Decentralized Autonomous Organizations | Decentralized Law

Decentralized Autonomous Organizations | Decentralized LawA Monthly Legal Journal Covering the Crypto-Legal SpaceDear Crypto-Legal Observers, It’s hard to avoid the narrative that decentralized autonomous organizations are everywhere and will change everything, forever. Whether you believe that or not, it’s undisputed that before the bear market, DAOs were growing exponentially, as were the number of articles written about them. Among the many DAO-related articles shipped this year by Bankless Publishing, you’ll find the following titles: DAO Governance Primer, Beginnings of the InDAOstrial Revolution, DAOs v. Corps Is the Trial of the Century, DAOs Unlock How We’re Made to Work, Wen DAO? Roadmapping the Path to Launch, Wyoming Opens its Doors to DAOs, and, of course, DAOs Will Change Everything. Last winter, mainstream media caught on to our little secret, publishing articles such as: The Promise of DAOs, the Latest Craze in Crypto, Why Your Group Chat Could Be Worth Millions, and DAOs Aren’t A Fad — They’re A Platform. While we don’t know what the future holds for DAOs, we do know they are here to stay. We could generally define a decentralized autonomous organization as a digital-native, distributed, purpose-driven organization, which, to varying degrees, leverages the unique characteristics of the blockchain to organize and incentivize activity via new systems of social coordination. Although it can sometimes be hard to know when an organization is a DAO, to paraphrase a famous U.S. Supreme Court opinion, you know it when you see it. But the same cannot be said for the laws and regulations affecting DAOs and their contributors. While there is a robust body of literature about DAOs, there are so far only a few legal articles dedicated to the subject, including those published by Decentralized Law. Unlike DeFi, DAOs have yet to come within the crosshairs of regulators and lawmakers, and most DAOs continue to operate more or less oblivious to their legal status or which laws and regulations might affect them. Fortunately, however, this is starting to change. As DAOs continue to mature, more of these organizations are seeking legal advice on how to organize their on-chain and off-chain activities in ways that comply with current and anticipated laws and regulations. Among those helping DAOs navigate these murky waters is Aleksa Mil, the Managing Director of WACEO, which is a “DAO-focused non-profit that provides DAOs with a framework for compliance, legality, and risk management and prevention in line with regulatory best practices”. Aleksa and her organization help DAOs figure out how to operate in ways that are both compliant and decentralized. Decentralized Law had the pleasure to sit down with her to discuss innovative compliance, building with an eye towards regulations and risk mitigation, supporting women in crypto ❤️, decentralized governance, and the future of DAOs. Also in this issue we discuss bespoke entity structures for digital organizations, advocate for decentralized DAO governance models, analyze how to address disputes with unincorporated DAOs, dissect the concept of ownership in DAOs, consider smart contracts and DAOs as tax entities, get a juicy take on the fate of Web3 contributors, and summarize news and articles from throughout the cryptoverse. Although this newsletter may help to familiarize readers with the legal implications arising out of blockchain technology, the contents of Decentralized Law are not legal advice. This newsletter is intended only as general information. Writers’ opinions are their own; therefore, nothing in this newsletter constitutes or should be considered legal advice. Contact a legal expert in your jurisdiction for legal advice. Welcome to Decentralized Law. Contributors: eaglelex, lion917, hirokennelly.eth, COYSrUS, Trewkat, teresacd, lawpanda, MDLawyer, Jason Schwartz, DAOLAW, g0xse, B(3,A)Rhunter, Chameleon This is the official legal newsletter of BanklessDAO. To unsubscribe, edit your settings. 🤝 BanklessDAO Legal Guild and Polygon DAO PartnershipThe BanklessDAO Legal Guild is proud to announce an important partnership with Polygon DAO.   Polygon DAO has the aim of growing and decentralizing the Polygon ecosystem. Among their projects, Polygon DAO has set up the Polygon Village, a full-stack ecosystem for developers and builders, aimed at providing assistance and scaling projects willing to build on Polygon. Polygon Village offers support in the form of grants, job offers, and vouchers. It also organizes weekly Twitter Spaces and meetings for people interested in Polygon. Given the growing demand for legal assistance by early stage projects, the international lawyers which make up the BanklessDAO Legal Guild will provide an initial consultation to projects in exchange from a voucher from Polygon Village. For a project to be successful, it is very important to have clear ideas about how and where to start a Web3 venture. The Legal Guild will help to provide some guidance at a global level! BanklessDAO’s Legal Guild is excited to partner with Polygon to continue to help our ecosystem flourish. 🎙 InterviewAleksa Does DAO Compliance Right

After getting my law degree, I realized I wasn’t interested in 9-5 jobs, so I started exploring remote work opportunities. Soon after, I started building my career in tech startups in operational roles. I wanted to make a career change, and landed a job in a DAO not knowing what a DAO actually is. The more I learned about, and understood the concept of decentralization and DAOs, the more I wanted to be involved. The interest in legal-crypto issues came to me naturally due to my legal background and my work experiences.

I love the freedom it enables, and its endless possibilities. Blockchain technology removes the barriers and constraints we have in the traditional world, allows more participation, celebrates skills and creativity, and doesn't care about jurisdiction, religion, or skin color. It matters that you can build.

‘Non-compliant’ protocols operate in the gray area of law — unregulated and waiting to see what’s gonna happen and change in the regulatory framework. The non-compliant have no less technical project value, [but] they are rather uncertain, and the community is at high risk.

I think that regulations can be good for DAOs, and more specifically for DAO members. Currently, owing to the lack of regulations, mostly the investors are at risk. DAOs being deemed as general partnerships assumes unlimited liabilities of those involved. Meaning: one bad apple can burden a larger group of people with many legal issues. There is no investor protection in place that safeguards them from bad actors, scams, rugpulls. The lack of regulation causes many problems, for example in many cases a decentralized organization becomes centralized when DAO founders assume arbitrary authority for themselves. In such cases, many times the parties that suffer are the community members. Centralized platforms act like they own the investors’ assets, and think they can decide not to allow anyone to withdraw their crypto, or to keep them as a method to pay off their mistakes.

I think nowadays we have many examples of innovative compliance around crypto, as we see something new being decided or regulated almost every day. The question is however, how favorable it is for the industry. In the EU we have MiCA, the first unified crypto regulation that addresses many hot topics, such as stablecoins, consumer protection, and businesses' ability to operate within the EU. Looking at innovative compliance, the Wyoming bill was the first to provide DAOs the ability to be registered as DAO LLCs, and the Marshall Islands and Panama which are among the very few countries that recognized DAOs as legal entities. The UK legislation around stablecoins, Crypto Bill in the US, Thailand, Singapore, Korea … we see changes and updates in the regulations in many countries, and I believe that depending on how innovative they are, it will decide the economical future of the country. We see that Dubai is becoming a huge Web3 hub, thanks to its 0% taxes policy; and in India, even though there are a large number of investors and huge potential considering the population, the 30% taxes on crypto, probably won’t incentivize many to invest in local blockchain-related businesses.

I don’t think it’s easy to regulate DAOs as one has to take into account many factors, the major ones being the jurisdiction issues and understanding the legal and tax implications on the DAO and the community members. I believe DAOs should be regulated in a sense that they are seen, acknowledged, and recognized for what they are: decentralized organizations. DAOs face many challenges when interacting with the traditional world, mainly being able to pass AML/CFT checks that makes it possible for them to collaborate with the off-chain world. Having that ability to safely and compliantly interact with the traditional world would drive the mainstream adoption of Web3 a lot more and faster, and further aid the scalability of the environment. Regulating DAOs as decentralized organizations would separate them from being seen as general partnerships, meaning that investors’ liabilities wouldn’t be unlimited. It would potentially remove the need for registering a DAO as an LLC, which removes the risk of potential rug pulls and brings the protection to investors that their assets are theirs, and do not belong to an entity or a centralized individual. Regulating DAOs can benefit the environment for sure, but not at the cost of them losing their status as decentralized organizations built on fundamentals we know them for today.

I think DAOs are facing challenges both on chain and off chain. I’ve encountered a number of ‘DAOs’ that are just centralized environments in disguise. The developers themselves are not educated on how DAOs actually work, and what they are, in fact. It is perfectly normal that initially the DAO is quite centralized and is ‘managed’ by a few, but what matters is the decentralized governance framework, and the actual work done to achieve that decentralization. On conferences I met too many CEOs, CMOs, CTOs, CFOs of DAOs that just don’t get the fundamentals of the DAO, and have that Web2 mindset that runs the show. The power hunger and power struggle is not strange to human nature, however, what worries me is what effect that will have on DAOs as a concept. If the builders in the space can’t understand what a DAO actually is, act as true DAO initiators, and understand that the Community is not a Discord server — we can’t expect regulators and lawmakers to understand decentralized organizations. Another challenge is the lack of sense of responsibility of the project founders. I do think that project founders are the ones responsible for taking necessary precautions to protect the project and its investors — as in technical, in the legal sense as well. Lack of sound legal protection puts a large number of investors at risk, and if they had the trust and confidence to put their money into a project to support the developers’ vision, those same developers should take necessary measures to protect the investors as much as possible. Talking about off-chain challenges, I would say the industry is still facing the challenge of educating people on a larger scale about decentralized autonomous organizations, how they operate, and Web3 in general. Understanding the regulatory framework that supports decentralization is the biggest challenge for regulators and lawmakers.

DAOs have huge potential to go mainstream, but I think the adoption will take a long time. DAO is a novel type of structure even for those who are already building in the space, and to the off-chain world, I believe it would take longer to grasp and implement. Once people understand the true power of decentralization, and what a unified, decentralized unity can achieve, it will be the breaking point for the centralized environment.

WACEO is a DAO-focused non-profit that provides DAOs with a framework for compliance, legality, and risk management and prevention in line with regulatory best practices. It is an environment in which blockchain-based projects can interact with traditional world service providers in a centralized manner while maintaining a significant level of decentralization. We do that by providing blockchain-based projects with legal representation in that relationship. Our support entails performing legal and business assessments of the project where we understand potential legal and compliance risks associated with the project, and based on that give recommendations on best practices to mitigate those risks. As a way to support the legal and compliance needs of the environment, we are launching a token, a legal and compliance reserve currency that aims to be a multichain accepted payment and provision method for legal, compliance, and other needs. DAOs would be able to swap their native token against ours and create their legal reserves which can be deployed to pay for various DAO needs that require centralized world services. Having WACEO token legal reserves eliminates the need for fiat and stablecoin funds, and it further mitigates potential risks of centralization of the project and personal liabilities of the developers.

I am the managing director, and I run day-to-day operations of the organization. My main focuses are DAOs, and helping them build their operations and governance taking into consideration legal and compliance aspects. Currently, I am also leading the WACEO token project launch, and the Women W3mpowerment project.

I usually work 7 days a week. A bit less in the summer, though. I wake up, do my workout, and get to work. I spend a lot of time in meetings, with the team and partners. Right now, we are going for a private sale for our token, and looking for funds for our Women W3mpowerment project so most of my work currently revolves around investors and partner calls.

In our efforts to support this decentralized environment, we are also initiating the Women W3mpowerment project to bring more women to Web3. The blockchain industry has experienced hyper-growth in the past couple of years. However, the lack of female representation still remains an issue. According to research, less than 4.13% are female founders, around 26% are crypto investors, and less than 5% of female artists are involved in NFT sales. We strive to bridge this gap by educating female legal professionals on Web3 and creating jobs, networking, and new opportunities for them. Our initiative aims to focus on specific target groups of women that might not have had opportunities to get access to Web3 and understand its potential. Initially, we would work with a broader group of female participants, and then focus on specific groups and regions (e.g. Women of Africa, South Asia, South America, and discussing potential Women of Ukraine focused initiative). The goal is to make Web3 education available to the wider she-community and empower them to join Web3 and become builders and founders themselves.

Meeting DAO ‘CEOs’ that have been in the space longer than I have (giggle). I think the initial learning about DAOs, DeFi community, and the creativity in the whole Web3. When I first learned how the DeFi community works. It still amazes me to hear ideas of the builders, the problems they are solving and the constant innovation of the environment. Web3 is still so new, that every day you learn something new and being surprised by some events is not a rare occasion.

I definitely see wider adoption of crypto, in terms of both investors and institutions. More than ever, people are moving a lot faster with innovation than they used to, and even though there is some sort of stigma around crypto, people have unlimited access to information, and they can see the good and the bad, and decide to try to risk it when they see all the amazing stuff built. Web2 world lives online and I don’t think it will take much for it to move on chain. We just need to be patient and supportive, and do what we do: educate and build. In two years from now, we will have more regulations in place, and hopefully a smaller number of scams, so it will be a safer place for investors. We will surely have some countries — Web3 hubs — that will dominate the rest, and the others will either do their best to follow or will be left behind. That will depend on the innovative regulations and how supportive they are of the environment. Aleksa is Managing Director at WACEO where she focuses on working with DAOs helping them structure their governance and operations, and understand legal and compliance aspects of the decentralized instrustry. She also works closely with communities and educates them on DAOs and Web3. Aleksa is a multi-disciplinary legal professional who has built a career in operational roles in tech and fintech startups. She is passionate about DAOs, decentralized finance, and the endless possibilities of blockchain. Aleksa believes the future is decentralized, and DAOs and DeFi are here to change the way we live and work today. She is an advocate for inclusion and equal opportunities for everyone, and that is why she dedicates herself to working toward bridging the gender gap in the Web3 space. Aleksa strives to change the usual narratives of the lack of female presence in the blockchain industry by educating women on the environment and helping them establish themselves as professionals in the space. ⚖ DevelopmentsBespoke Entity Structure Creation for Digital OrganizationsAuthor: lawpanda

Decentralized autonomous organizations represent a new organizational structure that, in form if not always function, allows for decentralized decision making using blockchains and token-voting mechanisms. Where legacy industrial corporations are reliant on the separation of management and ownership, DAOs offer a radically different template for organizational participation where ownership and management are merged — driven by smart contracts, fluid memberships, and transparent transactional channels. One of the most discussed aspects of DAOs is the ongoing debate surrounding their legal status and structure, and the mechanisms that allow DAOs to interact with the rest of the world. What mechanisms will allow an organization that is intrinsically global to benefit from legal personality and limited liability? Can this occur without being incorporated in a single jurisdiction? What are the ideal jurisdiction and entity structures? Ultimately, can an on-chain organization comply with jurisdictional legal obligations while retaining its sovereignty, and do they even want to? Incorporating a DAO in any jurisdiction is generally not straightforward due to administrative — more so than substantive — hurdles. Most jurisdictions won’t accept reference to on-chain code as an operating agreement or bylaws, and even incorporation of these fundamental aspects of a DAO by reference can be difficult. Additionally, identifying the members of a largely anonymous or pseudonymous organization can be problematic, for obvious reasons. Incorporating or associating a DAO with a pre-existing legal entity structure is generally analogous to fitting a square peg into a round hole. With enough manipulation or hammering, it may eventually work, but your peg will almost certainly no longer retain its original desired attributes. A handful of forward-thinking jurisdictions are already making modifications to current entity structures or working to create new structures to support DAO incorporation in their regions:

Legal uncertainty continues to impede the growth and widespread acceptance of this new form of social organization. However, many may have forgotten that the U.S. LLC only came into existence in the late 1970s. The LLC only then acquired the full taxation and liability protection benefits that have allowed it to become one of the most commonly utilized enterprise structures since the early 1990s. The legislative changes required to reach that point were only brought about due to lobbying efforts by affected businesses and associated interest groups. Similar efforts, likely on an international scale, may be required to facilitate widespread adoption and use of DAOs — in whatever format — as a viable organizational structure or business model. The U.S. Limited Liability Company Is a Gen Xer

As mentioned, the U.S. LLC structure was developed in the late 1970s to address the radically different tax regimes imposed on incorporated and partnership structured businesses and the lack of limited liability in unincorporated U.S. entities. Partnership tax provisions impose only one level of taxation at the owner level (i.e. ‘pass-through’) and provide a number of other benefits, including the ability to allocate profits and losses more flexibly. Corporate tax provisions (with limited S corporation exceptions) require corporations to pay two levels of tax, once at the entity level and again at respective shareholder levels. At the time of the LLC's creation in 1977, partnership classification regulations administered by the Internal Revenue Service (IRS) imposed certain requirements on all unincorporated business organizations seeking the benefits of partnership taxation — and also precluded application of limited liability for non-corporate organizations. In 1988, the IRS issued Revenue Ruling 88-76 allowing the initial Wyoming LLC to be classified as a partnership despite the presence of limited liability protection. Adoption of the LLC as a recognized entity structure ultimately represented a new solution to the limitations imposed by the two-tier corporate tax structure and the preclusion of a limitation on liability by unincorporated organizations. The 1977 Wyoming Limited Liability Company (LLC) Act established the first unincorporated business entity in the United States to combine statutory limited liability protection with the ability to be taxed as a partnership for federal income tax purposes. The Wyoming Act was written specifically for Hamilton Brothers Oil Company (Hamilton). Due to the high-risk and speculative nature of their investments, Hamilton needed a flow-through entity to provide one level of taxation and limited liability protection similar to the Panamanian ‘limitada’. In contrast to the U.S. entities available at the time, limitadas provided direct limited liability as well as the opportunity to secure partnership status for U.S. income tax purposes. However, Hamilton quickly discovered that limitadas faced administrative challenges in the U.S. and, because no analogous company existed, raised doubts about the extent to which U.S. courts would recognize their limited liability feature. Because no feasible domestic entity combining limited liability and partnership taxes existed, Hamilton utilized attorneys and lobbyists to establish an unincorporated domestic entity similar to the foreign limitada in a friendly jurisdiction. The proposed entity would satisfy the literal criteria of a partnership while also offering direct limited liability protection to all participants. The proposed LLC Act was modeled after the German GmbH Code and the Panamanian LLC Act. These entity structures had four basic characteristics:

The newly developed LLC structure was initially introduced to — and rejected by — the Alaska legislature. Shortly after the rejection of the LLC legislation in Alaska, Hamilton presented an identical LLC bill to the Wyoming legislature, which promptly achieved enactment on March 4, 1977. Armed with the newly established Wyoming LLC legislation, Hamilton submitted a request for a positive partnership classification ruling from the IRS, the federal agency charged with determining whether unincorporated businesses escape association status. In 1980, following significant lobbying efforts, the IRS issued a favorable private letter ruling to Hamilton Brothers Oil Company regarding its Wyoming LLC. Unfortunately, this form of opinion is only applicable to the soliciting party. In early 1983, the IRS announced that it would review the impact of applying limited liability to organizations classified as unincorporated. During the five-year study, while LLC tax status and limitations on liability remained in limbo, further growth in LLC legislation and businesses employing the structure predictably ground to a halt. The LLC had little prospect of mass adoption as long as its taxation status was in question. On September 2, 1988, the Internal Revenue Service issued Revenue Ruling 88-76 — a public interpretation of the law on which all taxpayers may depend — allowing the Wyoming LLC to be classified as a partnership despite its limited liability attributes. Following the IRS's landmark decision to recognize the LLC's right to be taxed under the partnership rules, states began to implement legislation adopting the LLC as a business structure. By the end of 1996, all fifty states and the District of Columbia had passed legislation allowing the formation of LLCs within their borders. This new business form rose from obscurity, to be a viable alternative to partnerships and corporations, in less than 20 years, a rate unprecedented in the development of business organizations. Ultimately, the LLC's battle to emerge as an independent, viable alternative for doing business revolved around convincing the IRS that it met the partnership classification requirements. The LLC’s current viability as an entity structure only came about due to concerted lobbying efforts, and DAO proponents should understand that such targeted efforts will certainly be necessary to craft legislation that will allow DAOs to operate optimally and without sacrificing their inherent attributes. Current U.S. Legislative Efforts

In 2022, Senators Cynthia Lummis, R-Wyo. and Kirsten Gillibrand, D-N.Y. co-sponsored the Responsible Financial Innovation Act. DAOs were clearly not at the forefront when drafting the bill; one half a page out of the 69 pages of legislation addressed recognition of DAOs. The bill specifies that the default classification for these community-led entities is as business entities for tax purposes. It also requires most DAOs to be properly incorporated in accordance with existing laws of an identifiable jurisdiction, such as an LLC or partnership. The bill allows putative DAOs to avoid business disclosure requirements and not be considered a business entity if they can prove they are sufficiently ‘decentralized’. Ultimately, the legislation leaves a lot to be desired. It is, however, at least a starting point. At the state level, Wyoming, Vermont, and Tennessee have made efforts to accommodate DAOs by enacting laws that specifically acknowledge the validity of blockchain smart contracts as governing documents. Theoretically, this allows DAOs to simply point to the respective blockchain or contract to legally verify the members of the LLC while concurrently maintaining the benefits of blockchain technology — privacy and immutability.

Jordan Teague and other crypto-native attorneys have discussed some of the inherent limitations and design-choice issues associated with existing U.S. DAO LLCs. Compared to creation of the Wyoming LLC in the 1970s, legislative efforts to accommodate DAO registration in the U.S. have primarily been related to minor administrative modifications. Where the early Wyoming LLC Act combined attributes from distinct already-existing legal structures, the U.S. LLC acts are simply making administrative concessions. Due to the unique attributes associated with DAOs, a bespoke entity structure — designed specifically to accommodate the unique needs of an on-chain entity while still allowing real-world interactions and limited liability — may ultimately be the ideal way to accommodate DAO registration and activity. Modification and Bespoke Entity Creation in RMI

As of 2022, the Republic of the Marshall Islands (RMI) officially recognizes DAOs as legal entities, thanks to the Amended Not-for-Profit Entities Act of 2021 (Act). The act allows DAOs to register as Marshall Islands Non-Profit DAO LLCs and is based on legislation passed by the RMI government with the assistance of the founders of MIDAO Directory Services Inc. (MIDAO). In addition to its legislative efforts, MIDAO is a multinational organization that was formed to act as the registered agent for RMI DAOs and to assist DAOs in registering in the Marshall Islands under the new amendment. As previously stated, MIDAO led efforts to facilitate pro-DAO legislative changes. Former RMI chief secretary and co-founder of MIDAO, Bobby Muller, has stated that his country recognizes that now is a “unique time to lead” the “blockchain revolution”, and that DAOs will play an important role in creating “more efficient and less hierarchical organizations”. MIDAO's strategy is to provide a competitive cost of incorporation, a supportive government with internationally recognized courts, and an environment open to technological advancement. In addition to the non-profit LLC structure, MIDAO is also currently working on legislation that will allow the registration of a for-profit DAO LLC option that may be particularly useful to investment DAOs. Modification and Bespoke Entity Creation in the AIFC

Poko is a Y Combinator-backed startup that, in addition to on-chain DAO governance tools, is focused on making wrapping or associating DAOs with associated legal-entity frameworks as frictionless and inexpensive as possible. Poko believes that operating in a DAO should not preclude the project or members from taking advantage of the benefits afforded to a governmentally recognized legal entity, including the ability to contract, limitations on liability, tax implications, and other advantages associated with corporate personhood or jurisdictional personality. Poko is approaching its legislative efforts in iterative cycles in order to create a live-model jurisdiction that will allow DAOs to have a legal form that is compatible with on-chain governance. Poko is working with the Kazakh government to establish a new DAO jurisdiction based in the Astana International Financial Centre (AIFC). The AIFC is a Kazakhstan-based common law special economic zone that is developing innovative and forward-thinking financial regulations. AIFC was created in 2018 to establish a modern financial and legal hub between Asia and Europe. In 2021 it received an influx of bitcoin miners, and other cryptocurrency-related entities, as the result of China’s ‘crypto ban.’ As a result of this exposure, Kazakhstan became interested in developing a dedicated crypto/Web3 industry. To facilitate the initiative, the President endorsed a national crypto strategy. Cryptocurrency exchanges such as Binance and Bitfinex are set to open operations in the AIFC before the end of 2022. In contrast to other offshore hubs, AIFC and the government are implementing training programs to accommodate more than one hundred thousand information and technology engineers, with the goal of providing value to the crypto economy via a trained pool of workers. To distinguish itself as a well-regulated Web3 jurisdiction, the AIFC has implemented, or is considering, the following legislation:

Poko has been granted exceptions in the AIFC to create an initial limited number of ‘test’ DAOs, associating them with existing legal entity frameworks (foundations and special purpose vehicles (SPVs)). To facilitate the process, certain requirements that DAOs might have difficulty fulfilling have been eliminated for the test DAOs. Poko has already established the first investment DAO SPV in the AIFC and is working with regulators to have the next 100 test DAOs approved by the end of July 2022. Accommodations for the initial SPV-structured DAO included streamlining the overall registration process — and ensuring a fully electronic process, determining the best way to conduct KYC/AML/CFT requirements, issuing tax registration numbers, and establishing crypto-fiat banking rails. Based on the findings derived from the test DAOs, Poko will develop and introduce proposed DAO-specific legal structures to the AIFC in 2023. Considerations for this bespoke entity would include 1) zero percent corporate, income, capital gains, and dividend distribution tax rate until 2066; 2) the ability to utilize a common law legal regime based on English law for the first time in central Asia; 3) a frictionless corporate e-filing system that can be integrated with Poko’s dashboard; and 4) an independent court with leading British judges and International Arbitration Center for dispute resolution. Poko is also collaborating with the banking authority to establish a pilot crypto-fiat banking facility to accommodate crypto-native transactions. Poko’s goal is to facilitate decentralized on-chain and off-chain decision making and to allow DAOs and their members to choose their own on-chain and off-chain governance structures. Poko will provide entities in the AIFC — and eventually other jurisdictions — with the resources they need to succeed. Poko has stated that it is working to make Astana the ‘A’ in the ‘ABCD’ (Astana, BVI, Cayman, and Delaware) of the most popular DAO legal entity options. The COALA DAO Model Law

The DAO Model Law (ML) was published in June 2021 by the Coalition of Legal Automated Applications (COALA). COALA is an international, multidisciplinary research and development initiative that seeks to clarify blockchain technologies, smart contracts, and decentralized applications. The initiative is made up of lawyers, academics, economists, and computer scientists, among others. The ML seeks to strike a balance between the importance of innovation and experimental freedom in technological development.   As previously referenced, DAOs face significant legal uncertainty that arguably limits their development and use. The ML aims to create uniformity and legal certainty while allowing for additional innovation. This is facilitated by not requiring formal registration with a jurisdiction, unlike other regulatory frameworks or entity structures that may accommodate wrapping or association with a DAO. The ML combines autonomy for DAO members with separate legal personality for the DAO in order to encourage pseudonymous participation and to recognize that human-to-machine or machine-to-machine interactions can carry out valid legal acts. Participants in DAOs are also granted limited liability under the ML. The ML is ultimately intended to allow DAOs to retain their underlying characteristics and attributes while providing legal personhood with all of the associated protections and benefits. Because DAOs are inherently transnational, the ML strives to adopt a consistent set of rules that can be implemented across jurisdictions. DAOs formed in accordance with the ML's formation requirements will be recognized as legal entities separate and distinct from its members. To ensure its broad applicability, the ML provides a minimum set of rights, duties, and protections that are widely recognized in legislation governing analogous corporate entities in major jurisdictions. The ML also includes specific provisions that address the unique characteristics and challenges faced by DAOs, including procedures in the event of adversarial forks in the underlying blockchain, DAO restructuring, or failure events. Although no governmental authority could directly enforce the ML provisions onto a DAO, the baseline of legal certainty is meant to incentivize adoption. Despite the ongoing and active discourse regarding DAO entity structures in the Web3 community, the ML garnered minimal attention when announced in 2021. It has, similarly, not generated significant discussion. However, this could simply be based on the timing of the announcement or other unknown considerations. Notwithstanding, the ML represents, at the very least, a useful starting point for discourse with regulators and should not be disregarded. It is also worth noting that this is just the first iteration of a proposed model law. The ML’s executive summary references the UNCITRAL Model Law on Electronic Commerce as a loose exemplar for the ML. Legislation based on the Model Law on Electronic Commerce has only been adopted in 85 of the 193 member states of the United Nations in the 25 years since its issuance in 1996. Proponents of the ML will likely face significant challenges in persuading legislators that the principles of functional and regulatory equivalence on which the ML is based protect the interests of their jurisdiction. As with the development of the U.S. LLC in the 1970s, the development of a viable DAO Model Law necessitates a bottom-up, community-driven approach informed by both legal scholars and policymakers, as well as the experience of people working on the ground and interacting with DAOs on a daily basis. Say it With Me: We Are Still So Early . . .

As more people and money flock to DAOs, it will be important to resolve lingering questions about the legal rights and responsibilities of these entities and their members. In the U.S., states are leading the way. Outside of the U.S., entities like MIDAO and Poko are working to facilitate more significant legislative changes that will allow DAOs to be considered a viable entity structure, appropriate for widespread adoption. And, while slightly more esoteric in format, COALA’s Model Law provides a useful roadmap for DAO proponents attempting to enact legislative changes. It took nearly twenty years, from 1977 until 1996, for creation and widespread adoption — i.e. adoption by all 50 states and the District of Columbia — of the LLC entity structure in the U.S. Even this seemingly protracted period represented an unprecedented rate of adoption. Wyoming’s DAO LLC legislation was only enacted in August 2021 and does not ultimately represent a significant or groundbreaking modification of the entity structure in comparison to the LLC’s combination of pass-through taxation and limited liability protection. In the future, there will almost certainly be iterations or combinations of existing entity structures to accommodate ‘wrapping’ or other association of legal entities with DAOs before a more ideal structure is modified or created. Needless to say, it’s still relatively early in the legal lifecycle of DAOs and their associated legal structures and it is likely that existing structures will change or new structures will be developed in ways that have not yet been considered.

lawpanda is a U.S. attorney with an active litigation and counseling practice. He is a member of BanklessDAO's Legal Guild, LexDAO, the LexPunkArmy, and member/consultant/contributor to a variety of DAOs and protocols. When he’s not writing for Decentralized Law, he is working to reduce friction between on-chain and legacy entities through entity structuring and common-sense legal solutions. Governance Considerations for DAOsAuthor: Teresa Carballo

Governance has always been a controversial area in human history. Governance is a system by which rules, norms, and actions are structured, sustained, and regulated, as well as how they are enforced. Governance exists within nations, companies, families, and other organizational constructs, including in DAOs. DAOs were conceptualized to be a solution for democratizing decision making for a DAO itself and its treasury and a way to distribute power across the organization. Defining its governance model is one of the first decisions a DAO must make, as there are a number of ways to achieve democratization, and naturally it varies from one DAO to another. One of the most popular ways DAOs can facilitate this governance process is through the use of tokens. In many DAOs, the governance tokens are transferable, having and gaining market value as the DAO grows. Typically, along with the use of a token comes an agreement, which may be called a covenant or constitution, that governs relations among the members. Just as with nations, we are seeing DAO governance models that do not fulfill the ideals that DAOs were created to achieve. Decentralized governance has certainly been a challenge. Chainalysis analyzed 197 DAOs and found that ownership and control were more centralized than expected. Their investigation led to the following insights:

Clearly, many DAOs are not living up to their decentralization ideals. Here are some considerations to take into account when building and maintaining a decentralized governance model for DAOs:

For both lawyers and non-lawyers in the space, DAO governance presents interesting and challenging opportunities to develop innovative systems, involving both on- and off-chain governance. Teresa has a background in litigation but now focuses on corporate preventive law. She is fascinated by lawyering in Web3 and is licensed to practice law in Panama and Mexico. Which Law Applies to Unincorporated DAOs?Author: DAOLAW

Although the discussion about legal wrappers for DAOs gets more and more attention, many DAOs choose to launch and operate without any legal wrapper, especially in pro-decentralization and pro-anonymity communities. Doing so is legally possible, but it does create significant practical and potential legal consequences for active participants in a DAO. In the case of DAOs, especially those with economic interests, it must be assumed that the parties involved have a sufficient cooperative intention to be legally bound, so that the rules of international company law can be applied. But given that an unincorporated DAO has no place of residence and almost certainly no headquarters, determining which jurisdiction's law to apply to a dispute involving a DAO is complex. Moreover, unlike traditional software applications that reside on a particular server under the control of an operator assigned to a specific jurisdiction, DAOs run on every node of a blockchain — anywhere and nowhere. In contrast to traditional organizations led by individuals living in different and identifiable areas, DAOs are collectively managed by a distributed network of peers who contribute to the underlying blockchain-based network from anywhere in the world. Thus, a decentralized network, like a DAO, is fundamentally opposed to the traditional search under international private law for the cartographic center of a legal matter since no specific connection point can be determined. The traditional theories to determine the jurisdiction for companies in Europe are based on either the place of incorporation or their administrative center. This is not helpful in the case of DAOs because, typically, neither of these can be determined. Moreover, other reference points also have limits in this context. For example, the assets of a DAO are, if consisting only of digital currency, spread all over the world. Therefore, the principle of Lex loci rei sitae (law of the place where the property is situated) cannot be implemented. Possible SolutionsAssuming a situation where a DAO has entered into an agreement with another party, the question arises as to which jurisdiction’s laws would apply to legal action involving the agreement. A possible solution would be to determine the applicable law of the jurisdiction of the other contractual party, if the place can be identified. But this solution does not help with determining the legal status of a DAO in the first place. However, for a situation where there is no agreement, but a third party wishes to bring legal action against a DAO, an applicable jurisdiction must still be identified. It may be possible to rely on the Lex Fori principle. This means the positive law of the state, nation, or jurisdiction in which a lawsuit is initiated or a remedy is pursued. In other words, the legal procedures to be followed in such a case would be determined where a trial is being held, but the substantive law to apply would be based on the laws of where the action occurred. This principle is used to prevent 'forum shopping’, where plaintiffs bring actions in the location with the most favorable substantive laws to their case. The likeliest scenario for a lex fori case would be that a non-anonymous individual member of a DAO is sued either in their personal jurisdiction of residence or in the jurisdiction in which the plaintiff alleges the member, as part of the DAO, has engaged in sufficient acts to make the member subject to the laws of that state. Suing a DAO as an unincorporated entity separate from the DAO's members could be a problematic starting point for a plaintiff because the DAO has no address (in the real world, at least) at which to serve a complaint, which is a necessary step in commencing a lawsuit. However, a court might deem service of the complaint on an individual member of the DAO sufficient to constitute service on the DAO itself. Any court claiming jurisdiction over a DAO or its members will have to decide which jurisdiction's law applies to the issue of whether the DAO is a general partnership, joint venture, non-profit association, or another type of unincorporated legal entity. The legal analysis used to make this determination is fact-specific, varies by jurisdiction, and is not entirely predictable. With this in mind, it may make sense for some DAOs, especially those that may enjoy liability limitations as a non-profit in certain jurisdictions, to add a choice of law provision to the DAO articles of association, the white paper, or a participation agreement provided that the DAO has sufficient nexus to that jurisdiction. Finding a Way ForwardIn summary, unincorporated DAOs, in the absence of legal structuring, tend to be jurisdictional grab bags — it is hard to determine which jurisdiction's laws will apply to a DAO-related dispute. Thus, it may also be hard to predict the outcome of the dispute, as laws and civil procedure vary widely among different jurisdictions. So suppose no choice of law has been made, or the choice does not bind the DAO members. In that case, this leaves room for the plaintiff to either sue these individuals who are directly responsible for the plaintiff's alleged harms or to sue the DAO in a jurisdiction where the DAO would be qualified as a general partnership with joint and several liabilities on its members. In general, the application of lex fori already encounters theoretical legal concerns. In the case of DAOs, there are also legal uncertainty and practical issues. For these reasons, this issue needs to be further explored, and new theories must be developed to determine the applicable law. One solution to create legal certainty could be to base the jurisdiction on the location of the relevant blockchain's foundation on which the DAO runs. In the case of the Ethereum blockchain, this would mean that, given the location of the Ethereum Foundation in Switzerland, Swiss corporate law would apply to DAOs, provided no (enforceable) choice of law has been made. This grants the opportunity for a uniform linkage of the organizational forms on this blockchain, which provides increased legal certainty. This would also be more in line with the international private law search for a cartographic center. Finally, an international agreement on regulation of DAOs could create a specific regulatory framework for enabling choice of law provisions and determining the jurisdiction of a DAO in the absence of such a choice. Dr. Biyan Mienert is an attorney whose practice focuses on crypto and fintech. He currently lectures on Digitalization Law at the University for Applied Science in Hessen (Germany). He primarily conducts research and advises on the legal issues and structuring of DAOs, NFTs, Web3, and Token offerings. In his Ph.D., he developed a comprehensive legal framework for DAOs. He is a frequent speaker at international conferences and political working groups, and has advised numerous well-known crypto startups. The Concept of Ownership in DAOsAuthor: MDLawyer

While there isn’t a generally accepted definition of a DAO, these are organizations without a centralized leadership structure, for which governance is generally driven by the coded terms of smart contracts maintained on a blockchain ledger. With regards to the legal definition of such structure, the broad consensus between legal practitioners in most jurisdictions is to classify a DAO as a general partnership. A general partnership can be defined as an agreement between two or more persons to share a common interest in a commercial endeavor and to share its profits, losses, and assets. Such an agreement does not require any formality and thus arises by default from the actions of these persons, i.e. the general partners. These structures differ from limited liability companies as they are siloed from their members — they have their own legal personality. Thus, legal personality enables the shareholders of limited liability companies to have their liability shielded from the obligations assumed by the entities they are a part of. Accordingly, since a DAO does not have legal personality, referring to a DAO, from a legal point of view, is referring to its members. These are considered jointly and severally liable for the obligations assumed on behalf of the partnership. This applies even if these obligations derive from the actions of other members on behalf of the DAO, as any member can enter into an agreement that is binding on every other member, even when others are unaware of it. This effectively means that a counterparty to a DAO in an agreement may seek to claim the full amount of damages arising from the non-compliance of or default on an obligation under the agreement from any member of the DAO. Such members could then be legally obliged to pay the full amount of the damages to the claimant and may have the right to claim from the other members of the DAO their pro rata share in the paid damages. Nonetheless, this right may only be theoretical if the DAO’s members are unknown. Even if they are known, it may be complex to ascertain the amount of damages for which each member is responsible for. Hence, having a legal entity representing a DAO (a.k.a. a ‘legal wrapper’) may make sense to address several issues, notably:

A lot has been written with regards to the consequences of the legal classification of DAOs as general partnerships in relation to the potential liability of the DAO’s members. Nonetheless, until recently no case had ever been brought to court to challenge this understanding. The Sarcuni et al. v. bZx DAO et al. case may shed some light on how courts will treat DAOs. Here, the plaintiffs make an unprecedented argument to hold the DAO’s co-founders and governance participants jointly and severally liable for damages for the actions of the DAO on the theory that the members of the DAO had formed a de facto general partnership and thus the token holders are each general partners without any limitation of liability. In light of the above, one can envisage that the concept of ownership within a DAO is analogous to its liability regime. Since a DAO does not have a legal personality, from a legal point of view, it does not exist as a separate entity from its members, i.e. it is indistinguishable from the collective of its individual contributors. Accordingly, one could argue that, similar to a general partnership, members may have rights over the profits and assets of the DAO. A DAO’s assets are generally transmitted without legal formalities and thus could be seen as jointly owned by all of its members. This is the case, for example, with the transfer of title over cryptoassets to the treasury of the DAO. If the DAO acquires a ‘real-world’ asset, then it will also belong to its members (assuming no legal formalities to effect the transmission of property/ownership). Also, in relation to intellectual property (IP), since the authors of the IP will have title over it unless they assign it (which may require burdensome formalities), then the IP which is assumed to belong to a DAO may not even be of the partnership. In such cases it has been assigned, then all members will have title over it — which can become a complex issue if the partnership intends to commercialize or license it to a third party. This right of ownership, however, may not mean much as it is not clear how a member of a DAO could enforce its rights over the partnership, notably, due to the pseudo-anonymity provided by the blockchain. The situation may get even trickier if the DAO’s members intend to enforce their rights as there is no clear legal entity which can act as a plaintiff. In addition, to assert the rights of the partnership in court, all members may have to agree over the claim and file on the partnership’s behalf, which may not be feasible or desirable. To sum up, there are still a lot of open questions pertaining to DAOs and their members that lack a clear solution. Nonetheless, it is possible to contemplate certain legal constructions that could solve this uncertainty, but these are largely untested. The fact that DAOs are international organizations, bringing together members from across the globe, only makes these questions even more complex to resolve. MDLawyer is a Portuguese qualified lawyer who renders legal advice to founders and emerging companies throughout the startup’s lifecycle. Also, he has been very active in advising clients regarding blockchain and cryptoasset-related matters. 👮♂️ TaxationSquaring the Circle: Smart Contracts and DAOs as Tax EntitiesAuthor: Jason Schwartz

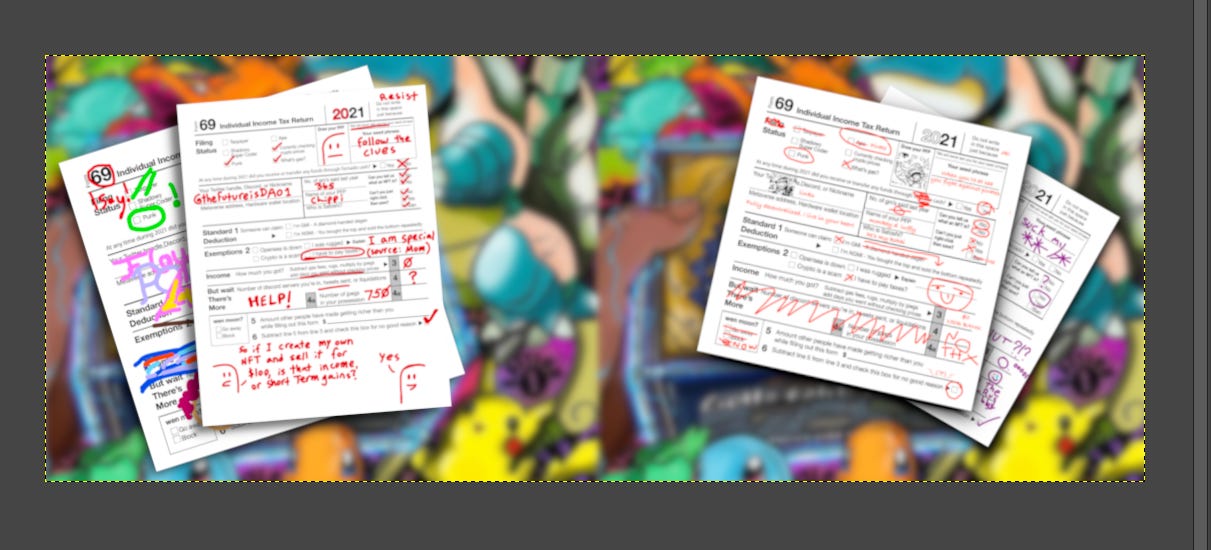

You’re not a U.S. tax lawyer unless you know your shapes: a rectangle is a 'C' corporation; a triangle is a partnership; and an oval is a disregarded entity for tax purposes. Shapes are important because virtually any arrangement in which parties divide profits creates an entity for tax purposes, even absent a non-tax legal identity, and the entity’s tax classification could have meaningful consequences. The tax law’s hair trigger for deeming entities to exist isn’t a big problem in the meatspace because parties with a regular course of cooperating off chain for profit typically need a legal entity for non-tax reasons, like liability protection or setting up a bank account. Once they choose a legal entity, the tax law’s default classification rules usually work well, and provide some electivity for when they don’t. But things get more complicated on Ethereum because, while traditional tax principles treat many pooled smart contracts and decentralized autonomous organizations as entities, it’s hard to determine what kind of entities they are, who their equity holders are, and how they are supposed to pay taxes, file tax returns and information reports, and withhold on payments to others. This article examines the problems with treating smart contracts and DAOs as tax entities, and discusses some legal structuring options for DAOs. I. Pooled Smart ContractsCurve’s '3pool' is a smart contract that algorithmically quotes exchange prices for the stablecoins DAI, USDC, and USDT. Anyone can add liquidity to the 3pool in exchange for 3CRV tokens that represent a share of the pool. The pool’s composition changes as traders swap stablecoins with the pool for a small fee. Normal tax principles seem to treat the 3pool as a business entity among the 3CRV holders, who own shares in an automated market-making business. But what kind of entity is the 3pool, and what are the attendant tax consequences to it and the 3CRV holders? A. Application of Default Classification RulesThe tax law contains default classification rules for unincorporated joint ventures (JVs) like the 3pool. Unfortunately, the rules are difficult to apply to most on-chain arrangements. 1. Is the 3pool created or organized in the United States? Tax regulations provide that a JV is domestic if it is created or organized in or under the laws of the United States or any state, even if it’s also created or organized in a foreign jurisdiction. Presumably, if you could point to a single programmer (or group of programmers) who deployed the 3pool from the United States, it would have been created there. Alternatively, if all 3CRV holders were in the United States, the 3pool would probably be domestic because U.S. law would govern their relationships. Finally, if the 3pool operated under a traditional contract that specified which jurisdiction’s laws applied in the event of a dispute, you could reason that it was organized in that jurisdiction. But there’s no way to determine with certainty where the 3pool was deployed from or where 3CRV holders are located because the 3pool is governed by Curve, a DAO whose members are globally distributed and largely anonymous, and 3CRV holders’ identities are similarly obscured by their public keys. And because the 3pool is an immutable smart contract, it has no choice-of-law provision. 2. Are all 3CRV holders’ liability limited by statute? Let’s assume that the 3pool is a foreign entity for tax purposes because it is not created or organized in the United States or any state. By default, a foreign entity is a corporation for tax purposes if all members have limited liability, which tax regulations say is 'based solely on the statute or law pursuant to which the entity is organized.' A foreign entity is a partnership for tax purposes if any member has unlimited liability. As a threshold matter, because we don’t know where the 3pool is organized, we don’t know whose statutes or laws to look at. However, there don’t currently appear to be any statutes or laws in any jurisdiction that limit token holders’ personal liability for actions taken by a smart contract, which suggests that the 3pool is a partnership, not a corporation. That said, it’s doubtful the IRS contemplated anonymous equity holders when it drafted the default classification regulations. Anonymity is a powerful practical limitation on personal liability. 3. Is 3CRV readily tradable and is less than 90% of the 3pool’s income passive? Under the publicly traded partnership partnership (PTP) rules of the tax code, a JV that otherwise would be treated as a partnership is instead treated as a corporation if (1) its interests are readily tradable and (2) less than 90% of its gross income in any year is passive. You can trade 3CRV on Uniswap, so it’s probably readily tradable. In addition, the 3pool’s income consists of fees and dealer income, which aren’t passive. So, even if the 3pool were initially classified as a partnership for tax purposes, it would probably be reclassified as a corporation under the PTP rules. 4. Are at least 50% of the 3pool’s assets or 75% of its income passive? U.S. taxpayers are subject to onerous penalties if they hold stock in a foreign corporation characterized as a passive foreign investment company (PFIC), unless they elect to be subject to pass-through tax on their share of the PFIC’s net income and gain. (Alternatively, they can elect to pay tax on the PFIC’s stock on a mark-to-market basis, but only if the stock is traded on a national securities exchange like the NYSE.) A foreign corporation is a PFIC if at least 50% of its assets or 75% of its income is passive. Passive is defined differently here than under the PTP rules. Tokens generally are passive assets, unless the corporation is a dealer in those tokens. There is a good argument that if the 3pool is a foreign corporation, it’s a dealer because it stands ready to take either side of a trade (e.g., DAI for USDC or vice versa). If so, it shouldn’t be a PFIC. B. Tax ConsequenceAlmost all entities either (1) owe U.S. entity-level tax or (2) require their owners to pay U.S. tax on a pass-through basis. The only exception is a foreign corporation that is not in a U.S. trade or business (a USTB) and is not a PFIC or a controlled foreign corporation (CFC) with 10% U.S. shareholders. The 3pool might fall within the exception, but only if we make several convenient assumptions. Other pooled smart contracts would have to be analyzed case-by-case. Pooled smart contracts that don’t fall within the exception are subject to tax payment and/or filing requirements that smart contracts don’t — and can’t — comply with. 1. Entity-level tax We determined that the 3pool was likely to be a corporation under the PTP rules. If the 3pool is a domestic corporation, it’s subject to US corporate income tax, currently imposed at a 21% rate, on its net income. The 3pool isn’t paying corporate taxes or filing tax returns. If the 3pool is a foreign corporation and is in a USTB, it’s subject to the 21% U.S. corporate income tax plus a 30% branch profits tax, for a net 44.7% federal tax rate. Normally, a foreign dealer like the 3pool is in a USTB if it or its agents negotiate or execute transactions from within the United States. Deploying an algorithmic trading program from within the United States might give rise to a USTB. As mentioned above, it doesn’t seem possible to determine whether the 3pool was deployed from within the United States. 2. Pass-through tax Assuming the 3pool is a corporation, foreigners shouldn’t be subject to pass-through tax. Assuming the 3pool isn’t a PFIC, U.S. people shouldn’t be subject to pass-through tax unless the CFC rules apply. A foreign corporation is a CFC if it is more than 50% owned by 10% US shareholders. In that case, each 10% U.S. shareholder is subject to pass-through tax. But because CRV3 holders are anonymous, it would be impossible to determine whether the 3pool is a CFC. In any event, the 3pool doesn’t provide pass-through reporting to holders. C. Exponential ComplexityDeFi allows market participants to conduct an ever-growing array of historically intermediated financial transactions. As a result, even if taxpayers received adequate guidance on how to treat the 3pool, they would probably have trouble applying that guidance broadly. 1. Unique positions For example, what if CRV3 holders could determine the price ranges to which they provide liquidity, so that each position is potentially unique? That’s how Uniswap v3 works, where liquidity providers’ positions are represented by ERC-721 tokens. It’s unclear whether general tax principles would treat each position as equity in its own entity or as a class of equity in one big entity. Under a multi-entity approach, unique positions (those held by only a single person) likely would be treated as disregarded entities, meaning that the holder would be treated as directly engaging in the smart contract’s market-making activities. Non-unique positions would be aggregated into a single entity. But liquidity providers are unlikely to know how many other people hold similar positions. Besides, without sophisticated chain analysis, it would be exceedingly difficult for most taxpayers to determine the exact transactions a smart contract was engaging in. 2. Bailment tokens What about smart contracts that give liquidity providers bailment tokens (such as Aave’s aTokens and Lido’s stETH) representing their contribution, and stream fees to them currently instead of having the fees build up 'inside' the token? I’ve previously argued that those arrangements look more like pooled securities loans than entities, but I can’t say whether the IRS would agree. If those smart contracts were instead treated as domestic corporations, the streamed fees would be dividends subject to 30% withholding tax when paid to foreigners. Smart contracts don’t withhold. The streamed fees would also be taxable dividends to U.S. holders, who may be subject to PFIC penalties on the dividends if the smart contracts were treated as PFICs. 3. Composability Finally, consider smart contracts like Yearn vaults, which algorithmically execute investment strategies using multiple other smart contracts. Traditional tax principles might require taxpayers to treat those contracts as parent corporations engaging in transactions with equity interests in multiple other corporations. U.S. token holders could be treated as owning multiple tiers of PFICs, resulting in onerous and likely non administrable compliance burdens. There could also be withholding tax obligations on payments between smart contracts. D. Is This for Real?The IRS’s virtual currency FAQs provide that virtual currency is property for tax purposes. Tokens generally need to be used as a medium of exchange to qualify as virtual currency. Property includes equity, but the FAQs don’t mention equity. Could we draw an inference that tokens are some kind of property other than equity if they are sufficiently liquid to be a medium of exchange? Probably not. The virtual currency FAQs are based on a notice that the IRS issued in 2014, long before the IRS could plausibly have been expected to consider the tax implications of DeFi arrangements. (Uniswap, which kicked off a wave of DeFi innovation, launched in 2018.) The notice expressly acknowledges that 'there may be other questions regarding the tax consequences of virtual currency…that warrant consideration'. You could still make a policy argument that pooled smart contracts shouldn’t be treated as tax entities. First, either contract or state law determines how traditional entities’ assets are distributed on liquidation. By contrast, pooled smart contracts can never be forced to liquidate, which makes them feel less like entities. The tax regulations arguably support this argument by assuming the existence of 'a joint venture or other contractual arrangement' for an entity to exist. Liquidity providers don’t have a contractual arrangement. Second, saying that a pooled smart contract is an entity merely begs the question of what kind of entity it is, which suggests that a different, more administrable treatment should apply. Finally, even if we determine what kind of entity a pooled smart contract is, decentralization and token holder anonymity will likely prevent anyone from being able to comply with the consequences of that determination. Decentralization and anonymity are non-tax-motivated features of Ethereum. It would be inappropriate as a policy matter to penalize people as tax evaders when the very nature of Ethereum is the cause of their noncompliance. Although those may be good policy arguments, the IRS would probably be reluctant to disavow entity treatment absent congressional action. Under traditional tax principles, pooled smart contract tokens look more like equity than anything else, and it is the job of Congress — not the IRS — to define new categories of products. Moreover, disavowing entity treatment seems like it could allow many business activities traditionally conducted by financial institutions to avoid corporate tax, a potentially big problem for the fisc that the IRS is unlikely to feel comfortable addressing without lawmakers’ say-so. Finally, it’s worth considering that if pooled smart contract tokens weren’t equity for tax purposes, they would likely default to co-ownership arrangements. Under co-ownership treatment, U.S. people would have to pay tax as if they had engaged in all of the smart contract’s activities directly, something they are unlikely to be able to do without sophisticated chain analysis. II. DAOsDAOs use smart contracts to decentralize their governance and execution functions. At scale, they raise many of the same tax questions as pooled smart contracts. A. Small Investment DAOsAssume three friends, two U.S. and one foreign, decide to start an art NFT investment DAO. They spin up a Gnosis safe and program it to execute actions only upon a majority vote. Each contributes ETH or stablecoins to the safe in exchange for governance tokens. (Side note: U.S. people generally recognize taxable gain, but not loss, on contributions of property to entities in exchange for equity.) 1. Partnership treatment The three friends clearly are in a partnership for tax purposes, and the governance tokens are its equity. U.S. tax law requires the friends to designate a partnership representative (typically one of them) to file tax returns on behalf of the DAO and deliver a Schedule K-1 to each of them annually reporting their share of the DAO’s income. Each friend has to pay personal income tax on that income, whether or not distributed. 2. Withholding on foreigners If the DAO is in a USTB, it has to withhold on net income allocable to the foreigner (again, whether or not distributed) at a 37% rate (or 21% if the foreigner is a corporation) and send the withheld amount to the IRS. The foreigner has to file U.S. tax returns and pay taxes on their share of income, and the withholding tax is credited against their ultimate tax liability. Trading from within the United States is a USTB unless the things being traded are stocks, debt, or commodities. Art NFTs aren’t any of those. So, the only ways for the DAO to avoid having to withhold on the foreigner are to (1) limit its activities to investing instead of trading or (2) avoid acting from within the United States. Both the distinction between investing and trading and the determination of whether an entity is acting from within the United States are highly fact-specific. In general, unless the DAO limits substantially all of its activities to long-term holding, it is likely to be in a USTB. And because two of the three decision makers are U.S. people, the IRS is likely to conclude that the DAO is acting from within the United States. 3. Publicly traded partnership risk Because the majority of token holders are U.S. people, the DAO is probably treated as organized under the laws of the United States. (See section I.A.1. above.) As such, if its tokens are readily tradable, the DAO is likely to be recharacterized as a domestic corporation under the PTP rules because NFT gains aren’t passive under those rules. So, to avoid corporate tax, the DAO will need to make sure its governance tokens aren’t readily tradable. 4. TL;DR The net result of all of the above is that the DAO will need to KYC its token holders and probably lock up their tokens to ensure that they are not readily tradable and that it always has contact information for each holder to send them K-1s. Each U.S. token holder will be taxed currently on their share of the DAO’s income and, if the DAO is in a USTB, it will have to withhold on the foreign token holder, who also will need to pay U.S. tax currently on their share of income. Since tax law is more compatible with centralization, it may make sense for the three friends to wrap their DAO in a domestic LLC. That way, they can contractually appoint a partnership representative, prohibit off-chain transfers of token ownership, and enjoy the non-tax benefits of a legal wrapper, like protection from personal liability. B. Big Investment DAOsIt’s easy for three friends to KYC themselves. But what if our hypothetical investment DAO wanted to admit many anonymous token holders instead of three friends? I talked earlier about why it might be appropriate as a policy matter to distinguish pooled smart contracts from tax entities. An investment DAO with a broad distribution of anonymous members might try to make analogous arguments. First, like pooled smart contracts, DAOs can’t be liquidated under contract or state law. Governance tokens exist in perpetuity, although they can be sent to a burn address (an address for which no one has the private key). Wide distribution and anonymity prevent any single jurisdiction from being able to compel a distribution of assets. The tax regulations seem to assume the existence of a contractual arrangement for an entity to exist, and the relationship of DAO token holders is governed through smart contracts instead of a legal contract. Second, concluding that a DAO is an entity usually leads to a lot of often unanswerable questions. Third, compliance is likely to be impossible in any event without sacrifices that most DAO communities won’t accept. Again, Congress — not the IRS — is the appropriate body to have to weigh the persuasiveness of those arguments. In the meantime, current tax law leaves token holders in the unfortunate position of having to decide between sacrificing the decentralization and anonymity permitted by blockchain tech, on one hand, and potentially failing to comply with U.S. tax law on the other. 1. Domestic corporate treatment A broadly held investment DAO that wants to comply with U.S. tax law might structure itself as a domestic corporation by forming a domestic LLC or a state-law unincorporated nonprofit association and filing a corporate election with the IRS. Domestic corporate DAOs need to file tax returns and pay corporate income taxes each year. However, as long as they don’t pay dividends, they can allow their tokens to be freely tradable among U.S. and foreign people and don’t need to KYC their token holders. Of course, other legal regimes like the U.S. securities laws might prevent people from spinning up domestic investment DAOs without locking up their tokens and KYC-ing holders, but that’s a topic for a different article. 2. Foreign corporate treatment A foreign corporation is unlikely to be a good tax option for investment DAOs with U.S. token holders. First, if the DAO is in a USTB, it will be subject to U.S. tax at a 44.7% rate. Second, if it is a PFIC (or a CFC with 10% US shareholders), U.S. people generally will be subject to penalties unless they pay tax on a pass-through basis, meaning that the DAO would have to give them annual reports. Art NFT investment DAOs are likely to be PFICs. C. Protocol DAOsThe 3pool is governed by the holders of veCRV ('ve' stands for vote-escrowed), who are largely anonymous. Market participants get back one non-transferable veCRV token for every CRV token they agree to lock up in the Curve protocol for four years. Shorter lockups get them fewer veCRV tokens. The veCRV tokens confer three benefits: the Curve protocol streams them a portion of the fees paid to all Curve pools; they receive 'boosted' yield from Curve gauges, which stream CRV tokens to LP token stakers; and they get to vote on protocol operations and improvement proposals. From one perspective, the Curve DAO looks like a traditional entity: veCRV holders share profits from a common enterprise and govern the workings of that enterprise. On the other hand, holders of veCRV, and of protocol governance tokens more generally, are often also users of the protocol (e.g., liquidity providers). If policymakers could be convinced that the 3pool and other pooled smart contracts shouldn’t be treated as entities, maybe they could also be convinced that the DAOs governing those smart contracts also shouldn’t be treated as entities. But for now, let’s try to apply the law in what appears to be its current state. 1. Entity-level tax Assuming that broadly held protocol DAOs with liquid governance tokens are entities for tax purposes, they are likely to be corporations under the PTP rules, since much of their income consists of non-passive fees. Lock-ups like those imposed by Curve are unlikely to prevent the governance tokens from being treated as regularly traded under those rules; veCRV can be readily acquired, and Convex has rendered them effectively liquid by pooling them into a smart contract and issuing transferrable cvxCRV to represent indirect ownership. Thus, to avoid corporate tax, most protocol DAOs need to take the position that, if they are corporations, they are organized outside of the United States and are not engaged in a USTB. 2. Pass-through tax If a protocol DAO is a corporation, foreigners can hold its governance tokens without worrying about being subject to U.S. income tax, but U.S. people have to worry about pass-through tax under the PFIC and CFC rules. Protocol DAOs treated as foreign corporations are likely to be PFICs, because most of their treasury assets (other than their own governance tokens, which are disregarded) are ETH, stablecoins, and other non-income-bearing tokens, and they aren’t dealers in those tokens. As a result, U.S. people are likely to be subject to PFIC penalties unless they elect to be taxed on a pass-through basis. However, protocol DAOs typically don’t deliver PFIC annual information statements that would permit the election. Arguably, if holders need to stake their tokens (e.g., for veCRV) to vote and share profits, then unstaked tokens might be warrants instead of equity for tax purposes. In that case, the onerous PFIC rules wouldn’t apply to them until they are staked. Staking would be treated as a nontaxable exercise of the warrants for physical delivery, and unstaking would be a taxable event that triggers PFIC penalties if the staked tokens have appreciated in value. U.S. people also would be taxed currently on any profits streamed to them, and could be subject to PFIC penalties on those amounts as well. Very generally, PFIC penalties are calculated by treating gain and big distributions as if they had been recognized ratably over the taxpayer’s holding period. The taxpayer owes tax at the highest applicable marginal rate for gain allocated to each previous year in their holding period, plus an interest charge as if for a late tax payment. 3. Off-chain bridges Protocol DAOs usually aren’t wrapped in legal entities like investment DAOs, but might use legal entities to conduct off-chain activities on their behalf. Curve DAO uses a Swiss GmbH, but many DAO communities have found Cayman Islands foundations to be more flexible. Cayman foundations aren’t legally required to have members, and their bylaws can bind directors to carry out DAO resolutions. Cayman foundations are helpful for signing legal contracts and conducting other off-chain activities on a DAO’s behalf. For example: