Earnings+More - Jul 20: BetMGM motors on in Michigan

Jul 20: BetMGM motors on in MichiganPennsylvania and Michigan June data, analyst Q2 previews, Las Vegas Sands preview, stablecoin analyst update +MoreGood morning, on today’s agenda:

Datalines

PennsylvaniaSports-betting GGR of $22.9m was down 46% YoY and 52% MoM with promos of $10.1m, or 47% of GGR.

For iCasino, GGR rose 16% YoY to $102.9m. Rush Street led the market with 24.8% followed by BetMGM with an estimated 22.5%, pushing FanDuel (17.9%) and DraftKings (14.3%) into third and fourth place respectively.

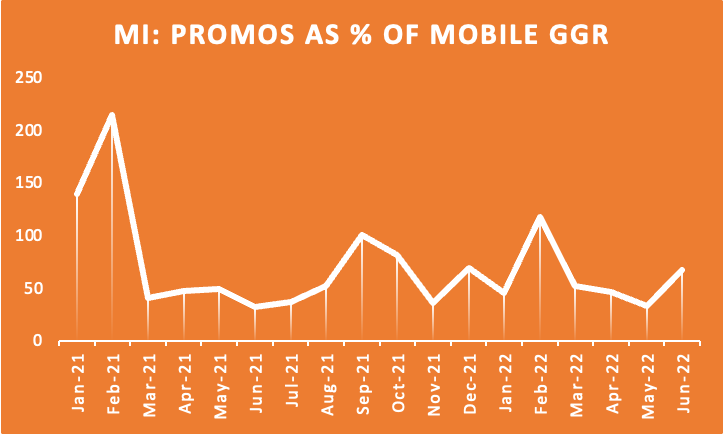

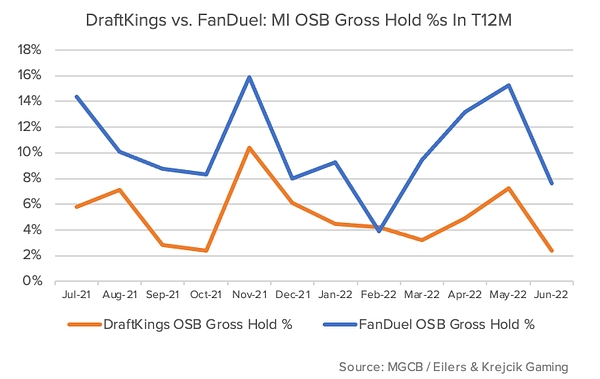

MichiganRising casino tide: Total OSB and icasino GGR for June rose 19.9% to $136.8m; sports GGR was down 42% YoY to $15.48m but net revenue of ¢5m was down 70% YoY with $10.3m of promos accounting for 67% of GGR. Mobile handle rose 14.8% YoY to $270m.

iCasino of $121.5m was up 36.2% YoY and down 4.6% sequentially. Land-based casino GGR dropped 7.2% to $98.2m with Deutsche Bank noting this compares with drops of between 2.4% and 3.9% in neighboring gaming states.

Connecticut: Total GGR rose 25.3% to $88m with slots GGR down 4.7% to $66.9m. OSB GGR was down 35% to $4.3m and handle was down 17.5% to $88.8m. Retail sports-betting GGR increased 18.6% to $521K while iCasino GGR was down 1.6% to $16.3m.

Tennessee: Sports-betting GGR for June was down 20.5% to $12.8m while handle was up 23.6% to $215.7m. Montana: Sports-betting GGR in June dropped 28.7% to $275K on handle down 21.3% to Handle $2.9m.   **Sponsor’s message**: Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. Their Gaming Fund, regulated by Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Analyst Q2 previews

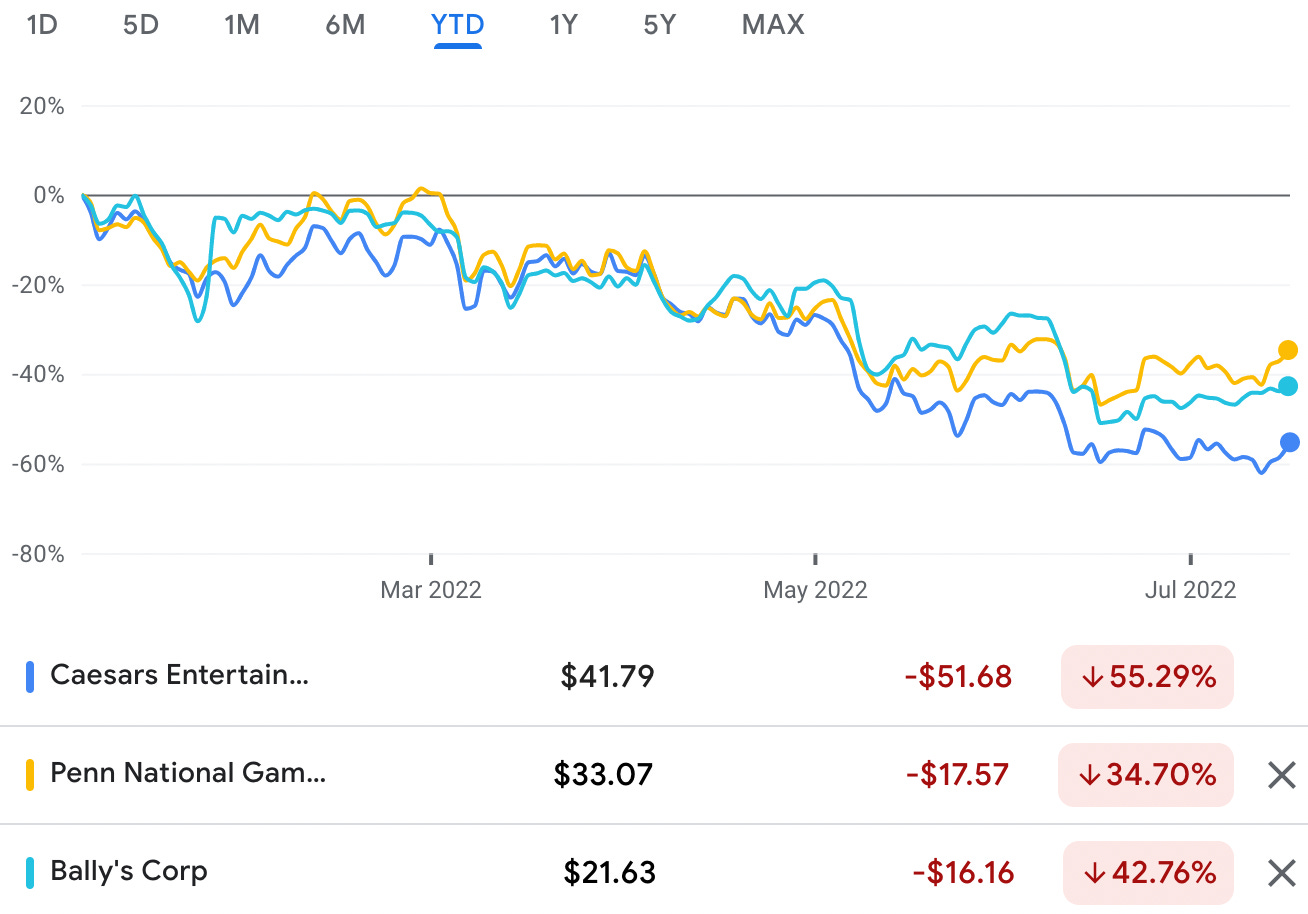

Can’t catch a break: The team at Jefferies point out the “magnitude of the weakness” in recent stock market performances - with sector names down 30% on average YTD - is down to issues of leverage and digital investment against a worsening macro environment.

Where the wild things are: The widely-held perception is that Las Vegas is vulnerable to downturns but while acknowledging the potential impact of slowing corporate travel budgets, the Jefferies team suggest Las Vegas is better-positioned than in the wake of the Global Financial Crisis.

Uh-oh: Analysts at Stifel have halved their target price on Ceasars as the team is now pricing in a full-blown recession including a dramatic slowdown in consumer spending and travel next year. Pulling back: Meanwhile, looking at the gaming suppliers the team at Macquarie say they are “slightly more cautious” on 2023 and 2024 and are taking a “prudent approach given the macro backdrop.

Endurance race: Jefferies, meanwhile, suggest exposure to lotteries and regional gaming, product momentum and “all-time best capital set-ups” suggest gaming suppliers “should endure if not flourish through economic cycles”. LVS analyst preview

Through a glass, darkly: Las Vegas Sands will report AMC today and the team at Deutsche Bank said they expect “little in the way of new news” with clarity around Macau “remains fleeting”.

Stablecoin analyst update

Peg: Looking at the potential for the use for digital deposits of stablecoins that are “firmly” (analyst emphasis) pegged to the dollar or the euro, the team at Roth suggest the benefits would include an 8% boost to EBITDA margins via less payment processing costs.

Glad to be gray: Roth estimates crypto wagering accounts for ~10%-15% of gray market GGR although adoption in regulated markets is “beginning to pick up”. Bank run: The Roth team suggest that mainstream adoption of crypto as a means to wager will depend on central bank-backed stablecoins which would be able to “apply the efficiencies of blockchain with the stability of traditional currencies”.

Macau updateDoom-laden: The data for Q2 was understandably gloomy given the current backdrop with VIP revenues down 94.3% vs. 2019 and off by 87% QoQ to $246m. VIP was worth 23.4% of overall gaming revenue vs. 50% in 2019.

Lottery.comOverenthusiastic accounting: The Nasdaq-listed Lottery.com is working with external auditors to review its cash reserves and revenue forecasts after it found that it had overstated its available cash balance by c$30m.

Recall, in May the company said Q1 revenues rose by $15.7m to $21.2m while adj. EBITDA came in at $7.7m. The shares fell over 27% on Monday before recovering slightly yesterday, up 1.8%. Kindred harmful gamblingFirst, do no harm: The percentage of revenue Kindred generated from harmful gambling stood at 3.3% in Q2, the same as Q1. The improvement after interventions was 84.7%. Over the period, Kindred entered a new collaboration with QuitGamble.com.

Earnings in briefNagacorp H1: First-half EBITDA increased to $130.1m from 2021’s pandemic-stricken $4.5m. Average daily volumes for the mass and premium mass market in Q2 recovered to 80.3% and 71.8% vs. FY19 respectively. NewslinesSpotlight Sports Group will launch a microsite for Sky Bet to mark the start of the English Premier League season on Aug 5. The site will be integrated into Sky Bet’s desktop site and native app. Spotlight also launched fantasylife.com earlier this month in partnership with ex-EXPN presenter Matthew Berry. Duel appointments: FanDuel has appointed Christian Genetski as president and Mike Raffensperger as chief commercial officer. Beach Point Capital Management will provide the debt financing for Broadway Gaming’s $46m acquisition of 888’s online bingo divisions. Betsson will start trading the €90m debt it raised via senior unsecured bonds on Nasdaq Stockholm after receiving approval from the Swedish Financial authority. What we’re readingEvery cloud: FTX’s Bankman-Fried makes the most of the crypto winter. The road to riches: It took 49 months for US sports-betting revenue to top $10bn. Wagers of fear: The Betting & Gaming Council rails against the nanny state. On socialPerception is reality when sports betting is not gambling.   Calendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Jul 21: Evolution: ‘We’re greedy for more’

Friday, August 5, 2022

Evolution Q2, Las Vegas Sands Q2, Betsson Q2, Q2 analyst preview, Caesars analyst updates +More.

Jul 22: Kindred hails 'promising' Dutch start as profits plummet

Friday, August 5, 2022

Kindred Q2, Las Vegas Sands analyst reaction, sector watch - cashless payments +More.

Aug 5: Earnings extra - DraftKings looks to market share gains

Friday, August 5, 2022

Draftkings and Century Casinos release Q2 earnings

Jul 25: Promo spend lowest since start 2021

Friday, August 5, 2022

Promo spend analysis, the shares week, the week ahead, startup focus - STX, Bettor Opinions funding news +More.

Jul 27: Boyd upbeat as clouds gather

Friday, August 5, 2022

Boyd Gaming Q2, Underdog Fantasy fundraise, Kambi Q2, XL Media trading update, Bally analyst renewal +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏