Solving the Compensation Puzzle | State of the DAOs

Solving the Compensation Puzzle | State of the DAOsYou're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.gm gm and welcome to the State of the DAOs! Compensation is one of the most challenging design challenges within DAOs. Getting paid in governance tokens offers unique ownership and equity incentives, but often falls short of providing a living wage to contributors. This week, Jake and Stake tries to solve the compensation puzzle by laying out variable compensation strategies that reward outcomes, recognize people for their work, and give them a stake in building something that matters. When DAO contributors start to think like owners, DAOs win. Next, we have an interview with the Impact DAOs Research + Book project featuring Alona Schevchenko, the founder of Ukraine DAO. Seneca52 shares the story of how DAOs enable people to respond to crisis much quicker than traditional charities, empower communities around a cause, and how crypto and the tools of Web3 help Impact DAOs fulfill their mission. Finally, we share the TL;DR on the latest DAO ecosystem takes and thought pieces, making it easy for you to cut through the noise and stay up to date on the world of DAOs. This is the current state of the DAOs. Contributors: Jake and Stake, Seneca52, Alvo von A, Austin Foss, Ashpreet, oxdog.eth, Suyash, makkiyzy, hirokennelly, siddhearta, Dippudo This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings. Solving the Compensation PuzzleAligning Incentives with Variable CompensationAuthor: Jake and Stake

In many professions, particularly sales, variable compensation (or performance-related pay) is used as a way to align employee incentives with business incentives, leading to positive outcomes for both parties. When the business makes more money, the contributor makes more money. This model rewards outcomes instead of time worked, giving contributors a direct stake in the outcome of their efforts as well as autonomy over their work. Someone who creates great results for little effort will earn the same as someone who toils for hours for equivalent results. Variable compensation is implemented in a variety of forms:

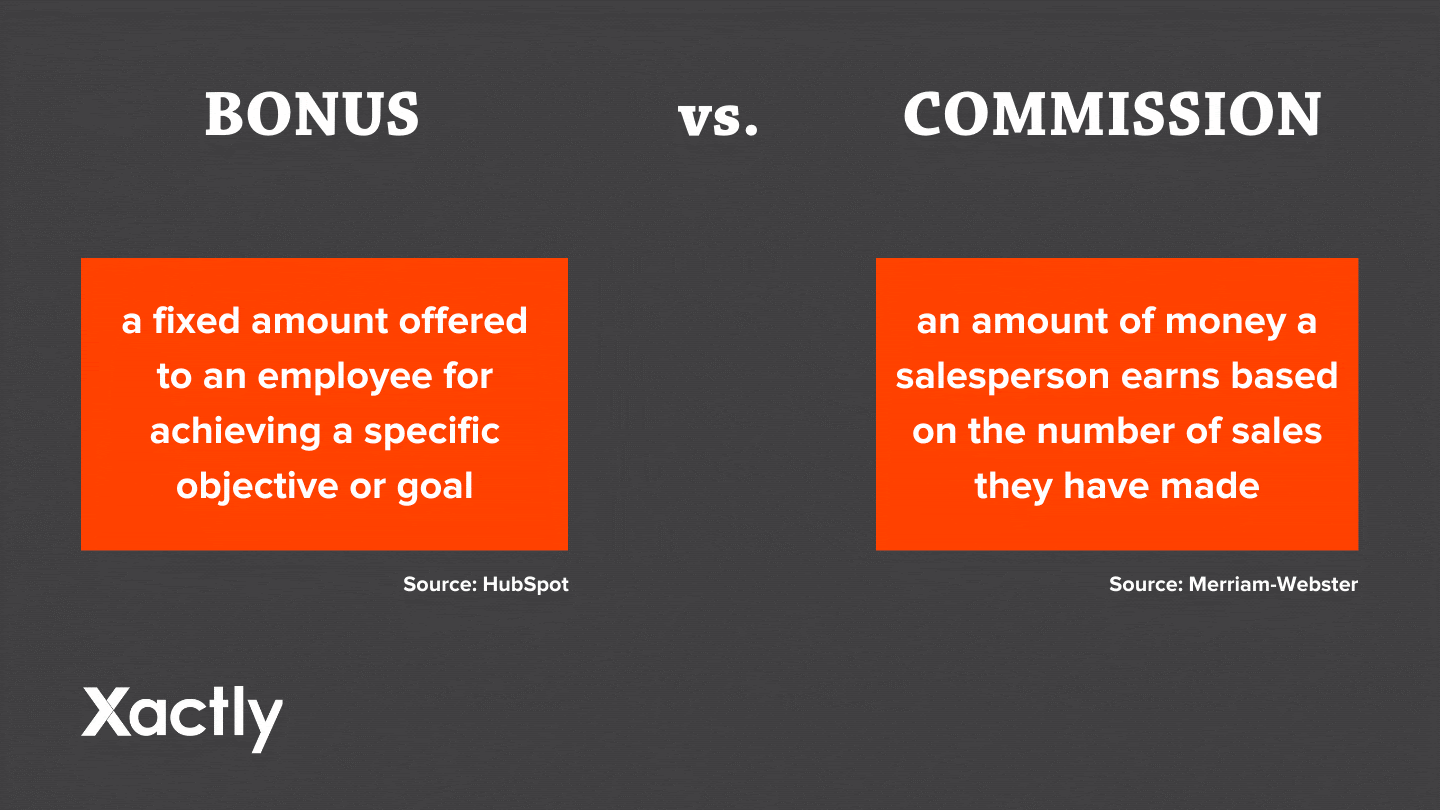

These compensation models ultimately link performance to strategic goals and the recognition of different levels of achievement. In practice, we already exchange “equity” (in the form of governance tokens) to fund projects, so we’ll explore two models that the DAO might find particularly useful: commission and bonuses. Commission and BonusesWith commission, contributors receive additional compensation in direct proportion to the revenue (or profit) that they generate. This compensation structure works particularly well with revenue generating projects and is the typical compensation model for customer acquisition (sales). Commission is flexible because the percentage can be adjusted to reward the sale of particular products. Given a product that’s not doing well in the short-term but is important for the long-term roadmap, a good commission structure can incentivize sales people to change priorities. Bonuses are similar to commission, but the additional compensation that contributors receive is usually fixed and based on meeting a particular milestone or achievement during a set time period. Both of these compensation models—commission and bonuses—can encourage DAO contributors to create projects that generate income, because DAO members have control over how much they make or don’t make. These compensation structures align incentives of the individual with that of the organization. The more revenue the individual makes, the more the DAO makes. This creates a situation where each contributor has direct control over how much they are paid. You get what you put in. This increases the autonomy of contributors and turns “generating revenue” into a game that can be optimized. We can make work more like a game and less like “work” as long as we have systems in place that allow people to 1) plug in easily and 2) see how others are doing.  Humans want to be valued, and compensation structures like these make value explicit through receipt of direct and specific rewards. If implemented well, this could lead to a culture of high performance within the DAO. Smart contracts have created the opportunity to design our own incentive structures, and variable compensation is another tool that we can experiment with. Compensation Design ChallengesHowever, there are some downsides. Execution RiskThis turns project leaders into founders and if the project doesn’t work out, you may get little for your efforts. This is why most variable pay plans include a base salary. Native DAO tokens can be used as a base compensation, but we should make it clear that project contributors will be rewarded for the value they bring, whether it’s revenue or some kind of internal value. Execution risk is somewhat unavoidable — with or without variable compensation. At the very least the DAO will have funded the education of its contributors. Bad FitThere are places where variable compensation simply doesn't make sense. One instance is cost-cutting. If contributors are rewarded based on how much they cut costs, this can lead to a downward spiral where growth is reduced through cost reduction. These are often competing goals. If two separate work streams of a project (or the DAO) implement incentive structures that run counter to each other, it could neutralize the benefit of both. And if the goals, KPIs, or quotas are unattainable, people will end up burning out and rage-quitting altogether. Poorly designed compensation can lead to worse overall outcomes. CommunicationCompensation structures shouldn’t be overly complex. If the structure is too complex, it will reduce overall effectiveness, because it’s hard to see how your results drive your compensation. It should be made abundantly clear how this kind of compensation affects the project overall, why compensation design choices were made, and how contributors are rewarded for their efforts. MoraleIf people feel like they’re not measuring up to their peers or they feel like they aren’t bringing value to the projects they’re participating in, their vibes will be low. We all want to create a fun place where we get paid to do the things we love to do, but people are different and they will have different outcomes. This could lead to increased competition in ways that are stressful. One study from 2021 stated:

Given the above concerns, I don’t think variable compensation is appropriate for all functions. But I do think it could be implemented if we choose effective parameters and design in the open. Set Your Own GoalsIMO variable compensation is particularly effective if DAOs let people set their own goals across all positions (even functions that are not revenue driving). By allowing members ownership of their objectives we give them autonomy over their work. This is really useful for roles that don’t directly tie to the bottom line and roles that are more difficult to quantify. For instance, while activities such as answering support questions or onboarding contributors don’t create revenue by themselves, they’re still very valuable. One study from 2007 supports the idea that goal setting and planning is linked to subjective well being:

Allowing contributors to set their own goals frames the question of success within the scope of the project and gives each person a stake in delivering something that matters. Avoiding Bad GoalsBut wouldn’t people just game the system and set bad goals? Yes, there’s always the possibility, but when people must state their goals publicly, there is social pressure not to under-shoot. The DAO treasury and project leads can work together to figure out what the goals are and to keep team leaders accountable. All variable compensation and goals are reported to the funding entity. When contributors know that their team, project lead, and funder can see what their goals are, they’re more likely to set better ones. Everyone, from team leaders and members, intuitively knows what good goals look like. These goals should be quantifiable and assessed/evaluated on a regular basis (a good place to start is monthly).

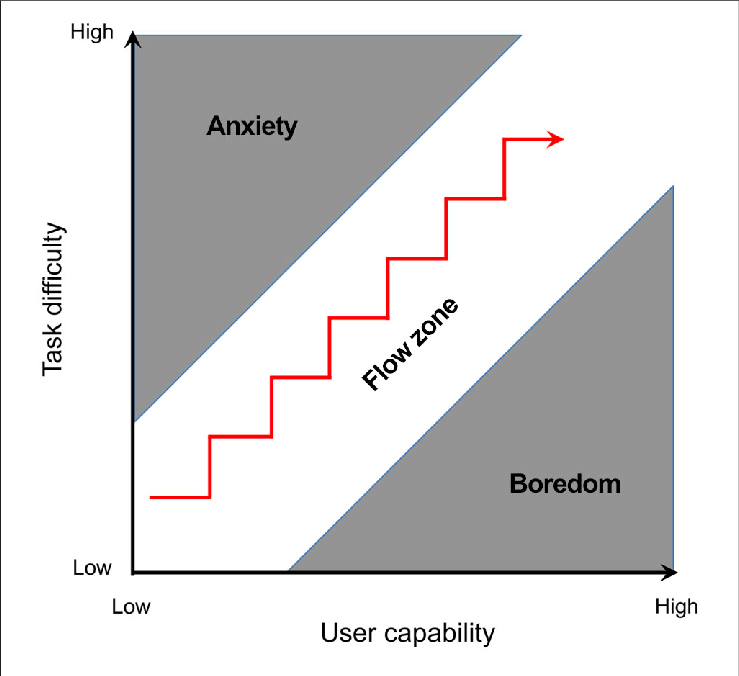

We can also implement a base pay (we already do) and a threshold that unlocks a portion of the commission/bonus. This can be considered “partial credit” for the work done to achieve the intended outcome. I propose a 50-50 split for base to variable compensation with half the variable compensation allocated after hitting a predefined mark. This is simply an example, and the numbers can be adjusted by each team. The bonus or commission can be taken in the DAO’s token or the asset that is paid as revenue. The key is to get members to think like owners and to give key players equity in proportion to the contribution that they provide. This will increase talent retention and reduce churn because the best people want a stake. Winners win, and they want to participate in the upside. The End GoalThis mechanism allows contributors to see and monitor their growth within the DAO. Churn should go down because people see that they are making progress and challenging themselves. This is a key factor in creating feelings of fulfillment in life. And while we can’t make people feel fulfilled (or feel anything for that matter), we should endeavor to create an environment where people can make good money and strive towards shared success. The goal here is to incentivize everyone to think and act like owners. While holding tokens gives people ownership, we can enhance this by implementing systems that get everyone aligned around a common goal. The ideal scenario is a place where we create a game-like environment where people can play and experience flow-states. A place where the more money you make for your community, the more money you make for yourself. A place where helping to make the pie bigger also earns you a bigger slice. Actions steps📖 Read The Current Scene in DAO Compensation by Hedgey ⛏️ Dig into How to get paid by DAOs | Lucas Campbell 🎧 Listen BountyHunter: Why DAO Compensation is Broken & How to Fix It | Cryptowsky from C3 Impact DAO StudyImpact DAOs Research + Book project is a decentralized, collaborative and open source project. The goal of the project is to publish a book on Impact DAOs that provides information, wisdom, and insights for new web3 entrants. The project covered ten DAOs in total, conducting three in-depth conversations per DAO. To learn more about the project visit the Gitcoin grant page. If you’d like to follow their work they’ll be regularly sharing their learnings and DAO builder interviews on Crypto Good. You can also follow the hashtag #impactdaostudy on Twitter. UkraineDAO: The Story Behind the LegendAuthor: Seneca52 You may well have heard of UkraineDAO. If not, here are the basics:

Origin StoryThe project began as the brainchild of Alona. As a Ukrainian, she was familiar with serial, empty grandstanding from Russia, but was concerned when foreign diplomats began to withdraw. She published an open letter, which was retweeted by her future co-founder Matt of PleasrDAO. Together they began to reach out to potential contributors in the areas of technology, smart contracts, art, and social media influence. The rest is history. What we can learnThe fascinating interview between Alona and Impact DAO Study founder Deepa is available here, and is full to bursting with insights and links to resources for the aspiring Impact DAO founder.   Here, for the curious, are four takeaways. DAOs can match the speed of a crisisUkraineDAO demonstrates that an absence of bureaucracy means it is possible for a DAO to get up and running not only in response to, but ahead of, a disaster. It also shows how quickly a DAO can adapt to the changing situation that so many ongoing crises present. “The beauty of a DAO,” says Alona, “Which is not possible with a traditional charity, is that we adjust to Ukraine and to its needs immediately.” Initially, the focus of UkraineDAO was on providing financial support to the military. Now it is about countering misinformation, so the Media working group (or ‘pod’) is currently the most active. The other twelve are ready to be called on when and if the situation warrants. DAOs truly empower the powerlessClearly, the central role of cryptocurrency is key to the power of the DAO. Whereas decentralized funding through GoFundMe or Patreon is possible, it remains vulnerable to centralized control (to take a case in point, see the story of Patreon and Come Back Alive). But the benefits don’t end there. Alona had only four hundred Twitter followers in early February, and was not a person you would classify as famous or powerful. Five years ago, targeting a multi-million dollar fund-raise and leadership of a 150-person organization would have been a stretch. Five years from now, it could be the norm. And it’s not just about empowering founders. Alona tells of a UkraineDAO contributor with autism and ADHD. This member not only found a way to have an impact on an event of global significance, but also discovered a sense of meaning that had eluded him in the claustrophobia of normality that entraps and paralyzes the majority of us regular folk. The DAO approach reduces the number of “helpless” people by turning them into heroes. Culture is King (not Technology)If you’re in crypto, you are probably familiar with this point already. But when the stakes are high, it applies even more urgently. Aside from the clearly vital role played by cryptocurrency, Alona has managed to create a successful DAO without the need for wall-to-wall web3 technology. As she puts it, “If you cannot collaborate in a Google doc, no DAO tool is going to save you.” Culture and organizational health, on the other hand, are paramount. The team safeguards both with a combination of careful entry criteria, and by keeping the atmosphere light and fun (but ‘not in a corporate way’). Speculation and Social Impact don’t mixThose who contribute to the UkraineDAO are given $LOVE tokens as “Proof of Giving”. However, speculation with these tokens is discouraged, and the DAO has formally requested exchanges not to list them. Alona has drawn on her former DAO experience in this regard. “When I started Ukraine DAO, I kinda already knew what to avoid. One of those things was token-based governance,” she explains, “Volatile tokens [mean] that when there is a bear market, everyone in the DAO is crying.” This is connected to the need for selective admission and to the importance of culture. The collective goal of UkraineDAO is antithetical to the pursuit of personal gain. ConclusionThe example of UkraineDAO shows that - with Impact DAOs especially - crypto, tokens, and the other apparatus of Web3 are technology that serves a goal, not the other way around. The right people trumps the latest tech, ten times out of ten. Alona’s concluding advice for those who want to build on UkraineDAO’s example is as follows: “Give selflessly…before you start asking for help. Then people will see why you’re doing what you’re doing and they will help you. Even absolute strangers.” For some, crypto is about amassing personal fortunes. For others, it is about making an impact in the world. Alona’s words are surely relevant not just for Impact DAOs, but for the broader crypto movement as it reflects on what it aspires to become and achieve. DAOs at a Glance

🧵  Does anonymity in DAOs lead to more effective teams?Author: Greg Calderiso Norms when working in DAOs are much different than the norms of the corporate world, and how those norms impact a team’s effectiveness depends on how they support a sense of psychological safety for each team member. Working in a DAO gives us flexibility in that regard, whether you want to remain anonymous or reveal your real identity, whichever norm floats your boat. Google once conducted a research initiative to try and find a pattern across 180 teams that would inform them what can be done to optimize for team effectiveness. Unfortunately for them “It was near impossible to find a pattern” in terms of hard skills or prior experience levels of the team members, but what they did find was the importance of psychological safety. Put another way, teams are more effective if we feel secure enough within the team to speak freely, not necessarily if we just threw all the most experienced people in a room together. Social Rules for DAOsAuthor: Alisha.eth DAOs require human input to prepare and advance executable proposals. As a result, new social environments have emerged alongside DAOs. Formalized social rules allow participants to build context around the processes of the DAO, without gatekeeping. A DAO lacking strong social rules will likely fall victim to extractive and self-interested parties who have no interest in advancing the mission of the DAO. Participation in most DAO environments is low because people feel unable to compete with incumbent DAO participants. There is no reason why those people can't create new environments governed by new sets of rules. It's an assumption that only one social environment can be attached to a DAO because there is only one executable environment. Social rules in DAOs are far more important and flexible than most realize. The Paradox of DAO ProfitabilityAuthor: Samantha Marin You would think that, given the hyper-financialization that gets tied to digital asset ownership and scarcity, there’d be more of a focus on DAO profitability, but so far this concept hasn’t been a focus. Much of the hype in the space has been extinguished and contributors can no longer bank on a token value rising due to general market exuberance. To foster a sustainable environment where one can still earn a living for his/her efforts, DAOs will have to identify sources of ongoing revenue. It’s not to say that theoretical conversations about decentralization and coordination no longer have a place, but the time has come to emphasize business strategy and the difficult decisions that underpin it. Profitability is the ethos of the corporation. This means that in a DAO, which is trying to reinvent commercial organization, talking about money can feel wrong. However, this is somewhat misguided because the most important thing for a DAO is its purpose. Sustainability is critical the ongoing advancement of this cause. A model that encourages highly skilled contributors and fosters talent growth requires underlying cash flows to support its ecosystem (and token price, by extension) in pursuit of its purpose. These Facebook and Tinder vets are building a Web3 social network called NicheAuthor: Mark Sullivan As Facebook's latest "growth" numbers suggest, the massive, ad-based, ubiquitous social network isn't the high-growth moneymaker it once was. Many consumers now spend more time watching short videos than sharing memes or pressing buttons. The founder of a new social network called NICHE believes that the next-generation of social networks will be community-based, with like-minded people building small communities based on more specific interests. NICHE USP: The platform will not make money by showing ads to people in the group, but rather, it will make money by helping creators make money, or when it helps users find valuable creator content. How the platform will make money: The NICHE founders are constructing their social network on top of Blockchain technology because producing and exchanging items of value is essential to using NICHE. They contend that establishing communities as DAOs on the blockchain develops an ecosystem that enables participants to own, manage and profit from the content they produce. When you join a group on Niche, it issues you a token that represents your ownership of a fraction of the group. Its founders believe that as the group add more members and content over time, the token value will go up. Funding: NICHE has recently closed a $1.8 million pre-seed round led by Metaweb, with follow-on funding from the alumni ventures group. It also got a grant from its blockchain partner, the NEAR foundation. Ecosystem Takes

🧵  Tally @tallyxyz Secretly terrified of quadratic voting because tbh you don't really know how it works? 🙀 In the latest from Content Guild, internet extraordinaire @austinrobey_ lays down a SIMPLE guide to quadratic voting that'll have you up to speed in 5️⃣ minutes. 🍻 https://t.co/rvtzbC9PZ1DAO governance attacks, and how to avoid themAuthor: Pranav Garimidi, Scott Duke Kominers and Tim Roughgarden 🔑 Insights: Every Web3 project has a native token that can be used to vote on various issues. However, permissionless voting is vulnerable to governance attacks, in which an attacker acquires voting power through legitimate means (e.g., buying tokens on the open market), but uses that voting power to manipulate the protocol for the attacker's own benefit. When designing the governance rules for a project, this equation (Profit to Attacker = Value of Attack - Cost of Acquiring Voting Power - Cost of Executing Attack) can be used as a guidepost for evaluating the impact of different design choices. To reduce the incentives to exploit the protocol, the equation implies three clear choices: decrease the value of attacks, increase the cost of acquiring voting power, and increase the cost of executing attacks.

The Problems of DAO Governance: GLF22 Survey ResultsAuthor: Jihad Esmail 🔑 Insights: Governance in crypto and DAOs is a critical component of organizational sustainability, stability, and impact. However, the issues of DAO Governance has majorly been with the experiences of individuals in the ecosystem, in the areas of traditional corporate hierarchy, majority voting, and Roberts rules. A survey was carried out on the crypto ecosystem to understand how governance challenges are currently emerging and the participants includes DAO Operators (Leaders of working group, pod, team, or guild), Contributors (Anyone part of the DAO Operators team), and DAO founders or Core team (Full-time members of the DAO).

Go Fork YourselfAuthor: Packy McCormick, David Phelps & Luca Prosperi 🔑 Insights: DAO governance should be more like a biological process run at internet speed: Internet-Native Evolutionary Governance. Once online governance models evolve past a certain point, they should be both different from and superior to offline ones because of the speed, scale, granularity, programmability, composability, and unboundedness of the internet, and the blockchain. The real promise of DAO governance might be forking: using governance to get people to disagree and through the process, discover subcommunities where they’re aligned and create their own version of a project. To be clear, there’s no one-size-fits-all model for DAO governance, and we’re not proposing that every DAO turn on its heels and encourage forking, which should often be a last resort. But if we’re experimenting and making mistakes anyway, we should make productive mistakes. Maybe one day, those new models will circle back and influence the way that humans coordinate offline. Maybe the lines between online and offline will blur to the point that governments and companies adopt new models born through this evolution. Forking offers a new way to think about governance on, of, and for the internet:

DAO Tokenomics – Using Tokens For Governance & Incentivizing Communities | Lucas CampbellAuthor: Raul Chisluca  🔑 Insights: Why do Web3 projects need tokens? In short, it’s because these assets provide ownership and incentives for coordination. However, there are over 20,000 tokens in circulation already, so does your project really need one?

DAO Spotlight: Polygon DAOThe Polygon DAO aims to decentralize, grow and innovate the Polygon community. It brings together community leaders, marketers, creators, developers, governance participants, and anyone who wants to help out. By joining the DAO’s Discord, you are part of Polygon’s ecosystem, connecting with communities, professionals, and projects. To tip your toes into the water, start as a guest in the DAO and see where the journey takes you. You can carry out support tasks as a contributor, communicate ecosystem and DAO news as a marketer, show your coding skills as a developer, use your creative talent as a creator, or participate in the creation of innovative governance processes. The DAO recently launched three different projects. The first is the WAGMI Jobs board - created in partnership with @devfolio - promising to help you find your dream Web3 job. In July 2022, it reported 563 jobs across 109 projects from top-notch Web3 companies. If you are interested, you can join their WAGMI Jobs board Talent Network. Second, Polygon DAO recently introduced a Proof of Personhood DAO governance model called PolygonID. It allows for anonymous but verified voting and private reputation building, all while users have control over their data. The third recently launched project is called Polygon Village. It’s a full-stack ecosystem to help developers build and grow their projects. Polygon Village partners across all domains with top-tier dapps. This gives builders free access to the best Web3 service providers under a single forum, including welcome vouchers, shared grants, hosting and infrastructure support, bounty boards, expert talks, audit services, and more. This is where the collaboration takes place. Bankless DAO is now a voucher partner to offer legal guidance to projects through consultations and legal draftings by the Legal Guild. If you are someone who wants to build on Polygon, consider joining their DAO as your first best contact point. Get Plugged InEvent HighlightsExploring Digital Identity for Decentralized SocietiesRadicalxChange is hosting an online event, August 16-18, that, true to its theme of decentralized societies (DeSoc), won’t have “speakers, keynotes, or panels”, instead the event will be co-created by all attendees at the start of each day to create the schedule. This event’s purpose stems from our modern reality that the function “broadly adopted open standards” for social verification would solve for has already “been filled by big technology organizations”, but building a possible alternative “is within reach.” Topics of discussion include DeSoc, Plural/Quadratic Voting & Funding, and Data Dignity. SmartCon 2022 — Hosted by ChainlinkThere will be two full days of keynotes, panels, developer workshops, and AMAs featuring leading projects and speakers from across the blockchain ecosystem. You’ll get insight into the latest Web3 developments directly from researchers, developers, and founders at the forefront of smart contract innovation. This event will be held live in New York City, New York and virtually from September 28-29. 🧳 Job OpportunitiesGet a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? Rook is looking for full-time and part-time contributors, with full-time salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

Please email newsletter@bankless.community for more information. If you liked this post from BanklessDAO, why not share it? |

Older messages

Uniqly: The Intersection of Physical Goods and Digital Assets | Decentralized Arts

Tuesday, August 9, 2022

Dear Bankless Nation, We've arrived at issue 50! What an incredible milestone. Congratulations to everyone on the amazing journey we have shared so far! Much has happened in the past few months:

The Season That Roared | BanklessDAO Weekly Rollup

Saturday, August 6, 2022

Catch Up With What Happened This Week in BanklessDAO

The AMM Edition (Part I) | DeFi Download

Thursday, August 4, 2022

Your Trusted Source for 101s, Project Announcements, and Tokenomics Tutorials.

NFTs Come to Football | Decentralized Arts

Tuesday, August 2, 2022

Dear Bankless Nation, What was Android #44 V864.962 thinking when it screwed into a shrub for a week? Was he exploring and imitating the archetypes—of which the Dusty Eye group speaks—or did he want to

Season of the Bear | BanklessDAO Weekly Rollup

Saturday, July 30, 2022

Catch Up With What Happened This Week in BanklessDAO

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏