The Diff - The Network Before the Internet

Welcome to the weekly free edition of The Diff. Subscribers-only posts you missed this week included the economics of acquiring NSO Group, with a brief riff on how one of the world's most successful tech incubators got that way through conscription; the challenges Pinterest's user acquisition present as it matures; and a look at an energy company that buys assets that may turn out to be enormous environmental liabilities. Coming soon: why tax law reduces tech labor mobility during downturns, how the SaaS boom was Keynesian, and the illuminating state of the Canadian economy. Get full access to The Diff and subscribe today. The Network Before the InternetPlus! Operational Issues; The Cloud; Rent and Inflation; The Glut; Credit and Macro; Diff Jobs

Welcome to the weekly free edition of The Diff! This newsletter goes out to 34,114 readers, up 473 since last week. In this issue:

The Network Before the InternetA stylized history of the Internet might go like this: decades ago, deep in the military-industrial complex, there were concerns that the US needed more resiliency in the face of nuclear war. Meanwhile, computing experts felt that high-quality connections between central nodes could be valuable in its own right, which they found a far more compelling argument. This project wouldn't have happened without government subsidies—without the confluence of military interest and technocratic management. But soon after this initial boost, most of its benefits (and most of its usage) were pushed by private interests, rather than public ones. The project was a subsidized substrate for a wild free-market experience, creating immense growth and ensuring that when most normal people interacted with the network, they were mostly interacting with for-profit companies rather than thinking about a government program. But this story also happened half a century earlier, with the interstate highway system. It featured some of the same driving forces—simmering technocratic desire to build a big, standardized system; Cold War paranoia about the risk of slow mobilization of US forces; a big bet that building a new network would induce demand. Both even featured cameo appearances by Senator Al Gore (albeit different Gores, thirty years apart). The highway system, like the Internet, started out without a direct commercial imperative: it was clearly valuable, but it was built to let private citizens travel, not to enable new business models. The system's prehistory starts with the dire state of American roads in the early twentieth century. In 1919, the US military decided to test out the country's roads by sending a convoy of 72 vehicles from Washington, D.C. to San Francisco. Their average speed while driving worked out to under 6 miles per hour, compared to a planned 15. Part of the problem was that most roads in the US were poor quality, and bridges were generally designed with horses or small cars in mind, not heavy trucks. (The convoy ended up destroying several dozen bridges.) A series of laws tried to remedy this situation, including one offering federal matching funds for state road construction in 1916, another larger one in 1921, and a plan for a national highway system in 1938. Wars disrupted the first and last of these, but in the postwar period roadbuilding was a particularly attractive area for government spending both because of the US's experience with Germany's infrastructure and because of the potential for high unemployment as the military demobilized. Aside from the general increase in the ease and speed of transportation, and the increase in sales for cars and especially trucks, the highway system spawned a number of successful companies:

They didn't just restructure demand, but also changed supply. Consider the retail business: trains are better for bulk transportation than trucks, but have a limited service area and timing. So the way retail works in a train-centric world is that there are large stores with diverse products in big cities, and smaller ones with a more limited selection, much more expensive products, and inconsistent inventory in more rural areas. But trucks allow retail to work well even in fairly remote places, and since truck transportation costs are a function of distance and time without high capital costs, the economics look pretty similar from one small town to the next. So the interstate highway system can also treat Walmart as one of its progeny.¹ These companies ended up with decent representation in the 1970s-era "Nifty Fifty"—the large, stable growth stocks that kept performing when the 60s boom in small growth companies and conglomerates fell apart. The project didn't just reshape big companies, though; it also changed cities. Highways made suburbs more viable, both because they sped up commutes from outside big cities and because they disrupted communities within them.² One feature of big platforms is that scaling on the platform happens faster than the scaling of the platform. Depending on how you count, the highway system took a generation or two to build, but also allowed some companies to go from startups to ubiquitous in just a few years. The same dynamic applies to more modern platforms: a TikTok star's growth curve is more hockey-stick than TikTok's, Zynga grew faster than Facebook by using Facebook's ads and social tools effectively, Compaq set growth records that Microsoft and Intel couldn't match by effectively contributing to their duopoly, and companies that figure out their unit economics with search ads can ride a very steep S-curve. But what sets the Internet and the Interstate Highway System apart from these platforms is that it didn't have a profit-seeking owner. Building on a platform means ceding control to that platform, and that runs two risks:

A public or nonprofit-owned platform still cares about the first concern, and will try to route around it, but it doesn't really care about the second. Especially because the benefits are so diffuse, there isn't much political will to claw back Walmart's profits from cheaper trucking. (In fact, the highway system sometimes gets criticized as a giveaway to car companies, but that's a weaker claim: car sales tracked well ahead of road improvements for decades, and high-quality roads mean that cars don't have to be replaced as often.) These platforms are rare, but there are more than two examples. A few other cases that look a lot like successful non-profit platforms that lead to private-sector opportunities include:

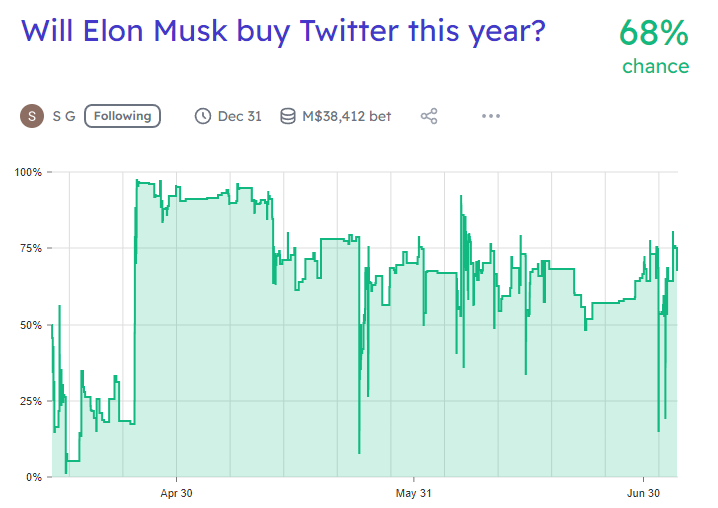

Privately-held platforms get a lot of justifiable love from investors. What could be better than building the most abstract part of the business and then collecting a royalty on all the object-level efforts that make it work for specific users? But there's plenty of upside in building on platforms, too, especially when those platforms don't have a P&L. Further reading: The Big Roads has much more detail on the conception and construction of the interstates. A Word From Our SponsorsManifold Markets is a play-money prediction market for betting on just about anything, from when specific new technologies will be available to questions about specific people. Prediction markets are a powerful tool for aggregating collective wisdom, but they're also a fun tool for speculating about the future, learning what other people think, and arguing with them. The site uses a play currency, Mana, which can be cashed out to donate to charities, or which can be retained in the site as a way to keep score and earn bragging rights. ElsewhereOperational IssuesThe usual way to look at capacity constraints is that companies don't like to buy long-lived fixed assets like oil refineries, ships, or planes unless they're sure that there will be long-term demand that justifies them. But another piece of this is the constraint on institutional knowledge: when business is bad, companies downsize or accept attrition, and that means they lose some of the expertise that allows them to operate at full capacity. Airlines are seeing this now; an American Airlines scheduling glitch allowed pilots and copilots of up to 12,000 flights to cancel flying plans ($, WSJ), and now the pilots' union is asking for a 200% pay bump to bring them back. This is not limited to US companies; in the UK, EasyJet's COO has resigned after a spate of mass flight cancellations. This kind of issue has cropped up frequently during the economic recovery. Even though employment is recovering, the increase in turnover means that workers will initially be less productive (though it's possible that they'll end up being more productive than they otherwise would be (at least, that's what one long-term study in a developed country shows, although in the short-term the disruption is negative). For businesses that need to deliver goods or people to specific places, this shows up in delays and cancellations, but the less measurable effect is on the availability and quality of services. If service businesses are less productive because more experienced employees have moved around, high demand can mean that they're still doing as much business as before, just with lower quality and less availability. The CloudFedEx plans to retire its mainframes and close its datacenters by 2024, with planned savings of $400m. This is a good reminder that despite a decade of strong growth, cloud penetration still has a ways to go. Amazon says only 10% of IT spending has moved over, for example, though they're naturally biased. One way to think about this is that adopting new technologies is easier if there isn't a legacy option to displace them; cloud computing was a very easy decision for companies that didn't have an existing investment in another model, and the longer they'd been operating with mainframes, the riskier and more difficult the switch would be. The upside to this is that the hardest-to-win contracts are also sizable, and since the challenge of switching is a combination of technical issues and institutional ones, they're also customers who will tend to stick around. Disclosure: Long AMZN. Rent and InflationWhen a metric starts to matter more, it's important to dive in and understand how it's calculated and what drives it. Figuring out inflation rates is nontrivial. (Consider college during lockdowns: if the price doesn't change but the venue switches from a nice campus to a Zoom window, clearly either college has gone down in quality or the price of Zoom lectures has gone way up, but inflation measures aren't agile enough to pick up on this.) An important pair of stylized facts about the CPI is:

So it's useful to look at asking rent trends on Zillow as a preview of what headline inflation will look like in the coming months. Rents are no longer accelerating, but aren't dropping much, either. The good news is that central banks spend a lot of time debating the finer points of these kinds of measurements, and are not oblivious to their limitations. The GlutThe WSJ has a good piece on how the inventory liquidation business is booming ($) as large retailers get rid of their excess inventory. There's a whole ecosystem for dealing with inventory that's been over-ordered; one reason the dollar store industry has prospered so much in the last few decades is that larger retailers are so inventory-averse, so there's an ample supply of marked-down inventory, albeit a fairly random sampling. One way to look at those companies is that they're partly an expected-returns arbitrage. Holding Christmas decorations in a warehouse from July through November is anathema to a company that obsesses over its inventory turnover ratio, but to a business that cares about gross margin (and has a warehouse footprint geared towards cheap long-term storage instead of high turnover) this can be a fair trade. In fact, you can look at the discount versus full price ecosystem as partly a way to move inventory to whichever balance sheet is willing to hold it—ideally consumers, briefly large chains, and, as a last resort, deep discount sellers. Credit and MacroThis piece is a good meditation on how hard it is to incorporate credit quality into macroeconomic models. One of the problems is the Minksy argument: more credit availability makes loans look better, and that leads to more credit until the low quality of the loans is undeniable, at which point the whole process reverses. This is clearly a big cyclical driver, at least some of the time (there's a reason the vogue for Minsky really kicked off in 2007, though his views applied well to levered-up fiber-optics companies in the late 90s, too). One of the difficulties with agent-based modeling in general is that to be realistic, the agents have to do dumb things, but they also have to do dumb things in clever ways. It's computationally expensive to model this process, and even a very sophisticated model won't capture all of the financial sector's creativity. Diff JobsDiff Jobs is our service matching readers to job opportunities in the Diff network. We work with a range of companies, mostly venture-funded, with an emphasis on software and fintech but with breadth beyond that. If you're interested in pursuing a role, please reach out—if there's a potential match, we start with an introductory call to see if we have a good fit, and then a more in-depth discussion of what you've worked on. (Depending on the role, this can focus on work or side projects.) Diff Jobs is free for job applicants. Some of our current open roles:

1 Because Walmart came of age at a time of high nominal interest rates and high inflation, it benefited more than it otherwise would have from supply chain management and tight controls on inventory. Managing this is uniquely achievable with trucks with trucks, where it wasn’t previously possible with trains before precision scheduled railroading (see this post for more on railroads). 2 Even when roads ultimately didn't pass through some neighborhoods, extended debates over where they should go were toxic for property values: when people thought their houses would be demolished soon, they didn't have an incentive to maintain them, and people with the means to do so left early. This was not the only contributor to cities' mid-century death spirals, but certainly had an impact—especially because suburbs allowed commuters to live far outside town, commute to a fairly safe downtown, and remain hermetically sealed from the rest of the city. A good lesson from this is that transformative technologies have winners and losers, and that the best way to address this is to swiftly identify and compensate the losers (if they’re going to be compensated at all). Policy can turn a painful disruptive period into a Pareto improvement, but only if it’s well-calibrated. 3 This is not always true, of course. Two forces that push against it are 1) when there's a long tail of valuable businesses, such that no one of them would make a big difference and copying all of them would be a chore, and the closely related 2) when the platform owner believes that they're early in the discovery process of what the platform is for, and don't want to capture the best current use at the cost of missing the 10 even-better-uses that haven't been developed just yet. Notably, the power of point 2 depends in part on assumptions about platform economics, but also on discount rates: when a platform owner feels economically secure, and real interest rates are low, it's optimal to wait a long time to maximize opportunities rather than hurrying to take advantage of the ones that have already presented themselves. You’re a free subscriber to The Diff. For the full experience, become a paying subscriber. |

Older messages

Longreads + Open Thread

Saturday, July 2, 2022

Microsoft, Long Wars, Taste, Axie Infinity, Student Loans, Roads, Singapore

NextEra Energy's Green Growth

Monday, June 27, 2022

Plus! Specialized Cloud; Bailouts; Another Look at Inflation; Trucking Recession; Belt and Road Alternative; Diff Jobs

Longreads + Open Thread

Saturday, June 25, 2022

Japan, General Purpose Tech, Platforms, Rates, Clean Energy, Yen, Commodities

Data's Limits and the Judgment Gap

Tuesday, June 21, 2022

Plus! Mobility; More Housing, Just in Time; Wargamification; Worker Shortages; Taiwan; Diff Jobs

Longreads + Open Thread

Saturday, June 18, 2022

Chips, Cloud, Roads, Jobs, Luttwak, Banks, Feedback

You Might Also Like

💎 Rough time for diamonds

Friday, January 3, 2025

Lab-grown gems sparkled, hedge funds delivered sturdy returns, and all your secrets | Finimize TOGETHER WITH Hi Reader, here's what you need to know for January 4th in 2:56 minutes. Mined diamonds

You can grow your savings

Friday, January 3, 2025

Take advantage of high-yield savings accounts today. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 China's in trouble

Thursday, January 2, 2025

The world's factory slowed, Britain's home prices perked up, and food trends for 2025 | Finimize TOGETHER WITH Hi Reader, here's what you need to know for January 3rd in 3:11 minutes.

Missed Nvidia's Last Big Move? Don't Miss This One

Thursday, January 2, 2025

The Market Rally Indicator Just Turned Green ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

💌 Financial stress? Don’t know her.

Thursday, January 2, 2025

New year, new goals. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Does AI Need You? - Issue #501

Thursday, January 2, 2025

Is AI an ally or a threat to tech professionals? Let's see what 2025 holds. View this email in your browser Does AI Need You? - Issue #501 January 2nd 2025 Let's recap… 2025 Outlook:

John's Take 1-2-25 Stealth Bear Market Alert

Thursday, January 2, 2025

Stealth Bear Market Alert by John Del Vecchio While the stock market had a solid year in 2024, yours might not have been great. Looking under the hood, while the indexes ended near their highs, many

Master trader's dividend portfolio revealed

Wednesday, January 1, 2025

How to collect "profit sharing" payments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 01-01-25 Mailbag: Questions and Harry’s Answers on the Fed, Govt Spending and the Markets

Wednesday, January 1, 2025

Harry's Take January 1, 2025 Reader Mailbag: Questions and Harry's Answers on the Fed, Govt Spending and the Markets We receive many questions on various topics, including direction of the

Warning issued for 2025: "This could be worse than the Great Depression

Tuesday, December 31, 2024

What billionaires and Wall Street are selling now ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏