WuBlockchain - Who lent money to Three Arrows Capital?

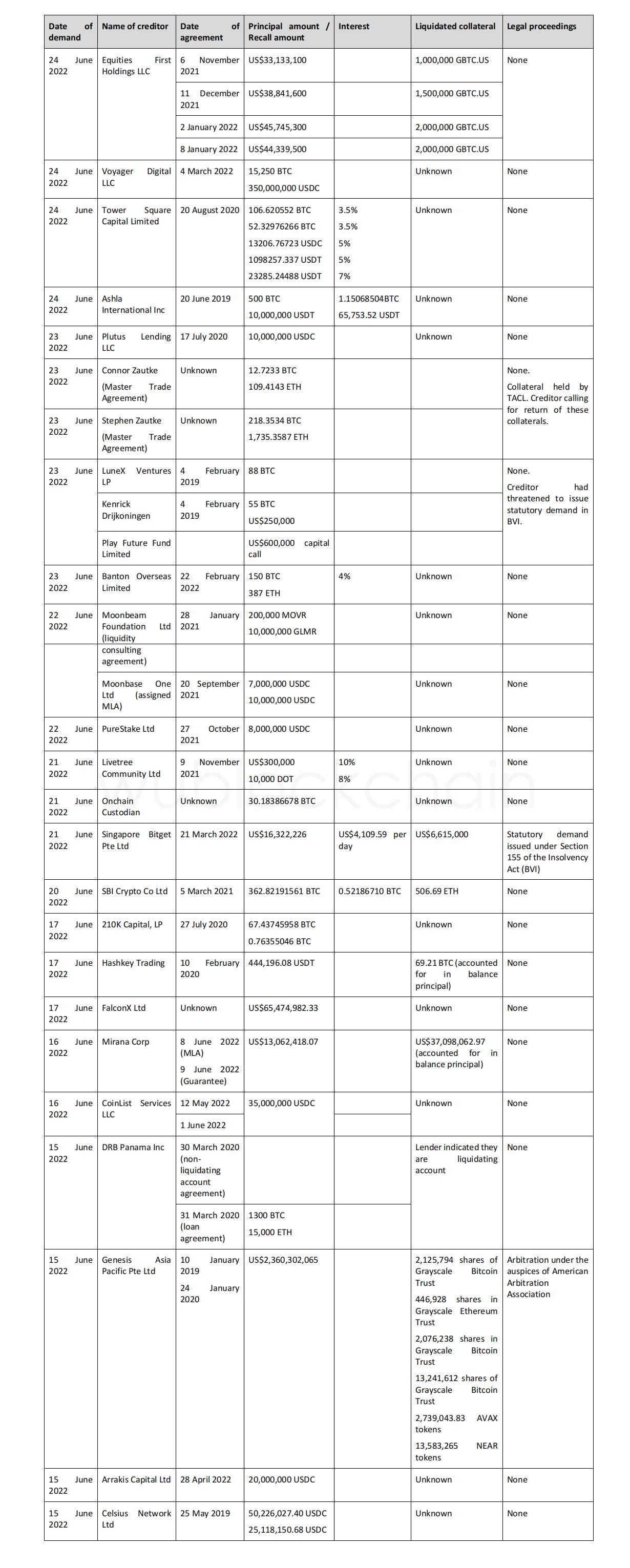

With the disclosure of more than 1,100 pages of liquidator documents, it is also known who lent the money to Three Arrows: https://www.docdroid.net/xKIqrjq/20220709-3ac-bvi-liquidation-recognition-1st-affidavit-of-russell-crumpler-filed-pdf The total is $3.5 billion, and since most of them are secured loans, the total loss should be in the range of $1-1.5 billion. Some of the 32 institutional debtors disclosed in the filing are as follows (However, the amount of some institutions and retail investors is not disclosed in this document): The largest creditor is Genesis Lending, which is owned by DCG. Genesis has always been known for its aggressive lending style, it was also one of the largest creditors of other institutions such as Babel Financial. Genesis has lent up to $2.36 billion. Fortunately, it is not an unsecured loan, the collateral of 3AC is GBTC, a total of 17,443,644 shares; 446,928 shares of Grayscale Ethereum Trust and 2,739,043.83 $AVAX and 13,583,265 $NEAR. There is still a shortfall of $462 million. The second-ranked creditor is Voyager with an unsecured loan of nearly $1 billion (in March value) to Three Arrows Capital, currently worth $600 million. Ironically, Voyager emphasized in every financial report that, based on its due diligence, the company believes that the borrower is a high-quality financial institution with sufficient funds to meet its due debts. The third-ranked creditor is Deribit, of which Three Arrows Capital is also an small investor, with a loan amount of $190 million. The fourth creditor is the well-known Equities First in the hedge fund coummunity, with a loan amount of 160 million US dollars. Among other borrowers, the Chinese world is more familiar with Coinlist ($35 million); Bitget Exchange ($16.32 million); Mirana/Bybit Investment Department ($13 million); Hashkey ($440,000). According to TheBlock, the creditors committee of Three Arrows Capital (3AC) has been established, consisting of five institutions, namely DCG, Voyager, CoinList, Blockchain.com and Matrixport. Blockchain.com does not appear in the above documents, but it said that it lent $700 million and incurred a loss of $270 million; Matrixport also did not appear in the above documents, and the loan amount and the loss amount are unknown. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish If you liked this post from Wu Blockchain, why not share it? |

Older messages

Can ETC take on Ethereum's ecosystem after Merging

Monday, July 18, 2022

Colin Wu

TSE Sponsored:Global Crypto Mining News (July 11 to July17)

Monday, July 18, 2022

1. The first bitcoin mining contract case in Beijing was upheld in the second trial, according to Global Network. The Beijing Third Intermediate Court held that the virtual currency trading speculation

WuBlockchain Weekly:CPI 9.1%、The Merge、Zhu Su and Top10 News

Friday, July 15, 2022

Top10 News 1、CPI hit 9.1%, 100 bps rate hike probability up link US June unadjusted CPI annual rate of 9.1%, expected 8.80%, the previous value of 8.60%, the largest increase since November 1981.

Celsius Bankruptcy Filing Disclosed Countless Bad Deals: buy $750m worth of rigs, $840m Debt from Tether was liqui…

Friday, July 15, 2022

Source: https://pacer-documents.s3.amazonaws.com/115/312902/126122257414.pdf According to documents filed with the US Bankruptcy Court for the Southern District of New York by Celsius Consulting

HK Cracks Down on Non-Compliant Crypto Businesses and Advertising Content Has Caused a Chilling Effect

Tuesday, July 12, 2022

The Hong Kong Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Bill 2022 is being amended for approval. It has a richer regulatory interpretation of cryptocurrencies. The industry

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%