VC Monthly Report:The amount of financing in July fell 48% from the previous month, focusing on the infrastructure

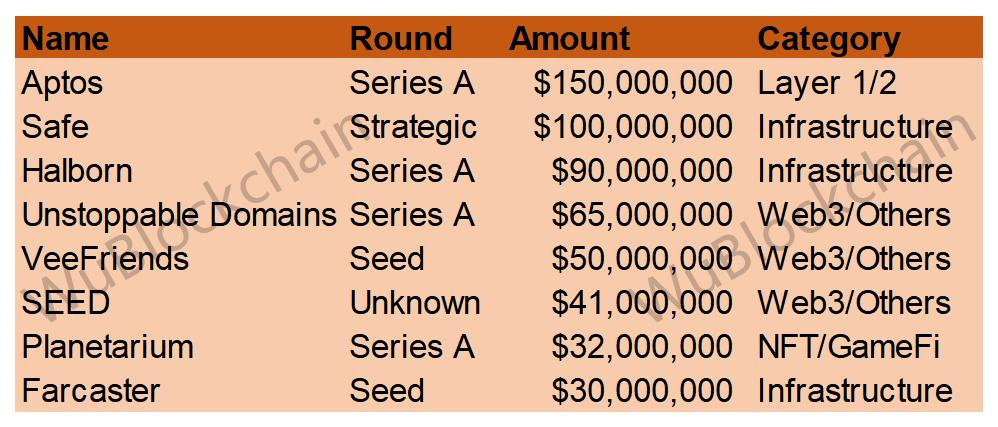

Author: Joey Wu Editor:Colin Wu According to Dove Metrics, there were 160 public investments by crypto VCs this month, down 16% MoM (191 projects in June 2022) and up 54% YoY (104 projects in July 2021). The secondary category is as follows. The infrastructure sector saw a significant increase in funding this month, accounting for 31%, while CeFi, DeFi and NFT/GameFi each accounted for approximately 20%, 27% and 24%. Total funding for the month was $1.91 billion, down 48% MoM ($3.67 billion in June 2022) and down 42% YoY ($3.31 billion in July 2021). This month was the first time this year that the amount of funding was negative compared to last year. The top 8 funded projects (excluding CeFi) are as follows. Aptos, a new public chain developed by the former Meta core team, uses a new development language called Move. Aptos is the most visible project since the second quarter, having already received investment from top institutions such as a16z, FTX Ventures, Coinbase Ventures and Binance Labs in March. This month it closed a $150 million round of funding led by FTX. Gnosis safe is an on-chain multi-signature wallet protocol on Ethereum, launched in 2018 and renamed Safe this month. As the leading multi-signature project on Ethereum, Safe serves over 90% of Dapps, DAOs, and institutions in the Ethereum and EVM ecosystem, hosting approximately $76 billion in assets. It closed a $100 million funding round this month, led by 1kx. Halborn is a blockchain security company that provides end-to-end cybersecurity services and security testing of Layer 1 blockchains including Solana, Cosmos and Substrate for security audits. It closed a $90 million round of funding this month, led by DCG. Unstoppable Domains is a domain name registration service focused on the Ethereum and Polygon networks, and currently has over 240,000 users and over 2 million domains registered on the platform ending in .crypto, .nft, .wallet, and more. Unlike other domain name platforms, Unstoppable's domain names are valid for life, require no renewal, and can be transferred without an escrow agent, with a current minimum registration fee of $5. The company closed a $65 million round of funding this month, led by Pantera Capital. VeeFriends is a social NFT project created by Gary Vaynerchuk, where NFT holders can become members of the VeeFriend community. Community members can enjoy tickets for three consecutive years (2022, 2023, 2024) to the VeeCon event, which will focus on business, marketing, creativity, ingenuity, entrepreneurship, innovation, competition, and of course, entertainment. The $50 million funding round closed this month and was led by a16z. Seed, a space colonization game developed by Klang Games, is set in the Avesta New Worlds and offers players a self-driven, self-managed and contributing community platform through AI technology. Seed is using Improbable's SpatialOS platform. It closed a $41 million funding round this month, led by Animoca Brands, which will be used to expand its workforce from around 70 to 150 people. Planetarium Labs is building a gaming ecosystem based on Libplanet blockchain technology, supporting games to run their specific blockchain networks with the freedom to design their governance models and token economics. It closed a $32 million Series A round of funding this month led by Animoca Brands. Farcaster, a decentralized social networking protocol that allows users to freely move their identities between social applications, has released an initial version of the protocol and client, and is currently working on a Farcaster v2 release with plans to launch later this year. It closed a $30 million round of funding this month, led by a16z. If you liked this post from Wu Blockchain, why not share it? |

Older messages

TSE Sponsored:Global Crypto Mining News (July 25 to July 31)

Monday, August 1, 2022

1. AntPool, the mining pool affiliated with mining rig giant Bitmain, has invested $10 million to support the Ethereum Classic ecosystem and plans to continue investing more, the pool's CEO, Lv Lei

WuBlockchain Weekly:Slow Pace of Rate Hikes、Rally、The Merge Narrative and Top10 News

Friday, July 29, 2022

Top10 News 1、75bps rate hike, preliminary real GDP annualized quarterly rate recorded at -0.9%, the market rose instead of falling The Federal Reserve announced in the early hours of the 28th that it

TSE Sponsored:Global Crypto Mining News (July 18 to July 24)

Monday, July 25, 2022

1. Chapter 11 bankruptcy pauses any attempts at civil litigation from creditors, and allows Celsius time to get its finances in order to repay its debts. Celsius saw its digital asset holdings dwindle

EXCLUSIVE:How Bitcoin Jesus Roger and the Exchange CoinFLEX Collapse

Monday, July 25, 2022

Author: Joey Wu Editor:Colin Wu

WuBlockchain Weekly:ETH Leading Soar、Tesla Dumped、3AC's Creditors and Top10 News

Friday, July 22, 2022

Top10 News 1、Rebounded, ETH led the rise, and the merger narrative worked? The market had a good rally after negative news such as CPI explosion and interest rate hike expectations, especially the

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%