Aug 3: Caesars: ‘No more $100m loss-making quarters for digital’

Aug 3: Caesars: ‘No more $100m loss-making quarters for digital’Caesars Entertainment, Full House Resorts and IGT Q2s, Massachusetts analyst reaction, igaming tax estimates +MoreGood morning. On today’s agenda:

Caesars Q2

Hotter than the sun: Regardless of the heat - and floods - CEO Tom Reeg said “there are not strong enough words to convey how well it's going in Vegas for us”. He noted that was despite Caesars Palace being “torn up” for most of the year with construction work.

Sale of the century: Reeg balked at the notion that the sale of a Strip property was “critical” for Caesars. “This is a discretionary trade for us,” he said, noting that previously analysts had questioned why a sale was necessary and now they were asking whether a deal can even be completed.

Head above water: Reeg said the digital operation “nearly” broke even in July. While he expected the business to go back to being loss-making for the upcoming football season, he noted that he didn't think total losses for the year on digital would “get near” the previously forecast $1.5bn.

Stick/twist: Reeg claimed that having hit ~15% nationwide digital handle market share, Caesars had reached a point where it was “comfortable pulling back” on ad spend.

Note: Wells Fargo pointed out there is evidence of promotional spend having moderated across the industry. Gone fishin’: Asked about ad spend going forward, Reeg said that compared to the Fall last year “it's going to seem like we've left the air entirely”.

The water carrier: Reeg said regionals had “carried” Las Vegas last year when Covid restrictions meant people couldn’t travel. “What you’re seeing is regionals aren’t quite as strong but Vegas is picking up the slack.”

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) has released its second annual sports betting industry research report. The 2022 'BetTech Ecosystem' has been expanded by more than 60% with the visual now containing seven new sub-segments and 127 new suppliers. The accompanying BetTech Ecosystem graphic visualises the core six operational segments of the sector: platform providers, trading, e-commerce, data, content and iGaming. Click here to download the full research report and visual. BREAKING: LeoVegas has been issued a £1.2m fine by the UK Gambling Commission for failures in its social responsibility and anti-money-laundering procedures. The company also received an official warning and will be forced to undergo an audit.

IGT Q2

The mighty dollar: A “nimble” IGT managed, as Deutsche Bank noted, to overcome adverse currency fluctuations, supply chain issues and tough YoY comparatives and deliver earnings above expectations.

Check in the Poste: The $785m sale of the Italian payment business Poste Pay is likely to complete in September and IGT said it will use the cash proceeds to pay down debt which currently stands at $5.72bn. The verdict: The Deutsche Bank team said given the historical resilience of lottery, it should help the company weather the potential economic downturn. Investors warmed to the figures, sending the share price up nearly 10% on the day. IGT share price moves 2 AugFull House Q2

If I spring a leak: Management pinned the blame for the pullback in revenues on the tough comparative period and the disruption being caused by the continued construction work on the Chamonix property in Cripple Creek, Colorado causing disruption to the existing neighboring property.

The last picture show: Lee said the Temporary casino - a sprung tent - was ”just about done” - and had the pictures to prove it (see above). “Trying to build anything these days with the supply chain issues is quite a challenge,” he noted.

Massachusetts analyst reaction

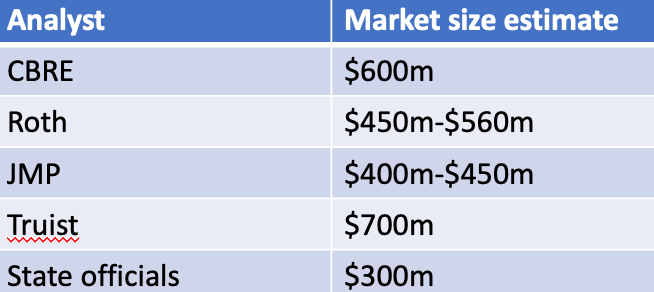

Commonwealth games: The last gasp sports-betting victory in the Massachusetts legislature means, according to CBFE, that retail betting “could” launch before year-end but mobile will have to wait until “at least” early 2023.

Out of the blocks: CBRE suggest that while retail could be launched before year-end, online will likely have to wait until “at least early 2023”. JMP pointed out the state’s casino operators MGM Resorts, Penn National and Wynn Resorts will be in prime position while DraftKings will no doubt hope to take advantage of its home state status.

Booster shot: Roth said the pace of legalization efforts had somewhat slowed this year but the previously-unlikely passage in Massachusetts might give legislators in other states such as North Carolina and Missouri a nudge in the right direction.

Takeaway: CBRE said that with a favorable tax rate, and the potential size of the market, they believe the Massachusetts news is a “major positive for the entire sports-betting industry that has gotten brushed aside amidst a hectic earnings season.” Tax report

The report from analysts at VIXIO Gambling Compliance commissioned by Light & Wonder suggests that if every one of the 42 existing land-based gaming and sports-betting states were to adopt igaming then the GGR cloud total over $30bn.

Better Collective analyst previewUp the hill: Looking ahead to the Q2 earnings, the analysts at Redeye suggest the company is likely to report the usual seasonal slowdown but they still expect a 41% QoQ revenue uplift to €56.4m.

iGaming NEXT: Valletta 2022. Taking place from 27-29 September in the heart of Malta’s capital, at the historic Mediterranean Conference Centre, the iGaming industry’s most disruptive live event is built on three main pillars: world-class content, high-level networking and amazing hospitality. With everything from informal golf and padel tournaments, the prestigious iGaming IDOL awards, networking events in some incredible venues, the Run Club, Streaming Olympics, free lunches, and so much more, we can safely say that NEXT: Valletta will be our biggest and best event ever. Use code '2ZyJt7Y4' for 10% discount on your ticket – view the event agenda and register here: https://igamingnext.com/valletta22/ Earnings in briefStar Entertainment said it expects to report revenues of A$1.53bn for the year when it reports its full-year earnings on August 22. Domestic revenues for Q422 were up 11% on pre-Covid levels at A$512m helped by a 28% increase in slots revenues on Q419. Table revenues were down 5% on Q419 levels. DatalinesColorado: Sports-betting GGR dropped 65.6% to $6.54m with online down 66.5%. Handle was up, though, by 36.3% to $313.2m. Baseball was worth 34% of total handle. NewslinesOpen all hours: Macau’s casinos have been granted permission to resume full operations by the authorities after previously only being able to operate with no more than 50% of staff. Rescue badge: The financially-challenged Scout Gaming said it has now launched its fantasy sports product with bet365. This came a day after the board confirmed it would hold an EGM to agree on a SEK55m emergency rights issue to keep the business afloat. Catena Media has announced its first large media agreement in North America with a multi-year partnership with NJ.com to provide betting and online casino content. Catena Media confirmed it means it replaces Better Collective which previously had a deal with NJ.com’s owner Advance Local. OpenBet has acquired proprietary sports technology and quantitative trading models provider Multi Builder Limited. What we’re readingWhat a waste of money: Predicting the hits and misses of the transfer market. Steal from the rich, give to the SEC: Robinhood fined for AML and cybersecurity violations. Calendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Aug 4: Hornbuckle: ‘We’re rockin' and rollin'

Friday, August 5, 2022

MGM Resorts and Everi Q2s, Caesars Entertainment analyst update, OSB analyst update +More

Aug 4: Earnings extra: Penn takes an entertaining turn

Friday, August 5, 2022

Penn Entertainment and Bally Corporation publish their respective Q2s

Aug 5: Weekend Edition #58

Friday, August 5, 2022

FuboTV's betting strategic review, RSI and Golden Entertainment Q2s, Penn and Bally analyst updates, sector watch - crypto +More

Jul 18: MGM’s Genting Singapore approach rebuffed

Monday, July 18, 2022

MGM/Genting Singapore rebuff, JKO/Playtech rumors, PlayUp strategic review, New Jersey data, startup focus - Cipher Sports +More

Jul 15: Weekend Edition #55

Friday, July 15, 2022

Snai talks rumors, UK White Paper delay, Rush Street analyst update, regionals Q2 preview, sector watch - esports +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏