Earnings+More - Jul 15: Weekend Edition #55

Jul 15: Weekend Edition #55Snai talks rumors, UK White Paper delay, Rush Street analyst update, regionals Q2 preview, sector watch - esports +MoreFollowing on from E+M’s reporting of a leak of some more of the details from the UK government’s gambling White Paper, the subsequent news suggests there will be further delays (see below) as we await a new Conservative administration. But as has been noted elsewhere, parochial issues around legislative timing aside, the wider sector should perhaps become well-versed in the issues around affordability checks. The UK is highly unlikely to be the only jurisdiction that will look at this particular issue in the coming years. SNAI talks rumorsThe obvious play: Sources suggest Entain is in talks to buy Snaitech from Playtech. It is thought the talks pre-date the failure this week of TTB Partners to come up with a bid for Playtech. ”They’re an obvious buyer,” suggested one source.

History: Playtech originally bought a 50% stake in Snaitech in 2018 for €291m which valued the company, including its debt, at €846m.

Both Playtech and Entain offered no comment this morning. UK White Paper delaysWaiting for Godot: The Daily Mail reports that the UK white paper on gambling reform has been delayed until a new Prime Minister takes office. Government sources have told the Mail it was “inappropriate to 'bind' the new administration” with new guidelines pushed through during the interim period.

Not happy: Former Tory leader and now anti-gambling campaigning MP Tory MP Iain Duncan Smith said he was very “disappointed.”

Further reading: The Pinchpoint newsletter discusses the implications of what was said on affordability this week. ** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. Rush Street analyst noteWhen yes means no: After a meeting with key RSI management, analysts at JMP suggest that even if the Californian online sports-betting ballot measure passes in November, RSI might still opt out of market entry due to the prohibitive costs.

Regional gaming Q2 previewNo buffer: Macro conditions and pressures on discretionary spending will mean hits to margins that “will be difficult to buffer” this quarter. As a result the analysts at Deutsche Bank have reduced their FY23 and FY24 forecasts for all three Boyd Gaming, Golden Entertainment and Red Rock from 5% to 20% against consensus.

No buffet: DB however also pointed out spend per visitor had softened in recent months, but this was due mainly to the elimination of lower-spend customers whose “typical patronage involved a trip to the since-shuttered buffet or on a low-value promotional offer”. Banner quarter: Meanwhile, the team at Wells Fargo expects a “strong” Q2 Strip performance from MGM, Caesars and Wynn Resorts reflecting weekend occupancy in the low 90% and recovering group/convention business at ~80% of Apr-May19 attendance.

Inspired analyst updatesIn the mood: Moody’s has upgraded Inspired Entertianment’s credit rating by one notch to B2 from B3 citing a positive outlook for the next 12-18 months.

Not hurting yet: Meanwhile, analysts at Roth suggested that recent commentary from Entain indicates strength in UK retail. While Entain is not an Inspired client, the performance of the retail estate (~40% of total UK retail betting shops) indicates the worsening economy is “not yet” impacting betting shops GGR.

Jefferies digital betting matrixAs you were: FanDuel, DraftKings, BetMGM and Caesars continue to lead the US OSB market in terms of monthly active users (MAU) and downloads, the heaviest-weighted data points in Jefferies’ betting matrix for June.

Future Anthem fundraiseA is for anthem: AI and personalization startup Future Anthem has closed a Series A fundraise to help it accelerate growth in the North American sports-betting market. The amount raised was not disclosed.

Amped up: Future Anthem’s Amplifier AI analyzes data to help operators optimize their performance and enhance customer experiences in real-time. The company is led by CEO Leigh Nissim. Sector watch - esportsHuddle up: HUDstats will provide its range of esports data and analytics products to Sports Information Services (SIS) as part of a new multi-year partnership. As part of the partnership HUDstats will provide SIS with real-time data for esports-betting purposes including NBA2K and FIFA streams.

There’s a riot goin’ on: League of Legends publisher Riot Games has partnered with React Gaming to provide the esports-betting operator access to its League of Legends‘ API.

Unique monitoring: Separately, Kambi has been talking up its ability to monitor esports-betting integrity, suggesting in late June that the monitoring of esports betting was no different to other sports, though with some unique challenges.

Earnings in briefGauselmann: Chairman Paul Gauselmann said the pandemic had “bottomed out” after his company reported H1 revenues at €1.76bn, up slightly on the figure for the same period 2019. The company said the first two years of the pandemic had cost the company €2bn in sales after Covid forced the closure of its 1,000 gaming outlets for up to nine months in total. The company added that 60% of sales now came from outside Germany with the UK and Spain being key markets.

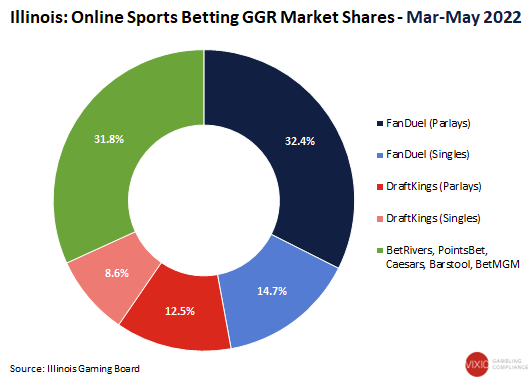

DatalinesIllinois: Sports-betting GGR came in at $67.3m, down 4.6% MoM. Handle was down 9% MoM but up 50.7% YoY to $764.6m.

Further reading: H/T to Daniel Stone from GamblingCompliance.com who points out that FanDuel generated more revenue from parlays than BetRivers, PointsBet, Caesars, Barstool and BetMGM did collectively from all bets in Illinois between March and May.   Indiana: Casino GGR for June was down 3.8% YoY and flat QoQ to $197.2m from a neutral calendar. Sports-betting GGR was down 38.1% YoY and -48.6% MoM to $15.8m while handle rose 4.1% YoY but was down 16.9% MoM to $256.3m.

NewslinesDAZN is in talks to acquire Eleven Sports from Italian entrepreneur and Leeds United Football Club owner Andrea Radrizzani, according to the FT. Eleven has an “eclectic” mix of sports broadcast rights including Formula One in Poland, and the Uefa Champions League and the next three seasons of the English Premier League in Portugal. MGM Resorts and BetMGM have renewed their official sports-betting partnership with the MLB which includes the use of official data. IMG Arena will supply PointsBet with more than 40,000 sporting events as part of a two-year streaming partnership between the two groups including streaming rights to the MLS, ATP Tour and EuroLeague basketball. Low6 and Inside the Pocket have agreed a strategic partnership whereby Low6 will deliver a selection of its free-to-play products to ITP’s content aggregation platform and marketplace. Evolution soft launched its live casino operations in Connecticut this week with FanDuel and DraftKings. Racing and Sports (RAS) will continue to provide its horse and greyhound racing data and feeds to Entain Australia for the next five years after the two groups extended their partnership. Betfred will be the official betting partner of the Cincinnati Bengals when legalized sports-betting in Ohio launches in January. Gaming Innovation Group has signed a head of terms agreement with the UK casino group Aspers for an initial three-year contract. GIG will supply its fully-managed solution to enable Aspers’ transition into an online gambling operation. Oddschecker and Yardbarker (part of Playmaker) have agreed a content partnership including the development of a new sports-betting hub which is expected to launch for the new NFL season. What we’re writingFlaw in the evidence: Scott Longley wrestles with the partial truths of gambling’s public health debate. For iGB. A lot to learn: Jake Pollard looks at what the US sector should take from the UK’s gambling dramas. What we’re readingLove/hate: Jonathan Bierig from Ultimate Odds on the ins and outs of UX. On socialWhat descending at 80kph feels like Calendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Jul 13: Exclusive: Leaked UK White Paper details

Thursday, July 14, 2022

Affordability limits, 'smart' stake limits on slots, free bets ban all feature.

Jul14 News alert: TTB Partners ends bid for Playtech

Thursday, July 14, 2022

Takeover saga ends “due to challenging underlying market conditions”

Jul 12: LVS’s $1bn lifeline to Sands China

Tuesday, July 12, 2022

Sands China loan, Rank analyst update, Playtika buyout reports, Cipher funding round +More

Jul 11: Could MGM buy Entain on the cheap?

Monday, July 11, 2022

Entain analyst reaction, Macau closure, Q2 transaction tracker, US online analyst update, startup focus - Mojo +More

Jul 8: Weekend Edition #54

Friday, July 8, 2022

UK white paper reaction, E+M startup funding Q2, Bet-at-home UK license suspension, FanDuel analyst update +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏