Silicon Valley Outsider - How Silicon Valley makes billionaires

How Silicon Valley makes billionairesVenture Capital 101 (MBA 80/20: Silicon Valley Startups)

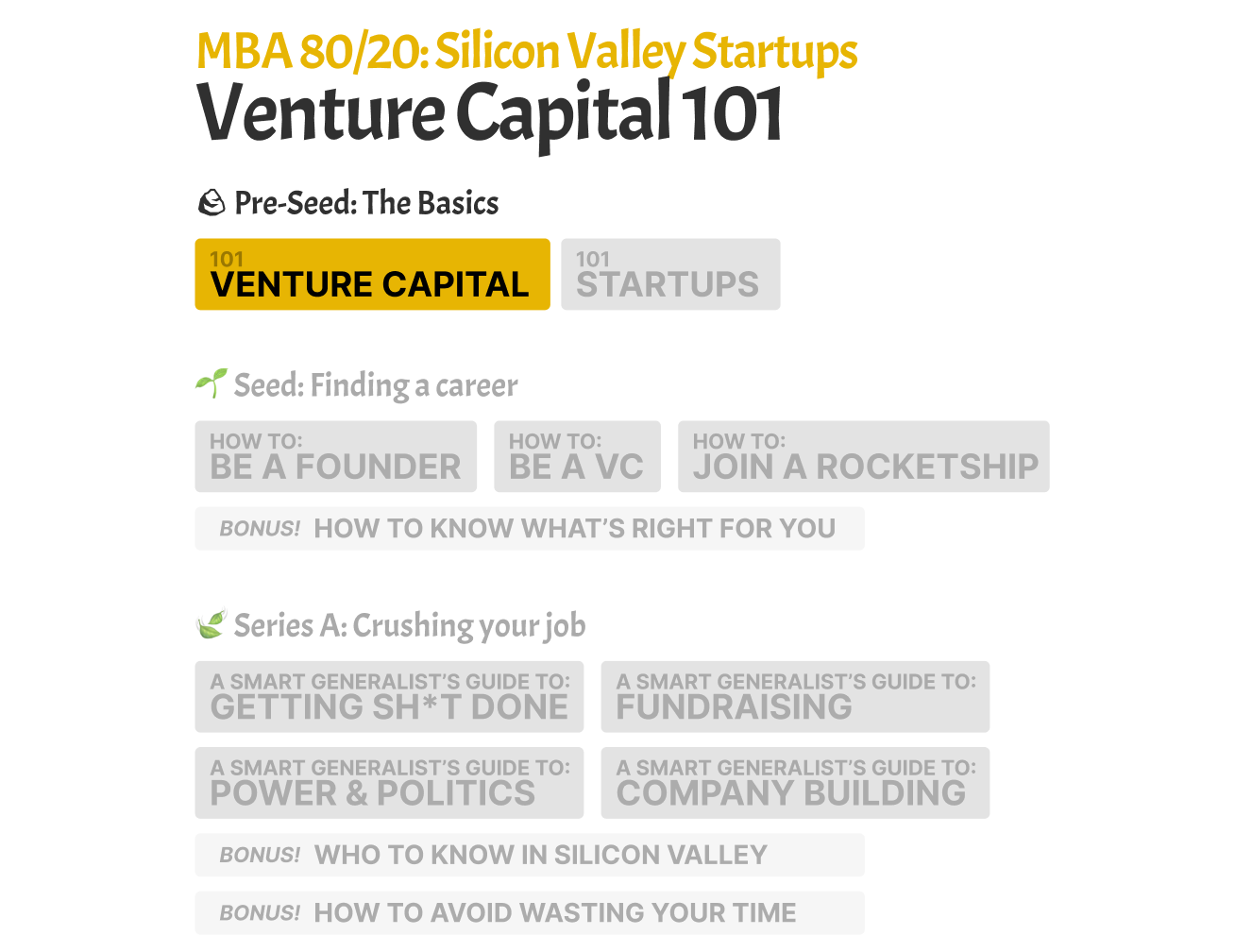

Modern-day Silicon Valley is the singular best time and place to start a company in the history of the world. Silicon Valley venture capitalists invest $60 billion per year into startups — that’s $25 million dollars invested per working hour. Since 2006, 50% percent of all billion-dollar startups, and 77% of all $10 billion+ startups, have been founded in Silicon Valley. And as a result, Silicon Valley has the most billionaires per capita in the world. The best way to understand how, and why, Silicon Valley has become so successful at producing billionaires is to follow the money: to understand who venture capitalists are, what makes them tick, and how they decide which startups are worthy of investment. That’s the goal of this post, the second installment of MBA 80/20: Silicon Valley Startups — Venture Capital 101. Venture Capital 101Some of the most important investment activity in Silicon Valley — and, therefore, the world — takes place on an unassuming suburban street in Menlo Park, California: Sand Hill Road. Doesn’t look like much, but the buildings across the way belong to Lightspeed Venture Partners and Accel Partners. Combined, they have invested over $40 billion into startups like Facebook, Slack, Dropbox, Spotify, Etsy, Snapchat, Nest, GrubHub, Calm, and Zola. And that’s just two firms from a very long list of Sand Hill Road tenants. $40 billion is a lot of money, and although the General Partners (GPs) that run these funds are doing just fine for themselves, they aren’t nearly rich enough to pony up tens of billions of dollars to invest in startups. What that means is that VCs also have to raise money — and they do so from their investors: “Limited Partners.” LPs are usually institutional money managers like pension funds, endowments, and sovereign wealth funds. Because they’re the ultimate source of money that makes the startup wheel turn, understanding what LPs want is key to understanding Silicon Valley as a whole. ⭐ To teach you more about Venture Capitalists and their LPs as efficiently as possible, I’ve put together three resources:

Without further ado, here’s Venture Capital 101 in 20 minutes or less:... Subscribe to Silicon Valley Outsider to read the rest.Become a paying subscriber of Silicon Valley Outsider to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

🇺🇸 The life, death, and re-birth of Silicon Valley patriotism

Monday, July 4, 2022

Anduril, Astranis, ABL, Palantir, Hermeus, Shield AI, and more

What business school teaches you about startups

Monday, June 27, 2022

Introducing MBA 80/20, a new perk for Silicon Valley Outsider subscribers

The startups are dead. Long live the startups!

Monday, June 20, 2022

A much-needed return to Hard Mode in Silicon Valley

My startup idea vs. entropy

Monday, April 4, 2022

And why $500000 wasn't enough for me to fight that battle

Some advice that I no longer live by

Monday, March 21, 2022

Or, why taking advice from internet strangers isn't *always* a bad idea

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved