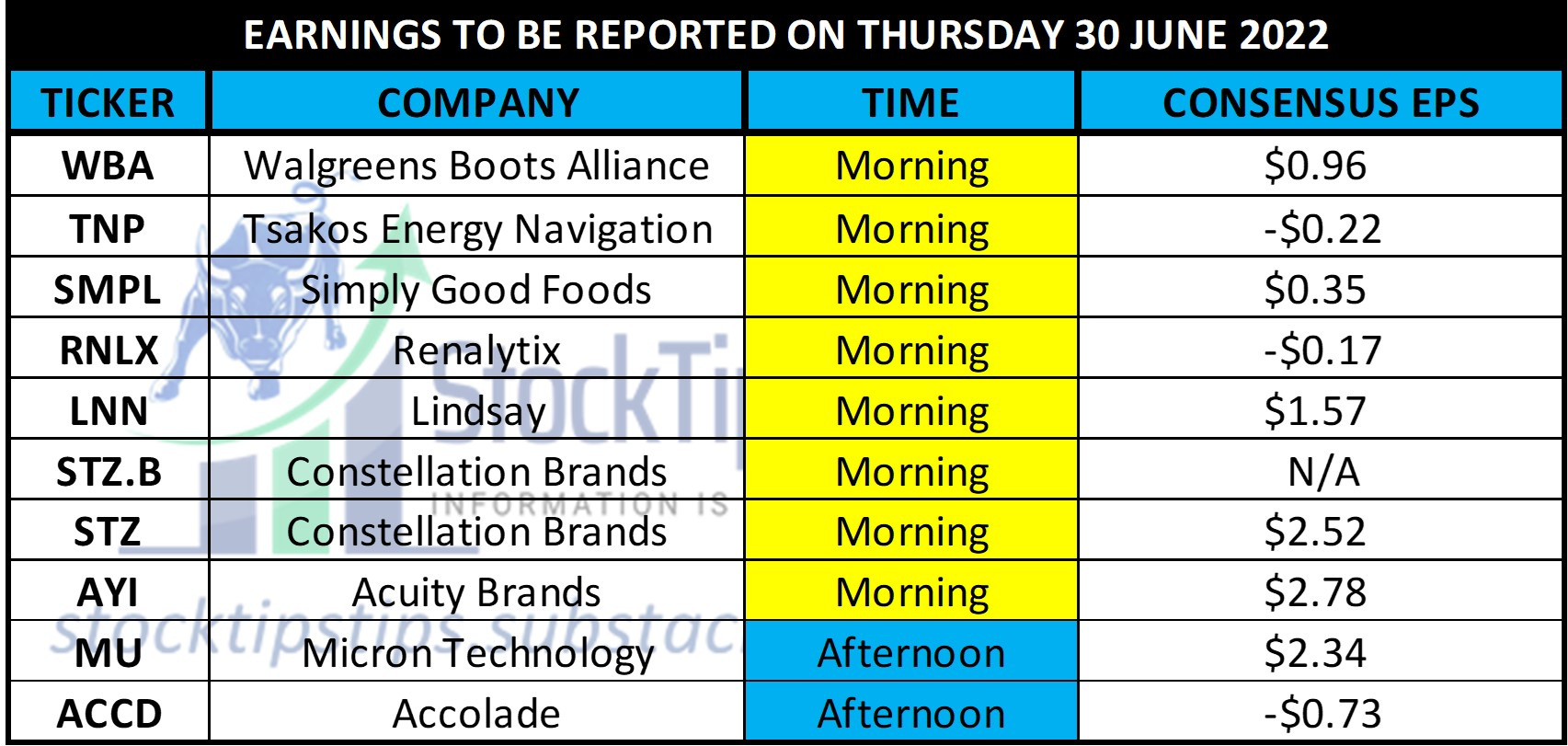

The Daily StockTips Newsletter 06.30.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. StockTips is NOW on Odyssey. It’s like discord but better in my opinion IM THINKING ABOUT ADDING ADDITIONAL VALUE TO THE NEWSLETTER: I’m thinking about creating a distro (I will be working on this during the weekend), for my paid subscribers. It will cover underlying trends & analysis & sent out either weekly or daily (I don’t know yet). It will be something akin to running estimates I used to produce as an analyst in my military days but in market form. It should not take long to produce. I will update it regularly on power point, covert it to pdf, & send it out (after adjusting the data to a lower quality so it doesn’t blow up your inbox). Once again, its not a guarantee yet. I need to put some thought into it. But it will help both you and I keep track of a rapidly moving market! It will not just report the news. It will give us the “so what” as well! At least how I see the numbers. TODAY’S OBSERVATIONS: Well futures are red & investors are tripping over each other to see if they can beat their peers to cash as we get closer to more pivotal economic data (An unrealistic overstatement … but you get the point). DO NOT TRUST THIS MARKET! Including the lone stock still on my buy list. IMPORTANT: Remember we have a new earnings season fast approaching that will fully reflect the true effects of the war in Ukraine & China lockdowns. Seems like old news right? It is … but this upcoming earnings season includes the fallout of both these items all the same! Earnings always reflect the previous quarter, not the current one. It’s easy to forget the past isn’t it? MAY PERSONAL INCOME/SPENDING (THURSDAY): Personal Income consensus is an increase of 0.5% Month over Month with April registering 0.4%. Consensus Personal Spending is an increase of 0.4% Month over Month with last April coming in at 0.9%. MAY PCE PRICE INDEX (THURSDAY): Of note but not necessarily highlighted in red, the Personal Consumption Expenditure is forecasted (no consensus) to come in at an increase of 6.7% Year over Year with April registering 6.3%. Month over Month numbers are forecasted at 0.9% with April coming in at 0.2%. Personal consumption expenditures, a measure of consumer spending, support the reporting of the PCE Price Index, which measures price changes in consumer goods and services exchanged in the U.S. economy. The Fed prefers PCE data though the CPI takes all the glory in the eyes of the public. PMI DATA: We do have some PMI data coming out at around 9:45 ET (Annotated on the calendar above). The Chicago Purchasing Managers' Index (PMI) determines the economic health of the manufacturing sector in Chicago region. A reading above 50 indicates expansion of the manufacturing sector; a reading below indicates contraction. The Chicago PMI can be of some help in forecasting the ISM manufacturing PMI. Stock futures fall more than 1% as S&P 500 tracks for worst first half of the year since 1970. European markets see declines as recession concerns persist; Germany’s Uniper down 14% on gas supply fears. China’s Shenzhen stocks rise as data shows factory activity grew in June; Asia stocks slip BUY LIST UPDATE: It’s always tough after a market dump to add either long or short plays. Be patient folks. All of the suggested short plays I posted earlier worked marvelously! But I’m hesitant to add more given the market lows. PAID CONTENT IN THE PAYWALL BELOW: 1 Stocks on the BUY LIST near/at/above the Buy Zone (Waiting to Swing) / 1 Options Strategy / A Detailed Breakdown of Yesterdays Earnings Beats & Misses / Most Recent Insider Buys/Sells / IPO Lockup & Quiet Period Expirations / 10 Stocks on the Price Based Assessment Watchlist / 3 Stocks on the Stocks Under $20 List (Read the Warning/Disclaimer) / 3 Stocks on the Highly Speculative Highly Volatile Small Cap List (Read the Warning/Disclaimer) / 8 Stocks on the short possibilities list. 👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option...Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 06.29.2022

Wednesday, June 29, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.28.2022

Tuesday, June 28, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.27.2022

Monday, June 27, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

Sign in to StockTips Newsletter

Saturday, June 25, 2022

. Here's a link to sign in to StockTips Newsletter. This link can only be used once and expires after 24 hours. Sign in now © 2022 StockTips 109 .

The Daily StockTips Newsletter 06.24.2022

Friday, June 24, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏